How to Avoid Emotional Investing When Markets Are Volatile

- Market volatility can tempt you to deviate from your financial plan or investment strategy.

- Emotion often overrides rationality, which can lead to less-than-optimal investment decisions due to underestimated risks.

- Work with an advisor who can help you stay on track during periods of uncertainty.

In a world riddled with uncertainty — shaped by geopolitical instability, market fluctuations, natural disasters, and other unforeseen challenges — getting advice and guidance that extend beyond asset allocation and retirement projections is essential.

How Emotions Can Put Your Financial Goals at Risk

Behavioral economics suggests that investors tend to experience twice the amount of psychological pain from losses compared with the psychological pleasure from gains.1 It’s the reason why, despite advice to the contrary, investors often choose to exit the market in a downturn — a short-sighted strategy than can disrupt long-term goals.

In fact, back in 2019, only 16% of US investors said they would move money to avoid losses during a volatile market. However, our 2023 ETF Impact Survey found that 26% of US investors moved their money to different investments or cash given the volatile market.2

Emotionally Charged Decision-Making

Emotions play a pivotal role in our financial decisions, influencing outcomes for better or worse. Fear and greed can cloud rational judgement, causing some investors to react impulsively to market fluctuations. And biases — like loss aversion, anchoring, and confirmation bias — can contribute to poor investment choices.

In a market downturn, anxiety over how steep losses might get can cause investors to sell low. Conversely, when markets are soaring, investors caught up in the excitement of chasing performance may be tempted to buy high.

Investor psyche can overpower rational thinking during times of stress, which can take a toll on your portfolio’s overall performance and potentially put your long-term financial goals in jeopardy. Being aware of these natural human biases, or of how your emotions can influence your decisions, can help you avoid emotional decision-making when it matters most.

The Risk of Trying to Time the Market

In times of market uncertainty or volatility, emotions tend to run higher than usual — which can cause investors to feel a heightened impulse to move to cash or try to time the market.

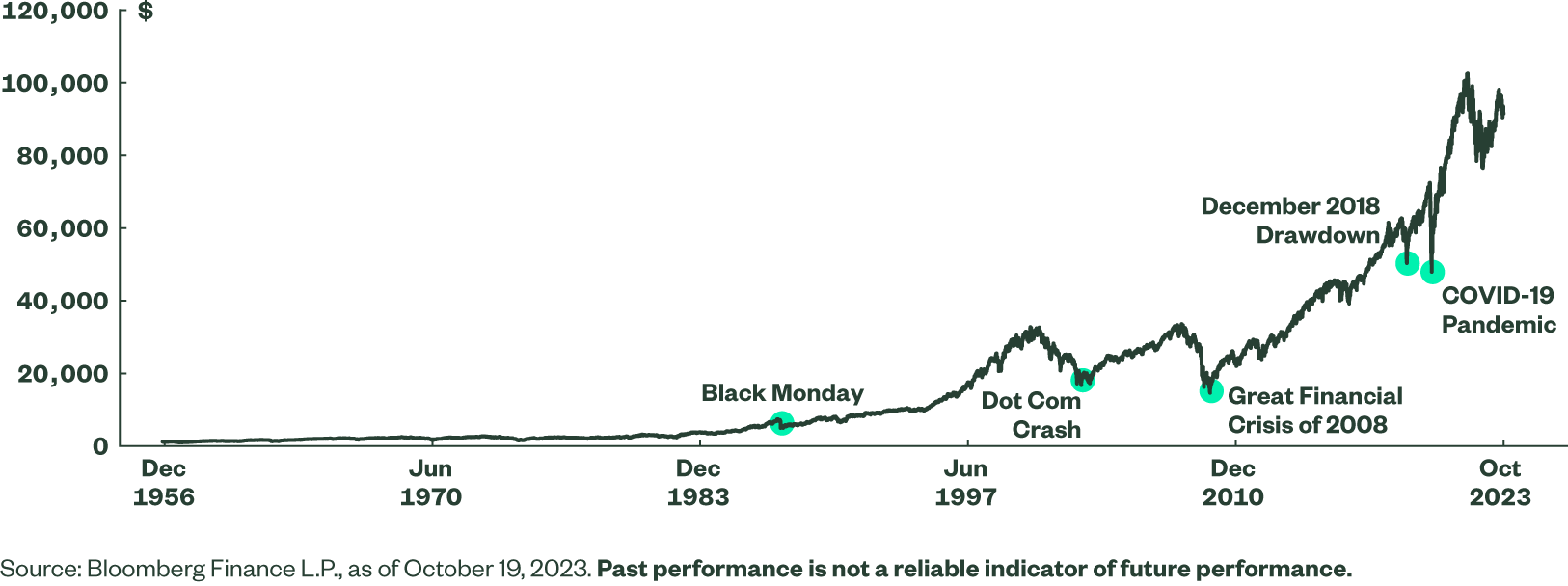

But history has shown that it’s impossible to know precisely when the market will sharply decline or rebound from its lows. And 70 years of stock market history remind us of the value of staying invested over the long term, even through major market downturns (Figure 1).

