How ETFs Are Created and Redeemed

- The creation and redemption process is unique to ETFs, and sets them apart from other investment vehicles.

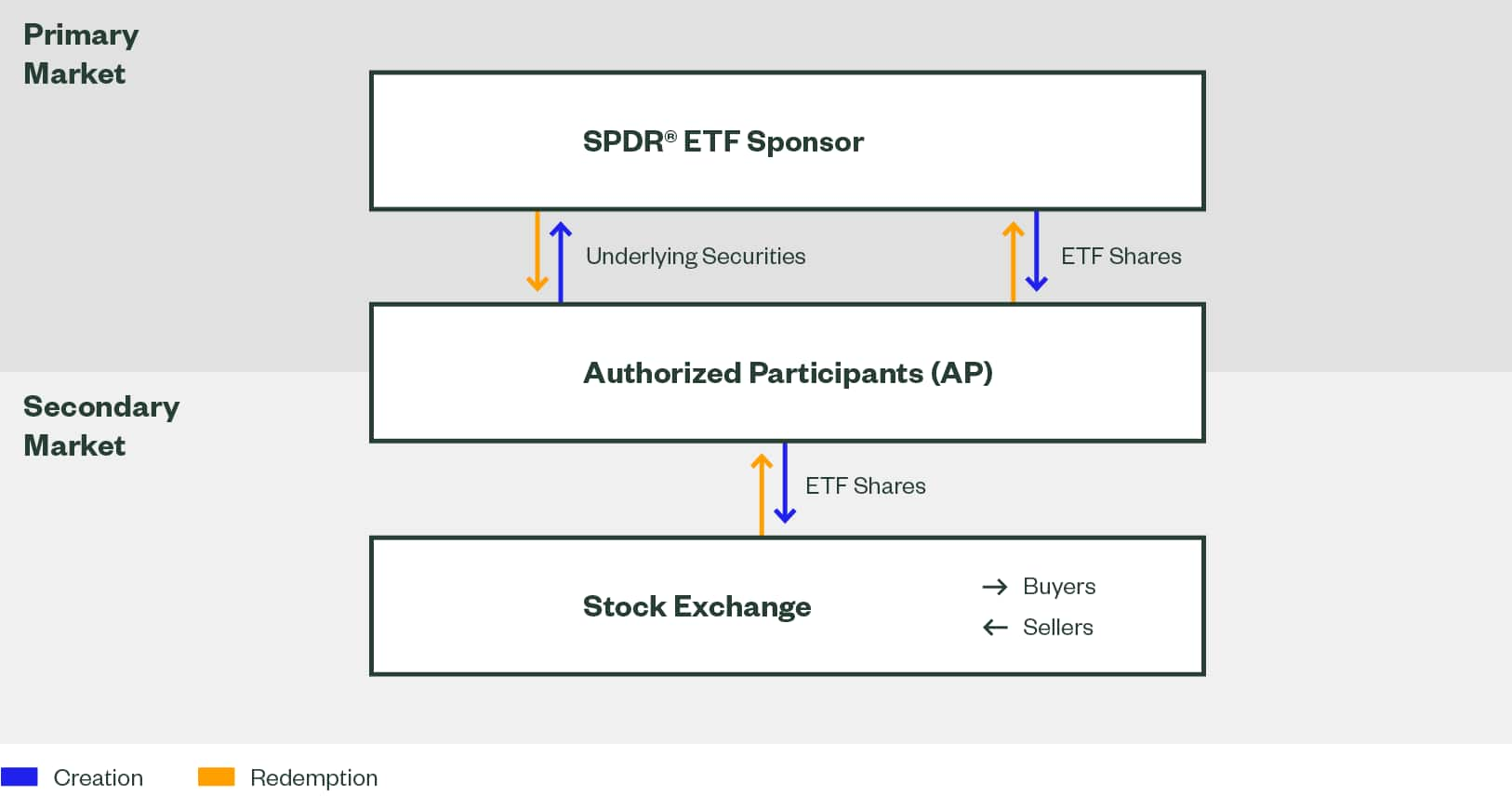

- The ETF creation and redemption process takes place in the primary market between the ETF sponsor and authorized participants (APs).

- This unique mechanism drives several potential ETF benefits, like cost efficiency, tax efficiency, and enhanced liquidity.

ETFs benefit from a unique process called creation/redemption, allowing them to trade on exchanges like individual stocks while maintaining a close correlation to the underlying assets they track. Specifically,

- Creation involves the buying of all the underlying securities and wrapping them into the exchange traded fund structure.

- Redemption is the process whereby the ETF is ‘unwrapped’ back into the individual securities.

This process sets ETFs apart from other investment vehicles and is the mechanism that underpins many of their benefits, from improved tax efficiency to enhanced liquidity. But there is a lot more to it.

ETF Creation and Redemption Process

The ETF creation and redemption process takes place in the primary market between the ETF sponsor and authorized participants (APs). APs are US registered, self-clearing broker-dealers, who regulate the supply of ETF shares in the secondary market.

Creation

Authorized participants create ETF shares in large increments — known as creation units — by assembling the underlying securities of the fund in their appropriate weightings to reach creation unit size, which is typically 50,000 ETF shares. The AP then delivers those securities to the ETF sponsor.

In return, the ETF sponsor bundles the securities into the ETF wrapper, and delivers the ETF shares to the AP. These newly created ETF shares are then introduced to the secondary market, where they are traded between buyers and sellers through the exchange.

When demand increases, more ETF shares can be created using this process. In effect, this allows the liquidity of an ETF’s underlying securities to enhance the liquidity of the ETF itself.

Redemption

APs can also redeem ETF shares by reversing this process. Large increments of ETF shares—known as redemption units—are collected in the secondary market and then delivered to the ETF sponsor in exchange for the underlying securities in the appropriate weighting equaling that redemption unit (again, typically 50,000 shares).

As redemption is the opposite process to creation, when demand decreases, the ETF can be dissembled back into single securities. As a result of the creation and redemption process, the ETF’s portfolio manager typically does not need to buy or sell securities except for rebalancing purposes.

Benefits of the Creation and Redemption Process

The creation and redemption process may seem complicated, but it is one of the mechanisms that drives ETFs’ potential benefits. Some of the key advantages include:

Premium/Discount

Because of the creation/redemption process, APs are always closely monitoring the demand for ETFs, and then buying or selling shares in response. By adding or subtracting ETF shares from the market, APs work to keep an ETF’s share price closely aligned with the value of the assets held in the portfolio, mitigating outsized premiums or discounts of the ETF market price to the ETF net asset value (NAV).

Tax Efficiency

Given that creation/redemption transactions are typically conducted in-kind — meaning securities are exchanged for ETF shares — they are tax exempt, helping to improve the tax efficiency of ETFs.

Liquidity

In addition, creation/redemption creates two layers of liquidity within an ETF. There’s a layer of available liquidity in the secondary market and a layer of liquidity of the underlying securities. This is why ETF trading volume is not an all-encompassing measure of the fund’s overall liquidity. To understand the full liquidity of an ETF, investors must also consider the liquidity of its underlying securities.

Invest in Your ETF Education

Whether you’re new to investing or a seasoned investor, our ETF Education Hub can help you discover how to evaluate ETFs, use them in a portfolio, and more.