An Update on Dividend Aristocrats

- Recent market volatility has left equity investors with few opportunities for protection and questioning the stability of dividend income streams.

- We believe that strategies such as the Dividend Aristocrats, which focus on dividend stability, could be well positioned for the current environment

Dividend Strategy Performance Remains Challenged

The coordinated nature of recent equity market pullbacks has adversely affected the selective nature of the Dividend Aristocrats index strategies. During broad sell-offs, it’s harder for defensive smart beta funds to provide the same downside protection they have historically demonstrated. The recent market pullback saw the MSCI World Index sell off 30.67% in less than a month (28 days). During this decline, the difference between the best performing sector (Consumer Staples) and the market was only 13.58%.1

The speed and narrowness of this market pullback, as well as the large accumulation of cash holdings, suggests a market that is not trading on fundamentals. The few stocks that have delivered relatively strong performance have an idiosyncratic benefit tied to the short-term reaction to the COVID-19 outbreak. This was largely concentrated in the Consumer Staples, Technology and Health Care sectors.

Specific names in Consumer Staples benefitted from a stockpiling of household goods ahead of global societal shutdowns to combat further spread of the virus. During the 28-day pull back in MSCI World, the Household & Personal Products Industry Group only sold off 8.57%. Meanwhile, specific growth stocks in Technology (work-from-home plays) and Health Care (drug/treatment development) provided some benefit to the market cap weighted benchmarks relative to dividend yield factor indices

We believe factor investors should position for a market that will resume trading on longer-term fundamentals. As the economic disruptions of the global pandemic continue to threaten dividends, the Dividend Aristocrats methodology is uniquely suited to target the most stable dividend payers.

Some sectors have been hit especially hard in the downturn. Energy stocks have collapsed as a result of falling demand and a lack of coordinated production cuts. Even the largest, best capitalised Energy firms, with impressive track records of established dividend programs, have not been immune to pullbacks. Many investors expect these firms to recover once we see resolution in the economic imbalance, provided they can continue to service debt. In the short term, investors worry that firms will need to cut dividend payments.

On 7 April, Exxon2 announced it was embarking on a plan to cut its capital spending by 30% in order to combat oil price headwinds, which have hurt the stock price. Importantly, the CEO reaffirmed the company’s commitment to supporting the dividend program, even if it required the use of its balance sheet to support the cash distributions.3 While this is somewhat anecdotal, is does highlight the primary selection criteria of the S&P High Yield Dividend Aristocrats Index – companies that have followed a managed-dividends policy of consistently increasing dividends every year for at least 20 years.

