How to Make Smarter Sector Versus Industry Investment Decisions

Sector investing is a powerful portfolio construction tool that may help deliver alpha by capturing more specific macro or fundamental trends than broad beta exposures can. Sector investing includes allocating to sub-sectors, or industries, given their larger opportunity set (74 GICS industries versus just 11 GICS sectors) and greater alpha potential.

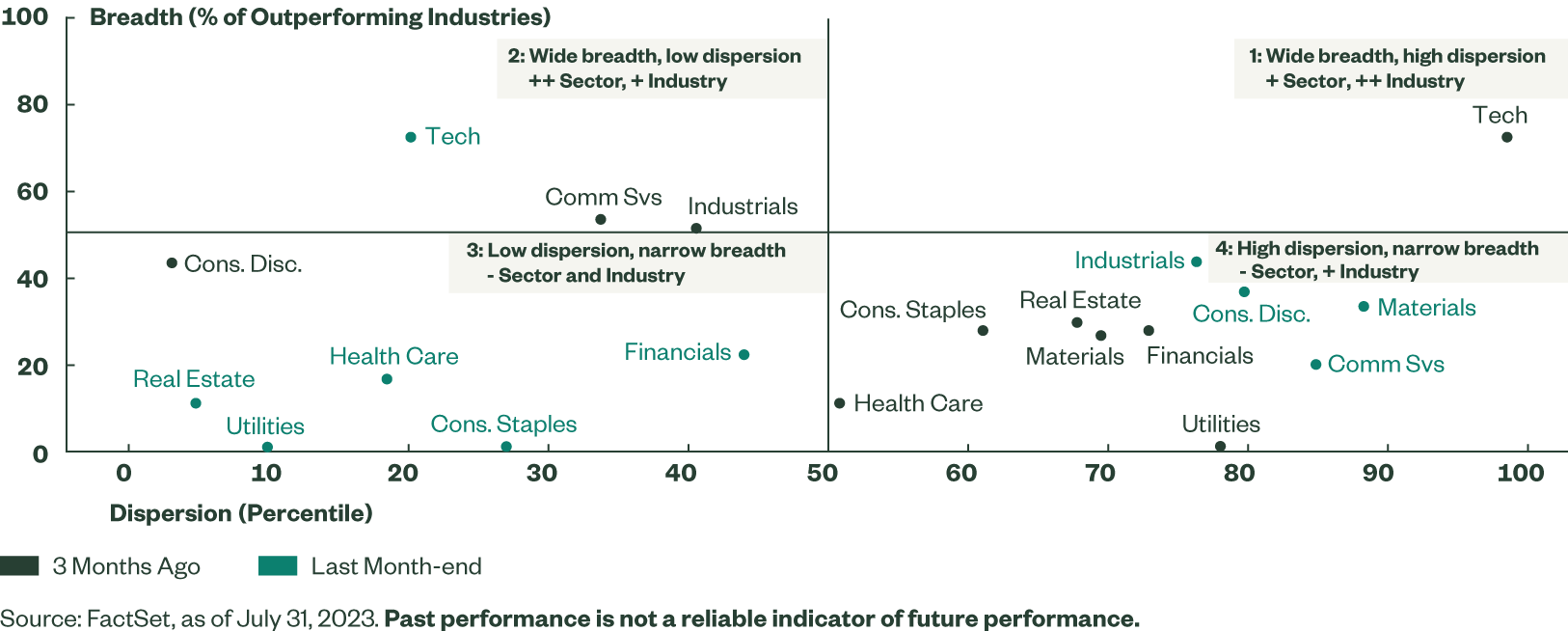

As we near the end of the rate hike cycle, with the effects of monetary tightening working through various parts of the economy at different speeds, the return paths across and within sectors have become more divergent than usual, as shown in Figure 1.

That makes it more important to decide when and where to use a broad sector strategy and when to choose more granular industry exposures. Our breadth and dispersion four-quadrant framework can help you survey the sector universe to make better informed sector versus industry investment decisions.

