Advancing Our Proprietary Asset Allocation Research

How to think about asset-allocation decisions over time is a critical investment decision facing investors. Our asset-allocation insights and approaches help our teams build multi-asset portfolios and provide informed advice to our clients.

Reprinted April 2024

As investment-related questions go, few are as important to clients as: “How do I allocate across asset classes available to me and evolve this allocation over time?” For many of our Investment Solutions Group’s (ISG) clients this is the main question they come to ISG with (Reference 1). Many clients of our Fixed Income Cash and Currency (FICC) group implicitly inquire along the same lines when considering rotation across sectors of fixed income markets (Reference 2). State Street Global Advisors has accumulated vast intellectual capital on this topic, which falls into three broad categories: Long-Term Asset Class (LTAC) forecasts, Strategic Asset Allocation (SAA) tools and methods, and Tactical Asset Allocation (TAA) models. All three remain areas of intense focus for the Multi-Asset and Fixed Income Research team and for our ISG and FICC organizations more broadly. This article highlights key recent innovations in these three areas, which were focus areas of discussion at State Street Global Advisors’ Investment Team Research Offsite held in November 2022.

Leveraging Long-Term Asset Class Forecasts

State Street Global Advisors’ strategic asset allocation recommendations to clients are closely tied to our forward-looking views on future risks and returns of portfolio components. Our Long- Term Asset Class forecasts process was designed to update such views on a quarterly basis and to disseminate forecasts both internally and externally. Read more in detail in Reference 1 at the end of this paper. Technically, these forecasts are produced under the umbrella of Multi- Asset Research, but reality crosses functional lines. We have a team of senior investment professionals across the entire firm who not only stands behind the LTAC quarterly process, but also oversees the outcomes and often suggests or reviews innovations.

Our LTAC process is continuously evolving and some of its recent evolution was discussed during our recent investment Research Offsite. Here we will cover two of those notable innovations:

- Creating links between long-term return forecasts of private and publicly-traded assets

- Introduction of the so-called “long-horizon” risk estimates

Across the industry, the debate is raging on whether private equity is a genuinely unique, alpha-generating, alternative investment style or simply another form of equity. Many of our clients own significant private equity portfolios and need to form views on the nature of those assets. Where these perspectives fall will affect ways clients build public/private portfolios, calculate overall equity exposure, and compare and benchmark performance.

In 2020–2022 our team ran a research project that attempted to shed light on these issues (see details in 2 in Reference). Instead of treating private equity as an independent strategy, we assumed that public and private equity markets are exposed to the substantially same market fundamentals. We also assumed that on top of that, public equity prices are subject to anxiety, flows, and other market noise encapsulated in the concept of “excess volatility” as introduced in the 1981 seminal work by Robert Shiller. To our delight, not only did such an approach showed excellent agreement with the empirical evidence, but it also yielded insights that we found illuminating.

First, the results of our research nicely resolves a long-standing conundrum. Many researchers (please see 2 in Reference) claimed that private equity returns are generally superior to public equity. However, a similar number of other researchers noted that over the long term, the advantage of private equity is small or even insignificant for an average manager. This seems like a contradiction, but if one takes a position as proposed by us in 2 in Reference, it is not. Both observations are correct. Excess volatility hurts public prices in the short-term, yet that difference dissipates as we extend the investment horizon explaining the conundrum.

