The Bullish Case for Japanese Equities

Japanese equity indices have risen recently to their highest levels since the early 1990s, with the Nikkei 225 finally surpassing its 1989 peak, building on the strong returns recorded last year. This performance was achieved despite the economy entering a technical recession and the Noto Peninsula earthquake that could have dampened market sentiment. The market rally marks a culmination of favorable macroeconomic conditions and structural reforms that have been in the works for years. This has helped improve the appeal of Japanese equities and we believe there is a strong case that this can be maintained into the future. However, there are a number of risks that warrant attention. As we set out the prospects for Japanese equities, we shine a light on the factors likely to influence returns in 2024.

New NISA Expansion

Prime Minister Fumio Kishida has long touted his idea of a “new form of capitalism” and he has placed an expansion to NISA (Nippon Individual Savings Account) at the heart of this. NISA is a tax-free program that allowed individuals to invest up to 1.2 million yen per year in general NISA accounts (that include domestic/foreign equities, ETFs, REITs and mutual funds) and up to 400,000 yen in tsumitate accounts (that invest in mutual funds for the longer term). Following a major overhaul in January 2024, the annual limits have been raised to 2.4 million yen and 1.2 million yen, respectively. In addition, the key part of the reform is the abolition of the 20-year tax-exempt period, making investments tax-free. This system serves the growing needs of the Japanese in preparing for retirement through long-term asset management and is a crucial factor in the bull case for Japanese equities. The revamped NISA has catapulted equity trading and the benchmark TOPIX to record highs. On a net basis, Japanese individuals bought more than 200 million units of ETFs in January, while the total traded value on TOPIX reached nearly 60 trillion yen in the week ended February 10, more than twice the average between 2015-2020.