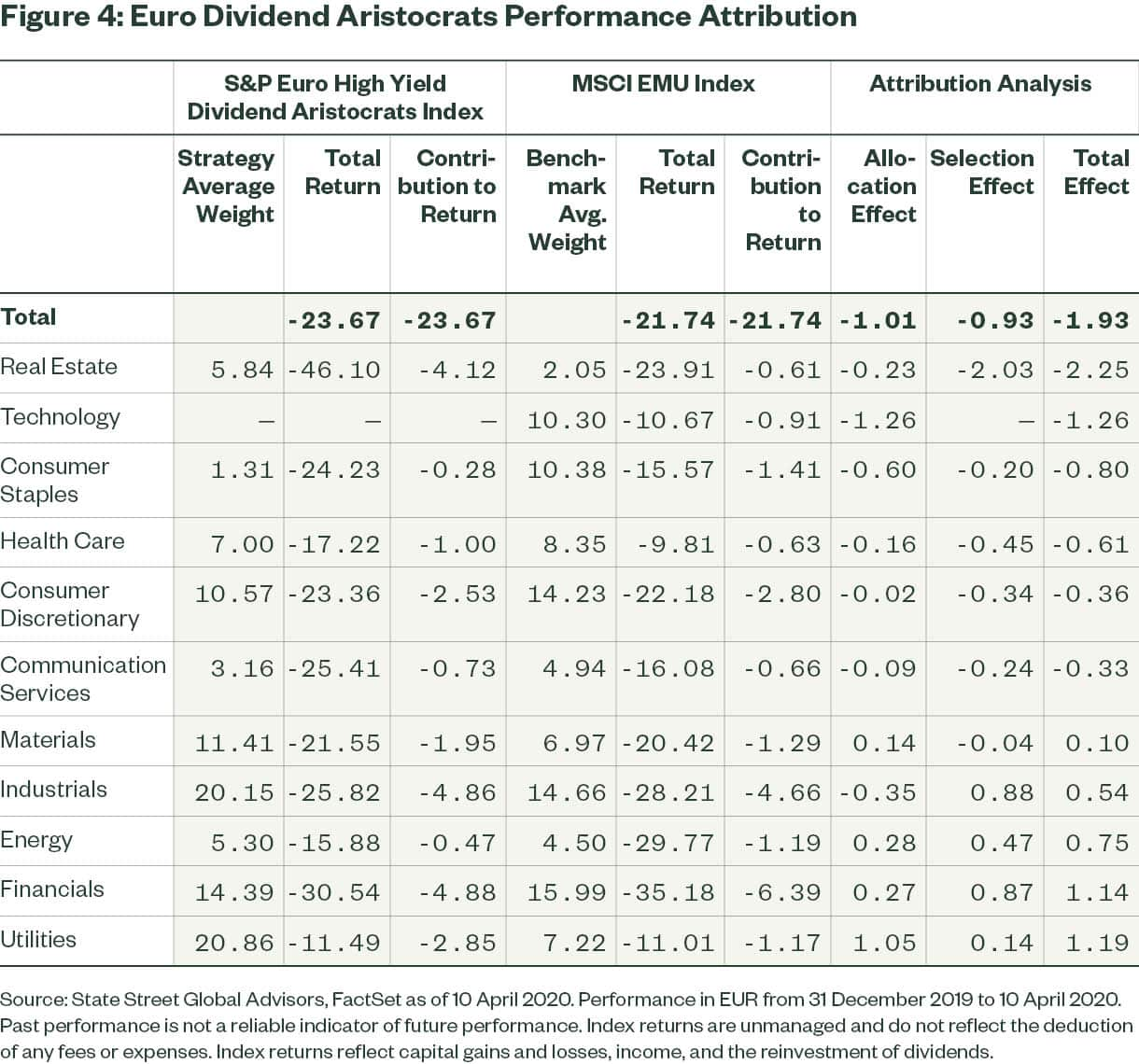

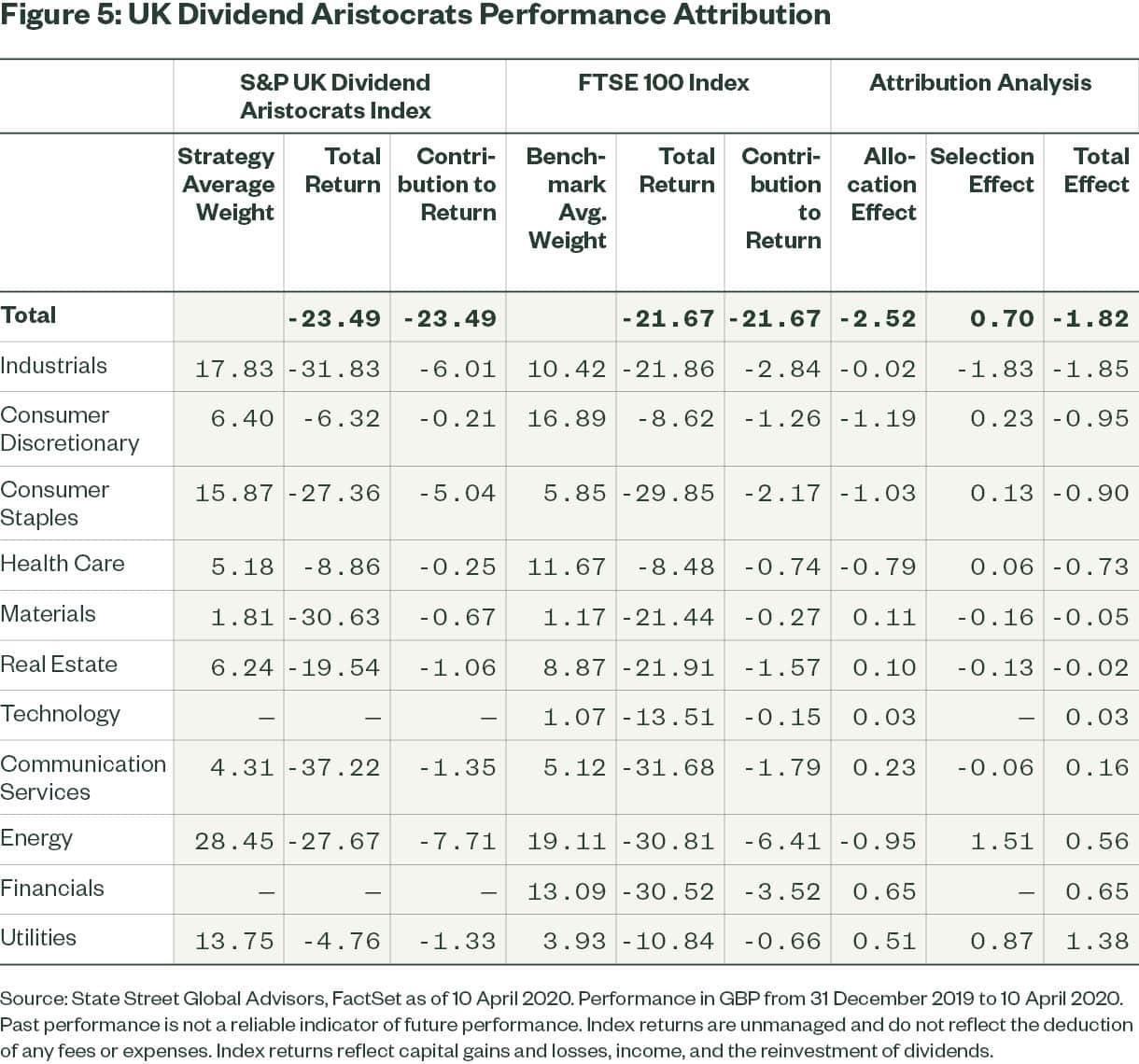

Figures 3-5 (appendix) contain detailed attribution (by sector) of the performance of US, eurozone and UK dividend exposures during the recent pullback.

European Regulators Move to Encourage Suspending Dividend Payments

In an environment where increasing social disruption has shocked the real economy, income investors are increasingly concerned about dividend stability. The drop in consumer demand at a time of high corporate debt levels has caused many investors to question whether companies will continue to generate the cash flows needed to return regular cash dividends to shareholders.

Additionally, as government bodies step in to help businesses weather the storm, some are explicitly calling for those businesses to hoard cash by suspending dividends to investors. On 27 March, the European Central Bank issued a recommendation to European banks to refrain from making dividend distributions until at least 1 October 2020.4

The Bank of England issued a similar request to UK banks at the end of March, which the country’s largest banks agreed to obey. Although, the regulator acknowledged that they “do not expect the capital preserved to be needed by the banks in order to maintain adequate capital positions,” in a statement issued on 31 March.5

While these regulatory actions will impact the dividend capacity of European banks, across the United Kingdom and eurozone, the SPDR® S&P® Euro Dividend Aristocrats UCITS ETF (13.3% Financials) and SPDR® S&P® UK Dividend Aristocrats UCITS ETF (27.1% Financials) may experience less of a threat to their dividends. The Financials exposure in each of these funds is largely skewed towards the insurance (Euro 13.3% and UK 8.25%) and capital markets (UK 16.4%) industries, which may have more capacity to maintain dividends.6

The foundation of the Dividend Aristocrats strategies is the long-term dividend track record. For this reason, while constituents in these strategies will not be immune from dividend cuts, it is as important as ever that investors recognise the value of dividend stability. This family of indices is uniquely positioned for the current environment, as it selects companies where the management teams have a demonstrated commitment of seeking to preserve regular cash dividends.

