Tax efficiency is structural: ETFs continue to issue fewer capital gains than mutual funds

With Tax Day approaching, investors are once again focused on their investments’ tax efficiency—and ETFs continue to stand apart, even setting records in 2025. Read on to discover why ETFs are so tax efficient and how they stack up against mutual funds.

For many investors, tax season can come with an unwelcome surprise—unexpected capital gains distributions. Increasingly, investors are looking for ways to reduce those surprises (who wouldn’t?), and ETFs are playing a growing role.

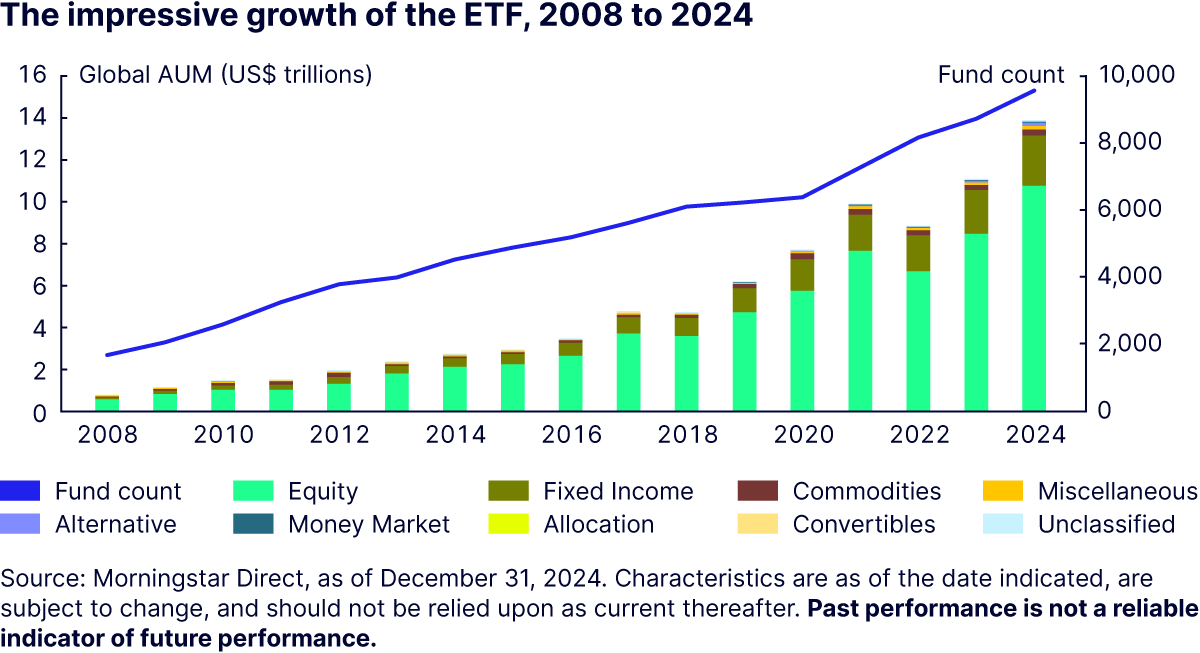

US-listed ETFs saw $1.515 trillion in inflows1 and the launch of more than 1,000 new ETFs2 last year—both all time highs. In contrast, US‑listed mutual funds experienced their second largest annual outflow, $692 billion3—despite equities, bonds, and commodities all ending the year higher.4

A major reason for this divergence likely lies in how the two vehicles handle capital gains.

How are ETFs inherently tax efficient?

ETFs and mutual funds may look similar on the surface, but when you lift the hood, you’ll find a number of nuances. Sure, they’re both open‑ended vehicles, but ETFs are generally more tax efficient due to how they are built—specifically, their creation and redemption process.

When most investors buy or sell ETF shares, those transactions occur on an exchange between investors, not at the fund level. Because the ETF portfolio managers typically don’t need to sell underlying securities when investors sell their ETF shares, ordinary investor trading activity doesn’t result in capital gains that must be distributed to investors.

In contrast to ETFs’ market level trading, when a mutual fund investor redeems shares, the fund itself must provide cash to meet that redemption. That means a portfolio manager may need to sell underlying securities. If those securities are sold at a gain, the realized capital gain must be distributed to all remaining shareholders in the fund.

Across asset classes, ETFs generate far fewer capital gains

The tax benefits of ETFs’ structure are visible across markets and over time.

Only 7% of ETFs paid a capital gain in 2025, compared with 52% of mutual funds.5 That’s in line with averages. Since 2016, ETFs have consistently paid fewer capital gains, with a long‑term average of 9% of ETFs distributing gains versus 53% for mutual funds.6 Across the combined universe of both mutual funds and ETFs, 40% of equity funds distributed a capital gain in 2025 compared to just 8% of fixed income funds.7

Breaking that down by vehicle highlights a sharp contrast:

- Equities: Only 6% of equity ETFs paid a capital gain in 2025, compared with 57% of equity mutual funds8

- Fixed income: 23% of fixed income ETFs distributed a gain, versus 37% of fixed income mutual funds9

And the more than 1,500 “alternative” ETFs—from derivative income to digital assets and nontraditional bonds10—designed to help investors boost portfolio resilience also proved more tax-efficient compared to their mutual fund counterparts. Last year, just 6% of alternative ETFs paid a capital gain compared to 30% of alternative mutual funds.11

While the ETF tax advantage shows up across asset classes, it becomes most pronounced when manager discretion—and turnover—increase.

Active management: Where the tax gap is widest

One of the defining investment trends of 2025 was the accelerating shift from active mutual funds to active ETFs—driven in part by persistent differences in both performance and tax outcomes.

Just 9% of active ETFs issued a capital gain last year compared to 53% of active mutual funds.12 Worse yet, nearly one-third of active mutual funds both underperformed AND paid a capital gain last year versus just 2% of active ETFs.13

Compared to the active ETFs, active mutual funds:

- Charge 0.32% per year more in fees14

- Saw 49% of active mutual funds underperform their benchmark versus just 26% of ETFs15

- Saw 53% of active mutual funds distribute a capital gain compared to 9% of active ETFs16

- Finished the year with 27% of mutual active funds underperforming and paying a capital gain compared to just 2% for active ETFs17

Even passive mutual funds lagged from a tax efficiency perspective. In 2025 just 4% of passive ETFs distributed a capital gain, while 41% of passive mutual funds distributed a capital gain in 2025, higher than the active ETFs’ rate of 9%.18

Tax efficiency: A consistent structural advantage

As investors increasingly incorporate traditional securities, derivatives, and alternative exposures within taxable portfolios, tax efficiency has shifted from a secondary consideration to a fundamental portfolio design input. The structure of investment vehicles now play a meaningful role in shaping after‑tax outcomes.

ETFs’ ability to limit capital gains distributions allows portfolio managers to concentrate on security selection and risk management rather than managing redemption‑driven tax consequences.

Across asset classes and styles, the evidence remains consistent: selecting a more tax efficient ETF can materially improve after tax results without requiring trade offs in exposure or return potential. This advantage is especially pronounced in active strategies, where higher discretion and turnover magnify the impact of tax drag.

The takeaway from reviewing 2025 data is clear: Tax efficiency remains one of the most durable advantages of the ETF structure, with the potential to meaningfully enhance long‑term, after‑tax performance—without compromising portfolio objectives.