Risk Sentiments Still Favor Equities

Each month, the SSGA Investment Solutions Group (ISG) meets to debate and ultimately determine a Tactical Asset Allocation (TAA) to guide near-term investment decisions for client portfolios. Here we report on the team’s most recent discussion.

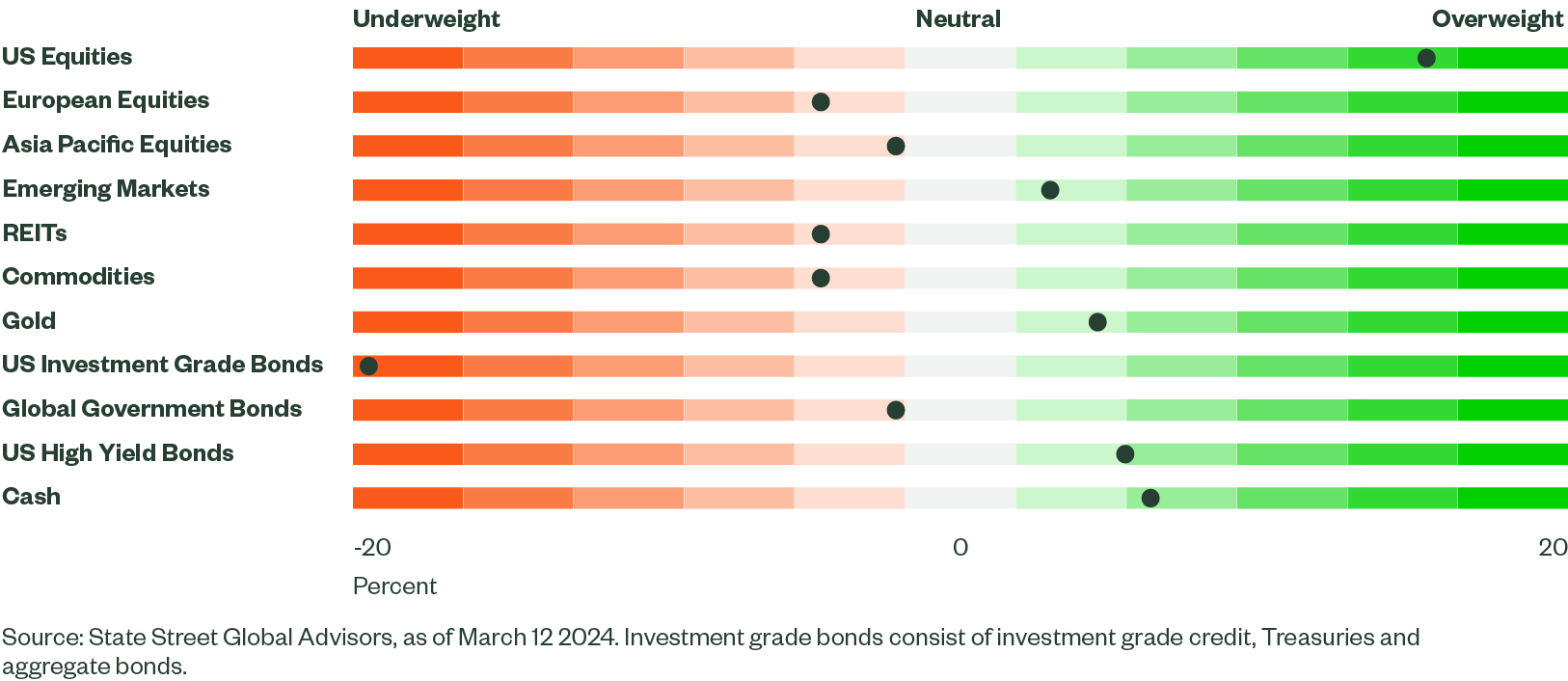

Figure 1: Asset Class Views Summary

Macro Backdrop

To market participants, it may seem that the path to normalization is akin to taking three steps forward and two steps back. Macroeconomic data over the past few weeks hasn’t sent a clear signal to the US Fed that rates are too restrictive, but the Fed should still be on track to cut rates sometime in 2024.

Activity in the US trended lower as impact from the Fed’s hiking cycle continued to work its way through the economy. The Fed’s Beige Book reflected a small increase in economic activity for February, but this is in contrast to the ISM survey measures, with both service and manufacturing purchasing manager's indices taking a step back. The overall outlook for future economic growth in the Beige Book was positive with expectations for better demand and less restrictive financial conditions ahead. The Atlanta GDPNow for Q1 is tracking at 2.5%, down from 3.4% last month, pointing to a moderating but resilient economy.