What Sector Breadth and Dispersion Reveal

We assess sector breadth and dispersion of sector moves with the S&P 1500 GICS level 3 industries, given their broad industry coverage.1

Sector breadth helps gauge the strength of sector moves. It’s measured by the 3-month average percentage of industries in the same sector outperforming the broader market (i.e., S&P Composite 1500® Index).

A good breadth indicates potential for strong sector performance. Widening sector breadth means that some common factors are lifting the overall sector and that strong sector performance is broadly supported — and not the result of just one industry powering sector performance.

High intra-sector dispersion supports alpha generation at the industry level, as it provides investors opportunities to generate high returns by owning leaders and avoiding losers. High dispersion reflects diverging return paths within the sector and warrants further research to identify if industry-specific macro or fundamental trends are driving this behavior.

Dispersion is assessed using the interquartile range — the difference between the third and first quartile — of rolling 3-month returns. The interquartile range helps reduce the impact of outliers driving the dispersion.

Since industry dispersion for sectors with more underlying industries tends to be higher, as shown in Figure 2, we measure an industry’s dispersion relative to its own history with a 5-year percentile ranking of its current value. Higher dispersion today relative to history results in a higher percentile ranking.

Surveying Sector and Industry Opportunities

To identify areas with more alpha potential, we divide sectors into four quadrants based on their breadth and dispersion.

- Quadrant I: Wide breadth and high dispersion. The sector rally is well supported by underlying industries. Certain industries in the sector may generate even more alpha.

- Quadrant II: Wide breadth but low dispersion. The sector rally is well supported by most underlying industries. Even industry performance supports pursuing alpha at the broad sector level, unless further analysis of industry specific fundamentals identifies more attractive industry opportunities.

- Quadrant III: Narrow breadth and low dispersion. Performance for overall sectors and most underlying industries is weak.

- Quadrant IV: Narrow breadth but high dispersion. Overall sector performance is weak, but there are pockets of opportunities at the industry level.

Plotting current breadth against dispersion, the bright teal dots in Figure 3 show:

- Technology is the only sector with breadth above 50%. Tech’s good breadth has been observed since last November, as the AI frenzy continues to drive the broad-based sector rally.

- Narrow breadth and high dispersion in Materials, Consumer Discretionary, Communication Services, and Industrials point to more alpha opportunities at the industry level in these sectors.

Figure 3: Plotting Breadth Against Dispersion, July 2023

Identifying a Sector or Industry Research Focus

Tracking sectors’ movement within the four quadrants compared to where they were three months ago illustrates two important underlying trends to inform your research and decision-making:

If a sector dispersion has become lower, focus at the sector level.

Technology, Utilities, Consumer Staples, Health Care, Real Estate, and Financials have moved from the right quadrants to the left ones. That means their intra-sector dispersion has tightened below the historical median over the past three months. Although Tech’s breadth remains high, the outperformance of some industry leaders — Software and Technology Hardware — has declined to lower single digits, resulting in low dispersion on the back of the waning relative strength of these two industry leaders.

Therefore, investors should be more cautious about Tech and watch for signs of further weakening. However, a lower dispersion driven by stronger relative strength of most underlying industries is a bullish sign for the sector.

On the other hand, Utilities, Consumer Staples, Health Care, Real Estate, and Financials have been sector laggards over the past three months. Their narrow breadth and lower dispersion indicate that bearish sentiment has spread across underlying industries within the sector.

If a sector has higher dispersion, focus at the industry level.

While Communication Services continues outperforming the broad market, its narrower breadth driven by underperformance in Entertainment and Media industries, and continued weakness in Telecommunication Services, underscore the sector’s waning momentum.

But Communication Services, together with Industrials, Materials, and Consumer Discretionary, have shown higher dispersion, indicating industry performance leaders in these sectors, namely Interactive Media & Services, Airlines, Building Products, Construction Materials, and Automobiles, are bucking the sector trends and warrant more in-depth research.

For more sector data and analysis, check out our quarterly Sector & Industry Dashboard — or explore how to invest with Sector ETFs.