Figure 1: The Growth of $1,000 Invested in the S&P 500, 1956 - 2023

How Working with an Advisor Can Help

In times of market volatility or uncertainty, when emotions can get the best of you, you don’t have to go it alone. A trusted financial advisor can:

- Provide a base-level understanding of the risks you encounter to help keep your emotions in check.

- Get to know you and your money mindset to help you navigate periods of heightened volatility or uncertainty.

- Help you avoid emotional decisions by emphasizing the value of a steady, long-term approach.

- Work with you to create a rigorous, well-diversified plan tailored to your unique financial goals and risk tolerance.

Advisors who emphasize a disciplined approach, and who focus on maintaining well-diversified portfolios and suitable asset allocations, can empower you to feel more calm amid the uncertainty, which can help you stay aligned with your financial plan and long-term goals.

Investor Expectations In Uncertain Markets

At each stage of your life, there are factors that will influence your financial strategy, including age or investing horizon, risk capacity, and the amount of money you have invested. Investing without emotion is easier said than done, but key considerations can prevent chasing futile gains or panic selling. This is especially important for two groups: new investors and those approaching retirement.

New and Younger Investors

Age and experience can affect how much risk you may be willing to take on. But higher risk investments may not always be suitable for your needs. Both, the allure of higher rewards and fear of losses, can distract from the practical or goal-oriented reasons for investing — such as saving for retirement.

New and younger investors, especially those who started investing after the Great Financial Crisis of 2008, have a lot less experience navigating bear markets (Figure 2) and may react more strongly when losses start accumulating.

If you identify as a newer investor, especially if you’ve never experienced a bear market or recession and emerged unscathed, you may be tempted to flee to cash when the market declines and anxiety runs high.

To avoid that scenario and feel more confident in the face of volatility, consider working with an advisor who can help you:

- Understand the concepts of risk aversion and loss aversion, and how these can sway decision-making.

- Grasp risk budgeting concepts, like opportunity cost and risk-adjusted returns, to support more intentional financial decision-making.

- Create a long-term plan with you and review it as needed to ensure it’s built to withstand periods of uncertainty or volatility.

Mature Investors and Those Nearing Retirement

As you near the decumulation phase in your financial journey, cash flow concerns become paramount. It’s also common for investors to focus on providing for the next generation during this time. For both of these reasons, emotions can dominate — including feelings you may have about your legacy or the well-being of your beneficiaries.

Retirees or those nearing retirement may worry about timing and sequence of returns risk, as both groups have limited income-earning years left to recover from significant losses.

If you are nearing retirement or already in the distribution phase, how can you stay calm if a turbulent market is just around the corner? It all goes back to the plan. An advisor can help you:

- Practice patience and good judgement during unanticipated events. A well-designed, balanced plan, and a diversified portfolio built to weather market fluctuations, can help you achieve the retirement you envision.

- Maintain a long-term investment strategy beyond the milestone by incorporating tactics that can mitigate risk as you approach retirement or your distribution goal.

- Focus on what you can control, like reviewing your plan during times of uncertainty to understand how it’s been designed to mitigate your sequence of returns risk, or to determine if adjustments may be needed.

When Uncertainty Strikes, Advisors Make a Difference

According to our 2023 ETF Impact Survey, we found that financial advisors play an important role for investors — especially in volatile markets. As shown in Figure 3, the majority of investors we surveyed, who work with an advisor:

- Had already discussed how market volatility could affect their financial goals

- Valued their advisor’s knowledge and guidance in uncertain times

- Felt their advisor helped them remain confident during market volatility

During stressed markets, advisors can play a vital role in helping you avoid emotional decision-making by reorienting you to the long-term outcomes you’re striving for — and also reviewing with you how your financial plan has been designed to help you reach those goals.

Challenging markets are inevitable, but they don’t have to derail your financial goals or put your long-term outcomes at risk. And the best time to start working with your advisor to identify potential risks is before market uncertainty or volatility strikes.

4 Things You Can Do in Volatile Markets

When volatility strikes and you feel tempted to make impulsive investment decisions, here are four things you can do instead.