Convertible Securities: What They Are and How They Work

As a hybrid asset class, convertible securities combine upside potential associated with equities and coupon payment and bond floor. With generally higher yields than stocks and low correlations to fixed income sectors, convertibles have become a powerful tool for investors seeking growth, income, and diversification.

Convertible securities are corporate bonds with an embedded option that allows investors to convert bonds into the common stocks of the issuing company. Behaving similarly to bonds when the underlying equity falls and more like stocks when the underlying equity rises, convertibles offer a potential cushion in stormy markets due to the bond-like floor, while also allowing investors to capture equity-like upside potential.

How a Convertible Security Works

When you hold a convertible security, you have the right, but not the obligation, to convert the bond into a predetermined number of shares. The number and type of shares that can be converted are set out in a convertible security’s offering documents. If you monitor the value of the bond in comparison with the value of the converted shares, you can choose to convert when the share is worth more than the bond.

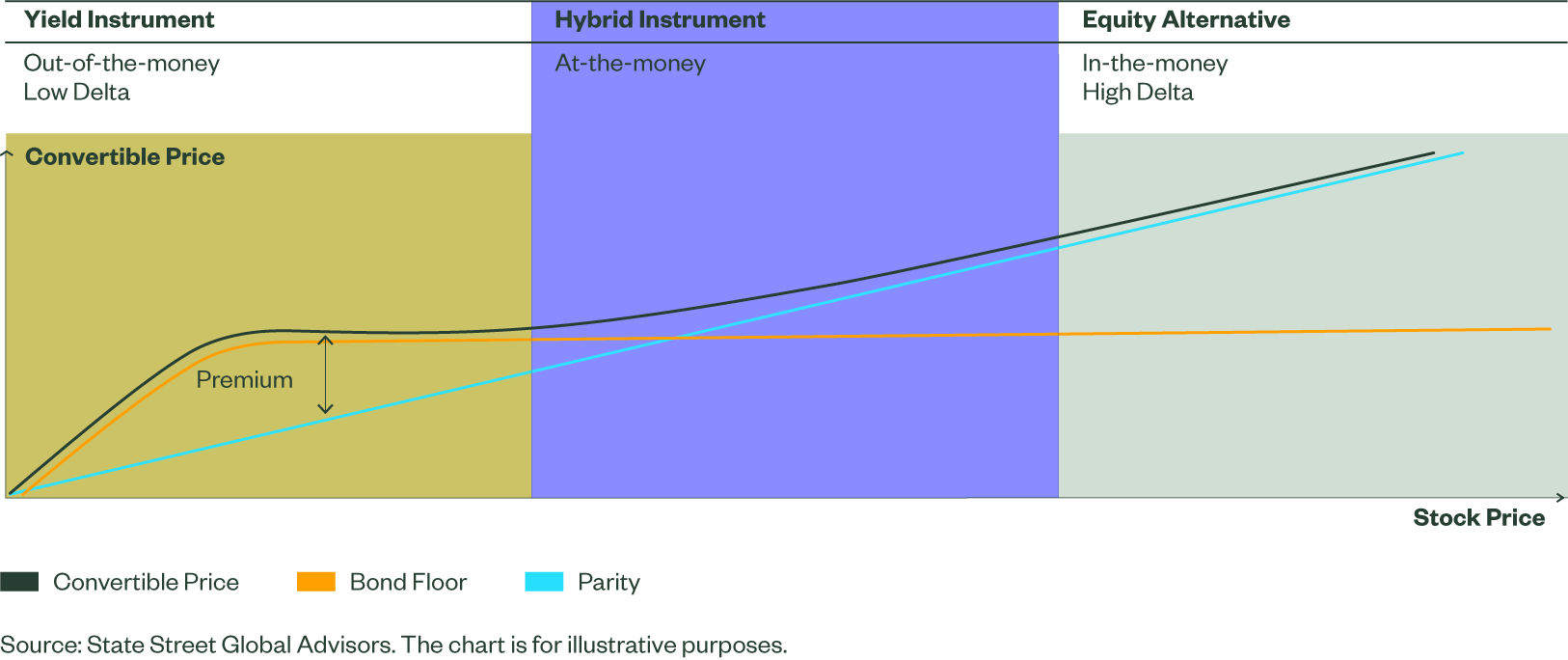

As the stock price gets closer to or above the conversion price, the value of the convertible bond typically rises, becoming more sensitive to the change of the underlying stock price (high delta) and taking on more stock-like characteristics (Figure 1) . On the other hand, when the stock price falls below the conversion price, the convertible behaves more like a bond, and its value typically does not fall as much as the stock because the coupon and principal value of the bond create Investment value (bond floor).

Figure 1: The Payoff of Convertibles

Benefits of Convertible Securities

Convertibles combine an anticipated downside risk mitigation of bonds with equity-like upside potential. Their hybrid nature supports a range of asset allocation goals based on historical data as shown below:

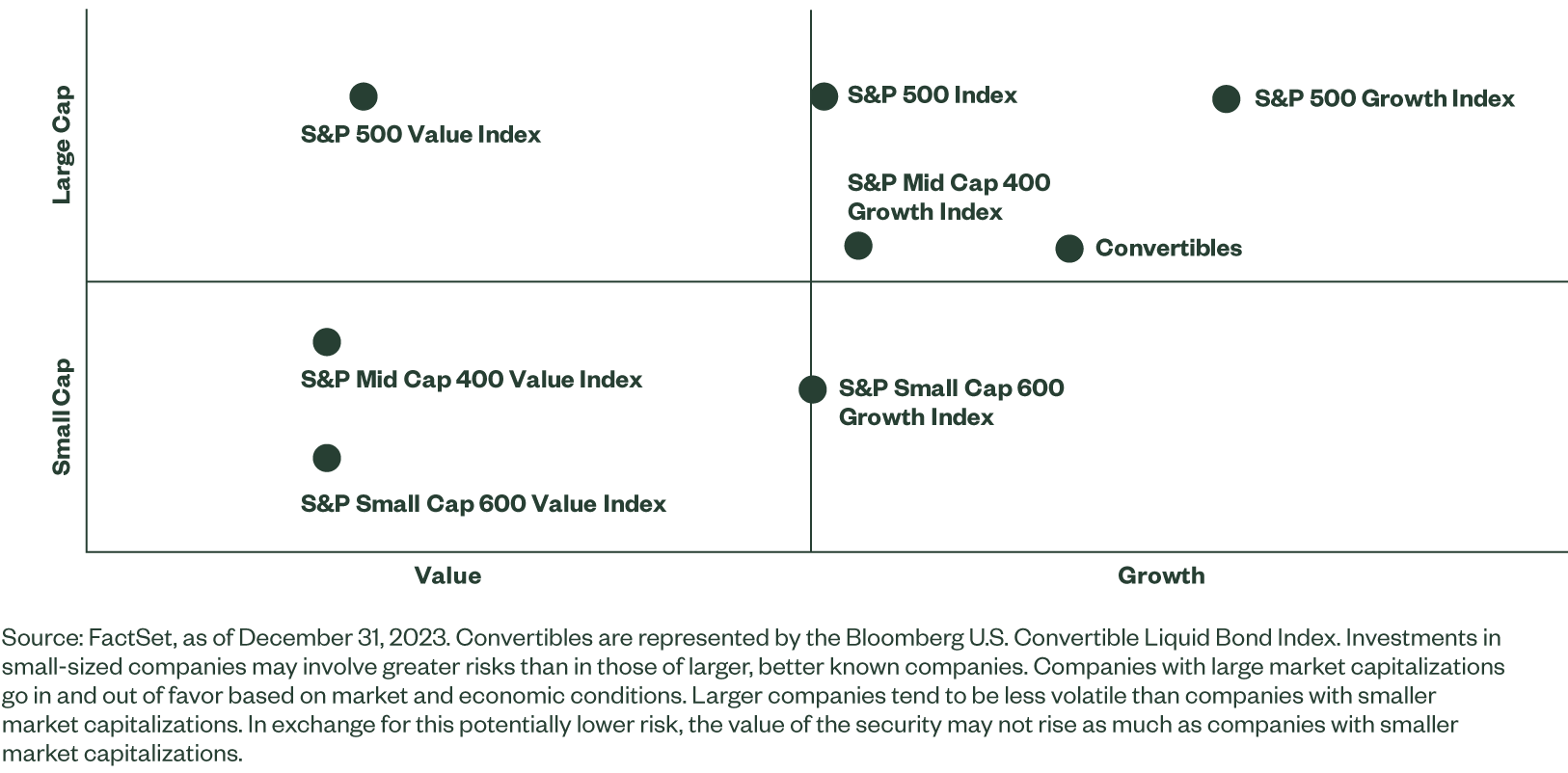

Growth Equity Exposure for Upside Potential – The option to convert to equities allows investors to participate in some of the upside of rising equity market. And given that convertible financing is particulary attractive for growth companies, which tend to exhibit strong earnings and sales growth but with low cash flows, convertible bonds often provide growth-oriented exposure (Figure 2).

Figure 2: Convertible Securities Return-Based Style Analysis (5 Year)