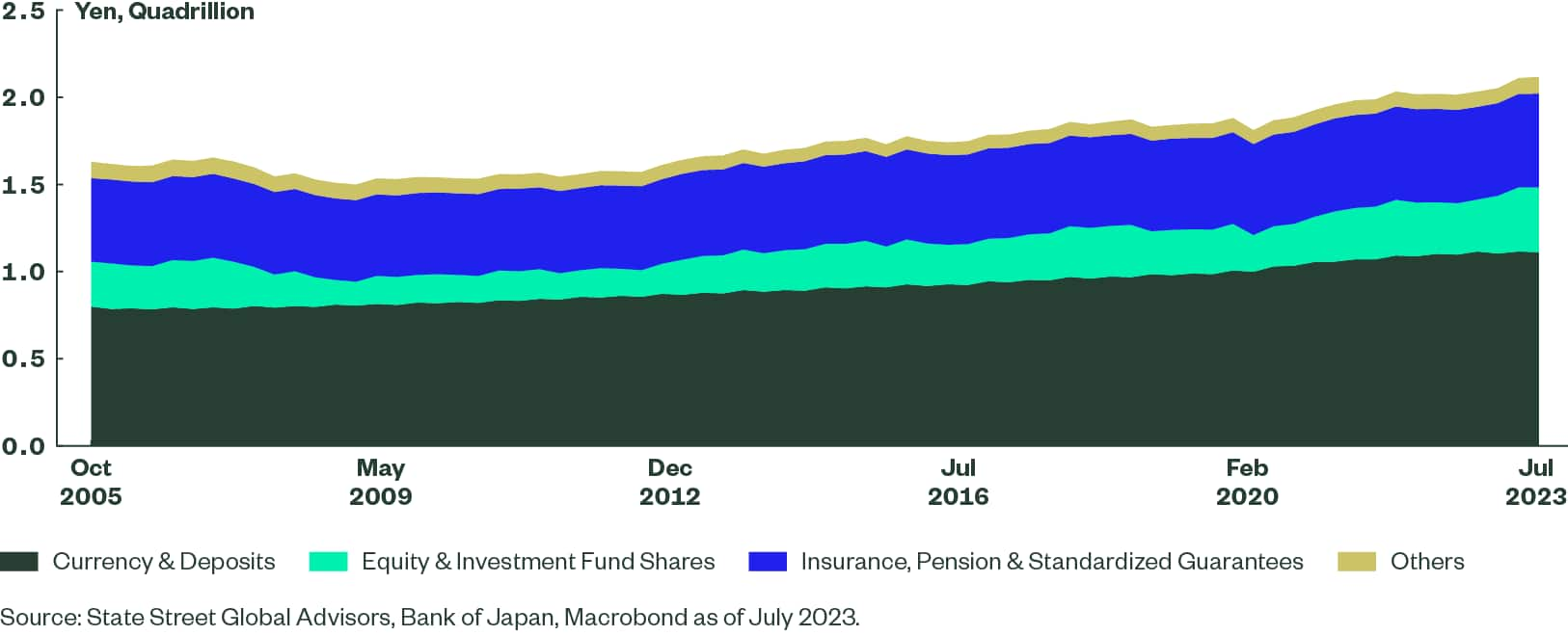

As illustrated in Figure 2, of the 2.1 quadrillion yen in household assets in July 2023, 52.5% are ‘currency and deposits’. Even with equities and investments at their highest level of 374.2 trillion yen, they only account for 17.6% of the total, in comparison to 51% in the US. By aiming for a 5% investment return annually, Kishida’s “Doubling Asset-based Income Plan” aims to increase households' investment in higher yielding investments.

Figure 2: High Share of Deposits in Japanese Household Assets

Corporate Reforms

Corporate reforms have been underway for ten years in Japan. According to the Tokyo Stock Exchange (TSE), 96.7% companies had 30% or more independent directors in 2023, compared to 6.4% in 2014.1 Furthermore, total buybacks have quadrupled to 4.15 trillion yen in 2023 from 2017. These reforms are culminating in the TSE’s latest efforts to improve the capital efficiency of companies, as 45% of the companies listed on the Tokyo Stock Exchange (TPX500 Index) traded below their book value in January 2023, compared to just 4% on the US S&P 500. As a result of the TSE’s guidance, this number is down to 33% as of February 19, 2024.

In March 2023, the TSE directed firms to disclose how they plan on improving their cost of capital and stock prices and updates the number of companies honoring their requests every month. As of February 2024, a staggering 54% companies have disclosed their intentions or are actively considering it. These improvements in corporate governance will help improve valuations of Japanese equities and are vital for optimism over the long-term.

Macroeconomic Backdrop

After two decades of stagnation, inflation is back in Japan. CPI inflation rose from a low of -1.2% year-over-year (y/y) in December 2020 to 4.3% in January 2023, predominantly led by sharply higher import prices due to supply-chain abnormalities since the Covid-19 pandemic. With base effects expected to cause a technical decline in inflation, greater attention is being given to the idea that wages will rise in response to higher inflation. This could in turn drive inflation again, creating a “virtuous wage-price spiral”.

