The case for collateralised loan obligations for European investors

Recent ETF launches have added impetus to a fast-growing European Collateralised Loan Obligation (CLO) market. CLOs may provide European intermediaries with an opportunity to enhance yield, improve portfolio credit quality, and reduce volatility.

A Collateralised Loan Obligation or CLO is a structured finance security backed by a pool of loans to non-investment grade companies. A CLO transaction issues its own bonds and uses the proceeds to invest in a portfolio of corporate loans. The cash flow from the underlying portfolio is then used to cover the principal and interest payments that the CLO structure owes its bond holders.

CLO’s facility to segregate different tranches of risk, coupled with generous interest payments - once credit quality is accounted for - has resulted in market acceleration since 2017. The US market has mainly led this but the value of outstanding Euro CLOs has more than doubled over that period to $250B USD.1

There remains some caution about CLO investment in Europe, in part because of a general reluctance about investing in securitised products. And CLOs have been traditionally less accessible than conventional credit, but the emergence of ETFs is improving access to CLOs.

There are three key reasons to consider CLOs:

1) Adding yield, improving credit quality and reducing portfolio volatility

The European Central Bank (ECB) looks close to the trough of the rate cycle, with the market pricing less than 20 basis points (bps) of further cuts. The only ways to improve the carry profile of portfolios are through extending along the yield curve, or taking additional credit risk. Extending maturity to pick up yield may work if there is a more accentuated economic slowdown, but there are risks in this approach, particularly given the curve’s recent track record of for periodic steepening. The alternative - taking additional credit risk – is vulnerable to an economic slowdown.