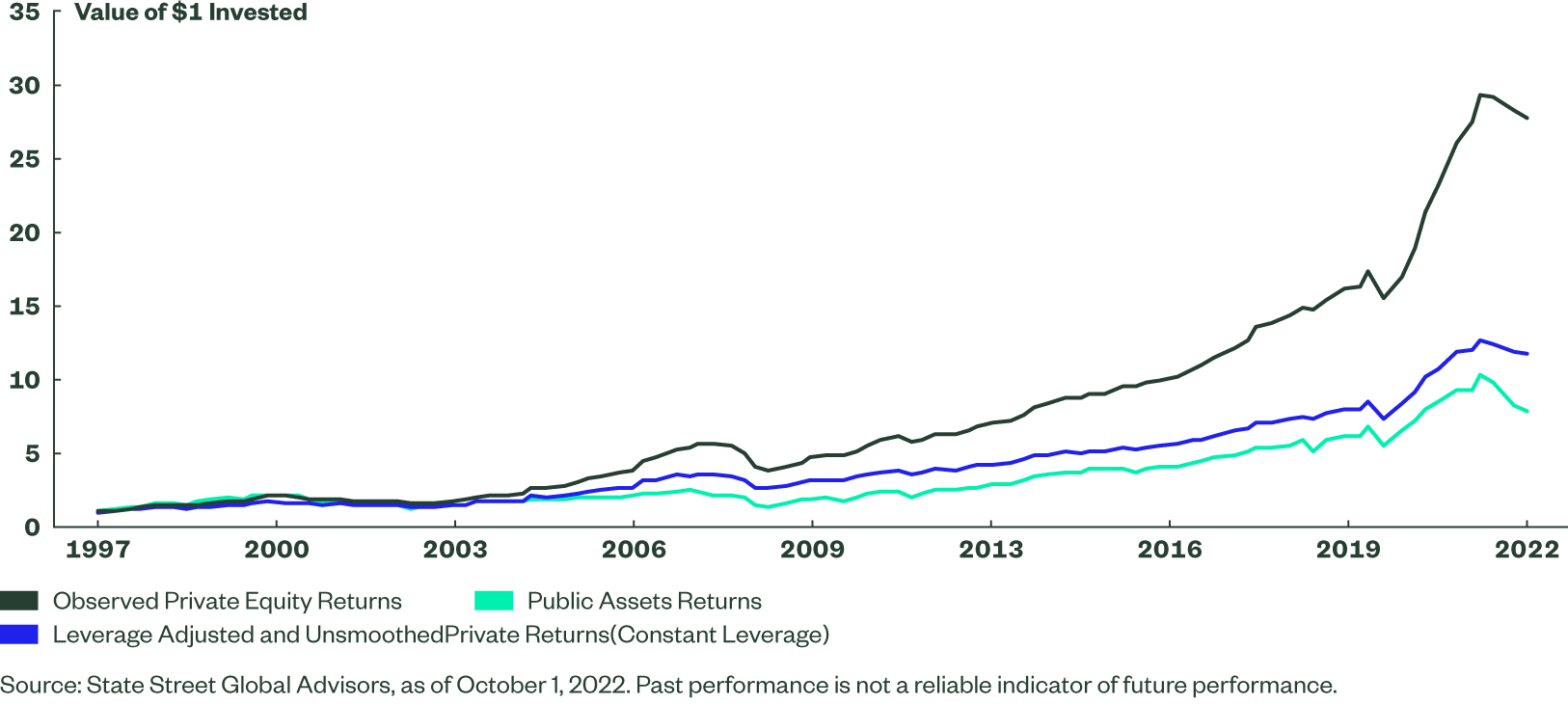

A second advantage we found is that our model allows computationally-easy performance attribution of private equity returns (Figure 1).

Figure 1: Private Equity Returns before and after Leverage Adjustments

Over short periods of time, private assets tend to have material advantages over their public counterparts because they are shielded from excess volatility. In the long term, however, excess volatility contribution mean-reverts and the advantage of private equity over public gradually evaporates as the investment horizon expands.

This newly-developed philosophy harmonizes return forecasts across public and private assets. Private equity forecasts become linked to common equity, private debt forecasts to those for liquid high yield, and private real estate forecasts to our views on Treasury rates and inflation. The new approach helped us offer better advice to our institutional clients that were grappling with how much to allocate to private assets to the otherwise liquid portfolios and how to evaluate broad macroeconomic exposures in such liquid/private blends.

The acquired understanding also evolved our views on how risk estimates need to be constructed for the purposes of strategic asset allocation. This important topic is what we will cover next.