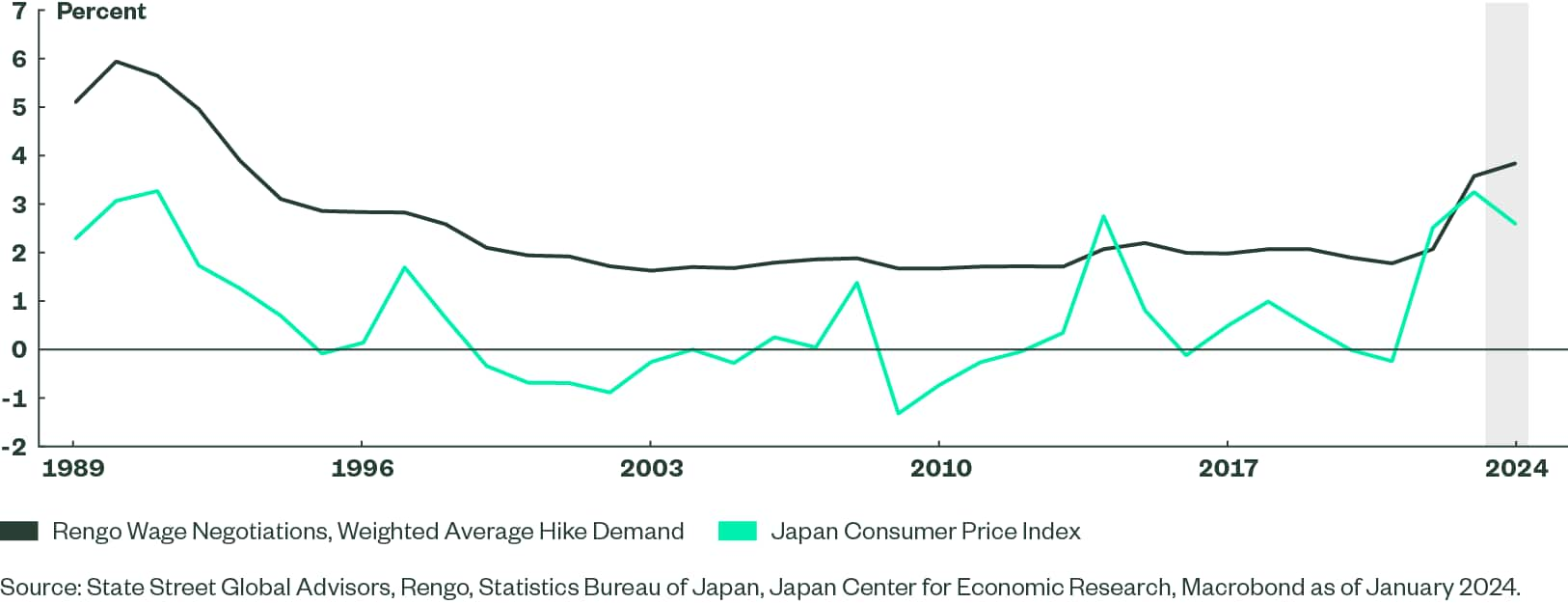

The core component of Japanese wages are determined annually during spring wage negotiations between unions and companies called ‘shunto’. Despite this component being increased by a three-decade high of 3.58% a year ago, the persistently high inflation since then has contributed to a stalling in domestic consumption. Against this backdrop, a survey by Japan Center for Economic Research forecast that this year’s shunto could deliver a wage increase of 3.85%. Japan’s largest trade union, Rengo, already plans to demand a 5.0% hike. Such increases could revitalize consumer spending and GDP. Although real GDP contracted 0.1% q/q in Q4 2023, nominal GDP rebounded 0.3% after stalling in Q3. Hence, this technical recession is precisely just technical and, real GDP could rebound in the coming quarters as inflation cools down. We expect CPI inflation to average 2.6% in 2024 (down from 3.3% last year), resulting in a rise in real incomes. Furthermore, consumer confidence has been rising on higher income expectations and an index measuring the willingness to buy durable goods is at a two-year high, according to the Consumer Confidence Survey by the Cabinet Office.

Interestingly, the return of inflation is incentivizing more Japanese to look into changing employment. The labor market in Japan is severely supply constrained, but this has generally not been reflected in wage inflation due to employees’ tendency to stay with the same employer. However, rising inflation is slowly changing this behavior, as 43.3% of those seeking employment in December had voluntarily quit their previous job.

Figure 3: Real Wage Growth Expected to Support Consumption in 2024

Bank of Japan Nearing Pivotal Moment

The Bank of Japan (BoJ) is near a pivotal moment for exiting negative interest rates, in place since 2016, as a virtuous wage-price spiral is taking shape. The dark horse among the favorable factors for Japanese equities is BoJ policy normalization, for two key reasons. First, we believe the process will be gradual and drawn out in order to restrict any spillover into the broader financial system. Governor Kazuo Ueda stressed repeatedly in recent times that easy monetary policy will continue after exiting negative interest rates. Second, higher policy rates and the new NISA could lead to higher interest and investment income, which will result in more positive earnings revisions. This will be bolstered by a strong US economy, whose Q4 GDP rose more than expected due to continuing disinflation.

