Preferred Securities: What They Are and How They Work

Investors seeking yield often turn to traditional allocations, such as dividend paying stocks, investment-grade corporates, or high yield bonds. Preferred shares (“preferreds”) frequently go overlooked — but this unique asset class offers several advantages worth considering.

How Does a Preferred Security Work?

Preferreds, which offer income potential, are securities that are generally considered hybrid investments, meaning they share characteristics of both stocks and bonds. They can offer more predictable income than do common stocks and are typically rated by the major credit rating agencies. Yet, because preferred shareholders have lower priority in the capital structure as compared to bondholders, the ratings on preferred shares are generally lower than the same issuers’ bonds. Although, the yields on preferreds typically are above those of same issuers’ bonds to account for the higher credit risk.

The designation “preferred” refers to the security’s treatment relative to common shareholders. Preferreds stockholders’ dividends typically have priority over common equity dividends. Preferred securities usually have long maturities or are perpetual with no maturity at all. There are two types of preferreds stock: cumulative and non-cumulative. Non-cumulative preferred stock does not repay unpaid or omitted dividends while cumulative preferred stock entitles investors to missed dividends. If a company with cumulative preferred stock suspends its dividend, these forgone dividends accumulate and must eventually be paid to preferred shareholders.

Companies may issue preferreds for a variety of reasons:

- Issuing preferred shares requires a lower cost of capital than issuing common shares. Corporations value them as a way to obtain equity financing without diluting voting rights.

- Preferreds give companies flexibility in making dividend payments. If a company is running into cash issues, it can suspend the dividend payments without the risk of default as would be the case with traditional bond issuance. However, if the preferred share class is cumulative (vs non-cumulative), then the company will still have to pay back previously skipped dividends before restarting dividends in the future.

- Preferred shares can be a balance sheet management tool, as a firm can raise capital to finance projects while not increasing its debt-to-equity ratio.

- Preferreds are issued primarily by banks and insurance companies, and preferreds can count toward regulatory capital requirements — allowing banks to issue preferreds in order to help maintain their required capital ratios.

Preferred securities can have a variety of different coupon structures:

- Fixed rate coupons generally pay a specified coupon rate for life. These structures can be beneficial when rates are expected to decline as the coupon will provide constant income, even during low rate environments.

- Fixed-to-floating rate coupons pay a fixed coupon for a present number of years (generally 5 to 10 years) and then convert to a floating rate coupon for the remaining life of the security or until it is called. The coupon conversion date typically coincides with a first call date, and often times the issuer will call the security instead of allowing it to begin its floating rate period. Compared to fixed-rate coupon structures, fixed-to-floating rate coupon structures typically experience less interest rate risk when rates rise.

- Floating rate coupons offers a coupon that is reset at specified intervals according to a predetermined formula. Interest payments fluctuate with an underlying index or base rising rate environment and offers significantly less interest rate risk than fixed rate bonds. Many preferreds with floating rate coupons also include a floor.

If they contain a call feature, preferreds may be called by the issuer after a certain date. The motivation for the redemption is generally the same as for bonds: a company calls in securities that pay higher rates than what the market is currently offering. While some preferred have seen refinancing with lower interest rate, many preferreds with high coupon rates remain outstanding, trading above their call prices for years due to a variety of factors that may impede the issuers from refinancing.

Some preferred shares are convertible preferred stocks that include an option for the holder to convert the shares into a fixed number of common shares after a predetermined date. More often than not, this feature is not at the election of the holder and is instead mandatory. Mandatory convertible preferreds automatically convert to common equity on or before a predetermined date, and therefore may behave in a more equity-like fashion than other preferred security types. The value of a convertible preferred stock is ultimately based on the performance of the common stock.

