Market Regime Indicator: Q4 2023

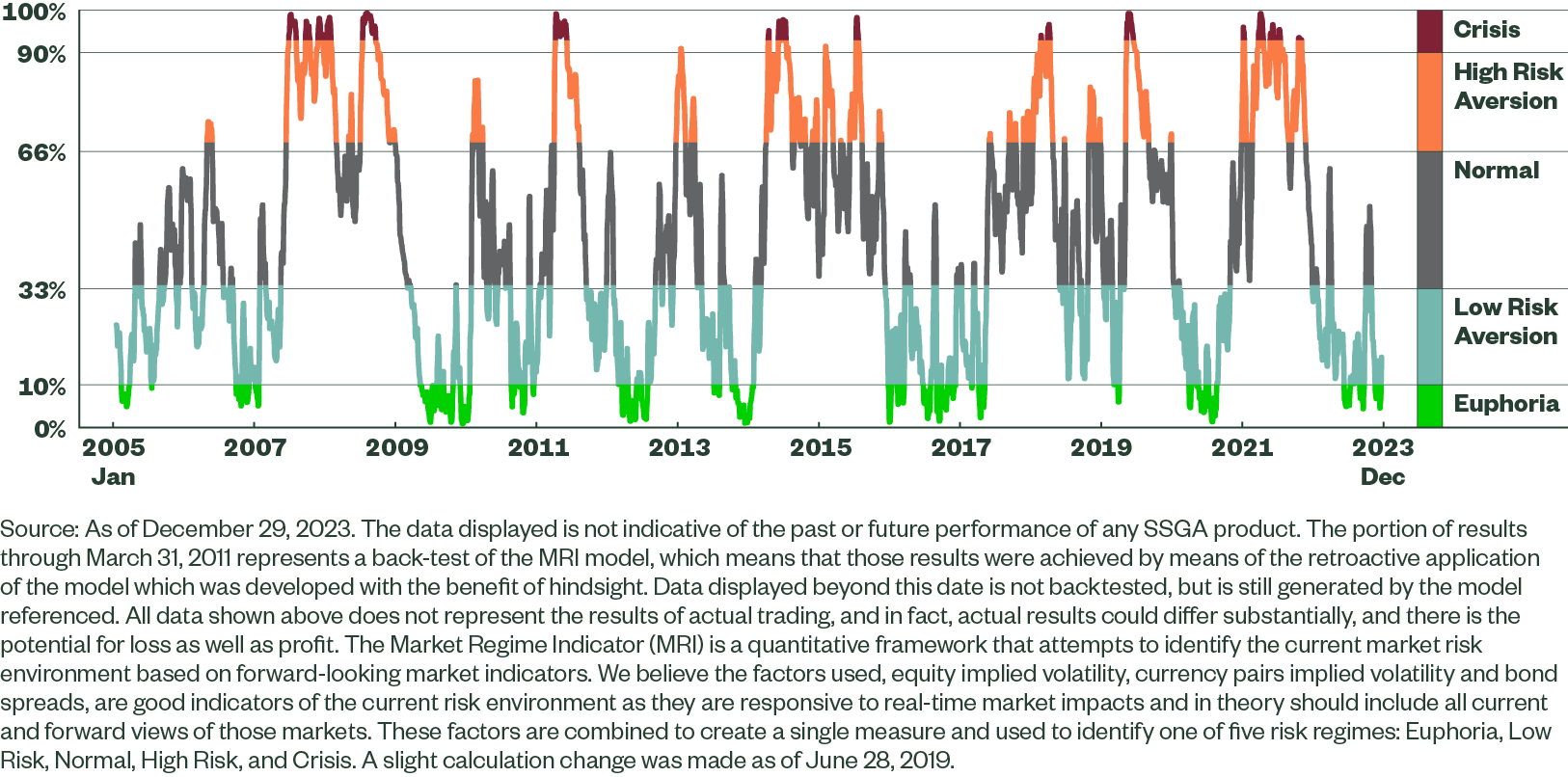

The Market Regime Indicator (MRI) is a proprietary macro indicator developed by the SSGA Investment Solutions Group (ISG). Based on forward-looking market information, it is designed to identify the level of risk aversion/appetite in the market. The factors utilized to generate the signal include implied equity and currency volatility, as well as spreads on fixed income.

The Investment Solutions Group uses the MRI as one of the inputs into its global tactical asset-allocation decision-making process.

The MRI is the result of over twelve months of rigorous testing by the Investment Solutions Group. The test results showed that the MRI tracked historical market stress events and trading strategies based on the level of outperformance generated by the indicator. By design, the MRI signal varies between 0% and 100%. On this scale, a high level is often characterised by market tensions, such as a significant increase in volatility and a drop in risky asset prices.