While the Bank of Japan appears set to tighten, we factor in only two hikes in 2024, both of 10 basis points (bps). If the economy copes well with this change (which is our base case), the Bank’s normalization process could continue. Given that nearly 60% of the BoJ’s holdings (as of the end of FY 2022) will mature in the next five years, we consider it timely for the Bank to gradually work on its balance sheet as well.2 However, the key here is a gradual process and long-term approach; given the huge Japanese government bond (JGB) holdings of the BoJ, equity markets could react strongly to any miscalculation.

Key Risk: A Stronger Yen

Historically, the Japanese yen has exhibited a strongly negative correlation with Japanese equities. A weaker yen tends to improve exporters’ earnings, which is an important contributor to the Nikkei 225 index. Meanwhile, large drawdowns in global equities, including Japanese equities, tend to coincide with broad economic distress and large central bank rate cuts. Such periods of heightened risk aversion often result in a sharp unwind in cross currency carry trades and a rise in the yen due to (1) the reduction in carry as interest rates converge (in the low-yielding yen’s favor) and (2) higher risk that makes carry less attractive at any level of rate differential.

At the time of writing, the real effective exchange rate is nearly 30% below its 15-year average, implying substantial scope for a rally. Much of this weakness can be tied to very high global interest rates compared to Japan. The US dollar three-month interest rate is 5.6% above the similar yen rate. Historically, this suggests the USDJPY exchange rate should be trading in the 140-142 range, close to the current level around 150. However, we believe a global monetary easing cycle is near as inflation normalizes. Current market pricing of three-month yields for one and two years from now are consistent with USDJPY falling back toward 125, a 17% yen appreciation. If a recession were to threaten or materialize in 2025 or 2026, rates could be significantly lower and bring USDJPY back into the 110-115 range. The long-run historical relationship suggests that this is a major downside risk for Japanese equities.

However, a strong yen may not weigh as heavily on Japanese equities as in the past. The factors discussed earlier in this article (such as the NISA expansion, corporate reform, and changing wage dynamics) are more structural in nature. These confer an advantage to the Japanese equity earnings and valuation outlook, independent of the potential negative earnings impact of a strong yen. The strong negative correlation between equities and the yen has also broken down since the onset of the pandemic (see Figure 4). We believe that this change is likely due to the shift to a positive bond-equity correlation in recent years. If we do slip toward global recession over the next one-to-three years, alongside a deflationary impulse, then the yen-equity correlation should fall back to well below zero. In such a recessionary environment, with USDJPY dropping toward 110-115, it seems likely that most global equity markets would fall back. However, since the end of 2009, the Nikkei has outperformed the MSCI World index by an average of 0.3% in months when the MSCI World was down. While that is good for local Japanese investors, global investors would additionally see that outperformance supplemented by the potentially large yen gain.

Uncertain Prospects for Kishida Administration

Another risk to consider is the slide in PM Kishida’s approval ratings; according to the latest (February 2024) Jiji Press poll, only 16.9% people approve his leadership, which is down 1.7% from January. The Liberal Democratic Party's (LDP) support rate is also low at 16.3%, up 1.7% in the month. The Kishida Cabinet and LDP’s lack of popularity is largely due to violations of the Political Funds Control Act involving LDP factions; the Kishida administration urgently needs to prevent recurrence and restore trust. Due to the low approval ratings, it is unlikely that Prime Minister Kishida will call an early general election. The current House of Representatives term is not due to end until October 2025, so there is no immediate election risk but developments should be monitored.

Prime Minister Kishida has set up the LDP's political reform headquarters and decided to dissolve the Kishida faction, and the Abe, Nikai and Moriyama factions have followed suit. The focus will be on the survival of the two remaining factions: the Aso and Motegi factions. Historically, LDP presidential elections are largely determined by the powerful factions, and Prime Minister Kishida won the last presidential election with the support of the Kishida, Aso, Motegi, and Abe factions. The next such election is scheduled for September 2024, and it will be interesting to see if the power structure changes after factions are dissolved, and whether the incumbent Kishida can be re-elected.

