Defined Contribution

Advisor Resources

Big as a Bank, Agile as an Advisor

With nearly $2.9 trillion assets under management, State Street Global Advisors has been a consistent investing force for over four decades.

In the DC advisor arena, we harness our scale and skill to further advisor practices and plan provider offerings. At the same time, we bring the same entrepreneurial spirit that drives advisors.

Going beyond the status quo, we work to extend our partners’ reach and strive to deliver better participant outcomes.

DC Investment Options

Leveraging a full range of institutional capabilities to enhance retirement outcomes.

Mutual Fund Product Guide

From index to active strategies, single to multi-asset funds, see how our lineup stacks up.

- What to Ask Your Index Manager?

- SECURE Act Signals Legislative Leap Forward for Retirement

- Social Media Success: A Quick Guide to Amplifying Your DC Practice

When it comes to index-based target date strategies, there seems to be some confusion.

DC Advisor Team

Gregory Porteous

Head of Intermediary Strategy

Heather Bailey

Head of Regional DC Sales

Mike Nelligan

Senior Relationship Manager

Alex McCarthy

Relationship Manager

Dan Cahill

Client Relationship Manager

Regional Territories

West

Justin Wilson

Senior Retirement Director

Justin_Wilson@ssga.com

Mobile: 857 272 9847

Midwest

Ned McNally

Senior Retirement Director

Ned_McNally@ssga.com

Mobile: 312 925 9198

East

Heather Bailey

Senior Retirement Director

Heather_Bailey@ssga.com

Mobile: 470 449 5641

Home Office

Campbell Jamieson

Internal Retirement Director

Campbell_Jamieson@ssga.com

Office: 617 664 6072

Mobile: 617 347 2279

Investment Approach

Having the Right Investment Conversations

Fee compression, service bundling and firm aggregation are industry trends changing the way advisors do business — and the segments they serve.

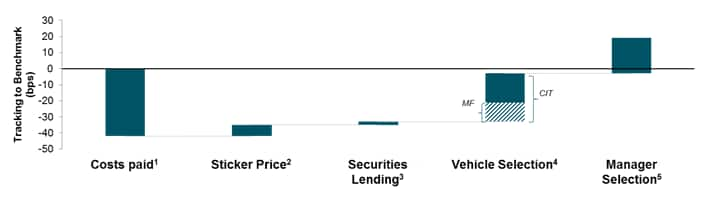

Increasingly, staying competitive means broadening your market reach. To do so, consider how you can pivot your investment conversations toward different dimensions of value, or what we refer to as operational alpha.

Getting to Operational Alphaii

Practice Management

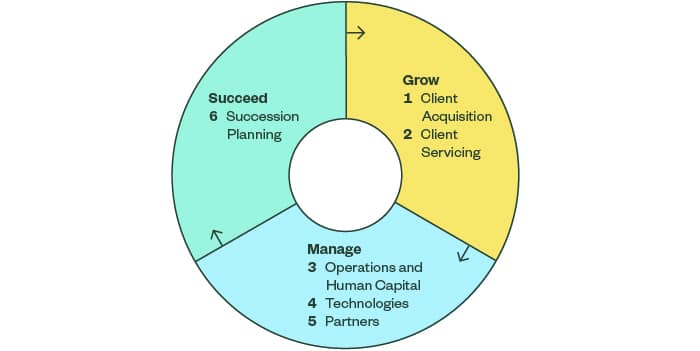

Enhancing Each Stage of Your Practice

We are committed to supporting the advisor community in growing and evolving prosperous practices. As part of this commitment, we’ve hosted a series of events for the country’s top retirement plan advisors through which we’ve gained insights across the business life cycle. Here, we share those findings, along with a content series dedicated to furthering advisor acumen across each business stage.

Succeed

Whitepaper coming soon.

For more information on our DC Advisor offerings, contact us at DCIntermediaryTeam@ssga.com.