Information Classification: General

State Street Global Advisors (SSGA) is now State Street Investment Management. Please go to statestreet.com/investment-management for more information.

Marketing Communication.

For investment professional use only.

United Kingdom: In the UK, this document has been issued by State Street Global Advisors Limited (“SSGAL”). Authorized and regulated by the Financial Conduct Authority, Registered No.2509928. VAT No. 5776591 81. Registered office: 20 Churchill Place, Canary Wharf, London, E14 5HJ. Telephone: 020 3395 6000. Facsimile: 020 3395 6350 Web: www.ssga.com.

Important Risk Information

Investing involves risk including the risk of loss of principal. Managed Pension Funds Limited (“MPF”) is a pooled investment vehicle enabling pension scheme investors to invest in one or more sub-funds of MPF. MPF is an insurance undertaking and investors in MPF receive a unit-linked policy, which is a type of insurance policy, and are allocated units in the relevant Sub-Fund(s) in which they invest. MPF has appointed State Street Global Advisors Limited (“SSGAL”) to act as investment manager to MPF. SSGAL may delegate provision of investment management services to its affiliated entities. MPF is authorized by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority and the PRA.

MPF is available to pension schemes registered with HM Revenue and Customs for the purposes of Part 4 of the Finance Act 2004. MPF is also available to certain insurance companies that wish to reinsure liabilities that the insurers have arising under unit linked life policies issued by the insurers to underlying pension scheme investors. Before investing you should consult with your tax or financial advisor to ensure you qualify to invest in MPF. Scheme members should consult with their employers or scheme trustees. Please note that neither SSGAL or MPF offer actuarial services and any investment service undertaken by those firms with an objective of matching projected pension fund liabilities does not include, or take responsibility for, the calculation of projected liabilities. Illustrations exclude the impact of fees, and actual investment returns may differ from projected cashflows, these projected cashflows are not projections of any future benefit payable under a specific policy.

Please refer to the MPF Key Features Document and Policy Document for full details about the Fund, including fees and risks. Please refer to the “General Risks Applicable to All Sub-Funds” and to the relevant “Sub-Fund Specific Risk Factors” sections of the “Key Features of Managed Pension Funds Limited” document, which is available at: https://ssga.com/ publications/firm/Key-Features-ofManaged-Pension-Funds-Limited.pdf.

The information provided does not constitute investment advice as such term is defined under the Markets in Financial Instruments Directive (2014/65/EU) regulation and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell any investment. It does not take into account any investor’s or potential investor’s particular investment objectives, strategies, tax status, risk appetite or investment horizon. If you require investment advice you should consult your tax and financial or other professional advisor.

The returns on a portfolio of securities which exclude companies that do not meet the portfolio’s sustainable strategy criteria may trail the returns on a portfolio of securities which include such companies. A portfolio’s sustainable strategy criteria may result in the portfolio investing in industry sectors or securities which underperform the market as a whole .

A Smart Beta strategy does not seek to replicate the performance of a specified cap-weighted index and as such may underperform such an index. The factors to which a Smart Beta strategy seeks to deliver exposure may themselves undergo cyclical performance. As such, a Smart Beta strategy may underperform the market or other Smart Beta strategies exposed to similar or other targeted factors. In fact, we believe that factor premia accrue over the long term (5–10 years), and investors must keep that long time horizon in mind when investing.

All information is from SSGA unless otherwise noted and has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

This communication is directed at professional clients (this includes eligible counterparties as defined by the FCA who are deemed both knowledgeable and experienced in matters relating to investments. The products and services to which this communication relates are only available to such persons and persons of any other description (including retail clients) should not rely on this communication.

Diversification does not ensure a profit or guarantee against loss.

Bonds generally present less short-term risk and volatility than stocks, but contain interest rate risk (as interest rates rise bond prices usually fall); issuer default risk; issuer credit risk; liquidity risk; and inflation risk. These effects are usually pronounced for longer-term securities. Any fixed income security sold or redeemed prior to maturity may be subject to a substantial gain or loss.

Equity securities may fluctuate in value and can decline significantly in response to the activities of individual companies and general market and economic conditions.