Looking ahead

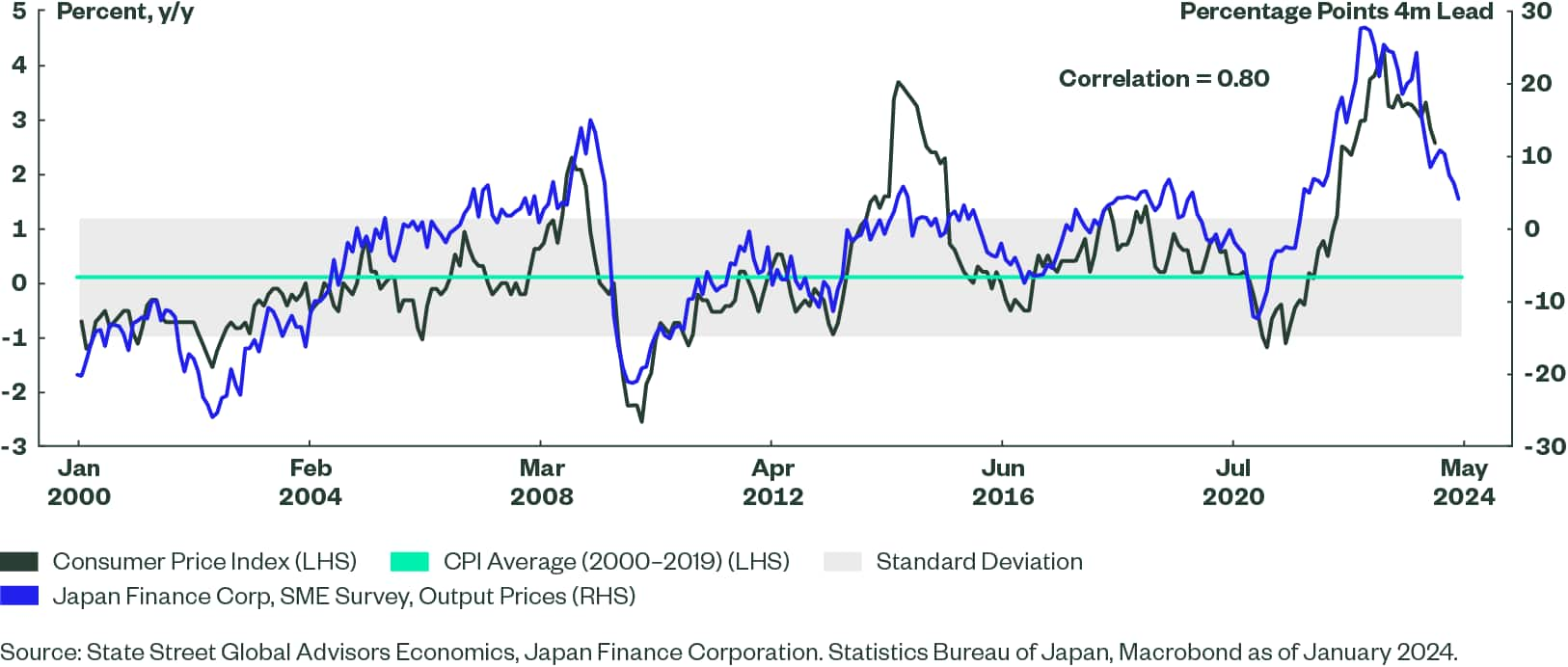

Japanese equities are well positioned to benefit from structural reforms and a favorable macroeconomic environment with ongoing TSE-led corporate reforms and inflation remaining strong. However, prices may be cooling faster than expected; the SME survey compiled by the Japan Finance Corporation leads the national CPI by four months with an 80% correlation, and shows that inflation could decline further in the months ahead (Figure 5). It is still above one standard deviation of the average CPI between 2000-2019, but close attention on inflation is warranted, especially as the BoJ adjusts their policy stance.