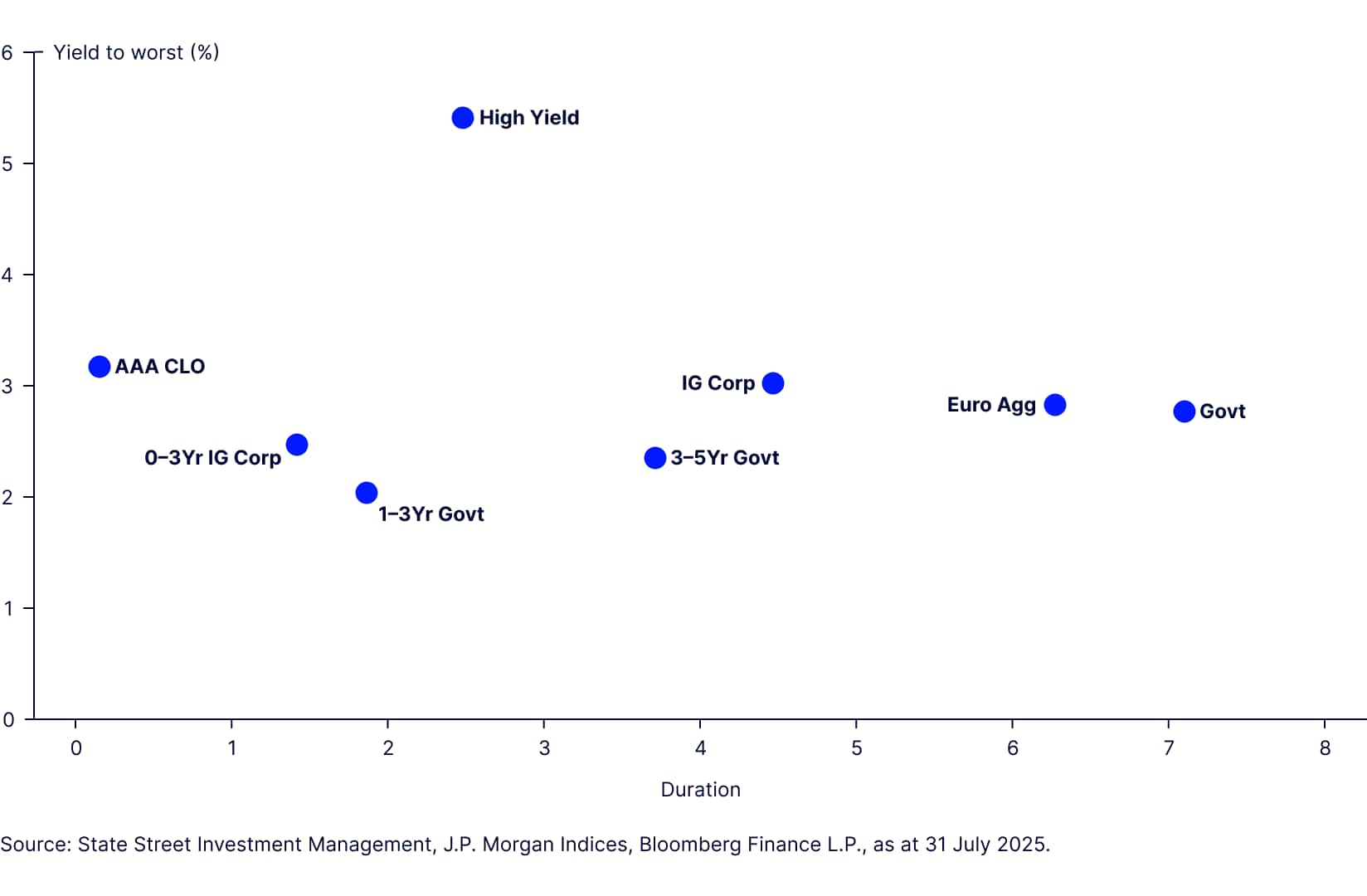

CLO’s are typically a floating exposure which results in a short duration. So even the top-rated AAA tranches have a strong yield, per unit of duration. Figure 1 illustrates this, with a higher yield (from the indices shown) only available by moving into High Yield bonds. That approach leaves investors with a lower quality portfolio.

Figure 1: Yield versus duration in the Euro fixed income market

CLOs target higher yields compared to similarly rated credit products. For example, J.P. Morgan's AAA-rated Euro CLO index has a discount margin to worst of over 110bp and a yield to worst spread of +70bp versus the Bloomberg EUR Corporate 0-3 Year Index, which is rated A3/BAA.2