Benefits of Preferred Securities

The case for preferreds and the role they can play as a diversified income generator within portfolios, is centered on four key aspects:

- Potential Yield

- Tax-advantaged Income Potential

- Low Correlations

- Less Volatility

Capturing Potential Yield

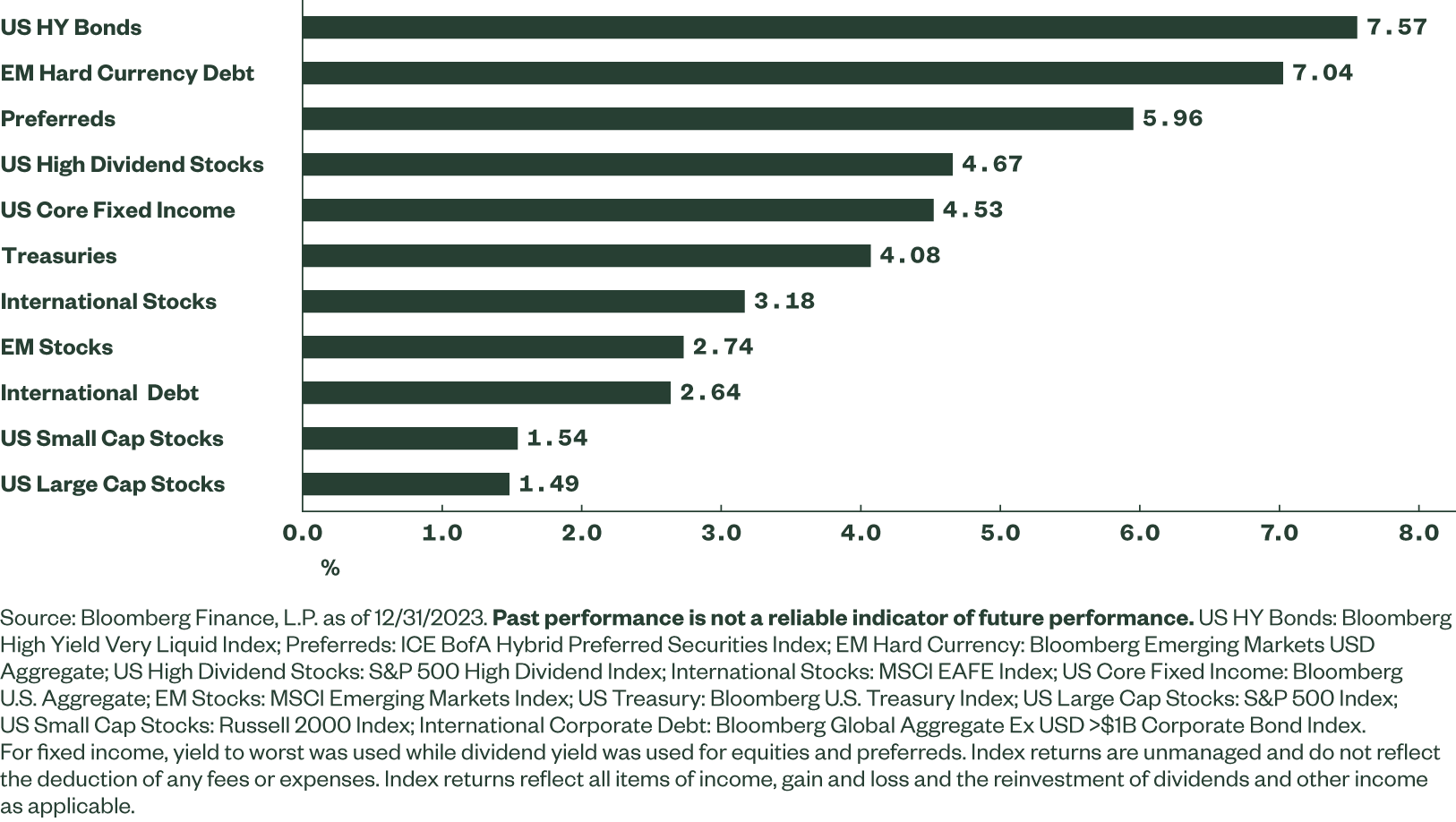

If yield is a key reason to consider preferreds, how does the asset class stack up against other income-generating choices? As shown below, preferreds compare favorably to dividend paying stocks, investment-grade corporate bonds and the broader bond market. While they may have a similar yield to high yield bonds, it’s worth pointing out that the index representing preferreds shown below is all investment-grade rated.1 While the ICE BofA Hybrid Preferred Securities Index consists entirely of investment-grade rated securities, it is important to note that not all preferred stocks are rated by ratings agencies.

