5 low-cost ETFs you can buy with $100 (yes, really)

- Fees add up. Bigger expense ratios can take a substantial bite out of your long-term returns.

- Diversification is automatic. ETFs let you own hundreds (sometimes even thousands) of securities at once.

- You don’t need much to start. With $100, you can buy a single share or even fractional shares through many brokerages.

At first glance, the difference between a 0.05% expense ratio and a 0.50% expense ratio probably doesn’t seem worth the trouble. On a $100 investment, it’s five cents versus fifty cents.

Pocket change, literally.

Except investing is a long game. When you compound those fees, year after year, that little decimal point balloons into thousands of dollars over time. That’s why low-cost ETFs have become the core building blocks for so many investor portfolios—they keep more of your money working for you, not your fund manager.

But before we answer the titular $100 question, what exactly distinguishes an “inexpensive ETF” from an “expensive one?”

What makes an ETF low cost?

The primary indicator is an ETF’s expense ratio: the annual fee you pay to own the fund. It’s expressed as a percentage of your investment, and it’s automatically deducted from your returns.

Expense ratios compound just like returns. A difference of half a percent may sound trivial, but over 30 years it could mean tens of thousands of dollars in missed growth.

For example, let’s assume you invest $100 today and every month for the next 30 years, earning a steady 7% annual return. With a 0.05% expense ratio (6.95% return), your portfolio would compound to just over $113,000. With a 0.50% expense ratio (6.50% return), your investment value drops to roughly $104,000—almost $9,000 less, just from fees.

Not quite pocket change.

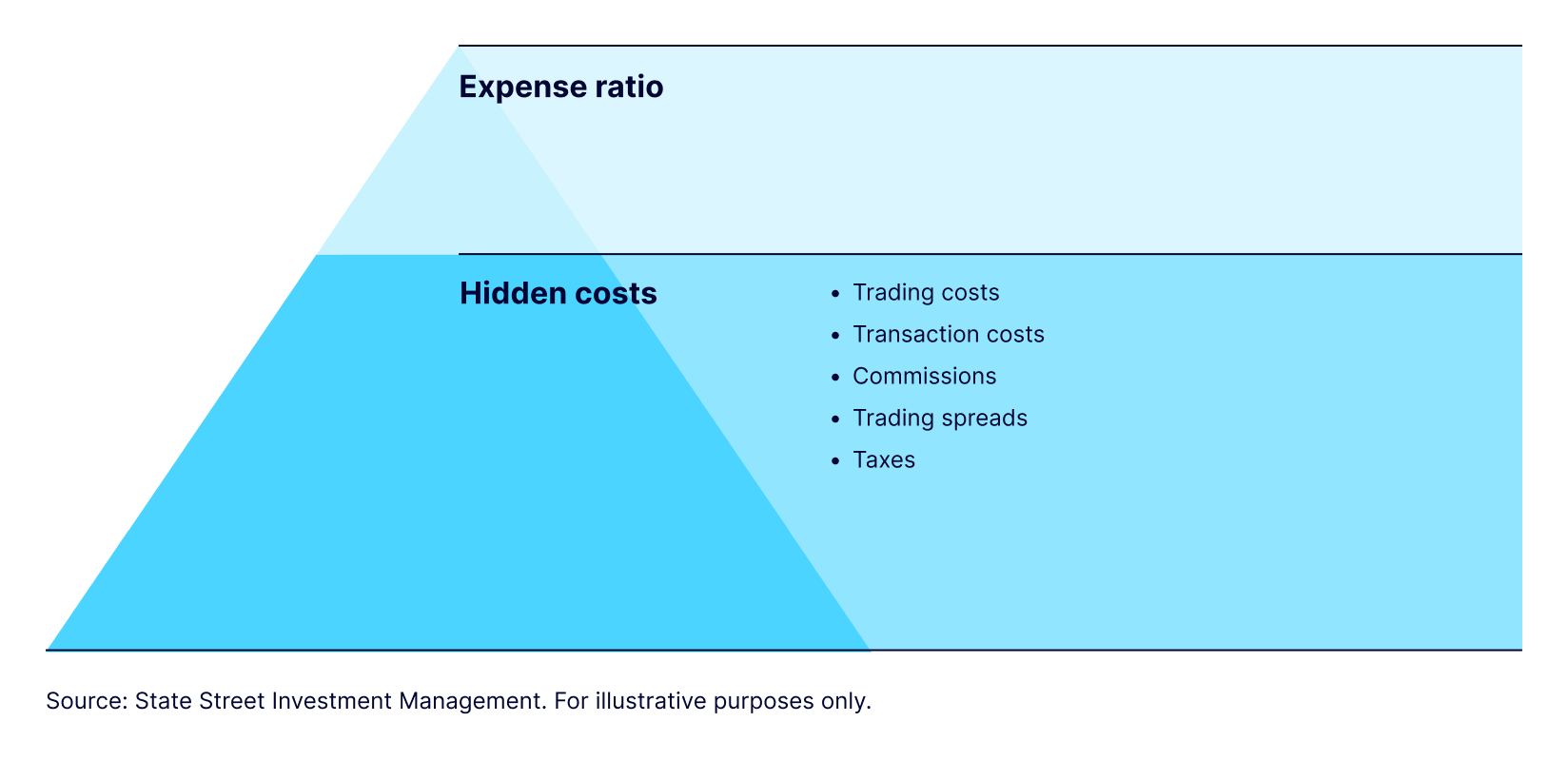

The expense ratio is the most visible cost of an ETF. But like an iceberg, what you see above the surface isn’t the whole story. There are other costs beneath the waterline that make up your total cost of ownership (TCO):

- Trading spreads: The gap between what buyers are willing to pay and what sellers are asking. Wider spreads can make it more expensive to get in and out of a fund.