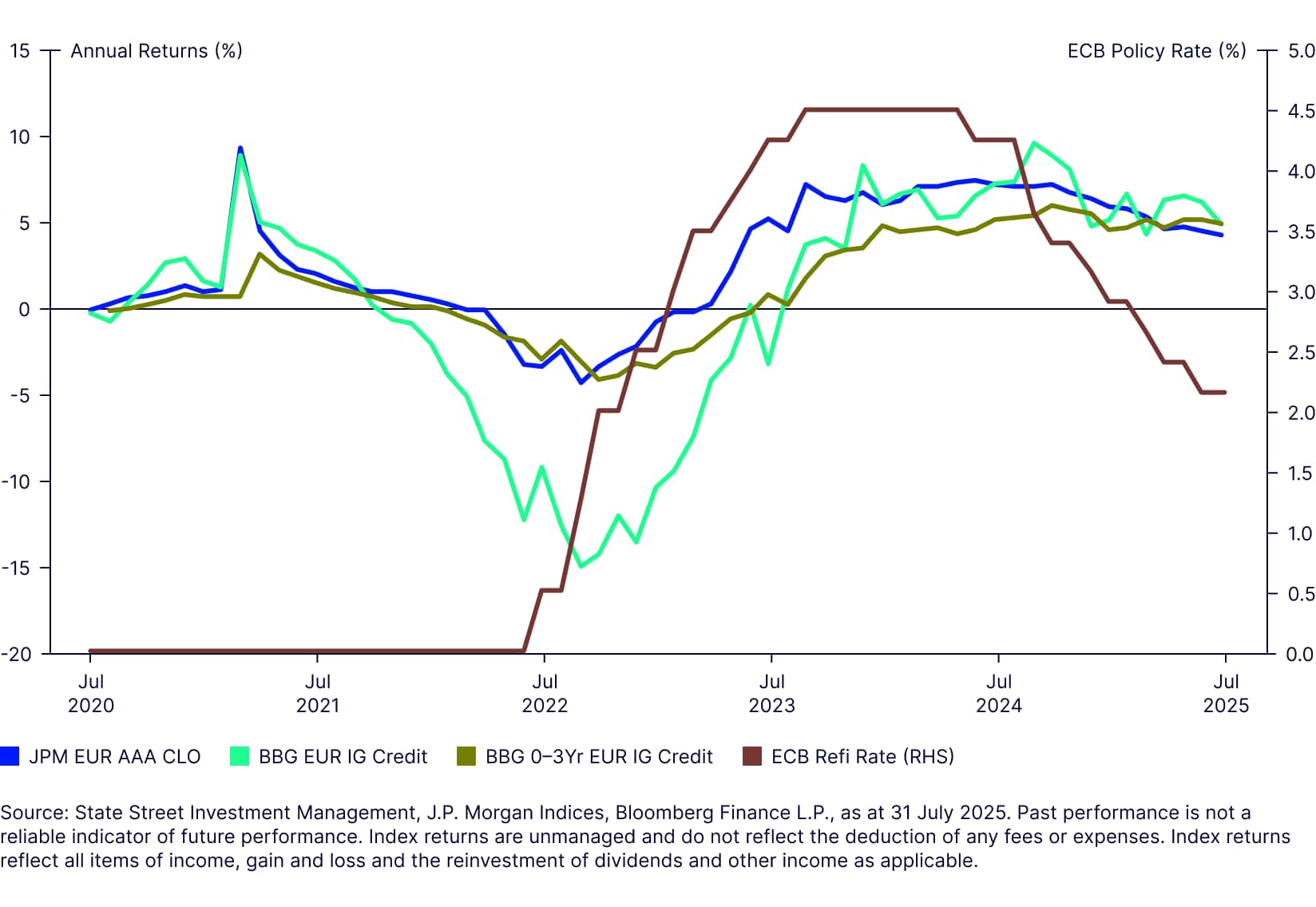

The benefit of this additional yield can be observed in relation to the policy cycle. Figure 2 shows the latest ECB rate cycle alongside returns from the J.P. Morgan Euro CLOIE AAA Index, the Bloomberg EUR Corporate and EUR Corporate 0-3 Year Indices.

Figure 2: Index returns over the ECB policy cycle

The short duration of the CLOs index limited early losses during the rate hike cycle, matching peak negative returns seen in the Bloomberg EUR Corporate 0-3 Year Index. CLOs then outperformed the short end of the IG credit curve from mid-cycle onward.

The extended duration of the Bloomberg EUR Corporate index contributed to the recovery in returns as peak rates came into view and the cutting cycle commenced. But it should be noted that since ECB rates peaked, returns for the J.P. Morgan Euro CLOIE AAA Index have only been marginally lower.3

2. Structure — reassurance of an AAA rating

A CLO is underpinned by loans to non-investment grade rated issuers. However, risk reduction in the securitised structure takes on several forms:

- The pool of collateral is wide and well diversified - unlike some industry specific asset backed securities that may be exposed to just one sector. A CLO tends to have more than 175+ borrowers, a diversity which creates greater resilience to economic shocks. The loans are senior-secured, which should support recovery rates in the event of an issuer default.

- CLO funds are actively managed and the underlying CLO bonds are an extremely transparent asset class. This allows opportunities to trade out of poorly performing loans, providing some protection against credit events.

- The tranche structure of CLOs enables investors to focus on the top AAA-rated portion. The AAA tranche has first claim on the stream of interest payments from the underlying loans. A CLO typically and has around 40% subordination - if losses on the underlying portfolio are no more than 40%, investors will receive their principal in full. There are also CLO coverage tests which are designed to protect noteholders. For a more detailed explanation of the structure of CLOs please see ‘An introduction to CLOs' by Antoine Lesne Link. The track record for CLOs is strong, with no European CLO of single A rating or above having defaulted since the inception of CLOs.4

The AAA rating coupled with the short duration and ETF wrapper mean CLOs may be of interest to Treasury functions managing cash flows at the front end of the curve. With a yield-to-worst of 3.15%, the pick-up to ESTR would be in excess of 120bp. Given the flatness of the money market curve, even versus 3 month or 6 month Euribor, pick-up is above 100bp.5

