US Favored Over European Equities

Each month, the State Street Global Advisors’ Investment Solutions Group (ISG) meets to debate and ultimately determine a Tactical Asset Allocation (TAA) that can be used to help guide near-term investment decisions for client portfolios. By focusing on asset allocation, the ISG team seeks to exploit macro inefficiencies in the market, providing State Street clients with a tool that not only generates alpha, but also generates alpha that is distinct (i.e., uncorrelated) from stock picking and other traditional types of active management. Here we report on the team’s most recent TAA discussion.

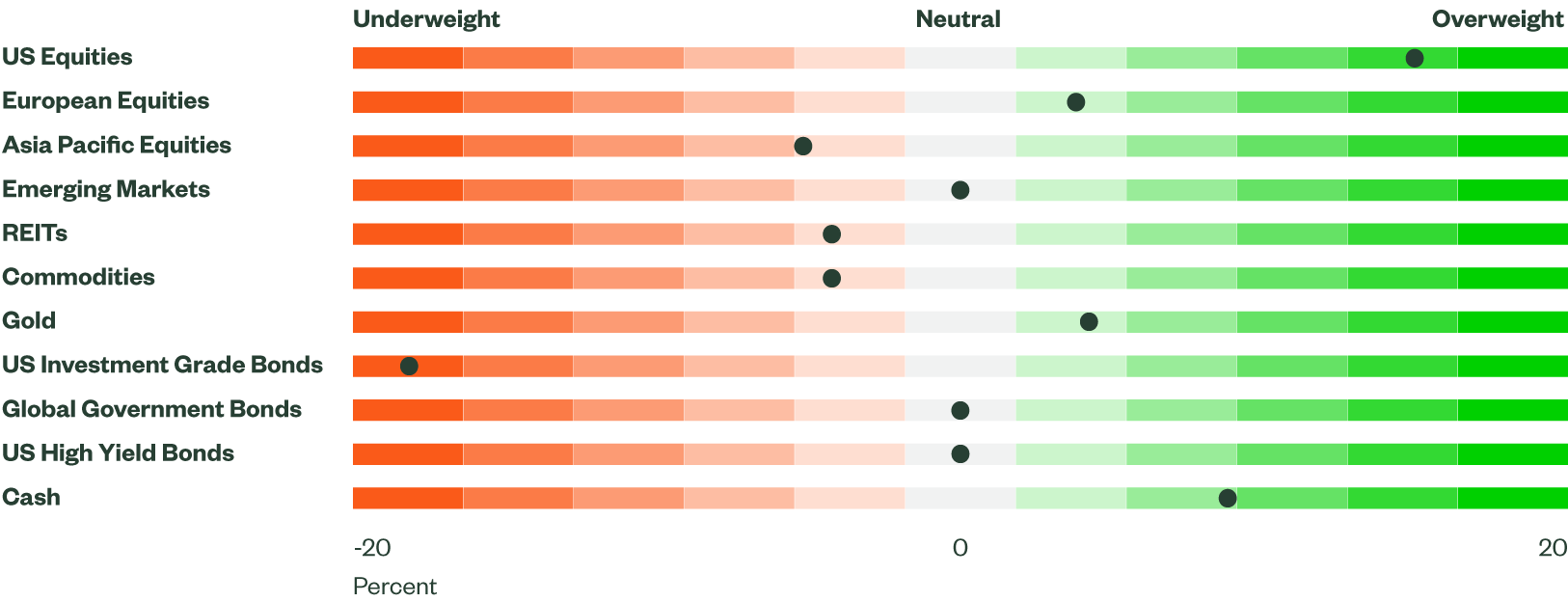

Figure 1: Asset Class Views Summary

Source: State Street Global Advisors, as of 10 August 2023. Investment grade bonds consist of investment grade credit, Treasuries and aggregate bonds

Macro Backdrop

Recent developments reinforce our view that the global economy will remain resilient, but growth will slow alongside inflation.