Figure 5: Downside Risks to Japan’s CPI

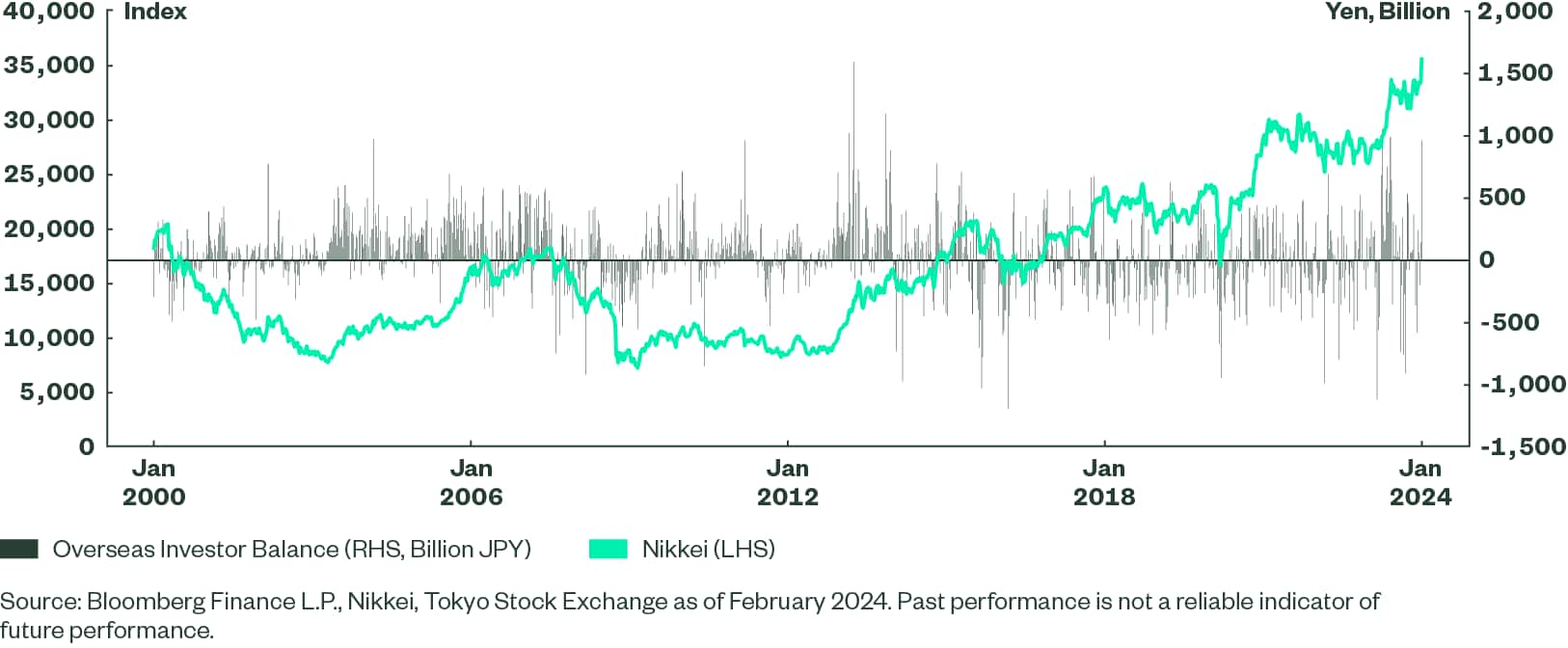

Foreign investors are a crucial force in the continued bullish case for Japanese equities. Strong overseas inflows were observed after the postal reforms in 2005 and at the beginning of Abenomics in 2013-2014 when equities rallied. For example, Japanese equities advanced after Warren Buffet’s Berkshire Hathaway bought into five trading houses in Japan in 2020 and had raised its stake to an average of 8.5% by last year. However, global flows are a function of overseas monetary policy and have the potential for higher volatility amid a rapidly evolving global macro backdrop.

Figure 6: Overseas Investors Balance and Japanese Equity Market

The Bottom Line

Japanese equities have rallied in early 2024, and we suspect their best is yet to come. The rally is the culmination of important structural reforms and a favorable macroeconomic environment and are well set to continue this performance into the years ahead. However, rapidly cooling inflation, the possibility of a stronger yen, and a low approval rating for the current administration pose risks.