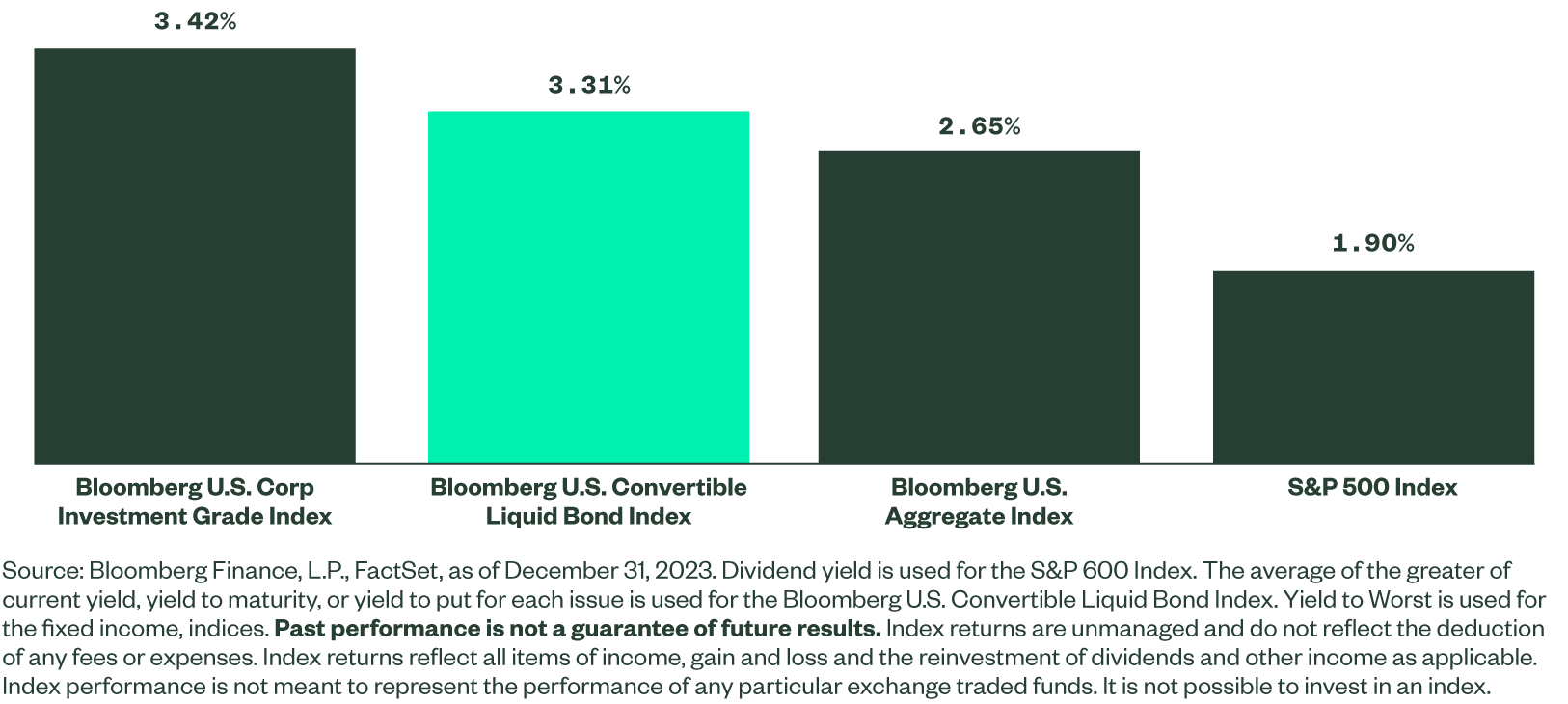

Higher Yield than Equities – Because of the value of the option to convert, the yield of convertible bonds is usually lower than that of nonconvertible corporate bonds from the same issuer. However, over the past 10 years, convertibles have provided a higher yield than equities and the traditional core fixed income segment, as represented by the Bloomberg U.S. Aggregate Index (Agg) (Figure 3).