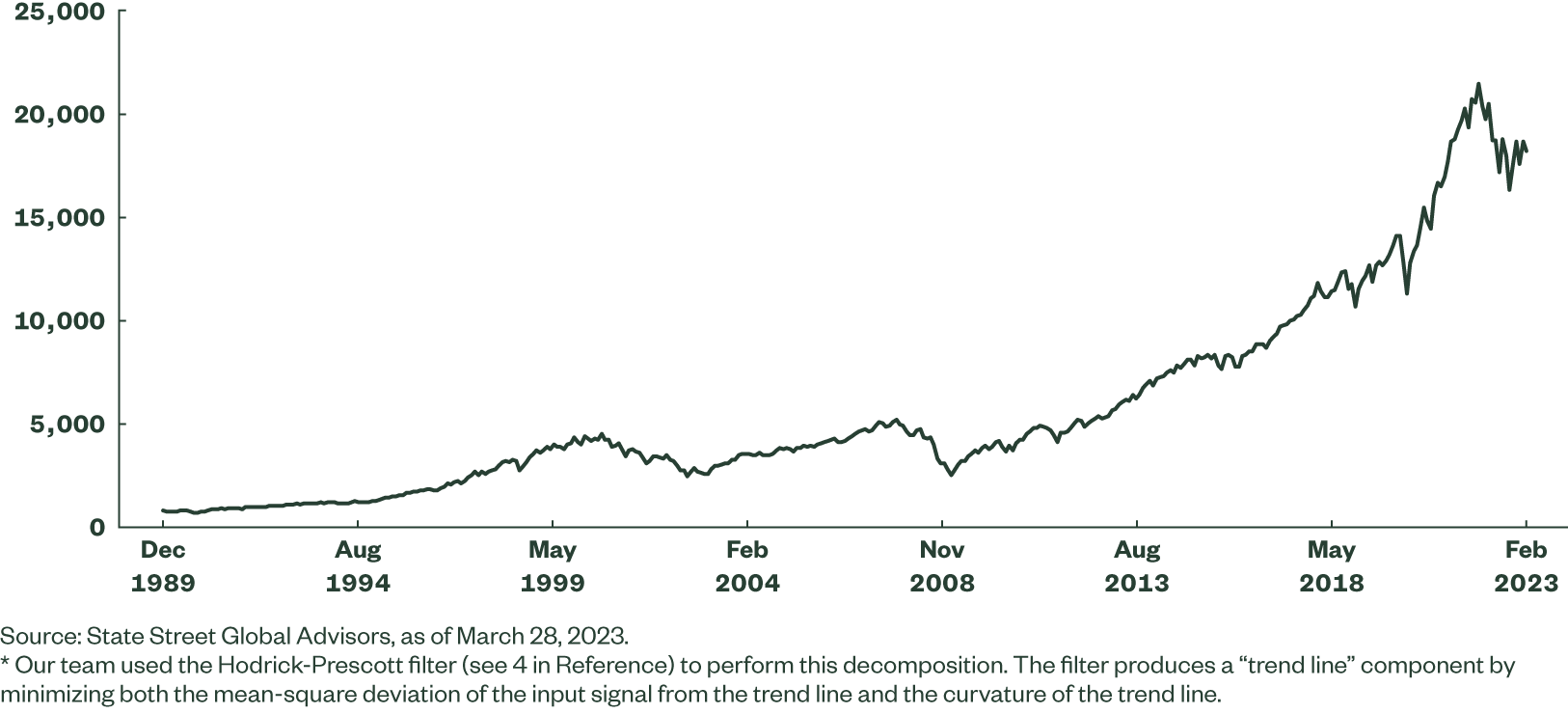

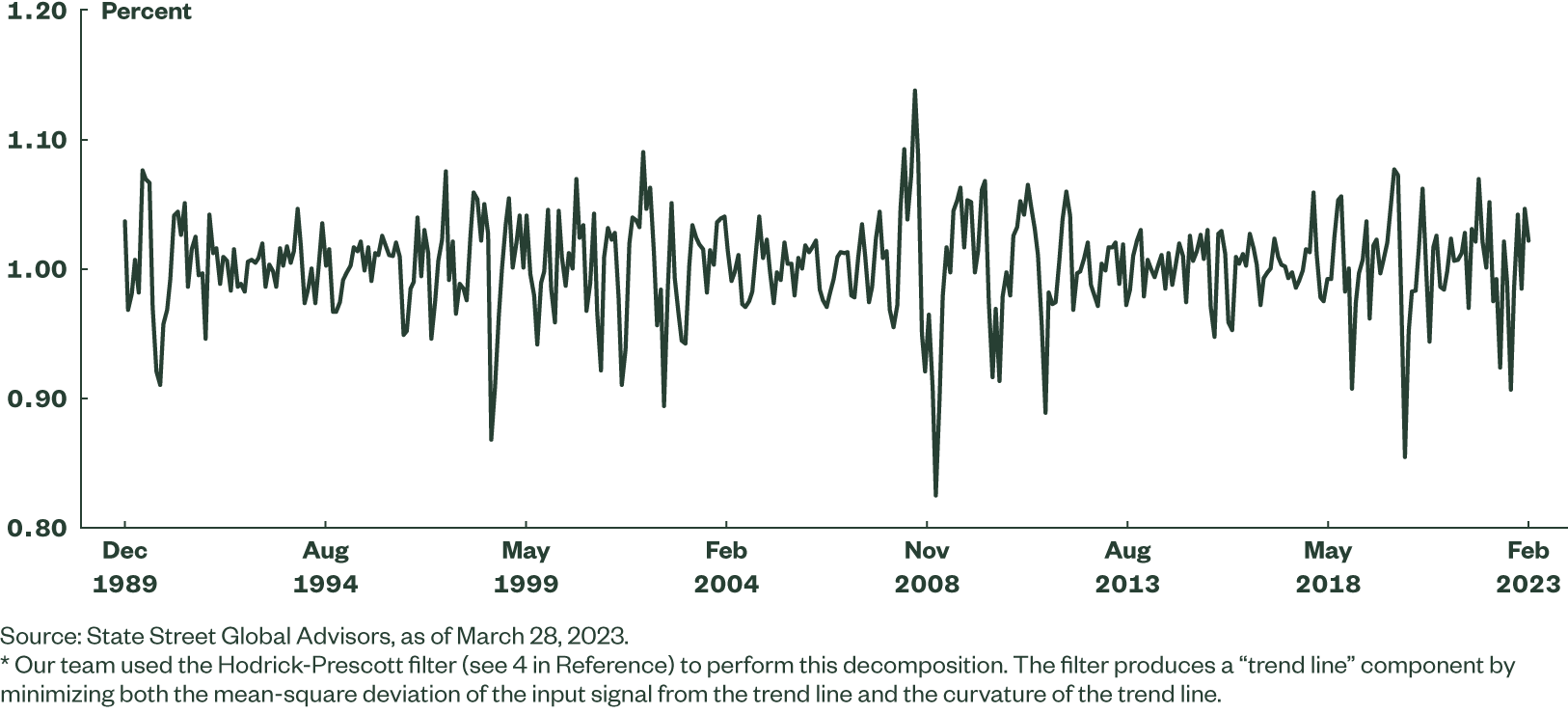

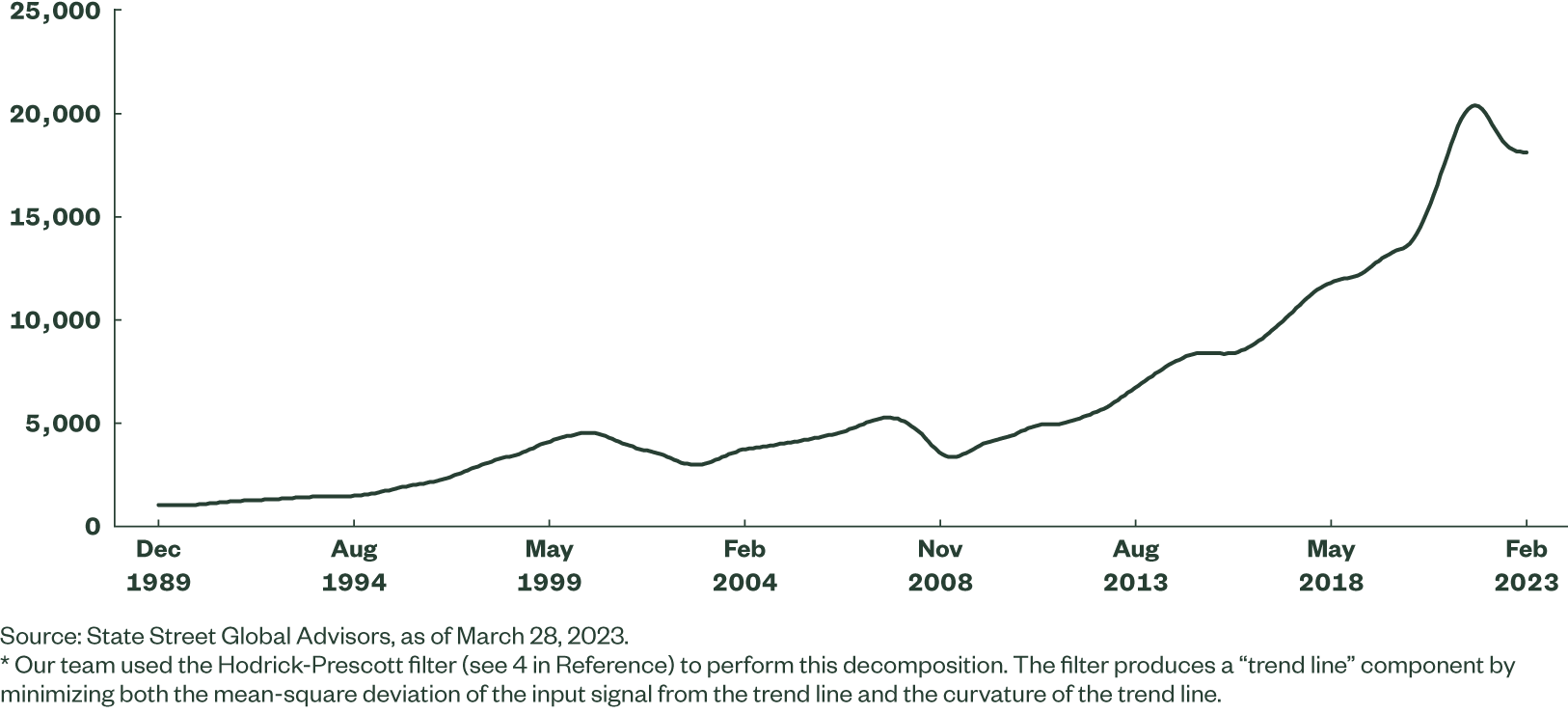

One of the challenges of asset management is how to harmonize multi-year longevity of a typical institutional investment horizon against quickly changing market dynamics. Many of our clients have been struggling with this predicament and our recent research (see details in 3 in Reference) provides an interesting and distinct paradigm for a solution. It is known that price patterns of many core asset classes are combinations of two somewhat independent components. Over the long term, prices are anchored to some sort of a slow-moving, fundamentals-based process, while in the short term, these prices quasi-randomly cycle around such anchors. We illustrate this decomposition on an example of US equities as represented by the S&P 500 Index (Figure 2).

Figure 2: Decomposition of Historical Asset Price Patterns on the S&P 500 Index*

The two components of the S&P 500 Index differ not only in terms of speed of change, but also in their long-term dynamic. The slow, “persistent” component grows over time, reflecting growth in the real economy and corporate earnings. In contrast, the fast, “transient” component is directionless and strongly mean reverting.

We believe that it is well-advised to fit investment decision-making tools to the relevant investment time horizon. For strategic asset allocation work, such investment horizon need to be made appropriately long, so from late 2021, we started extracting the comparably persistent components from all asset returns and publishing their volatility as part of our LTAC process. Notably, for publicly-traded equities, credit, and real estate instruments such a calculation expunges excess volatility, reducing public-asset volatility figures to levels close to those of their private counterparts (after leverage adjustments).

Our new approach arms clients with multiple new tools, which we described at length in two recent papers titled “Dual-Horizon Strategic Asset Allocation” and “Expanding Long-Term Asset Class Forecast — Long-Horizon Risk and Private Assets” (see 3 and 4 in Reference). It is self-consistent and broadly harmonizes asset allocation with empirical evidence for both private and public assets. By separating persistent from transient asset returns and explicitly focusing on the former, it adds clarity to the process and allows simple practical implementation. It also allows investors to better understand risk drivers in their portfolios.