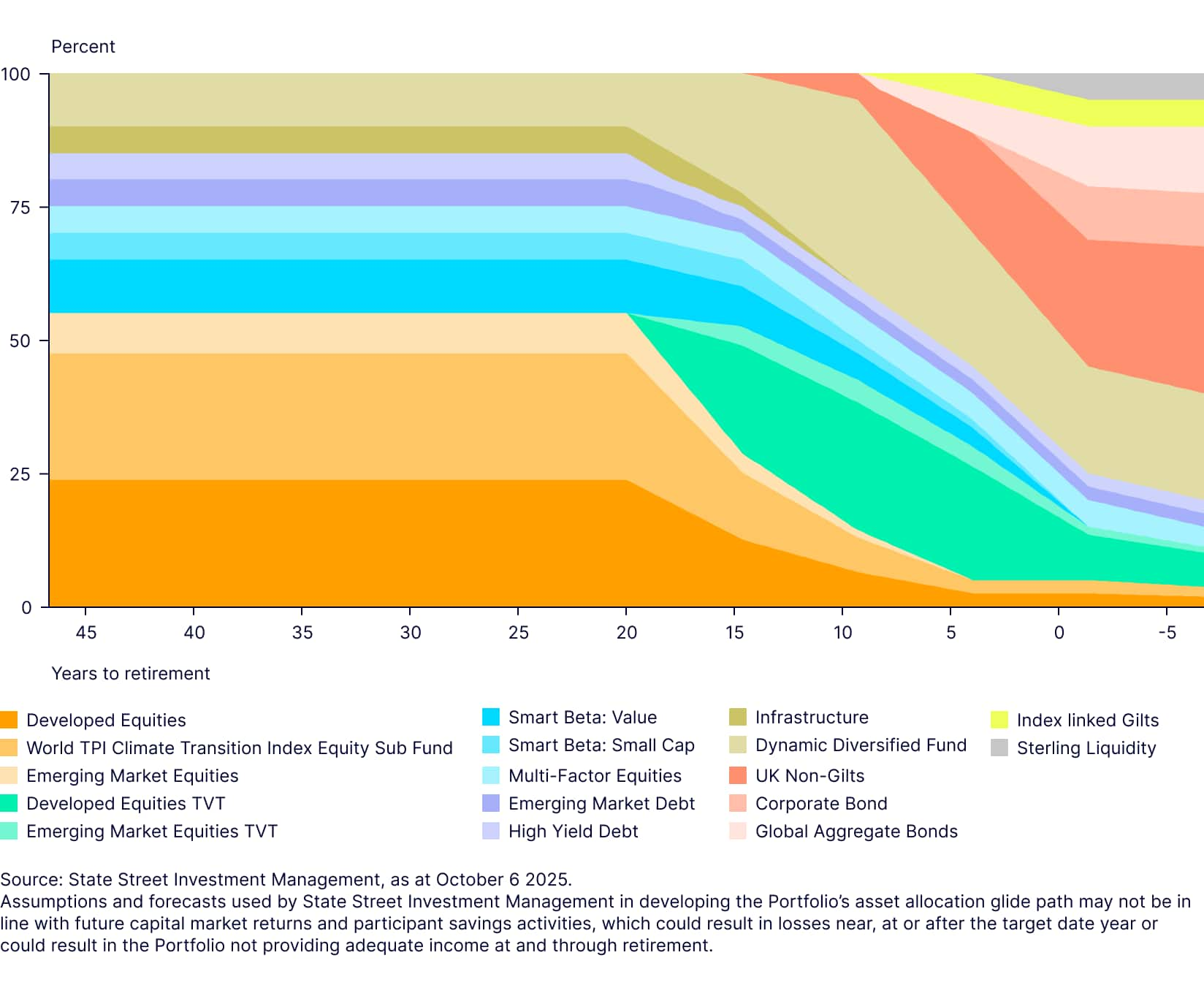

Assumptions and forecasts used by SSGA in developing the Portfolio’s asset allocation glide path may not be in line with future capital market returns and participant savings activities, which could result in losses near, at or after the target date year or could result in the Portfolio not providing adequate income at and through retirement.

The trademarks and service marks referenced herein are the property of their respective owners. Third party data providers make no warranties or representations of any kind relating to the accuracy, completeness or timeliness of the data and have no liability for damages of any kind relating to the use of such data.

SSGA Target Date Fund are designed for investors expecting to retire around the year indicated in each fund’s name. When choosing a Fund, investors should consider whether they anticipate retiring significantly earlier or later than age 65 even if such investors retire on or near a fund’s approximate target date. There may be other considerations relevant to fund selection and investors should select the fund that best meets their individual circumstances and investment goals. The funds’ asset allocation strategy becomes increasingly conservative as it approaches the target date and beyond. The investment risks of each Fund change over time as its asset allocation changes.

Investing in foreign domiciled securities may involve risk of capital loss from unfavourable fluctuation in currency values, withholding taxes, from differences in generally accepted accounting principles or from economic or political instability in other nations. Investments in emerging or developing markets may be more volatile and less liquid than investing in developed markets and may involve exposure to economic structures that are generally less diverse and mature and to political systems which have less stability than those of more developed countries.

Asset Allocation is a method of diversification which positions assets among major investment categories. Asset Allocation may be used in an effort to manage risk and enhance returns. It does not, however, guarantee a profit or protect against loss. Diversification does not ensure a profit or guarantee against loss.

The information contained in this communication is not a research recommendation or ‘investment research’ and is classified as a ‘Marketing Communication’ in accordance with the applicable regional regulation. This means that this marketing communication (a) has not been prepared in accordance with legal requirements designed to promote the independence of investment research (b) is not subject to any prohibition on dealing ahead of the dissemination of investment research. The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without SSGA’s express written consent.

© 2025 State Street Corporation - All Rights Reserved.

4637451.7.1.EMEA.INST

Expiration Date: 31/10/2026