Lose the Carbon, Keep the Returns

Less Than You Think.

We’ve developed a number of highly effective solutions that can quickly help you address climate change risk and position your portfolio for the transition to the coming low-carbon economy.

Climate Change Investment Risk Brings Opportunity

We believe climate change is one of the biggest risks in investment portfolios today. These risks impact almost all segments and industries – not just the obvious polluters.

However, with climate risk comes tremendous investment opportunity as the economy reworks against the impact of climate change. Read on to discover how you can transform your equity and fixed income portfolios to lose the carbon and keep the returns.

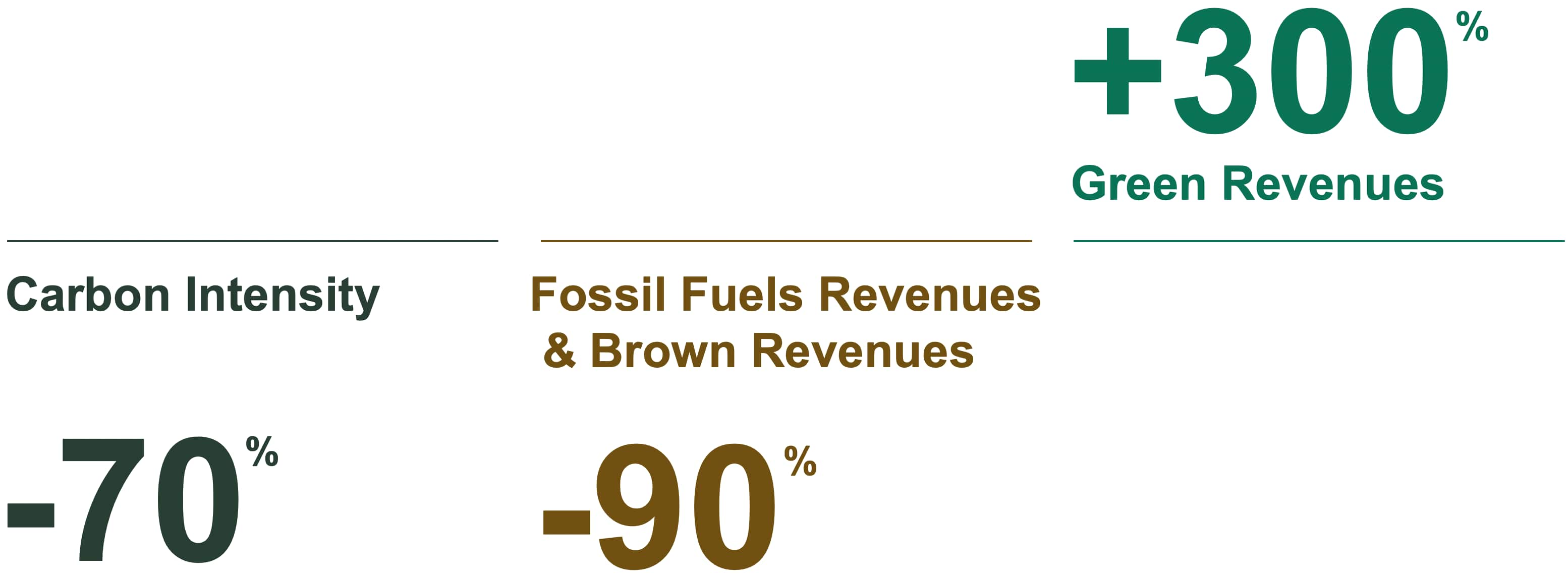

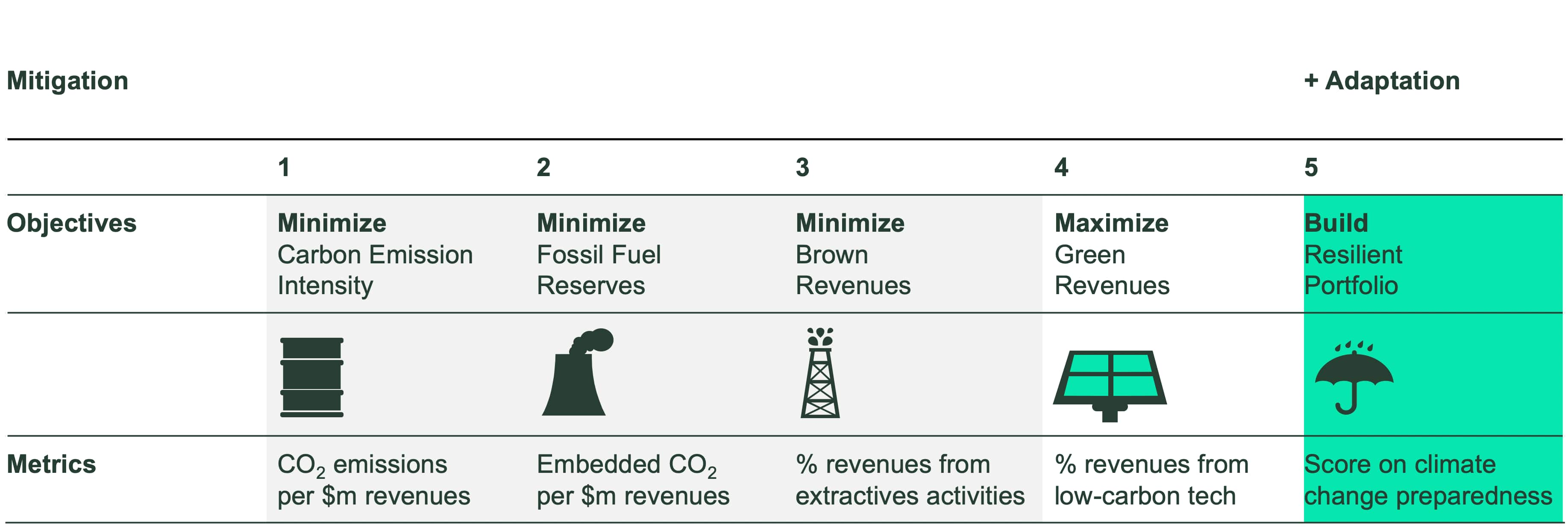

This breakthrough strategy offers global equity exposure, while effectively targeting climate change. It achieves results through a powerful mix of mitigation of current impacts and adaptation to future climate risks.

Source: SSGA, as of 1 January 2020.

Delivers Across the Board

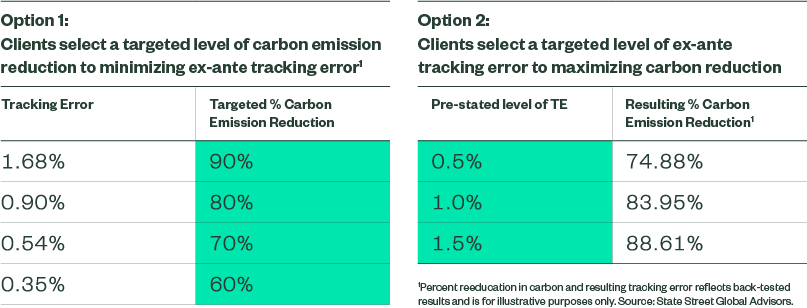

Our Solution offers fully customizable equity exposure and allows you to select either your preferred carbon-reduction objective or targeted tracking error.

Choose Your Ideal Carbon Reduction Range (%)

We offer fully customizable corporate bond exposure with a client-selected carbon reduction target range.

Contains Carbon Risk while maintaining benchmark characteristics.

Choose Your Ideal Carbon Reduction Range (%)

Achieving Lower Carbon with Familiar Returns

We are helping investors understand, control and benefit from the quantifiable trade-offs between carbon reduction and tracking error. Most importantly, we are demonstrating that significant improvements in carbon intensity can be achieved with minimal impact to credit quality or interest-rate risk relative to corporate bond benchmarks.

Aligning for the Future

The State Street Low-Carbon Corporate Bond Strategy seeks to create customized portfolios with a lower carbon footprint and similar returns to the performance of the client’s selected fixed income benchmark.

The Strategy is designed to create customized portfolios that achieve the client’s goals for carbon reduction within constraints for tracking error, credit quality, duration, interest rate exposure and other factors.

For questions or for further information about the State Street Global Advisors ESG Investment Solutions, email us at esg@ssga.com