Utilizing Strategic Asset Allocation Tools and Methods

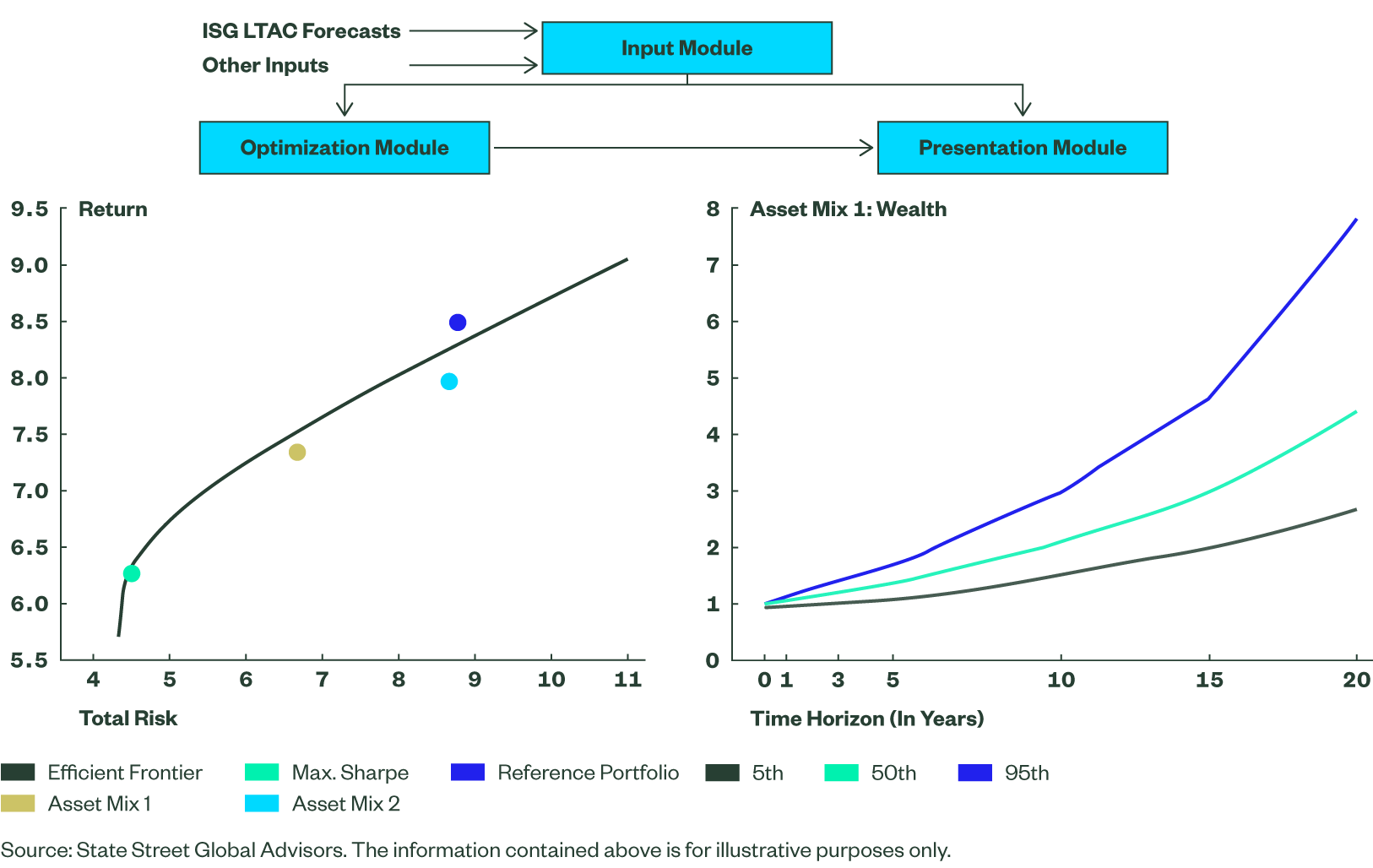

While the previous section — and most of the Research Offsite material — was dedicated to methodological innovations, in one of the Research Offsite presentations we reviewed how we deploy those innovations efficiently. Over the course of 2020 to 2022, we created a new platform for our Strategic Asset Allocation (SAA) work that we named Portfolio Universal Modeling Application or PUMA. The idea behind it was to create an intellectually coherent and efficient platform that reflects our shared philosophy of SAA, integrates ISG Long-Term Asset Class forecasts for seamless use, and builds visualization tools catering to our client needs (Figure 3).

PUMA was constructed by analysts from the Multi-Asset and Fixed Income Research team in coordination with ISG portfolio management organization and Investment Strategy team. It has an impressive scope of functionality and currently forms the foundation of our SAA process.

Figure 3: Proprietary PUMA Schematics

During the Research Offsite, we reviewed functionality of this platform and discussed various methodological innovations that it incorporates, including “Efficient Ridge” as a more stable alternative to the Efficient Frontier, our implementation of Dual-Horizon Asset Allocation (following 3), Monte-Carlo simulations supporting target date fund investor outcomes, and many others. We continue to enhance this platform with the current focus on custom glide paths and other innovations related to our target date fund franchise.

Evolving Tactical Asset Allocation Models

The Investment Solutions Group (ISG) has been offering a broad range of multi-asset, tactical solutions to institutional clients for more than three decades. Generally, the objective of our Tactical Asset Allocation (TAA) models is to outperform a given benchmark through dynamic reallocation of portfolio assets. Crucially, the focus is on asset class exposures (usually expressed through ETFs or index funds) as opposed to individual securities, with typical dimensions of trading being equity sectors (for example, global industrials versus global financials), country indexes (for example, US versus Australia), interest rates (long-duration bonds versus short-duration bonds), and credit quality (for example, high yield versus investment grade). Getting such tactical asset allocation calls right holds a critical place within the overall investment process.

TAA is also an area where collaboration between Multi-Asset and Fixed Income Research and the rest of our investment organization is most active. Some of our models (for example, Market Regime Indicator [MRI]) have been adopted by other teams, for example the Active Quantitative Equity (AQE) team. In the same vein, we often adopt ideas from other divisions — a recent example of our team following AQE’s suggestions and starting to use alternative sentiment data as part of our equity sector rotation strategy is a case in point.