Figure 1 : Preferreds Have a Higher Yield Than Most Common Market Segment

Key Takeaway: A potential 6%+ yield for a group of primarily investment-grade securities is worth considering for the income generation portion of a portfolio.

Tax-Advantaged Income Potential

Beyond an attractive yield potential, many preferred securities pay qualified dividend income (QDI) rates, which may enhance after-tax yield. Taxed at roughly 20%, QDI rates can be considerably less than ordinary income rates. Since preferred securities are hybrids of stocks and bonds, certain preferred securities generate qualified dividend income. This type of income is typically created by common stocks and taxed at the lower capital gains tax rate. In contrast, traditional fixed income investments create income subject to ordinary income tax rates (up to 37% based on current tax brackets).2

Targeting Portfolio Diversification

One of the basic principles of portfolio construction is ensuring portfolios are properly diversified, seeking to balance risk and return by including assets with low correlations. A way to examine the potential diversification benefits of an asset class, and its use case, is to understand its correlation profile. For instance, if a fixed income exposure has a low correlation to other bond strategies but is highly correlated with equities, than its inclusion into the fixed income sleeve of a standard 60/40 equity/bond allocation may do two things:

- Improve the diversification profile within the bond allocation

- Make the total portfolio more equity sensitive

If that is the intended goal, inclusion could be a good idea. In any case, understanding the cross-asset correlation profile of an exposure prior to implementation should be on the investor’s portfolio construction checklist. For preferreds, as they are both bond-and stock-like, their correlation profile is low relative to both asset classes, as shown below. Their correlation basic US Treasuries is very low at 0.13 over the last 15 years (based on monthly returns).3 They also have lower than 0.464 correlation to equity-sensitive high yield bonds and to equities themselves — from all parts of the world.

Figure 2 : Preferreds Have Low Correlations to Common Market Segment

Key Takeaway: Preferred shares have low historical correlations to traditional stocks and bonds, indicating that their return patterns may be differentiated throughout certain market environments, resulting in a potential portfolio diversifier.

