Framework More Constructive on US Large Caps

Each month, the State Street Global Advisors’ Investment Solutions Group (ISG) meets to debate and ultimately determine a Tactical Asset Allocation (TAA) that can be used to help guide near-term investment decisions for client portfolios. By focusing on asset allocation, the ISG team seeks to exploit macro inefficiencies in the market, providing State Street clients with a tool that not only generates alpha, but also generates alpha that is distinct (i.e., uncorrelated) from stock picking and other traditional types of active management. Here we report on the team’s most recent TAA discussion.

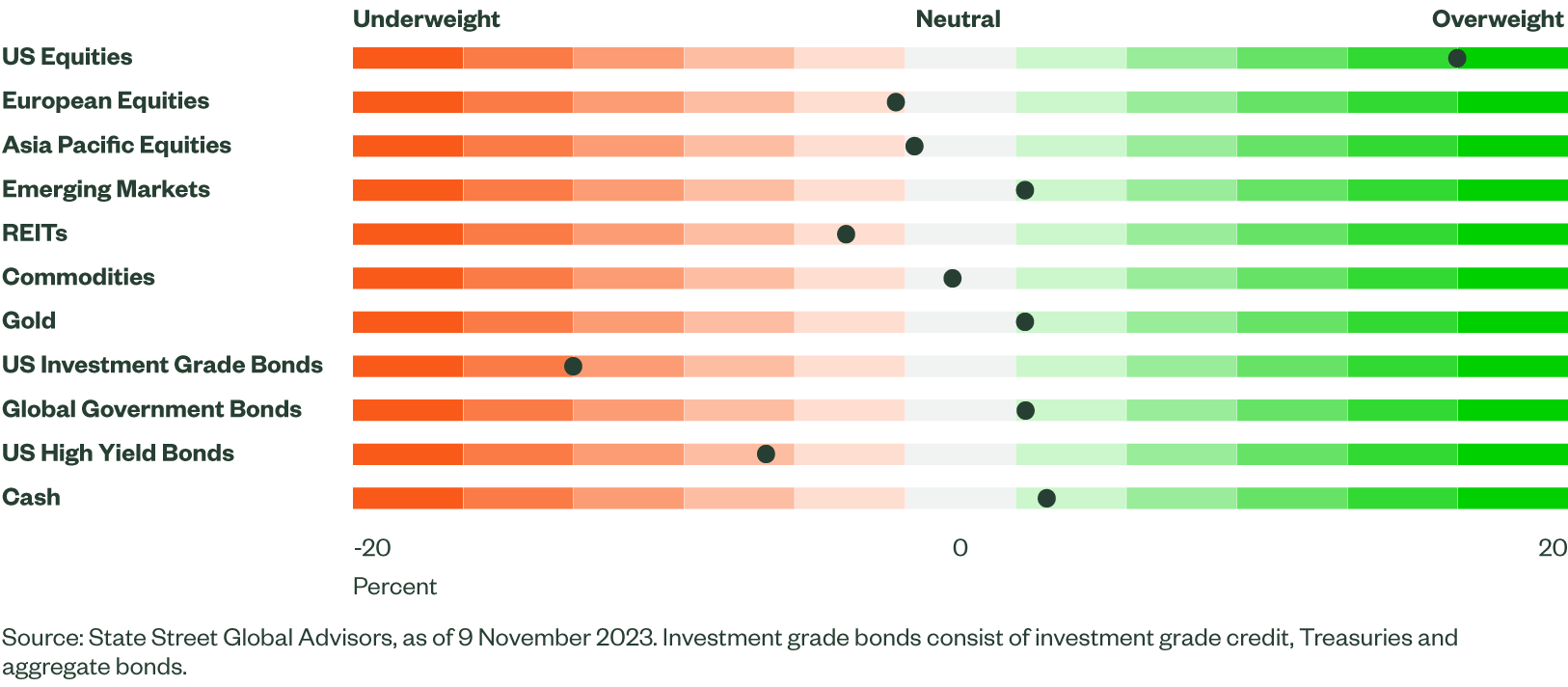

Figure 1: Asset Class Views Summary

Macro Backdrop

The strong third-quarter economic growth number for the US gives the appearance of an economy accelerating. Datapoints, however, are pointing to a growth slowdown ahead, which does not imply a recession as household fundamentals should support resilience.

After a stellar third quarter, the Atlanta Fed’s GDPNow estimates the US economy tracking a seasonally adjusted annual rate of 2.1% in the fourth quarter, a moderation from 4.9%. Activity measures point to slower growth ahead with the manufacturing purchasing managers' index (PMI) dropping further with new orders contracting at the fastest rate since May. While the services PMI remains in expansion, it came in well below expectations in October. Strong consumer spending and sticky service inflation suggest it is only a gradual slowdown.

The lagged effects of tighter policy (the fed funds rate, balance sheet runoff and tighter lending standards) are still negatively impacting the economy, but to become less restrictive, the Fed will need to witness employment and wages cool further. On that front, we see signs of progress. While the unemployment rate is low, it has ticked up to 3.9%, its highest level since January 2022, and while some oscillations around this level are likely, it appears the unemployment rate has bottomed.

Labor readings are solid, but looking under the hood suggests a less robust picture. The recent nonfarm payrolls disappointed, and while the three-month average is still solid, the previous two months were revised down by a combined 110,000. Some of the drop is due to the auto workers’ strike, which accounted for most of the decrease in manufacturing jobs, but a third of the jobs were also from the government. The Bureau of Labor Statistics’ labor diffusion index, which tracks the net industries adding employees, has been deteriorating and now sits at its lowest level since the onset of COVID-19.