We Have Identified Five Different Market Regimes

Crisis (level close to 100%) — Extreme risk aversion (‘Fear/Panic’)

High Risk Aversion (level above the average) — Aversion toward risky assets

Normal (level oscillating around the mean) — Characterized by neutral market sentiment

Low Risk Aversion (level below the average) — Appetite toward risky assets

Euphoria (level close to 0%) — Extreme risk appetite (‘Greed/Complacency’)

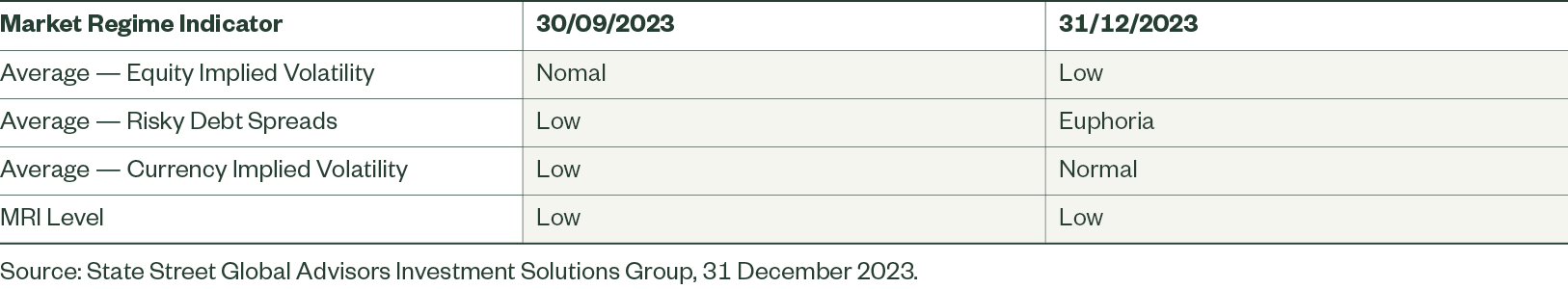

Figure 1: Market Regime Indicator Table

Figure 2: Market Regime Indicator (MRI) Evolution

Market Commentary

Markets during the fourth quarter of 2023 were a tale of two halves, with the driving forces once again, inflation and central bank policy. October saw an escalation of the themes of the third quarter with a significant shift in bond yields amid worries that interest rates may stay higher for longer. The MRI moved higher from Low Risk regime into Normal regime for the first time since March (amid the SVB crisis). However, the narrative turned from November onwards, with more promising inflation data and a shift in tone from several central banks. The MRI moved back into Low Risk regime early in November, and continued lower into Euphoria regime to close the month. The signal flipped between Low Risk and Euphoria regimes during December, signaling the positive market sentiment as the year came to a close.

The Implied Volatility on Equities factor entered the fourth quarter in Normal regime and October saw no relief from the soaring bond yields that had pushed the factor higher in September. Early in the month, data in the US on both manufacturing and job openings suggested the economy was proving more resilient than expected meaning a growing chance of another rate hike. Meanwhile, a number of hawkish statements from Federal Open Market Committee members confirmed the higher-for-longer narrative. Mid-month saw an upside surprise in US CPI and a significant increase in geopolitical risk in the Middle East following a surprise attack by Hamas on Israel. Against this backdrop, yields in the US moved to new cycle highs and equities sunk with the factor moving into High Risk regime. The month closed with the S&P 500 in correction territory, after dropping over 10% from the July highs.

Sentiment shifted in November, with a number of factors behind the move. Perhaps most importantly, the US Federal Reserve (Fed) held rates steady for the second consecutive meeting, with many considering Chair Powell to be moderately dovish in his prepared remarks. This was followed by holds from both the Bank of England and the European Central Bank. The quarterly refunding announcement also turned out to be better than expected, with increases not as bad as had been feared. Additionally, weaker US data also reduced the likelihood of future hikes. Combined, this saw a rally in bonds and equities, with the Implied Volatility on Equities factor moving lower into Low Risk regime. A downside surprise in US CPI added to the turnaround and, by the end of the month, the factor had moved into Euphoria regime, with the S&P 500 index back to its highs for the year.

December broadly saw a continuation of this theme. Early in the month, Eurozone inflation slowed to its lowest level since July 2021. The Fed meeting gave markets more good news, with 17 of 19 Fed policymakers seeing rates lower by the end of 2024, and none seeing them higher. Equity markets continued to advance and volatility fell, with the CBOE Volatility Index (VIX) falling to a post-pandemic low of 12.07. The Implied Volatility on Equities factor remained in Euphoria for much of the month, moving only marginally higher towards the end of December into Low Risk regime.

The Risky Debt Spread factor began the quarter in Low Risk regime and initially moved higher into Normal regime. However, in mid-October, an interesting divergence emerged as risky bond spreads tightened while equity volatility moved higher, with the factor moving all the way lower into Euphoria regime. This reversed in the latter part of the month as spreads moved wider, in line with the broad risk-off sentiment, with the factor moving back higher into Normal regime. November saw spreads start to tighten following the sharp reversal in tone regarding rate expectations — a theme that continued into quarter-end. Reflecting this, the factor moved lower into Low Risk regime in mid-November, and Euphoria regime in early December.

The Implied Volatility on Currencies factor was – on average – the MRI component with the lowest readings in the final quarter. Entering the period in Low Risk regime, the factor did move briefly higher into Normal regime early in October, but unlike the risky debt and equity volatility factors, it reversed and moved all the way lower into Euphoria regime by the end of the month. November saw the factor remain in Euphoria regime throughout, as the central bank holds and the seeming end of the hiking cycle reduced uncertainty in currency markets. In December, the factor moved higher, briefly touching Normal regime, as speculation mounted that the Bank of Japan could bring an end to its negative interest policy as Governor Ueda stated that policy management would become even more challenging from the year-end and heading into next year. The factor did move lower again, into Low Risk, before closing the year in Normal regime.