3. Diversification

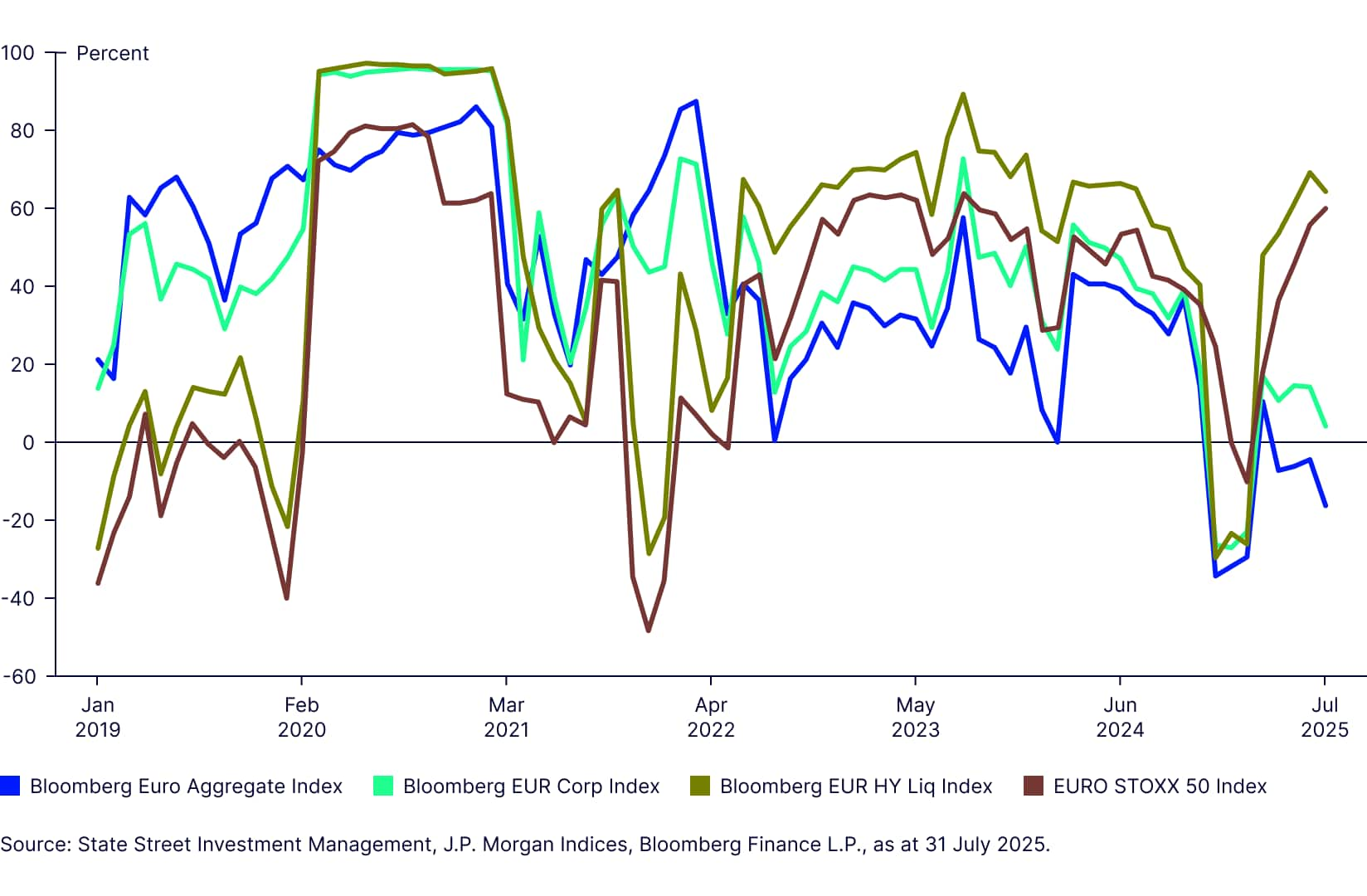

CLOs are a floating exposure, usually with a quarterly reset. In this respect they have a rather different return profile to government bonds, or credit. The short duration partially immunises against big swings in bond market sentiment. Figure 3 shows the rolling 12-month correlation of returns between the J.P. Morgan Euro CLOIE AAA Index and key Euro-denominated bond and equity indices.

Figure 3: Rolling 12-month correlations of the J.P. Morgan Euro CLOIE AAA Index

There have been periods of relatively high correlations with risk assets (EUR High Yield and EURO STOXX 50) in particular, such as in 2020 when all market valuations were hit by Covid but then underwent an aggressive recovery. But correlations to the less risky parts of the bond universe, such as Euro Aggregate and investment grade credit have remained relatively low despite the AAA rating.

