Understanding the ETF Liquidity Ecosystem

Liquidity is one of the most important features attracting a diverse group of investors to exchange traded funds (ETFs). To understand where ETF liquidity comes from, explore the mechanics of ETF trading and the roles played by key members of the liquidity ecosystem.

9 min read

How Do ETFs Trade?

An exchange traded fund (ETF) is an investment vehicle whose shares trade intraday on stock exchanges at market-determined prices.

ETFs are unique because they offer two markets for trading:

1. The secondary market, where most investors trade

2. A primary market that supports the ETF liquidity and allows them to trade close to the Net Asset Value (NAV) throughout the day.

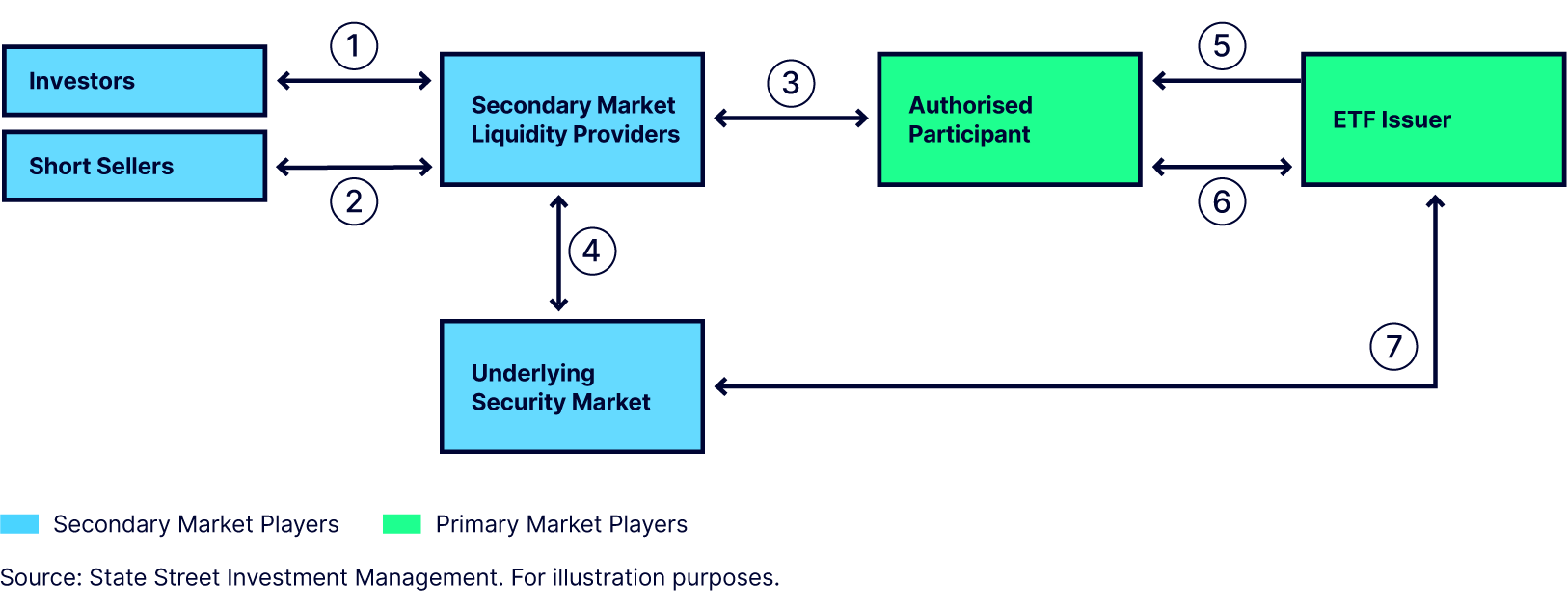

Figure 1: The ETF Liquidity Ecosystem

As you can see, the ETF liquidity ecosystem has many participants. Does the ETF trading ecosystem seem a little too complex? Let's break down Figure 1 to understand the key ETF trading activities point by point.

Buyers and sellers of ETF shares place their orders through registered brokers, exchanging cash for ETF shares when buying and vice versa for selling.