During the Research Offsite, we covered multiple TAA innovations we developed in the past couple of years, including a set of new signals for regime-driven investing (aiming to enhance our Market Risk Indicator or MRI), recent additions to our unified Global Equity Model (GEM), and a new approach to modeling high yield spreads. For the purposes of this article, we will focus on highlighting the latter.

Case Study

Regime Switching with a Gradual Transition Model for High Yield Spreads

High yield spreads have a peculiar dynamic:

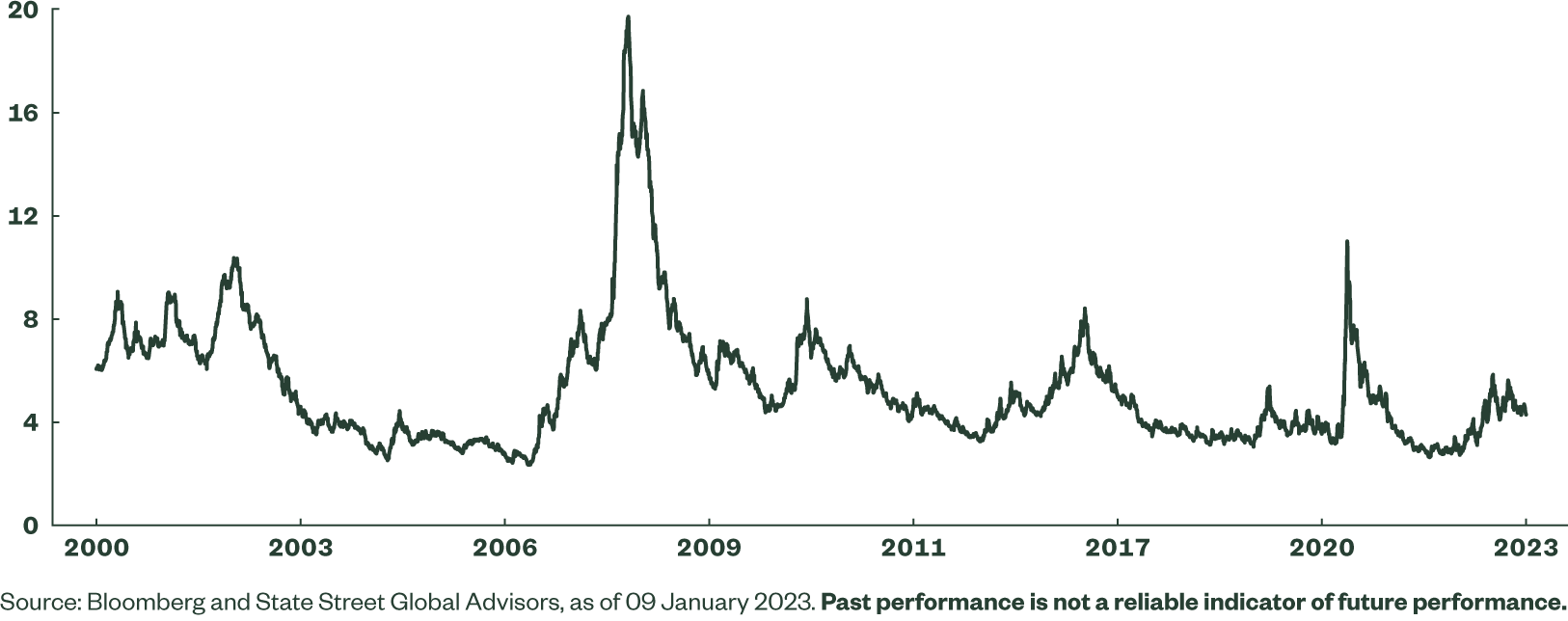

- Distribution of spread changes is far from normal; it has fat tails and is skewed towards large positive increases (see Figure 4).

- Periods of relative quiet and stability for spreads are periodically interrupted by periods when spreads increase dramatically for some time and then fall back to their original state.

- These transitions from low to high levels and back are not instantaneous, heights achieved by spreads during periods of spread expansion vary materially, and there is noticeable asymmetry in such transitions in terms of speed — climbing up tends to happen faster than sliding down.

Figure 4: High Yield Spread History

There are multiple benefits in capturing all of these features in a single stochastic model for spread behavior and we believe we have developed a novel way of doing so (Reference 5). Our approach is based on two assumptions. First, in a manner consistent with the so-called Hidden Markov Models (“HMM”) paradigm, we assume that spreads follow a stochastic process with two states: the “normal” state and a “crisis” state. Each state is characterized by its own set of parameters, including an average corresponding to the “fair” level of spreads for that state and a diffusion term responsible for volatility around that level.

In a departure from the traditional HMM approach, we also introduce spread mean-reversion into the model, see Equation (1).

Equation 1

St -St-1 = (aN(mN-St-1)+σNϵt)(1-θt)+(ac(mc-St-1)+σCϵt)θt (1)

Here St is value of spread at time t, θt is 0 for normal regime and 1 for crisis regime, and {aN/C, mN/C, σN/C} are sets of parameters (speed of mean-reversion, fair value, and volatility) for “normal” and “crisis” states, respectively.