In summary, a favourable yield profile, makes CLOs attractive, for having a higher yield than similarly rated corporate bonds, and a high yield per unit of duration profile. The fact that this additional yield can be obtained through an AAA-rated exposure that has a limited correlation with other fixed income assets should increase its appeal as a way of reducing volatility and improving credit quality in portfolios.

The market for CLOs opens up

The investment case for adding in CLOs into a portfolio will be clear for many investors, but the difficulty in accessing the asset class has been a barrier to entry. That has changed with a raft of ETF launches over the past 12 months. The first US CLO ETFs arrived in 2020 but started to gain traction during the 2022/2023 Federal Reserve rate-hike cycle. The investment rationale for incorporating CLOs into portfolios is compelling for European intermediaries, though historical access challenges may have limited adoption.

As is often the case, where the US leads, Europe follows. CLO ETFs for the European market started to arrive in the second half of 2024 after changes in European legislation allowed UCITs funds to consist entirely of CLOs. The number of European listings has continued to grow in 2025. All the new ETFs are focused on the AAA tranche of the CLO structure.

Aside from the universal appeal of the ETF wrapper, the growing acceptance of CLOs means that more investor types are participating in the market. Banks and asset managers have been the dominant investors in the AAA tranche European CLO market, but enhanced ease of access and a better understanding of the asset class could broaden its appeal to pension funds and wealth managers seeking yield.

The regulatory tide has continued to evolve in favour of CLOs. In the U.S., insurer exposure has steadily increased over the past decade. At year-end 2023, CLOs represented approximately 5.2% of insurers’ bond portfolios, up from 2.8% in 2018.6

In contrast, European insurers have securitisation investments that account for less than 1% of their portfolios. A key reason has been the high Solvency Capital Requirements (SCR) associated with these exposures. However, as part of the Solvency II reform, the European Commission acknowledged that the existing framework failed to reduce disproportionately high prudential costs and did not significantly boost investment in securitisations by insurers.7

Use cases

There are several interesting investor use cases for CLO ETFs.

Enhancing the yield versus duration trade-off

The most obvious use is as a way of improving the running yield on a portfolio. With the ECB looking close to the end of its rate cutting cycle, limiting further bond price gains, the portfolio’s running yield could become an increasingly important element of returns. The yield to worst on the J.P. Morgan Euro CLOIE AAA Index was 3.16%, and yield to maturity was 3.31% as at 31 July 2025, which is higher than the 2.84% and 2.86% for the Bloomberg Euro Aggregate Bond Index. Adding in 5% of CLOs to a portfolio based around the Euro Aggregate Index sees the yield to worst rise by 1bps and the yield to maturity by 3bp.7 Small gains, but there are collateral benefits in that the duration would shorten by 0.2 years, improving the yield per unit of duration ratio. In addition, credit quality would rise, with the amount of AAA-rated paper increasing from 21.3% to over 25%.

Liquidity management

Using ETFs as a liquidity sleeve has gained popularity. In the event of a cash call on the portfolio, investors can remain fully invested in their core holdings, liquidating ETF holdings to raise any required cash

ETFs are liquid but can still experience significant volatility - unlike holding cash. CLOs are not cash, but they are AAA-rated and have historically been relatively stable. And they provide a material yield uplift versus cash rates. The spread of the yield-to-worst of the J.P. Morgan Euro CLOIE AAA Index over ESTR was 128bp at the end of July 2025. This is well above the 12-month average of 66bp.8