Short sellers pay a fee to the lender so that they can borrow ETF shares to sell in the market and then buy them back later at a lower price to lock in a profit before returning them to the lender. In exchange for ETF shares, the short seller provides collateral, typically required to be higher in value than the borrowed shares.

When the demand for ETF shares exceeds or falls short of the shares available for sale in the secondary market, there will be disparities between the ETF market price and its intrinsic value (NAV) based on underlying security prices.

The primary market then provides additional liquidity, as market makers engage Authorized Participants (APs) to create/redeem ETF shares to balance supply and demand, thereby keeping ETF share prices close to their intrinsic value. Market makers will deliver ETF baskets to the AP in exchange for ETF shares.

Before creating ETF shares, market makers may need to source underlying securities in the ETF basket by tapping into their own inventory or buying from the underlying security market.

For less liquid securities, such as emerging market equities, market makers may not be able to source the securities. In this case, the ETF issuer might accept cash-in-lieu as part of the ETF basket, purchase those securities directly from underlying security markets for the fund, and then charge related costs to the market maker.

This process happens in reverse with redemption orders, if market makers need to liquidate the ETF basket delivered from the AP and return the proceeds to the seller of ETF shares. In the end, creation and redemption of ETF shares in the primary market may result in transactions in underlying security markets.

At the end of each trading day, the ETF issuer publishes the Portfolio Component List, which includes the security names and corresponding quantities that comprise the ETF basket for the next trading day.

The AP creates/redeems ETF shares by exchanging securities in the basket for shares of ETFs, or vice versa.

ETF portfolio managers buy or sell underlying securities for managing corporate actions (e.g., dividend payments, mergers and acquisitions, spinoffs), index reconstitution, and cash flows to realign portfolios with their benchmark and minimize tracking error. These transactions may impact the liquidity of underlying security markets.

Who Are the Major Liquidity Players in the ETF Market?

ETFs’ unique creation and redemption process and secondary market trading involve a number of capital markets players who contribute to the ETF liquidity ecosystem, including:

Exchanges

While ETFs are generally listed on one exchange, trading of ETF shares occurs across many trading venues. These include national securities exchanges (e.g., NYSE, Nasdaq and CBOE), alternative trading systems (ATSs or “dark pools”), and over the counter.

Broker/Dealers

Brokers and dealers execute trades on behalf of clients by routing orders to trading venues or by matching buyers and sellers directly. Dealers buy and sell securities for their own account. They charge commissions for their services to execute and settle trades.

- Institutional Sales and Trading Desk: Some brokers have a dedicated institutional trading desk that specializes in facilitating large trade executions at defined prices. They may quote a market for a given ETF at a given size (risk trade) or act as an AP to place a creation or redemption order on the client’s behalf with the ETF issuer (end-of-day NAV trade).

Authorized Participants (AP)

APs are the only counterparties allowed to enter creation and redemption orders with the fund. They are typically self-clearing broker-dealers that serve many functions, including acting as dealers in ETF shares in the secondary market and as agents for market makers and other liquidity providers to create/redeem ETF shares.

Market Makers

Simultaneously making offers to buy (bid) and sell (ask) securities at specified prices, market makers provide two-sided liquidity to other market participants. They facilitate the exchange of securities between end investors by bridging the gap between the time when natural buyers and sellers enter the market. Market makers profit from the spreads of their bid/ask quotes, as well as arbitrage opportunities between an ETF’s NAV and its market price. This also helps with price discovery and keeps the ETF prices in line with its NAV.

- Lead Market Maker (LMM): Selected by the Primary Listing Exchange, LMMs are required by the exchange to meet minimum performance standards, such as best bid and offer, minimum displayed time and minimum quoted spread. In exchange, LMMs receive economic benefits, such as lower transaction fees and higher rebates from the exchange.

- Electronic Market Makers (EMM): EMMs employ algorithmic and high-frequency trading technology to harvest bid/ask spreads with relatively high trading volume in a short period of time without human interaction. They usually minimize using their balance sheet by making their positions market neutral by the end of the day.

