Cash Attractive on a Relative Basis

Each month, the State Street Global Advisors’ Investment Solutions Group (ISG) meets to debate and ultimately determine a Tactical Asset Allocation (TAA) that can be used to help guide near-term investment decisions for client portfolios. By focusing on asset allocation, the ISG team seeks to exploit macro inefficiencies in the market, providing State Street clients with a tool that not only generates alpha, but also generates alpha that is distinct (i.e., uncorrelated) from stock picking and other traditional types of active management. Here we report on the team’s most recent TAA discussion.

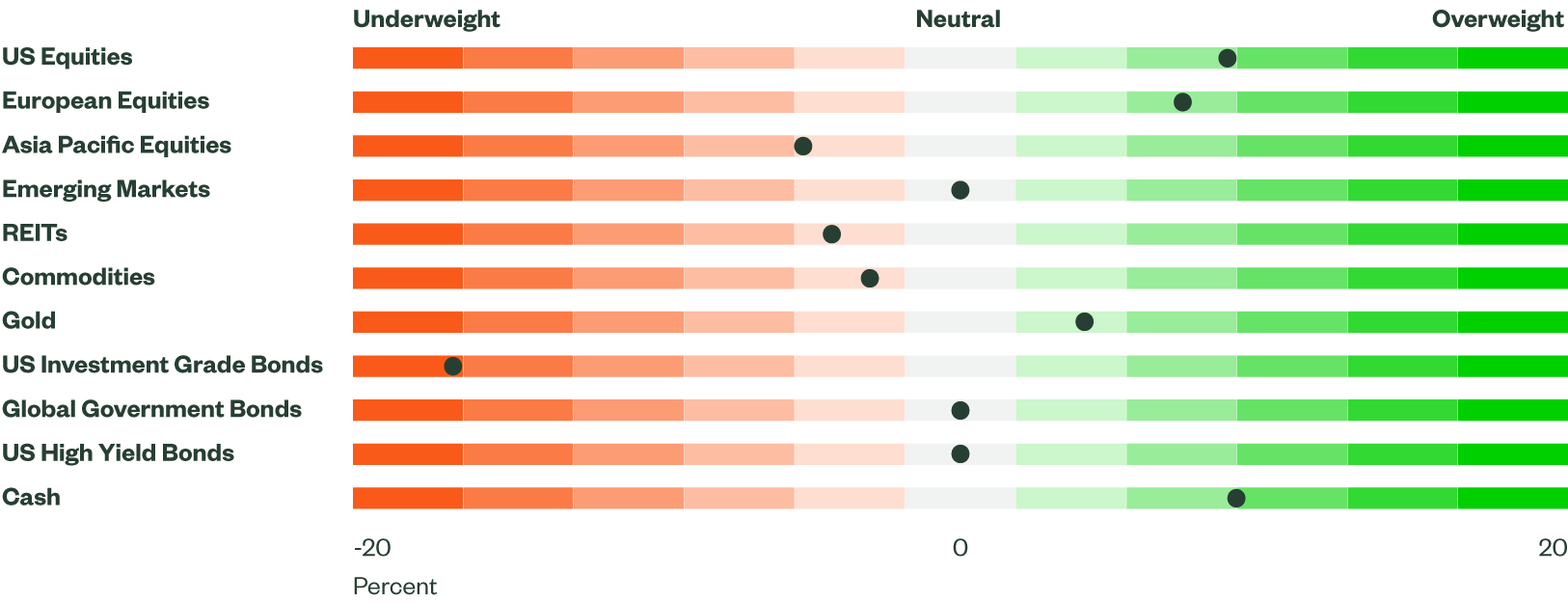

Figure 1: Asset Class Views Summary

Source: State Street Global Advisors, as of 11 July 2023. Investment grade bonds consist of investment grade credit, Treasuries and aggregate bonds.

Macro Backdrop

As we close the book on the first half of 2023, the US economy has outperformed expectations, but our view remains that growth will continue to slow and inflation pressures will ease. The sizable upward revision in Q1 GDP highlights the resiliency of the Unites States (US), but momentum should slow as lagged impact from higher rates and tighter financial conditions starts to tighten the bolts.

The recent CPI release was a welcome surprise to the downside, and we continue to believe disinflation trend remains intact. A meaningful decline in the Produce Price Index (PPI) and declines in prices paid for both the services and manufacturing indexes further support this view. While core inflation has remained sticky, we do not believe goods disinflation has fully run its course, particularly with goods consumption still running above pre-COVID levels. Used car prices have dropped, but still have further to go when evaluating the Manheim Used Vehicle Value Index, which remains exceptionally high. Services inflation should also ease on lower rents. Measures from Apartment List and Zillow signal a further decrease in owners’ equivalent rent from extreme highs, but a rise in unemployment is likely needed to bring this measure down to more historical readings.

Although risks have risen, recession is not a high conviction view for us. Consumers have been a pillar of strength, and to a large extent, they remain strong. Perhaps the continued spending is from improving confidence as the Conference Board’s Consumer Confidence Index steadily improved, hitting the highest level since January 2022. Labor market data has been mixed, and while the market is cooling, it remains strong. Similarly, wage growth continues to fall but remains elevated with the average hourly earnings sitting at 4.4%.