Seeking Income with Less Volatility

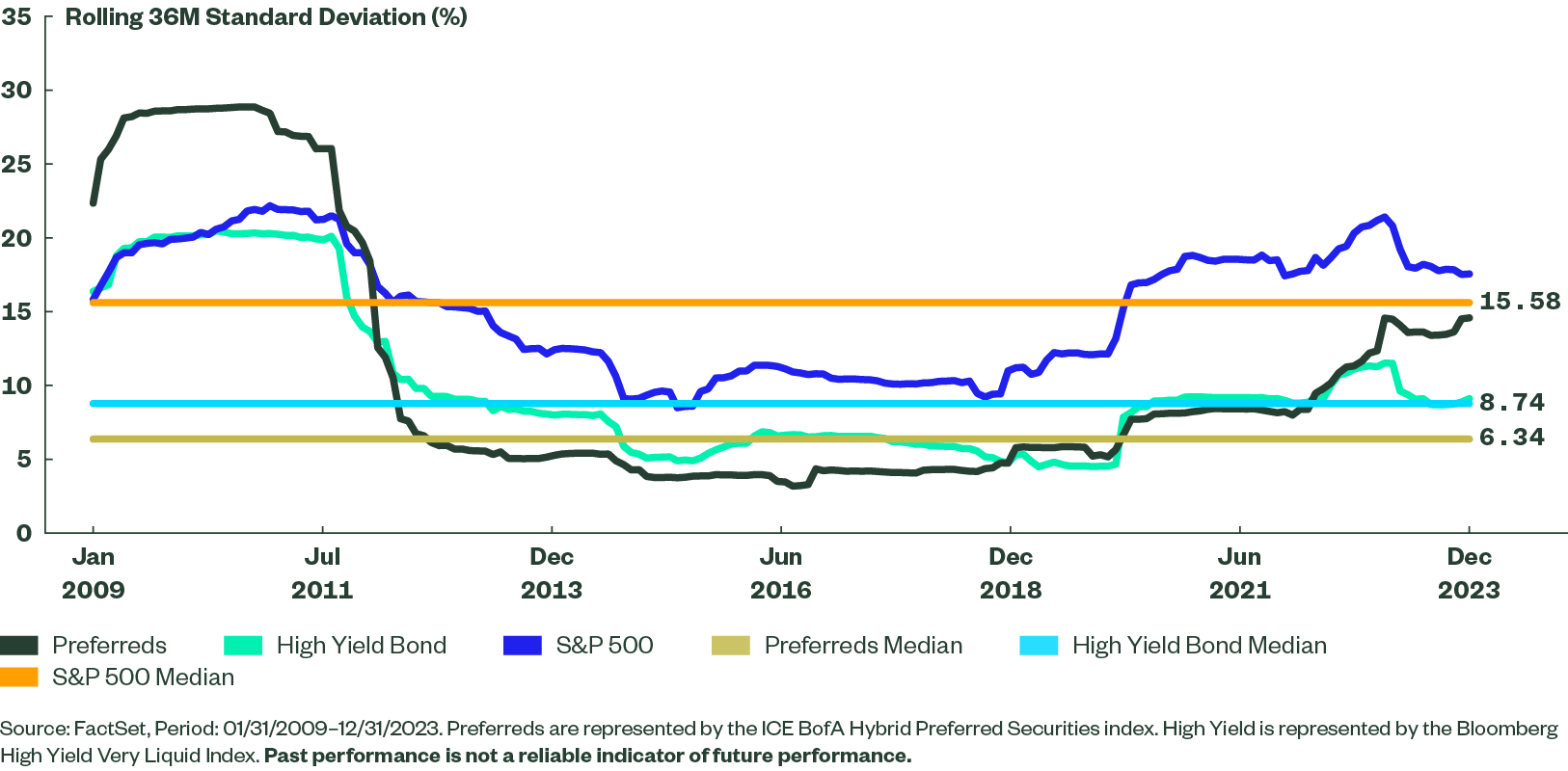

As a result of preferred shares having both bond – and stock-like features, the volatility profile of preferreds has historically been lower than that of pure common stocks, while being just a touch below that of credit-sensitive high yield bonds, as shown below. For this analysis, we used the historical median rolling 36-month standard deviation of returns over the last 15 years, as a rolling measure can account for the cyclicality within an asset class. It is also more constructive than periodic returns, as one can examine outliers. For instance, preferred shares became more volatile than both high yields bonds and US large-cap stocks during the financial crisis due to the financial concentration within the asset class.5 The latter point may be helpful in understanding return patterns if there is a market event that creates short-term volatility in the financial sector.

Figure 3 : Preferreds Have Historically Had Lower Volatility than Stocks and High Yield Bonds

Key Takeaway: Due to the hybrid nature of preferred shares, the volatility profile is lower than that of common stocks — both traditional US large caps and the actual underlying common stocks of the same preferreds — and credit-sensitive high yield bonds. Therefore, preferreds add high income potential without taking on outsized volatility.

How to Allocate to Preferreds

Preferreds may be an option for investors seeking some of the highest yields in the investment-grade universe while maintaining overall portfolio diversification.

Due to the unique features described earlier, investors can integrate preferreds into their portfolios with these goals in mind:

- Income Diversification: With relatively low historical correlations to traditional stocks and bonds — 0.43 and 0.36, respectively — and a beta of 0.50 to stocks,6 preferreds may help to diversify portfolio income generation.

- Reduce Equity Volatility: These hybrid vehicles may also generate attractive potential income per unit of risk, considering that their yield per unit of trailing 36-month volatility is 0.54 versus 0.28 for long-term Treasuries and 0.15 for US large-cap dividend equities.7 While high yield bonds have offered higher yields per unit of volatility, they may bring more significant credit risk to a portfolio. Preferreds have higher quality ratings than that of high yield bonds as they typically hold mostly investment-grade rated securities from the highly-regulated banking and insurance sectors.8

Figure 4 : Yield-Per-Unit of Volatility

Consider the SPDR® ICE Preferred Securities ETF

Investors seeking a potential source of income should take a closer look at preferreds, as the elevated level of income coincides with potential tax and diversification benefits but is not the result of taking on high levels of volatility.

The SPDR® ICE Preferred Securities ETF (PSK) employs stringent credit-quality criteria and largely holds investment-grade securities. PSK’s index also excludes convertible preferred securities, meaning the fund may exhibit less equity risk than peers that include this security type. In order to avoid issuer concentration, the index also invokes a 5% issuer cap.