However, it is not all doom and gloom, as the prime working age labor participation rate has increased, as have job openings, with the job openings-to-unemployed ratio remaining high at 1.5x. Finally, although wage growth has steadily moderated, it remains elevated and positive in real terms.

Expectations for slower growth and inflation, along with trends in the labor market and wages, support our view that the Fed has finished hiking. However, the Fed’s path moving forward is complicated as growth and inflation are elevated and the risks for another hike are high. In a recent speech to the IMF, Fed Chairman Jerome Powell noted as much, stating the Fed is not confident they have achieved a sufficiently restrictive stance to bring inflation down to 2% over time.

Most worrying is the “supercore” measure, core services ex-housing, which has moved higher with the increase being broad based. The softening in labor and wages should help bring inflation down further, but the timeline for this is uncertain.

Outside of the United States, growth has been weaker, while activity measures also point to sluggish growth ahead. However, there are some positives. The eurozone economy has struggled but not collapsed. Recent PMI readings point to broad-based weakness in demand, but the euro area business sector is profitable and continues to hire, which has supported households with solid wage gains. The war in Ukraine and energy crisis last winter have restricted consumption, but high savings and positive wage growth provide room for upside to consumption in Europe in the future.

In Asia, grid spending has helped offset weakness in domestic consumption and China’s real estate sector, while Japan’s labor market remained firm. Additionally, both countries announced stimulus with China increasing this year’s fiscal deficit and Japan announcing a one-off tax cut with cash distributions to low-income households and subsidies to ease utility bills.

Overall, we still believe that tighter financial conditions, softer labor and wage dynamics as well as consumer fatigue will bring global growth and inflation down.

Directional Trades and Risk Positioning

After moving off the very strong, sometimes euphoric, risk sentiment readings experienced most of the year, investor attitude towards risk taking remained neutral for most of October. The instability in the Middle East created some uncertainty, while large Treasury issuances were met with weak auctions, which left investors questioning demand. Elsewhere, inflation outpaced expectations with both producer prices (PPI) and consumer prices (CPI) beating forecasts while consumer inflation expectations in the NY Fed survey ticked higher. Lastly, Fed minutes released mid-October suggested officials believed rates to be restrictive but that another hike may be appropriate with more discussion around higher for longer.

Implied volatility on currencies appeared to shake off any concerns, with our measure moving lower throughout the month, eventually settling at the low end of euphoria. However, an increase in risky debt spreads and higher implied volatility on equities kept our Market Regime Indicator (MRI) in a normal regime. As we closed October and moved into November, weaker jobs data, underwhelming PMI releases and another Fed pause lifted risk appetite. Risky debt spreads decreased while implied volatility on equity marched lower, with both factors finishing on the cusp of low risk and pushing our MRI down into a low risk regime. Overall, investor risk appetite has improved and is supportive for risk assets.

While our outlook for fixed income has improved, our quantitative models still forecast higher yields and favors equities over bonds. For equities, weak recent performance has turned our price momentum indicators negative, but has improved valuations, which appear strong. Elsewhere, analyst expectations for both earnings and sales have declined, but balance sheet health amongst companies remains robust. Overall, our outlook for equities remains favorable.

Recent data and Fed speak have produced a rally in bonds, but our evaluation of fixed income suggests yields may move higher while credit spreads could widen. While the latest ISM manufacturing PMI reading weakened, it remains higher than our lookback window, which suggests yields should rise. Additionally, nominal GDP continues to run well above the yield on long-term Treasuries, which also suggests rates should increase.

With our MRI moving into an environment that is typically supportive for risk assets and our forecast for equities still positive, we increased our overweight to global equities while selling cash and aggregate bonds.

Relative Value Trades and Positioning

Within equities, our forecast for non-US developed equities has softened while expectations for the US remain firm. In Europe, sentiment indicators, estimates for both sales and earnings, have deteriorated and have become more negative while some of the macroeconomic factors have also become less supportive. Valuations remain attractive, but the region is not attractive on a relative basis.

Improvements in both sentiment and macroeconomic indicators combined with still positive price momentum and healthy balance sheets keep the US atop our regional rankings. Within the US, our framework has become more constructive on large caps relative to small cap equities. Valuations are more attractive for small cap, but improved earnings sentiment and price momentum are more favorable for large cap equities.

Against this backdrop, we sold European equities, which offset the buy resulting from our directional addition to global equities. Additionally, we sold US small cap equities with all proceeds deployed to US large cap. At the total portfolio level, we now hold a significant overweight in US equities with overweights to both large and small cap.

Within fixed income, we sold high yield bonds and a small amount of cash which funded the purchase of non-US government bonds, which is now an overweight. Our expectations for high yield remain muted as meaningfully higher rates imply a rising cost of capital that could create additional hurdles. On a relative basis, non-US government bonds are more attractive and allow us to diversify our currency exposure given the sizable overweight to US equities.

Finally at the sector level, we maintained an allocation to energy and the split allocation to communication services. We rotated out of industrials and into tech while also moving the split allocation from materials into financials. Despite the recent pullback in oil prices, energy remains our top ranked sector, buoyed by positive macroeconomic factors, attractive valuations and robust price momentum. With a large portion of earnings season behind us, analysts’ expectations for earnings and sales have improved and are now meaningfully positive for the communications services sector. Sturdy price momentum and desirable valuations buttress the sector.

Our expectations for industrials are still positive, but weaker price momentum and worse sentiment readings have pushed the sector down our rankings. Similarly, our outlook for materials remains optimistic, but a deterioration in price momentum and sentiment indicators make the sector less appealing on a relative basis. Technology is expensive based on valuations, but healthy balance sheets, solid price momentum and meaningful improvements in expectations for both sales and earnings have pushed the sector up our rankings. Lastly, the addition of financials was driven by better sentiment measures, which turned positive.