The level of consumer cash reserves remains highly uncertain and debated. The Fed anticipates excess savings to drain, but research by Citi estimates excess savings are still around 5.5% of GDP, down from around 10% in late 2021. Bank of America notes that liquid assets fell slightly this year but are still US$4.4 trillion higher than in 2019, suggesting an excess savings buffer.

Consumers are strong but are being increasingly constrained by the high cost of borrowing. Although demand is not collapsing, it is slowing. Most importantly, it will continue to slow in the months ahead even as disinflation offers a welcome support to real income. The recent FOMC statement cautioned that “tighter credit conditions for households and business are likely to weigh on economic activity, hiring and inflation.” Household debt as a percentage of disposable income in the US remains low, while corporations have low debt service ratios after both deleveraged following the Global Financial Crisis.

However, deterioration is bound to happen with the cost of credit rising for both businesses and consumers. Data from the Senior Loan Officer Opinion Survey reflects this reality with willingness to lend to consumers and large firms dropping to levels historically associated with recessions. The resumption of college loan payments will only work to further restrain consumers.

The labor market and wage growth, although gradually cooling, remain too tight for Fed. More easing in core services ex-housing is needed, which means wages need to cool more. Arguably, the Fed should be done with hiking, given the real borrowing costs, but given the above scenario, recent commentary and the latest summary of projections, a hike in July seems all but certain. For its part, market expectations have recalibrated higher and now better align with the Fed’s outlook.

Directional Trades and Risk Positioning

On the surface, investor risk appetite has been resilient with our Market Regime Indicator (MRI) anchored in low-risk regime. However, under the surface, there is a disconnect between equity and bond markets, with our implied volatility in equity factor finishing in euphoria regime while our measure for risky debt spreads residing in normal regime. It is worth noting that both factors advanced higher over the final week of April.

Hotter-than-expected inflation prints, another bank failure and the fast-approaching debt ceiling deadline added more uncertainty. Implied volatility in currency also remained very benign with our measure residing in euphoria regime. Overall, the MRI still pointed to a favorable risk environment for equities, but we are cognizant of overhanging risks.

Our fundamentals-driven model remained constructive on global equities. Sentiment indicators, analysts’ expectations for both sales and earnings, improved, while top-down macroeconomic factors remained supportive. Lastly, our evaluation of valuation metrics, including free-cash-flow and buyback yields, remained slightly positive.

Commodities remained under pressure and our quantitative assessment forecast further pain as still unfavorable curve structures implied future prices may fall further.

Bonds benefited from the banking turmoil and expectations for a Fed pivot, but our model forecast higher rates. With nominal US GDP still exceeding the yield on long treasury bonds and headline inflation numbers receding quickly, our model suggested that yields might rise. Additionally, interest rate momentum also pointed to higher rates.

Overall, our quantitative forecast supported an overweight in equities, but we are mindful of the increased risks and decided to slightly reduce risk in our portfolios. We sold a small portion of our equity allocation and reduced our commodity exposure, going further underweight. Proceeds were deployed to cash, which boasted an attractive yield and could provide some insurance in the event investors become more fearful.

Relative Value Trades and Positioning

Within equities, we continued to reduce exposure to Pacific equities, now a healthy underweight. The offsetting buy was into emerging market equities, bringing our allocation to neutral. Our examination of Pacific equities pointed to weaker expected returns. Price momentum, both short and longer-term measures, was weak, while valuations became unattractive. Further, sentiment measures deteriorated as analysts revised expectations for both sales and earnings. Our expectations for emerging markets (EM) increased due to improvements across a few factors. Valuations remained attractive while better top-down macroeconomic indicators and healthier balance sheets supported EM equities.

Within fixed income, we sold intermediate government bonds, maintaining overweight, with proceeds invested in cash. As mentioned above, our model is forecasting higher yields and cash is more attractive on a relative basis.

At the sector level, we maintained our allocation to industrials, but rotated out of materials and consumer discretionary into energy and communication services. Industrials remained our top sector, exhibiting strength across all factors. Robust price momentum, strong sentiment and health balance sheet measures buoyed the sector. Our forecast for materials is positive due to decent price momentum and attractive valuations, but weak downgrades to both sales and earnings expectations drove the sector down our rankings. Consumer staples benefitted from sturdy price momentum and strong corporate balance sheets, but our evaluation of top-down macroeconomic factors and valuations dent the outlook and pushed the sector down our rankings.

The rapid increase in rates during 2022 weighed on the tech-heavy communications sector, but positive performance recently improved short-term price momentum, which supported the sector. Elsewhere, expectations for earnings improved and valuations remained attractive. Lower oil prices and recession fears weighed on commodities and sectors closely associated, such as energy. This is reflected in ongoing earnings and sales estimate downgrades and weaker short-term price momentum. However, longer-term measures of price momentum, still healthy balance sheets across energy companies and attractive valuation metrics strengthen the outlook for energy.

To see sample Tactical Asset Allocations and learn more about how TAA is used in portfolio construction, please contact your State Street relationship manager.