Increase Overweight in Cash and Equities

Each month, the State Street Global Advisors’ Investment Solutions Group (ISG) meets to debate and ultimately determine a Tactical Asset Allocation (TAA) that can be used to help guide near-term investment decisions for client portfolios. By focusing on asset allocation, the ISG team seeks to exploit macro inefficiencies in the market, providing State Street clients with a tool that not only generates alpha, but also generates alpha that is distinct (i.e., uncorrelated) from stock picking and other traditional types of active management. Here we report on the team’s most recent TAA discussion.

While China’s growth has underwhelmed and Germany, the world’s fourth largest economy, has entered a technical recession, forecasts for a US recession continue to be pushed back further into 2023 and even 2024. Data has been a mixed bag and revisions have been quite large, but, overall, recent data prints have been stronger than anticipated, signaling resilience in activity and inflation. This is reflected in the Citi Economic Surprise Index, which has been positive for the US, but has been steadily weakening in Europe and China.

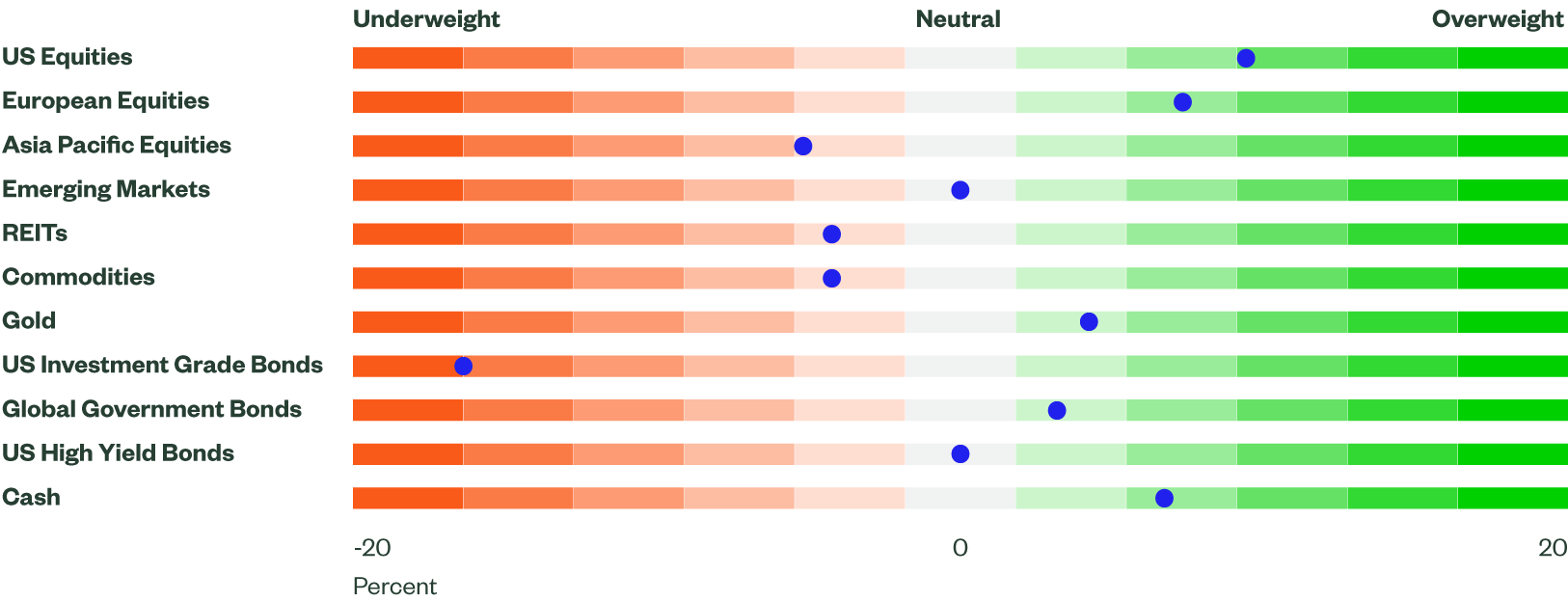

Figure 1: Asset Class Views Summary

Source: State Street Global Advisors, as of 9 June 2023. Investment grade bonds consist of investment grade credit, Treasuries and aggregate bonds.

After weighing on growth, housing seems to have found a pulse and appears prepared to contribute positively to the gross domestic product (GDP) in the US. Home sales and permits have trended higher, while new starts appear to have bottomed, supported by a serious lack of supply. High mortgage rates and the still soaring house prices could dampen the momentum, but near-term momentum remains positive.

Consumers have continued to exhibit strength, with personal consumption expenditures (PCE) surprising to the upside in April, rising by a strong 0.5% MoM. Consumers still have cash, and while excess savings have been winding down, they remain positive and should be supported by a healthy labor market. Employment reports have been mixed and the strong Job Openings and Labor Turnover Survey (JOLTS) report may overstate genuine job openings, but jobless claims remain low and demand for labor remains strong.