Our research shows that such formulation captures all three essential features dynamic that we outlined earlier. The HMM component alone can incorporate the skewness and fat-tailed nature of spread distribution. When the state changes, mean-reversionary component of Equation 1 makes spread transition from one fair value to the other gradual . Furthermore, since the speed of mean-reversion is state specific, the speed of spread climbing up from low to high level may be different from the speed of the spread sliding down from high level to low. In other words, we may be climbing up more quickly and sliding down more slowly. Finally, the model incorporates different heights to which spread has risen during “crisis” periods: the height is mostly driven by the speed of the climb (aC) times the amount of time we spend in the “crisis” regime. Such times vary and so does the height of each peak.

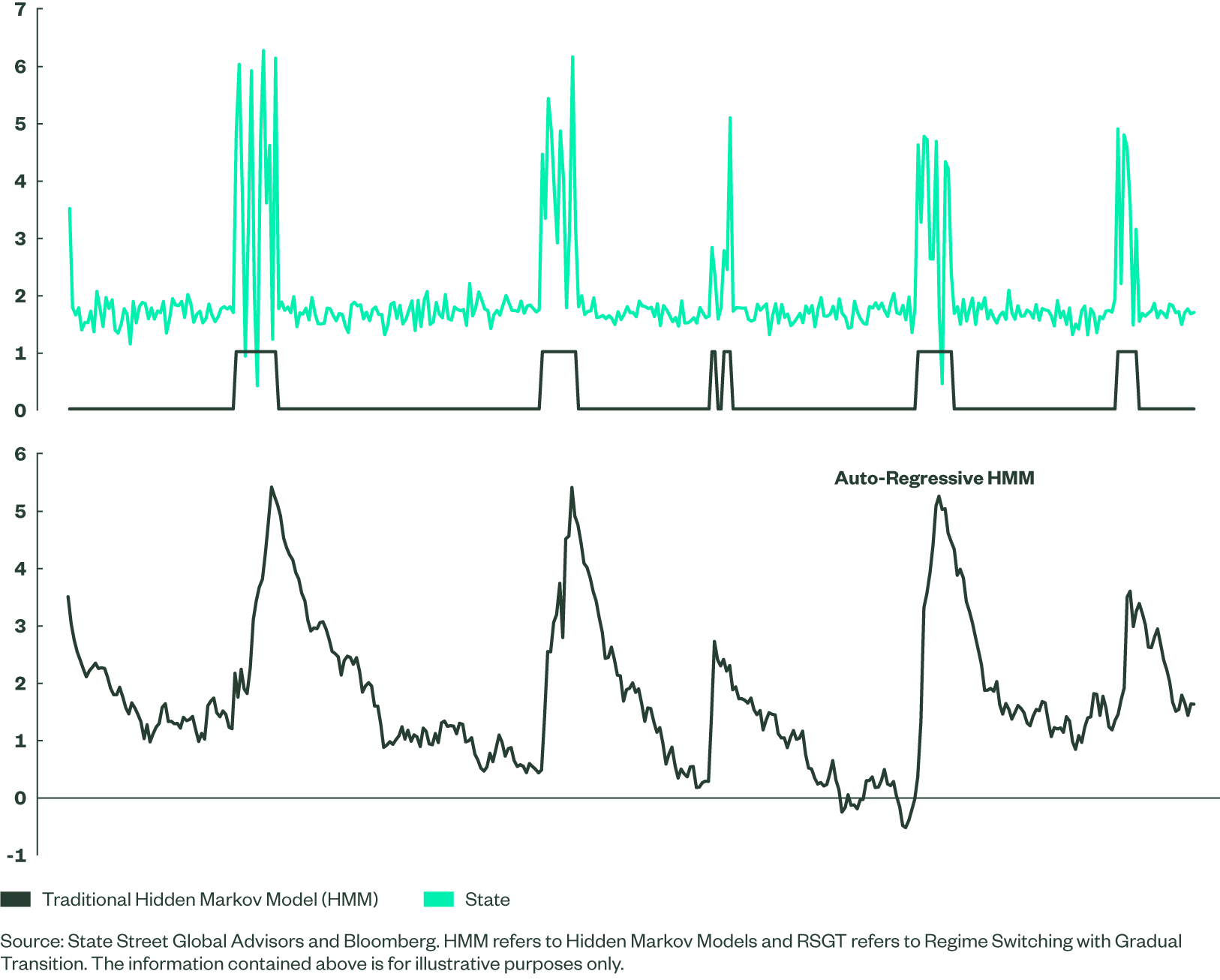

We named our model Regime Switching with Gradual Transition or RSGT. It is instructive to visually compare a hypothetical example of a “conventional” HMM model versus the RSGT style model that contains auto-regressive terms. Figure 5 provides such an illustration. Even a cursory comparison of Figures 4 and 5 illustrates that our model is better suited for describing credit spreads than a conventional HMM.

Figure 5: Comparing a Traditional HMM versus a RSGT-style Model (a Hypothetical Example)

We see our newly-developed RSGT as an exciting new way of modeling credit spreads, which promises to enhance our tactical asset allocation toolkit. It is also well differentiated from the existing literature, both in terms of mathematical formulation and in terms of how we use it.

Further analysis (see details in 5 in Reference) shows that at all times, option-adjusted spread (OAS) offers a conservative view on future default-related losses while risk premia is consistently positive and substantial. That risk premia is also highly variable and is at its highs right when credit losses have already been mostly realized.

