Decarbonizing Portfolios with SPDR® MSCI Climate Paris Aligned ETFs

Decarbonizing Portfolios with SPDR® MSCI Climate Paris Aligned ETFs

For investors seeking to implement net-zero strategies and address climate change in a holistic way, SPDR’s Climate Paris Aligned equity ETFs track leading MSCI indices and seek to decarbonize their portfolios swiftly, effectively and cost-efficiently.

Investors Are Taking Notice

Increasingly, investors are focused on the potential risks posed by climate change and seek solutions that decarbonize their portfolios. Underscoring the momentum toward broad adoption of climate investing, in our recent investment survey, 61% of North American investors said that they would implement decarbonization targets within three years.

Climate ETFs provide an effective vehicle for investors who are looking to decarbonize their portfolios in our view.

MSCI, a leader in climate data — and the provider of the indices tracked by our climate ETFs — may help investors meet their decarbonization goals with confidence.

Partnering with MSCI for a Swift and Efficient Solution

MSCI has been a pioneer in carbon and climate change analysis since 1990. The company is a leader in climate data and analytics and an acknowledged authority in climate indices.

MSCI Climate Paris Aligned Indices are designed as alternatives to familiar, broad equity benchmarks. They are designed to enable clients to decarbonize their portfolios quickly and cost-effectively without the need for extensive research and portfolio analysis.

MSCI Climate Paris Aligned Indices

Paris Aligned Benchmarks (PABs) were first introduced in 2019 as tools to accompany the transition to a low-carbon economy by the Technical Expert Group of the European Commission. These indices are intended to help reallocate capital toward a low-carbon and climate-resilient global economy.

PABs require a 50% reduction in greenhouse gas (GHG) emissions compared with a parent index in year one, then a 7% year-on-year reduction of GHG emissions relative to the fund itself.

MSCI’s Climate Paris Aligned Indices are designed to meet and exceed the EU Paris Aligned benchmark requirements, seeking to decarbonize at an annual rate of 10% to ensure a temperature aligned with 1.5°C (“self-decarbonization”).

The indices have a number of exclusions, including:

- PAB activity exclusions, which include companies with certain involvement, based on levels of production or revenue in:

- Thermal coal mining

- Oil- and gas-related activities

- Power generation from thermal coal, oil, natural gas

- Tobacco

- Controversial weapons companies with certain involvement based on levels of production, revenue or ownership