Figure 3: 10-Year Monthly Average Yield

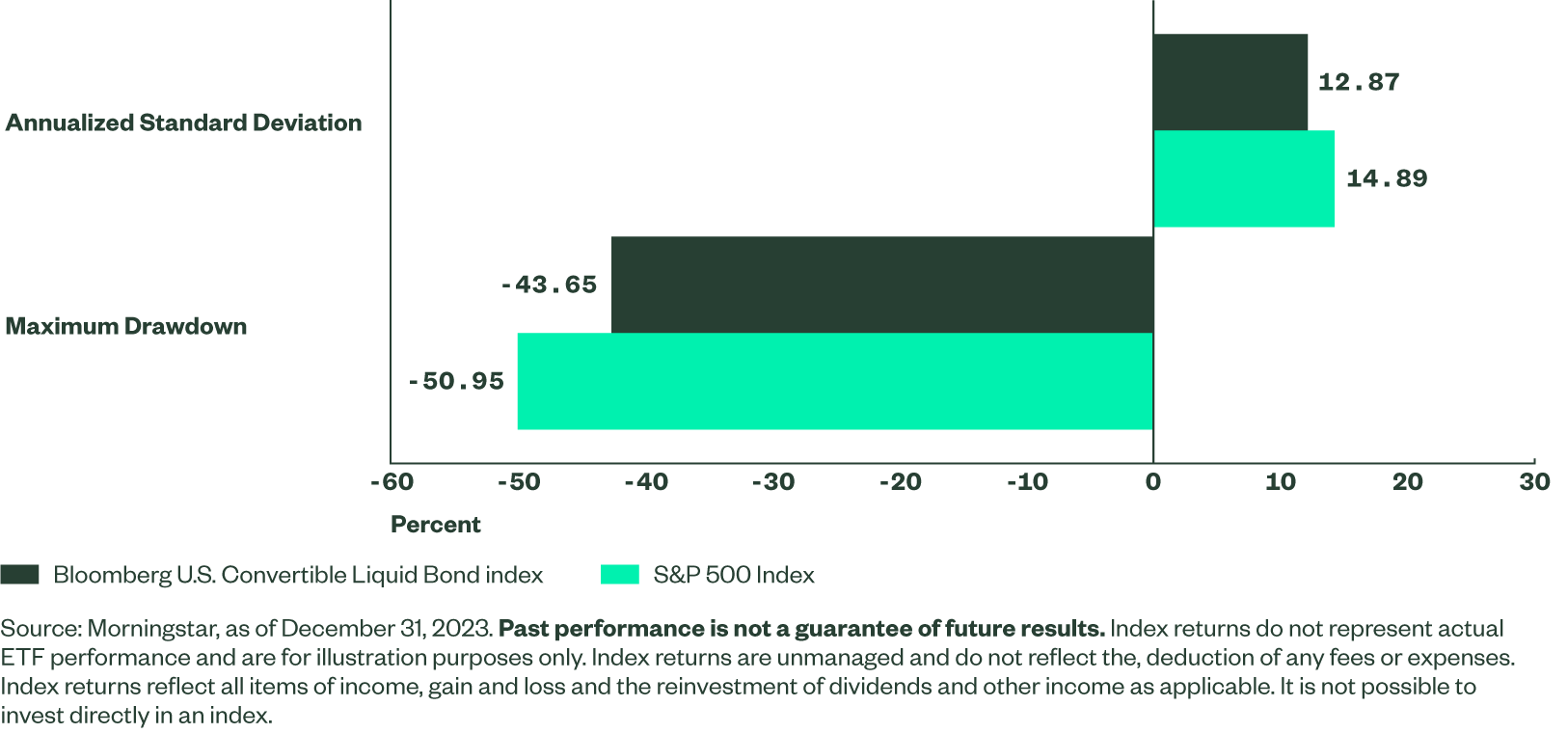

Lower Volatility and Less Drawdown than Equities – Convertibles’ periodic fixed coupon payment and the return of the principal value at maturity (if not converted before maturity) can potentially provide downside risk mitigation that is absent in equities. Convertibles have experienced lower volatility and typically lower drawdown than the broader equity market over the past 20 years (Figure 4). And, in the event of default, convertible bondholders are paid out before common stockholders.

