Investing in Gold with ETFs

2024 Gold Outlook: Can Turning Macro Tides Spur New Gold Highs?

Already supported by central bank buying and demand, our gold strategy team looks for shifting monetary policy, an economic slowdown, and increased volatility to create a positive environment for gold.

Invest in SPDR Gold ETFs

What Can Gold Do for You?

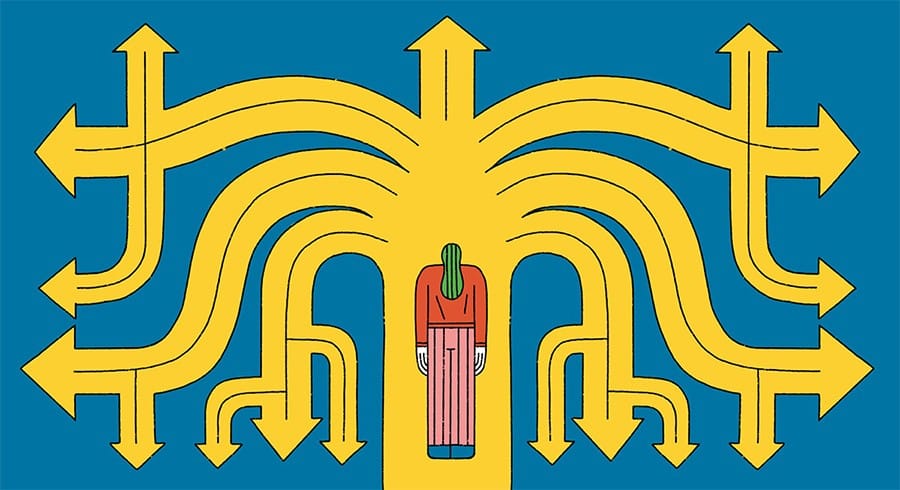

Gold’s investment characteristics, rooted in multiple sources of demand across global economic and business cycles, may help gold serve multiple roles in an investor’s portfolio — during good times and bad.

Gold Is Not Just Another Commodity

Gold is often classified as a commodity alongside other precious metals or broader commodities, like oil and real estate. But with gold’s unique fundamentals and characteristics, it may warrant its own classification in an investor’s portfolio.

Choose Gold in an ETF

Investors can access gold in many different ways — from bars and coins to mutual funds and futures contracts. But gold-backed exchange traded funds (ETFs) offer a high degree of flexibility, transparency, and accessibility to the gold market with the cost-effective liquidity benefits of an ETF wrapper. Learn about the different ways gold can be added to a portfolio and the potential advantages of accessing gold using an ETF.

Work With a Global Leader

In November 2004, State Street Global Advisors launched SPDR GLD®, the first US gold-backed ETF. GLD’s arrival made it convenient and cost effective for investors to have gold exposure in their portfolios. We’ve built a dedicated team of SPDR gold strategists to help investors understand how gold can fit in a portfolio, and launched GLDM® in 2018 in response to growing investor need for a low-cost, gold-backed ETF option.