Derivative Trading Desks

These desks actively transact in the underlying ETF to dynamically hedge their position(s), as they facilitate transactions on a variety of financial instruments for institutional clients. Additionally, ETFs seeking to track indices linked to other structures, such as swaps and futures, are often used in relative value arbitrage between vehicles.

Short Sellers

Short sellers provide liquidity, as they tend to be selling into demand when share prices appreciate, and conversely looking to buy back shares when prices decline. For example, if most investors are optimistic about the asset’s future performance, ETF share prices increase, leading to more demand of ETF shares. Short sellers who hold a contrarian view will borrow shares from brokers and sell them when there is more demand for purchases and then buy them back later, when most investors are selling.

Create-to-Lend Desks

Create-to-lend desks create ETF shares (through an AP) for the purpose of lending them to clients seeking to borrow the shares. They usually hedge their positions to minimize price risks.

Each of these capital markets players contributes to ETFs trading more efficiently throughout the day, which benefits both buyers and sellers. There are also economic benefits for the capital markets participants.

Who Are the ETF Issuer’s Liquidity Players?

The ETF issuer develops ETF products, determines fund investment objectives, manages the ETF portfolio according to the fund’s objectives and oversees day-to-day operations. Within the organization, these four functions deal with market liquidity:

Portfolio Manager and Trading Desk

Portfolio managers manage the ETF portfolio, seeking to achieve the investment objective. They determine the composition of ETF baskets. Portfolio managers’ trading desks execute trades as directed by portfolio managers. They work with liquidity providers of underlying securities to source liquidity, minimize trading costs, and seek best execution.

Capital Markets Team

Building relationships with APs, exchanges, market makers, trading desks/platforms, and other liquidity providers, the capital markets team plays an active role in promoting competitive markets to improve the ETF liquidity ecosystem. Given their relationship with market participants and insight into primary and secondary market activity, they are a critical resource for investors looking to execute large ETF trades efficiently.

Product Development

ETFs rely on arbitrage activities to keep the fund’s market price in line with its NAV. And so, when designing an index for an ETF to track, the product development team ensures the ETF basket is liquid enough to efficiently manage the fund from a liquidity perspective. This, in turn, allows market participants to effectively create/redeem ETF shares and keep prices in line with the NAV.

Liquidity Risk Management

The liquidity risk management team monitors fund underlying asset liquidity and funding liquidity using a variety of risk metrics and quantitative models in normal and stress scenarios to ensure the ETF’s ability to meet client redemption in a fair and orderly manner. They engage with portfolio managers, traders, product managers, and other stakeholders to address any liquidity issues identified.

Figure 2: Economic Incentives for ETF Market Participants

Market Participant | Economic Incentive |

| Buyer/Seller of ETF Shares | Buys ETF shares at a lower price and sells at a higher price later. |

| Trading Venue | Earns revenue from transaction fees paid by market participants trading on their platform. Listing exchange also earns listing fees paid by ETF issuers. |

| Broker | Earns commissions by fulfilling client buy/sell orders through finding matches in the secondary market. |

| Market Maker | Profits from spreads of their bid/ask quotes. Arbitrages between an ETF’s intrinsic value and its market price. |

| Lead Market Maker (LMM) | Profits from spreads of their bid/ask quotes. Arbitrages between an ETF’s intrinsic value and its market price. Receives economic incentives from the exchange, such as lower transaction fees and higher rebates. |

| Electronic Market Maker (EMM) | Captures arbitrage opportunities by using high-frequency trading algorithm. |

| Institutional Sales and Trading Desk | Earns commissions by providing market making services to institutional clients for their large transactions. |

| Derivative Trading Desk | Maintains risk neutral of their total portfolio by trading a wide range of financial instruments, such as ETFs, swaps, and index futures. |

| Short Seller of ETF Shares | Profits from falling ETF share prices. Borrows ETF shares, sells them now, and buys back later at a lower price to return shares to the lender to make profits. |

| Create-to-Lend Desk | Driven by clients’ demand of borrowing ETF shares. Profits from lending fees. |

| Authorized Participant (AP) | Acts as an agent for market makers and other liquidity providers to create/redeem ETF shares and earn commissions. Some APs also earn revenue through market making activities. |

| ETF Issuer | Earns fees as a percentage of fund net assets. |