The Dividend Aristocrats Methodology Targets Dividend Stability

The primary stock selection component of the Dividend Aristocrats family of strategies is long-term track record (5-20 consecutive years) of maintaining (or raising) the regular cash dividend delivered to shareholders. Figure 2 (below) provides a detailed overview of the index construction.

In addition to this high standard of dividend stability for stock selection, the methodology also includes a process called Monthly Dividend Review, as part of the index maintenance rules. This process is designed to remove companies at month-end that meet either of the following conditions, on the applicable reference date:8

• The constituent stock publicly announces a suspension or cancellation of its dividend program.

• The constituent stock lowers but does not eliminate its dividend, and its new yield is significantly lower than the lowest yielding constituent.

In the event a stock is removed as a result of the Monthly Dividend Review, the stock is replaced at month-end (in the case of the Euro and UK strategies) or during the next annual reconstitution (US, Global, Pan Asia and Emerging Markets). The decision to remove any index constituent sits with the S&P Dow Jones Indices (“S&P DJI”) Index Committee.

In a FAQ published by S&P DJI on 31 March 2020, the index provider issued some important clarifications on the application of their index methodology, given the current market environment. S&P DJI will continue to reconstitute its dividend indices according to the published index methodology.

Many of the indices have specified target constituent counts and additional weighting rules for diversification included in their rebalance processes documented in their applicable methodologies. In the event the rules as detailed in the index methodology cannot be met, the Index Committee will review the results and determine if discretion needs to be exercised to ensure the applicable Index continues to meet its stated objective.10

For more information on the ETFs referenced in this note, including full performance histories, please view their fund pages:

SPDR S&P Euro Dividend Aristocrats UCITS ETF

SPDR S&P UK Dividend Aristocrats UCITS ETF

SPDR S&P U.S. Dividend Aristocrats UCITS ETF