The overlooked middle: Uncover what mid caps can do for your portfolio

- Mid caps occupy the “in-between” space: established companies with proven models but still plenty of growth potential.

- Mid caps offer more diversified potential for growth and stability than large caps.

- Investors can access mid caps through ETFs like the State Street® SPDR® S&P MidCap 400® ETF Trust (MDY).

In families, the middle child sometimes gets overlooked—not as celebrated as the eldest, not as doted on as the youngest. Mid-cap companies can feel the same way in the stock market. Large caps get the headlines, small caps get lauded for higher growth potential. And so, mid caps end up flying under the radar.

With less analyst coverage than large caps and fewer investors paying attention to them than small caps, mid caps can be a source of untapped upside potential.1 They’re established enough to offer portfolio stability like large caps, yet nimble enough to offer promising growth potential like small caps. For investors who know where to look, the “middle child” may just surprise you.

The case for mid-cap investing

As all parents tell their kids (hopefully), there is no favorite child. Investments are no different—large, mid, and small caps all have their respective strengths and trade-offs. But why might mid caps be the right investment for you?

Broad sector exposure

You could say mid caps live in the sweet spot of innovation and expansion. They’re no longer bootstrapping start-ups fighting for survival, but they still have ample runway to scale. And this is reflected in a more balanced sector exposure than heavily concentrated large caps.

But what sectors are mid caps in? I thought you’d never ask. Notable middle market sectors include:

- Industrials: May include companies leveraging automation to meet global supply chain demand.

- Financial Services: Regional banks and fintech firms with established market penetration and maneuverability.

- Information Technology: Cloud-based platforms, software developers, and cybersecurity firms that have secured a foothold thanks to enterprise and/or consumer solutions.

- Consumer Discretionary: Brands with loyal followings that are expanding into new markets.

- Health Care: Especially biotech and medical device manufacturers that are actively advancing treatments.

More stability than small caps

Mid caps typically enjoy advantages of scale that small caps haven’t yet realized—stronger balance sheets, better access to cost-effective capital, and proven business models with established customer bases.

Their operational maturity means their revenue streams tend to be more predictable than small caps, and they have historically experienced less market volatility than smaller firms (Figure 2).

Of course, no company (regardless of size) is invincible. But mid caps offer an attractive balance between growth potential and stability.

QUICK QUIZ

If the S&P MidCap 400® were a standalone country, where would its total market value rank among the world’s largest markets?

Correct!

The S&P MidCap 400’s market capitalization is $3.28T.2 That means that if it were a standalone country, it would rank in the top 10, sitting between #6 United Kingdom ($3.64T) and #7 France ($3.16T).3

Sorry, wrong answer.

The S&P MidCap 400’s market capitalization is $3.28T.2 That means that if it were a standalone country, it would rank in the top 10, sitting between #6 United Kingdom ($3.64T) and #7 France ($3.16T).3