Figure 4: 20-Year Volatility Max Drawdown

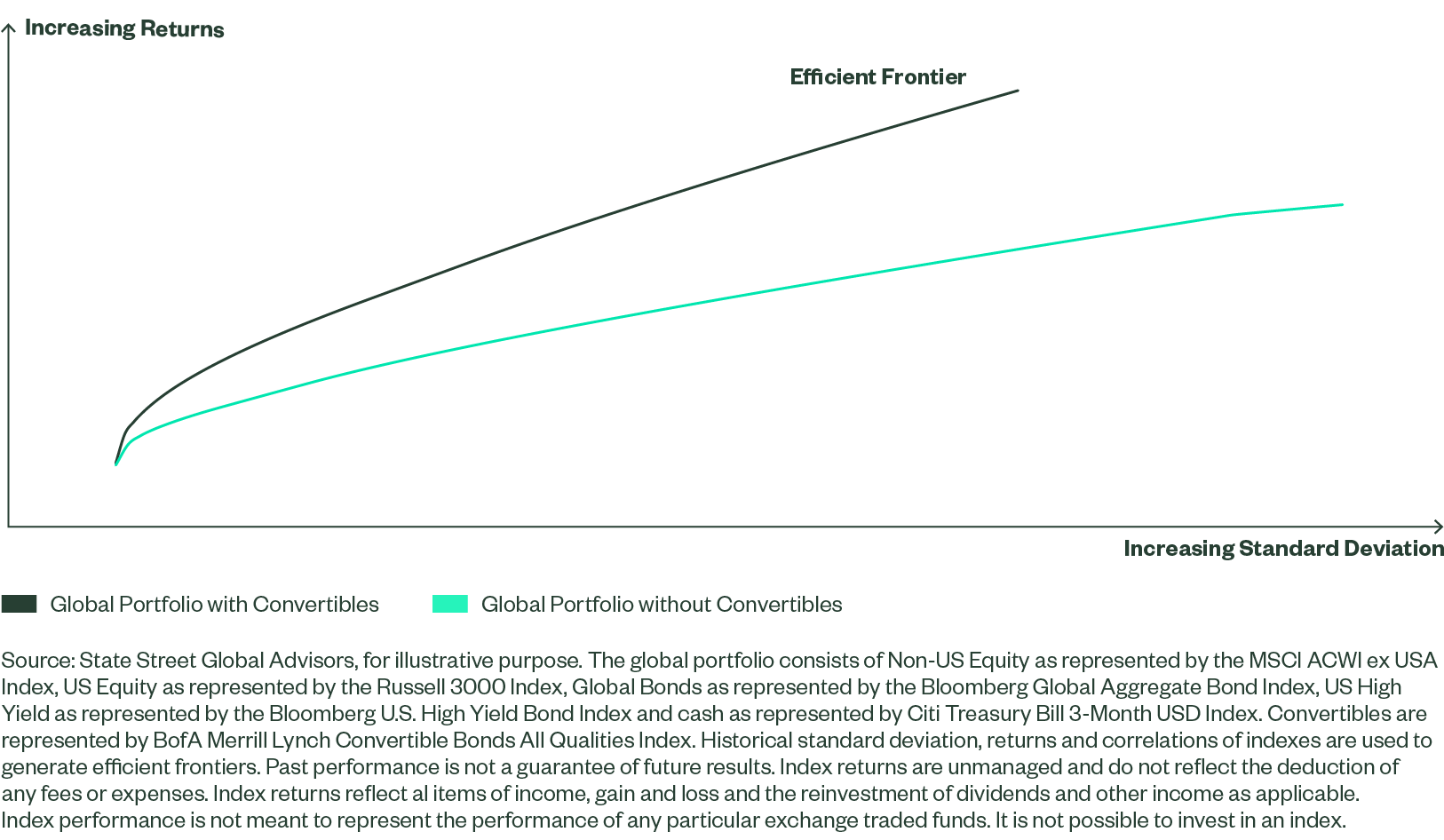

Lower Correlation to Rate-Sensitive Fixed Income Sectors – With their unique risk/reward profile, convertibles have historically exhibited low correlations to traditional interest rate-sensitive bond sectors,1 making them a potential portfolio diversifier. Adding convertibles to a fixed income and equity asset allocation may potentially improve portfolio returns without increasing risk (Figure 5).

Figure 5: Enhanced Risk or Return Profile by Adding Convertibles

Risks Associated with Convertibles

While issuers of convertibles range across the spectrum of credit quality — investment grade, non-investment grade and non-rated — a large portion of the market remains unrated because bond rating programs can be expensive and time-consuming to set up for companies accustomed to raising capital through equity. Additional potential risks with convertibles include:

- Credit Risk: The risk of the issuer not being able to make scheduled principal or interest payments.

- Interest Rate Risk: As with plain vanilla bonds, convertible bond prices may be negatively impacted by rising interest rates, especially when convertible trade out-of-the-money.

- Liquidity Risk: Convertible can be less liquid than corporate bonds, especially in times of market stress.

- Equity Risk: The equity price may never reach the conversion price, thereby negating the value of the option to convert.

- Call Risk: Bond issuers may repay securities with higher coupon or interest rates before the maturity date.

How to Allocate to Convertibles

Convertible securities’ historically low volatility relative to traditional equity indices, combined with their income stream, can potentially provide diversification benefits, which can make them a useful portfolio construction tool.

Due to the unique features described earlier, you can integrate convertibles into your portfolios with these goals in mind:

- Boost Diversification and Enhance Yield: Given their historically low correlation to interest rate-sensitive bonds and higher yield than the Agg,2 convertibles could serve as a complement to the core fixed-income allocation to increase fixed income portfolio diversification and potentially enhance yields.

- Reduce Equity Volatility: For investors seeking to lower the volatility of their equity portfolio, convertibles could act as a defensive growth equity exposure. Investors may want to consider replacing a portion of their growth-oriented equity exposure to seek to reduce the overall risk in terms of standard deviation while maintaining upside equity market participation.

CWB – Consider the SPDR® Bloomberg Convertible Securities ETF

With a gross expense ration of 0.40%, CWB may be compelling vehicle for accessing the traditionally illiquid convertibles market in a cost-efficient way. CWB’s index is designed to represent the market of U.S. convertible securities, such as convertible bonds and convertible preferred stock, with an issue amount of at least $350 million and a par amount outstanding of at least $250 million.3