Despite this strength, there is undoubtedly some weakness. The Conference Board’s leading economic indicator for both Europe and the US continues to fall, signaling a worsening economic outlook and slower growth ahead. Manufacturing and services activity measures weakened in the US, Europe and China in April, with manufacturing activity remaining in contraction. In the US, the services Purchasing Managers’ Index (PMI) fell more than expected and is on the cusp of contraction.

While inflation has moderated, some areas remain stubborn. Prices paid in both the manufacturing and services PMIs fell, but PCE inflation figures surprised to the upside again, and the University of Michigan’s survey showed that consumer inflation expectations for the next five years had hit a 12-year high of 3.2%. Finally, the Zillow Observed Rent Index (ZORI) has continued to moderate year-over-year, but in absolute terms, the index has turned higher again, suggesting it will take some time before shelter inflation works through the Consumer Price Index (CPI). While the disinflation move remains intact, it will likely take longer than expected to return to the US Federal Reserve’s (Fed) goal of 2.0%. Additionally, inflation and the labor market remain too high for the Fed’s liking, which could force its hand into at least one more rate hike in 2023.

Tightening credit standards are a growing headwind, and combined with persistent inflation and sustained monetary policy tightening, they will weigh on economic activity and likely cause a recession. However, the strength among consumers and corporations, along with the eventual policy pivot from the Fed, should lighten the impact.

Directional Trades and Risk Positioning

Investors continue to exhibit strong risk appetite, as measured by our Market Regime Indicator (MRI), which remained in a Low Risk regime throughout May. The debt ceiling crisis, more upside surprises on inflation and the re-pricing of the Fed’s monetary policy expectations briefly unnerved equity markets toward the end of May, with our measure of implied volatility on equity jumping from Euphoric to the upper end of a Low Risk regime, where it finished the month. Helping to offset this move was a calming in bond markets, with our measure for risky debt spreads easing to the lower threshold of a Normal Regime. After collapsing in March, implied volatility on currency has been almost nonexistent, with our reading scraping the bottom of a Euphoric regime. Overall, our MRI still points to a favorable risk environment for equities.

Risk sentiment is not the only favorable tailwind for equities. Our fundamentals-driven model continues to forecast positive returns. Bottoming toward the end of 2022, analyst expectations for both earnings and sales have rebounded, with sentiment a positive for equities. Our evaluation of the health of company balance sheets is favorable and supports our outlook on equities. Lastly, valuation metrics, free cash flow and buyback yields remain attractive and buoy equities.

The recalibration for fewer Fed rate cuts weighed on bonds in May and our modeling forecasts more pain ahead with high rates. The resilience of US economic growth leaves nominal GDP higher than the yield on long Treasury bonds, signaling that yields could rise further. With headline inflation having dropped precipitously from the 2022 highs, our model indicates that yields might have fallen too low and some upward repricing might occur. Further, recent interest rate momentum also points to higher rates.

With support from both our risk indicators and our fundamental model, we increased our overweight to equities. Additionally, we expanded our cash overweight and funded both purchases by selling US aggregate bonds.

Relative Value Trades and Positioning

Our assessment of the regional equity landscape continues to favor US and European equities. Against this backdrop, we executed a minor rotation from Pacific equities into US small cap equities. The buying of US small cap brings our allocation to a slight overweight, which was supported by strong macroeconomic factors for the US. Additionally, price momentum for the US has improved, making it more attractive relative to Pacific equities. Furthermore, sentiment indicators – expectations for both sales and earnings – are weaker for Pacific equities and dampen our outlook on the region.

Within fixed income, we continue to favor a barbell approach, with an overweight to cash as well as a small overweight to longer-term government bonds; and, in keeping with that view, we reduced exposure to both intermediate government bonds and non-US government bonds. The proceeds were moved to US aggregate bonds, offsetting the sell on the directional side for a net buy of 0.5% at the total portfolio level. With our bond models suggesting little movement in the shape of the curve in the near term, we find the combination of short-end carry and long-end duration to be attractive.

At the sector level, we maintained our allocation to industrials, but rotated out of energy and communication services into consumer discretionary and healthcare. Industrials retains our top ranking, supported by strong sentiment with robust analyst expectations for both sales and earnings. Elsewhere, short-term price momentum remains weak, but longer-term measures buoy the sector. With the drop in energy prices and recession fears, energy companies have struggled to find a stable footing. Price momentum, both short- and long-term, is a headwind for the sector. Although valuations are attractive, expectations for a recession and lower demand, combined with lower energy prices, are a drag on profits, which is reflected in the poor earnings and sales estimates.

While not a leader, healthcare exhibits strength across all factors, except valuations. In our estimation, balance sheets appear solid, while price momentum is strong and expectations for profits are positive. The artificial-intelligence-driven tech rally has improved price momentum for the tech-heavy communications sector. However, a meaningful drop in earnings expectations, combined with unfavorable macroeconomic indicators, has pushed the sector down in our rankings. Our expectations for consumer discretionary improved, with better long-term price momentum complementing solid short-term momentum. Although valuations are marginally unattractive, strong consumers help buoy the outlook for both sales and earnings, which buttresses the sector.

To see sample Tactical Asset Allocations and learn more about how TAA is used in portfolio construction, please contact your State Street relationship manager.