In Europe, estimates for Q2 GDP growth showed a positive but easing growth rate. In contrast, the US economy expanded 2.4%, far above expectations of 1.8% and ahead of last quarter’s sturdy pace. Additionally, private domestic demand and consumption spending grew, supported by strength in the job market and a healthy consumer appetite.

While nonfarm payrolls missed expectations, ADP employment data showed strength. Jobs reports are lagging indicators, and more forward-looking indicators such as initial and continued claims do not signal any warning signs yet. Initial claims remained low while continuing claims moved lower and stayed near levels from January 2023.

Debt as a percent of disposable income rose but remained historically low. Further, a significant number of US homeowners hold mortgages at a rate under 5% with a third holding it under 3%. These factors help explain why households have been able to weather rising interest rates and elevated inflation and should continue to provide some support going forward. For their part, consumers have become more optimistic with both current conditions and expectations improving in both the University of Michigan’s Consumer Sentiment Index and the Conference Board’s Consumer Confidence Index.

However, there are signs of stress that could point to weaker growth ahead. Manufacturing activity remained weak while service purchasing managers' indices (PMI) softened across regions in July, suggesting that the services sector may be losing momentum. Demand for loans and banks’ willingness to lend are weakening. This has a lagged effect, too, and should, therefore, weigh on economic activity going forward. Lastly, the Conference Board’s Leading Economic Indexes for the United States (US) and Europe continued to drop and signaled slower growth ahead.

While inflation has not fallen as fast as expected, the recent decline in both headline and core personal consumption expenditure inflation gauges reflected progress. The path to lower inflation will not be linear and recent upside surprises in average hourly earnings and prices in the services PMI highlighted this fact. The easy part is now behind us with base effects no longer being very supportive. However, continued disinflation in goods and services should bring inflation down further. A potential increase in energy prices and housing momentum are risks to monitor for the rest of the year.

After another rate hike (eleventh), Fed Chair Jerome Powell noted inflation has a long way to go and left the door open for yet another hike in September. For our part, we believe the hiking cycle is over with the Fed maintaining the current rate into 2024. However, between the Fed’s commentary and strong US economic data, the risks for another hike are high.

Overall, US data continues to show strength with inflation pressures easing, lessening the odds of a recession. While we believe growth will eventually slow, a recession is not currently a high conviction view.

Directional Trades and Risk Positioning

Weaker corporate earnings and a rate hike by the Fed had modest impact on investor risk appetite in July and drove our Market Regime Indicator (MRI) from Euphoria to Low Risk. To be sure, this reading is still an attractive environment for risk assets. The increase in the reading was driven by an increase in implied volatility for currency, which finished the month in Low Risk regime, moving up from Euphoria where it began the month. Both implied volatility on equity and spreads on risky debt are benign and are in Euphoria. The spread on risky debt component did ease during the month and is now in Euphoria.

At the July “Alpha II” meeting, we noted a move in the MRI from Euphoria to Low Risk and added slightly to risk assets. With the indicator remaining in Low Risk in August, we did not need to adjust the equity position further. We did, however, note a deterioration in our forecast for commodities driven by weakening conditions in agriculture and energy. As a result, we reduced the commodity position by 1%, placing the proceeds into cash.

Relative Value Trades and Positioning

Within equities, we saw a decline in the forecast for European equities. While valuation measures are still attractive for the region, sentiment (both earnings and sales) and longer-term momentum have deteriorated. With this decline, we reduced our exposure to Europe, placing the proceeds into both US large-cap and small-cap equities. Smaller-cap stocks received the majority of the proceeds from this trade as they currently benefit from more favorable valuation and macro characteristics.

Within fixed income, our outlook continues to be poor. On balance, our fixed income model is forecasting a higher level of rates, a steepening curve, and wider credit spreads – none of which bode well for prices. While we continue to be tactically underweight in bonds in our portfolios, we are not making any adjustments at this time.

Finally, at the sector level, we continue to favor Industrials and Consumer Discretionary but halved their active exposure. In addition, we also sold the position in Materials, given the overall decline in our forecast, adding Consumer Staples and Communication Services. Staples and Communication Services are now our top-ranked sectors. Both Staples and Communications Services benefit from very strong earnings and sales expectations.