US exposure without the concentration risk

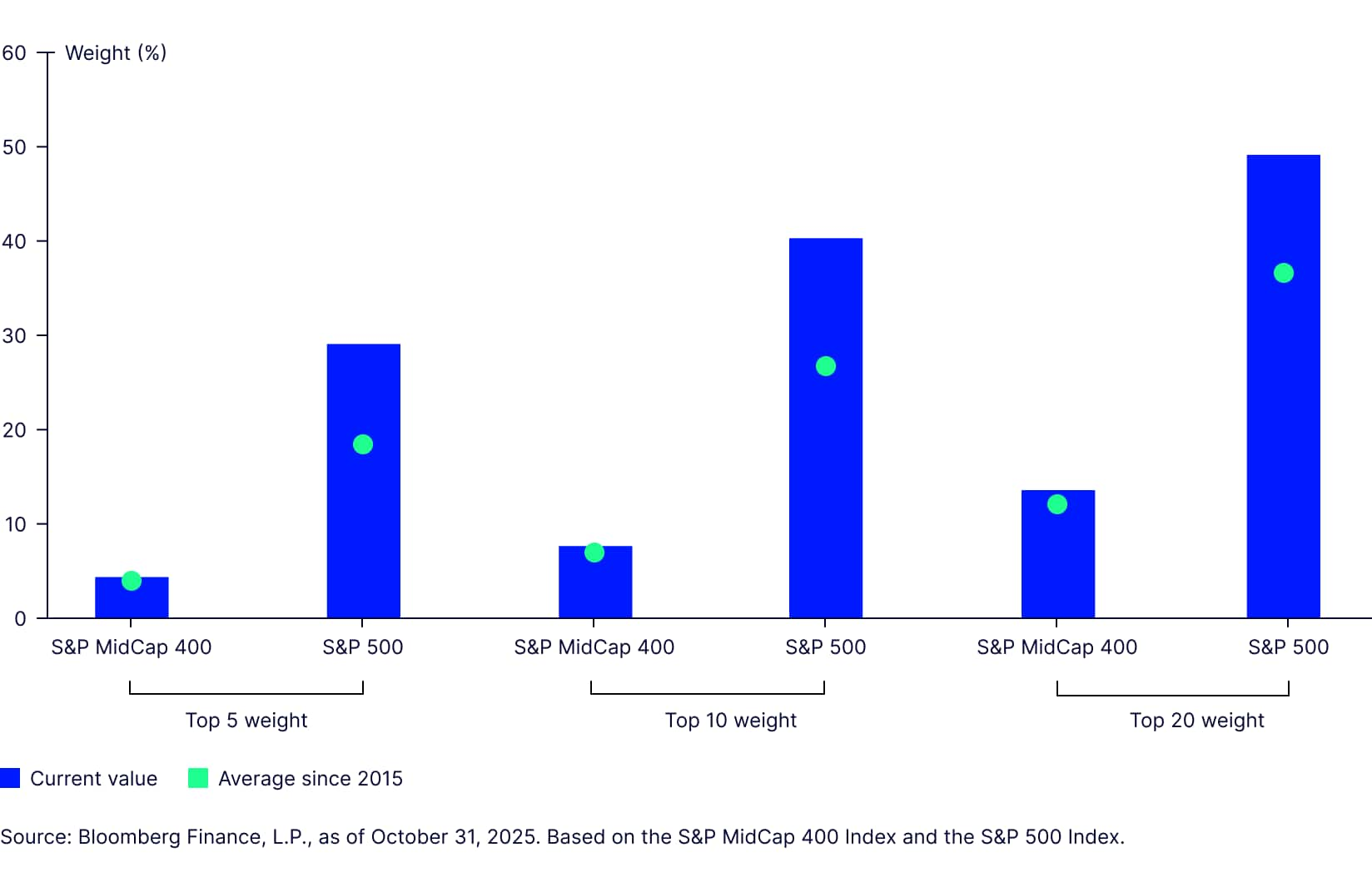

These days, a handful of mega-cap tech related titans control the movements of large-cap indexes—just 10 companies make up 43% of the S&P 500.4 While those big names have delivered strong returns, leaning too heavily on a handful of names can leave a portfolio exposed to single name concentration risks.

The top 10 holdings represent just 7% of the S&P MidCap 400 Index and the top 20 equal just 12% (Figure 3).

Figure 3: Mid caps may offer greater diversification among top holdings than large caps

With mid caps, you can access the strength of the US economy, without piling into the same crowded trades as everyone else.

More reasons to play the middle

Take a swing through Finding the fairway: 9 reasons mid caps belong in every investor’s bag. This exclusive white paper tees up how mid caps hit a rare balance of growth potential, stability, and US focus.

How mid caps have performed historically

Mid caps may fly under the radar, but they don’t sit on the sidelines twiddling their thumbs. Over the past few decades, they’ve actually outperformed both small-cap and large-cap indexes.

And compared with the Russell 2000 (which pulls its holdings from a subset of broader Russell indexes based on the number of stocks rather than a market-cap cutoff), the S&P MidCap 400 stands out by offering investors a more well-defined mid-cap segment—one that has delivered stronger long-term performance.

Ways to invest in mid caps

Convinced mid caps deserve a place in your portfolio? There are plenty of options to choose from.

For most investors, the simplest way to invest in mid caps is through an exchange traded fund (ETF) or mutual fund. These funds bundle together hundreds of mid-cap companies, giving you diversified exposure in a single trade.

ETFs like the State Street® SPDR® S&P MidCap 400® ETF Trust (MDY) track the S&P MidCap 400, a widely followed benchmark, and make it easy to add the “middle child” of the market through any brokerage account.

If you prefer a hands-on approach, you can build your own basket of mid-cap stocks. This gives you control over the specific companies you own, which can be useful for over-and under-weighting as well as tax-loss harvesting. The trade-off is the time, research, and overall effort to identify which mid caps have the potential to succeed.

Another option is working with a financial advisor or asset manager who can build a mid-cap portfolio for you. This route comes with the added benefit of expert, goals-oriented guidance. That said, a custom single name mid-cap portfolio could add other complexities (e.g., trading costs).

Invest in the power of the middle with MDY

In a single trade, the original mid-cap ETF can provide your portfolio with a unique blend of stability and growth potential.

Looking for that competitive edge? Don’t overlook the middle market

Mid caps typically aren’t regulars in the headlines, but that’s precisely why they can catch people by surprise. With proven business models, room to grow, opportunities for acquisitions or consolidation, and less analyst attention than large caps, they can offer investors a unique balance of stability and upside potential.

We’ve seen firsthand how mid caps can add efficiency and potential upside to a portfolio. MDY—the original mid-cap ETF—shows some love for the proverbial middle child by giving investors easy access to hundreds of mid-sized companies across the market.