- Portfolio turnover: Funds that trade their holdings frequently may incur higher transaction costs and, in some cases, trigger taxable capital gains distributions.

- Taxes: While ETFs are generally tax-efficient, turnover and capital gain distributions can still impact after-tax returns.

Figure 2: Expense ratios—only the tip of the iceberg in the TCO equation

Index ETFs tend to be cheaper and make the “low-cost ETF” list. Because they simply track a benchmark (like the S&P 500), they require less day-to-day management. That efficiency gets passed down to you in the form of lower fees.

5 low-cost core ETFs for your portfolio

There are thousands of ETFs. Fortunately, you don’t have to hunt through the market for “good deals” like you might at an outlet mall. We offer a full lineup of low-cost State Street® SPDR® Portfolio ETFs that you can use to build your core portfolio. Start exploring with these five—each designed to deliver broad market exposure at some of the lowest costs in the industry.

| Low-cost ETF | Expense ratio | Exposure | Use case |

|---|---|---|---|

| State Street® SPDR® Portfolio S&P 500® ETF (SPYM) | 0.02% | 500 of the largest US companies | Core US equity holding—simplest “starter” ETF for most investors |

| SPDR® Portfolio Developed World ex-US ETF (SPDW) | 0.03% | Developed international markets outside the US | Diversifies beyond US equities, adding Europe, Japan, etc. |

| State Street® SPDR® Portfolio Aggregate Bond ETF (SPAB) | 0.03% | Broad US bond market | Stability and income |

| SPDR® Portfolio Emerging Markets ETF (SPEM) | 0.07% | Emerging-market equities (China, India, Brazil, etc.) | Growth from developing economies |

| State Street® SPDR® Portfolio Total Stock Market ETF (SPTM) | 0.03% | Entire US stock market (large, mid, and small caps) | Broad US diversification |

State Street SPDR Portfolio S&P 500 ETF (SPYM)

SPYM is one of the simplest and most cost-effective ways to invest in the US stock market. With an expense ratio of just 0.02%, it gives you the lowest-cost S&P 500 exposure1 to roughly 500 of the largest companies across all major sectors.

Investor fit: Those who want an ultra-low-cost, diversified ETF they can hold for decades. SPYM might work well as a core equity holding in almost any portfolio.

State Street SPDR Portfolio Developed World ex-US ETF (SPDW)

SPDW provides broad access to thousands of companies in developed international markets, like Europe, Japan, Canada, Australia, and so on, at among the lowest cost.2

Investor fit: Those looking to diversify beyond US equities and gain exposure to global markets. SPDW can complement a US-focused ETF like SPYM by giving you access to leading companies overseas, too.

State Street SPDR Portfolio Aggregate Bond ETF (SPAB)

SPAB gives investors exposure to the US investment-grade bond market—including Treasurys, corporate bonds, and mortgage-backed securities—with an expense ratio of just 0.03%. It’s designed to be a core fixed income building block, helping add stability and income to a portfolio that’s perhaps already heavy on stocks.

Investor fit: Those who want to balance equity risk and potentially smooth out portfolio returns over time.

State Street SPDR Portfolio Emerging Markets ETF (SPEM)

SPEM taps into the growth potential of emerging markets like China, India, and Brazil, all for a low 0.07% expense ratio. These economies tend to grow faster than developed ones but can also be more volatile.

Investor fit: Those seeking long-term growth opportunities and who are willing to accept more ups and downs along the way. SPEM may work well as a satellite position alongside a core-US or developed-market ETF.

State Street SPDR Portfolio Total Stock Market ETF (SPTM)

SPTM gives you exposure to the entire US stock market (large-, mid-, and small-cap companies) in one trade, with a rock-bottom 0.03% expense ratio.

Investor fit: Those who want maximum coverage of US stocks without having to juggle multiple ETFs. SPTM can serve as a single, comprehensive equity holding in a long-term portfolio.

Why low-cost ETFs are essential core portfolio building blocks

There are countless ways to use ETFs in a portfolio. The low-cost core State Street SPDR Portfolio ETFs is one of the most effective ways to build a foundation. By minimizing fees, they allow more of your money to stay invested and work for you, instead of chipping away at net returns every year.

Building a portfolio is like baking a cake. There are thousands of recipes, from confetti and pound cake to red velvet and German chocolate (anyone else suddenly hungry?). But no matter which one you choose, you’ll almost always start with the same base ingredients: flour, sugar, and eggs.

At the base of a portfolio, low-cost ETFs play that same role. They’re the core ingredients that give structure, balance, and staying power, while leaving you free to add other “flavors” like thematic funds, sectors, niche markets (like private credit and digital assets), or individual stocks.

For example, a diversified mix of US stocks, international equities, and bonds—each represented by a low-cost State Street SPDR Portfolio ETF—can give you balance across markets and help smooth out volatility. From there, you can layer in more specific strategies, depending on your goals and risk tolerance.

How to choose a low-cost ETF

Determining which low-cost ETF to invest in depends on your goals and your strategy:

- Building a long-term core portfolio? Broad funds that track domestic and international companies—plus bonds—can provide the balance and diversification most investors need.

- Focused on fine-tuning? You can add ETFs that tilt toward specific regions, asset classes, or strategies. Most investors start with the core, then layer in the extras—just like a cake recipe first calls for flour (unless you’re making tortes), but might later add cocoa, mousses, or sprinkles.

The broad suite of State Street SPDR Portfolio ETFs is designed to help you build the low-cost core foundation that suits you. And if you want to dig deeper into how ETFs work and where they fit in a portfolio, the Investor’s Guide to ETFs is the “cookbook” for you.