Volatility reduction

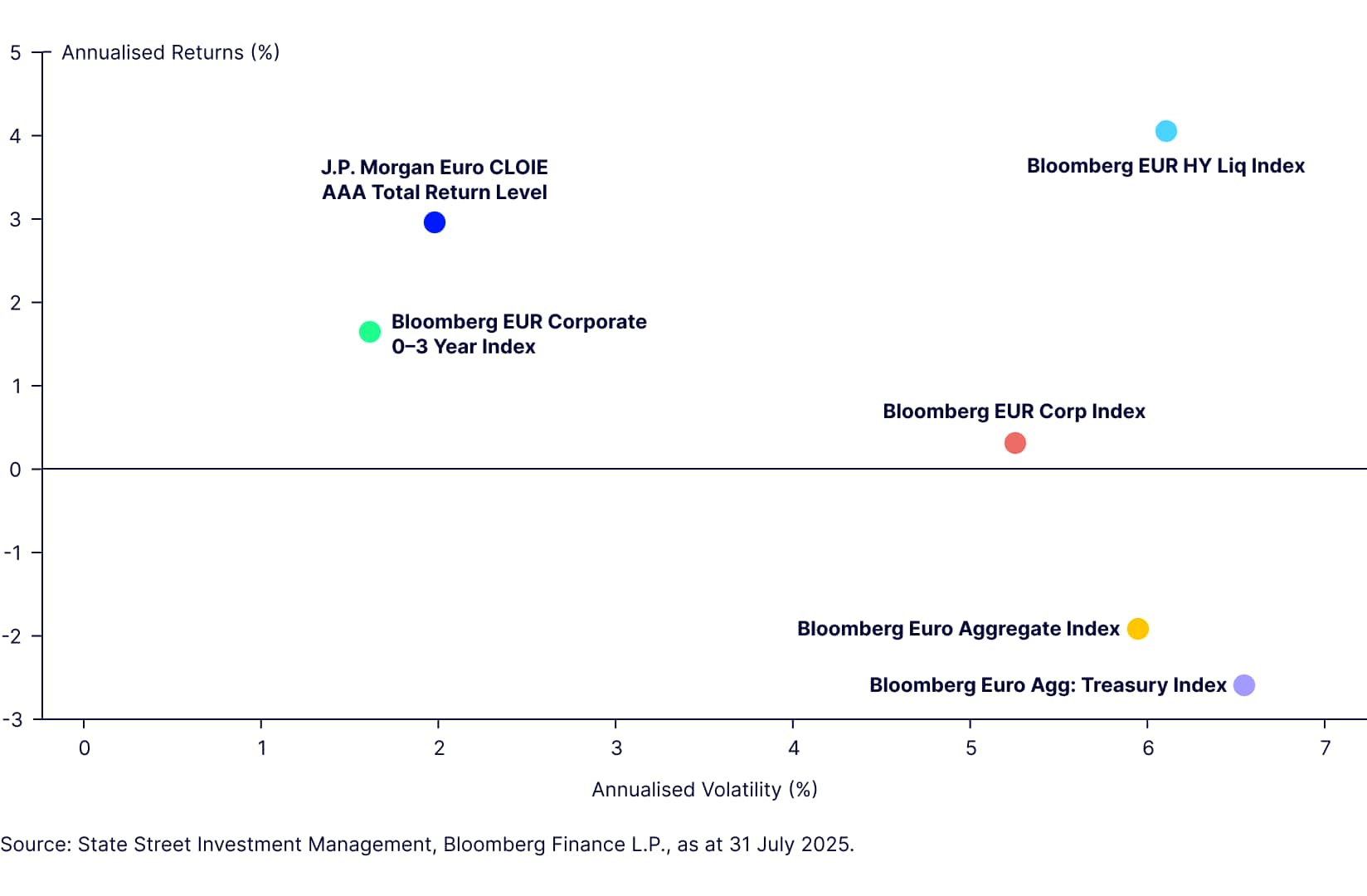

CLOs’ have a short duration and are relatively stable. This can be a valuable tool in reducing portfolio volatility. Figure 4 shows the five-year performance of various EUR denominated strategies. Returns vary materially but almost all strategies have five to seven percent annualised volatility.

Shortening portfolio duration is an obvious way to reduce volatility. Substituting part of the broad EUR corporate exposure for the 0-3 Year segment of the curve would have boosted returns and reduced volatility. The volatility of the J.P. Morgan Euro CLOIE AAA index has been slightly higher than that of the Bloomberg EUR Corporate 0-3 Year index over the past five years but this is more than compensated for by the additional yield. Annual returns on CLOs have been, on average, 130bps above those of short-dated EUR investment grade credit over the past five years.

Figure 4: Five year returns versus volatility of EUR-denominated indices

Explore CLO funds

Link to State Street Blackstone Euro AAA CLO UCITS ETF fund page