The labor market continued progress towards more balance, but the job openings-to-unemployed ratio still sat at 1.45. Layoffs continued to garner headlines, but jobless claims, both initial and continuing, remained relatively low even after ticking higher over the past couple weeks. Elsewhere, February’s ADP private payroll underperformed, but still pointed to a solid pace of job gains. February’s payrolls report exceeded expectations, but was offset by meaningful downward revisions to previous readings. Like the ADP report, the payrolls report also reflected solid job growth. Finally, the unemployment rate rose to 3.9%, the highest level in two years, helping slow wages, which continue to grind gradually lower.

After mixed inflation readings the previous month, inflation data released over the past few weeks was higher than anticipated, boosted by service sector pressure. January’s consumer price index (CPI) grew 3.1% YoY due to an acceleration in core services and higher food inflation. This was followed by a firm producer prices index, which jumped more than expected with strong gains in services. The Fed’s preferred personal consumption expenditures price index also advanced in January, led by core services inflation, including ex-housing categories, and less deflation in core goods than previously. The February CPI release did little to assuage concerns, with both headline and core readings above consensus estimates and the six-month average core CPI reading continuing to move higher.

Inflation is likely to decelerate further, but numerous risks will test the Fed’s confidence that prices will settle close to target. Fed Chair Jerome Powell’s testimony in early March struck a more hopeful tone, but commentary from other members of the FOMC was less optimistic. Labor markets are cooling and wage growth is falling, but services inflation remains too tight for the Fed to hit its target. Ongoing geopolitical tensions, the possibility of higher oil prices and the potential for shelter to re-accelerate, among others, will challenge the disinflation trend and keep the Fed cautious. Sticky inflation and looser financial conditions will keep the Fed on the sidelines for now, but we do expect multiple rate cuts before year end.

Directional Trades and Risk Positioning

Investors have looked past larger-than-anticipated inflation prints and Fed caution, choosing instead to focus on continued positive economic activity, the ongoing disinflation trend and solid corporate earnings. Risk sentiments stayed favorable with our Market Regime Indicator (MRI) oscillating between low-risk and euphoria regimes. While a euphoria regime signals some complacency among investors, both regimes are typically favorable for risk assets. Risky debt spreads and implied volatility in currency measures remained benign, spending most of February towards the bottom of euphoria. Implied volatility in equity drove gyrations, with the MRI bouncing between normal and low-risk regimes. Overall, our MRI signals a positive attitude towards risk.

From a quantitative perspective, our models continue to forecast positive equity returns but a challenging environment for most fixed income assets.

Equity valuations weakened due to strong performance over the past few months, but sentiments, both earnings and sales expectations, improved while price momentum and balance sheet health are robust.

Manufacturing PMIs retreated in February but are still higher than a few months ago, signaling improved growth and higher interest rates. Additionally, our momentum indicator and sturdy nominal GDP growth imply that yields will continue to rise. Our model remains upbeat on high-yield bonds, expecting further spread tightening. Recent equity momentum, seasonality and the relatively lower levels of government rates support the sector.

With no significant changes to our forecasts, we maintained our previous directional positioning. We retain our overweight in equities, high yield and cash funded from aggregate bonds. Additionally, we continue to underweight broad commodities, but hold a target overweight to gold, which remains supported by our model.

Relative Value Trades and Positioning

There were no changes to our regional rankings and we did no execute any trades. The US is our top-ranked country across all factors except value and is our largest overweight. Our forecast for emerging markets has softened but is still positive and keeps us modestly overweight. Sentiment continues to weaken, but valuations are still attractive and price momentum is advantageous. Our forecast for Europe improved but remains negative due to poor sentiment, with both sales and earnings expectations declining. Pacific equities benefited from upgraded price momentum and strong sentiment indicators, but weaker balance sheet health and poor macro factors weighed on our expectations. Overall, we maintained an underweight in global developed market ex-US equities.

Given the very minor changes to our forecasts for fixed income, we made a small adjustment to our bond positioning. We sold US intermediate government bonds with proceeds deployed to non-US government bonds. The sell leaves us with a small underweight which combined with an underweight to aggregate bonds, helps fund our healthy overweight to high-yield bonds and cash.

Finally, at the sector level, our model continues to favor technology and communication services and we maintain those allocations. Elsewhere, we rotated out of financials and into industrials. The downgrade to financials was due to softer price momentum indicators while macroeconomic factors are still negative. Industrials benefited from improvements in valuations and better sentiment while price momentum remains favorable. Robust price momentum, healthy balance sheets and sturdy sentiment indicators drove our model’s preference for communication services and technology.