These observations have several asset allocation implications. They certainly support having high yield as part of a strategic asset portfolio, given its positive and material risk premia profile. The studies also suggest a tactical asset allocation strategy that exploits risk premia blow-outs. It is rational to enter into a high yield position if you are in cash (or establish an overweight on top of your strategic high yield weight) right after such blow-outs and hold this position (or overweight) while risk premia subsides.

Our regime-driven RSGT model provides an intuitive mechanism for implementing such a tactical strategy. We can enter into a long high yield trade when “crisis” state ends (we enter “normal” regime) and spreads are still attractively elevated and then exit it when either spreads approach normal levels (making remaining opportunity set unattractive) or another crisis begins.

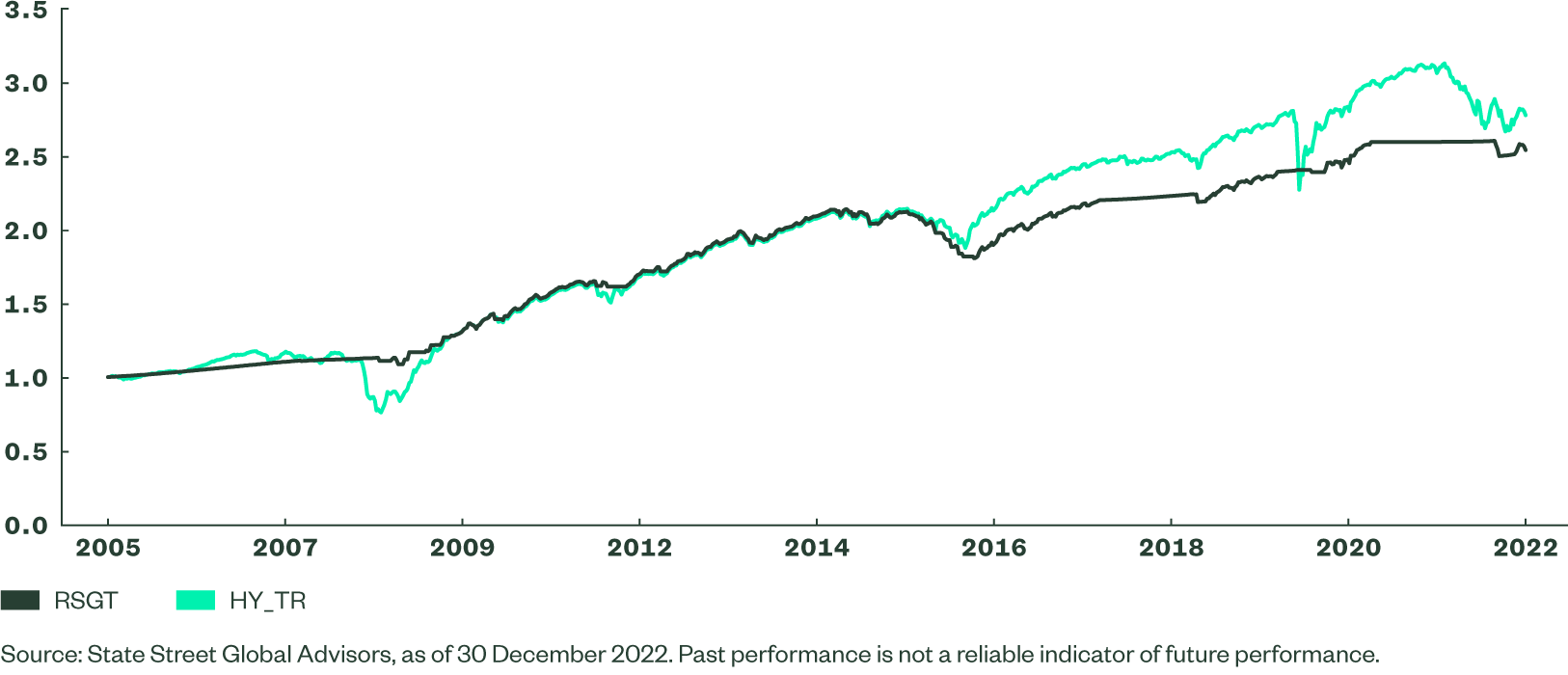

Figure 6 compared outcomes of holding such strategy with experience of holding a high yield index over the entire time horizon between Aug 2005 to Dec 2022. While relatively competitive in terms of absolute performance, RSGT-based model has substantially better risk-adjusted characteristics, including higher Sharpe ratio and much lower drawdowns.

Figure 6

Figure 6: A RSGT-based Strategy Against Buy and Hold

Concluding Remarks

This short paper outlines several key innovations in the area of strategic and tactical asset allocation that were developed by the Multi-Asset and Fixed Income Research team over the past couple of years and highlighted during our investment team’s recent Research Offsite. It is important to emphasize that these innovations are not purely intellectual pursuits. Rather, our long-term asset class forecasts are broadly used across State Street Global Advisors and by many of our institutional clients. Our insights into how private and public equity relate to one another help us build multi-asset portfolios and provide informed advice to our clients. New insights into how to model credit spreads will not only help us manage fixed income sector rotation strategies, but also can be applied more broadly. All markets are tightly connected in today’s environment; when we can form forward-looking outlooks on such spreads, these same views may help manage diversified, multi-asset tactical portfolios.

Overall, the State Street Global Advisors Research Offsite has proven to be a fantastic forum, where ideas were shared, innovations discussed, and collaboration fostered between various teams across the firm’s investment organization. We look forward to the next one.