- Societal norms and environmental controversy violators

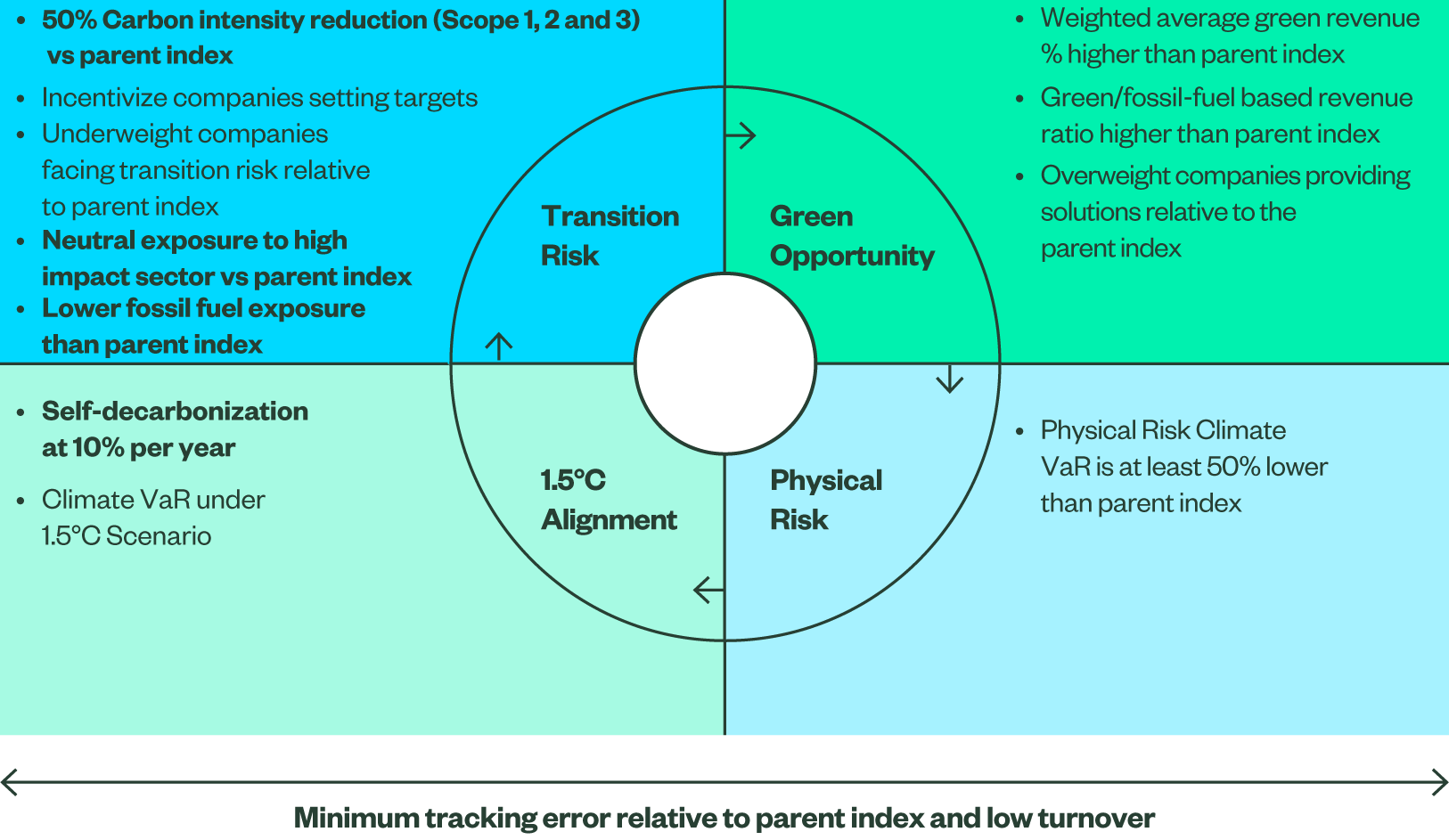

The indices employ an optimization process that seeks to improve the climate profile of their respective parent indices by minimizing exposure to the physical and transition risks of climate change, increasing exposure to sustainable (or green) investment opportunities and aligning to 1.5°C — while maintaining a modest tracking error relative to the parent index and offering low turnover.

The four climate objectives — transition risk, 1.5 °C alignment, green opportunity, and physical risk — are explained below.

The information contained above is for illustrative purposes only.

The indices are rebalanced following semi-annual reviews in May and November each year, at which point they must adhere to 50% reduction in carbon emissions and continued decarbonization.

The indices are aligned with TCFD (Task Force on Climate-Related Financial Disclosures) recommendations, with a substantially reduced carbon footprint (including Scope 3 product and supply-chain emissions). The weights of companies with substantiated reduction targets are elevated and there is a reduction in physical climate risk exposure (based on the MSCI Climate Value-at-Risk model).

Why SPDR for Climate?

SPDR ETFs, which are sponsored by State Street Global Advisors, the asset management arm of State Street Corporation, offer a suite of broad equity exposures designed to reduce fossil fuel exposure, mitigate transition and physical risks, capture opportunities and evolve with the goals of the Paris Agreement. These funds offer investors a cost-effective way to decarbonize the core of their equity portfolios.

In a world of change and uncertainty, investors need to consider any factor that has a material impact on long-term value creation. Decades of investing experience position us to help investors use a variety of ESG/sustainability investing tools to meet their needs.