Gold For Portfolios

- Gold’s historically low or negative correlation to other asset classes means the potential for greater diversification.

- A strategic allocation to gold may help reduce the impact of market volatility.

Why Consider Investing in Gold?

Gold is both an investment and a consumer good. Global economic growth, income growth, monetary policy and market volatility drive demand.

A strategic allocation to this unique asset class may help an investor to pursue the following potential benefits of gold:

- Long-term returns

- Greater diversification

- Improved risk-adjusted returns

- Deep liquidity

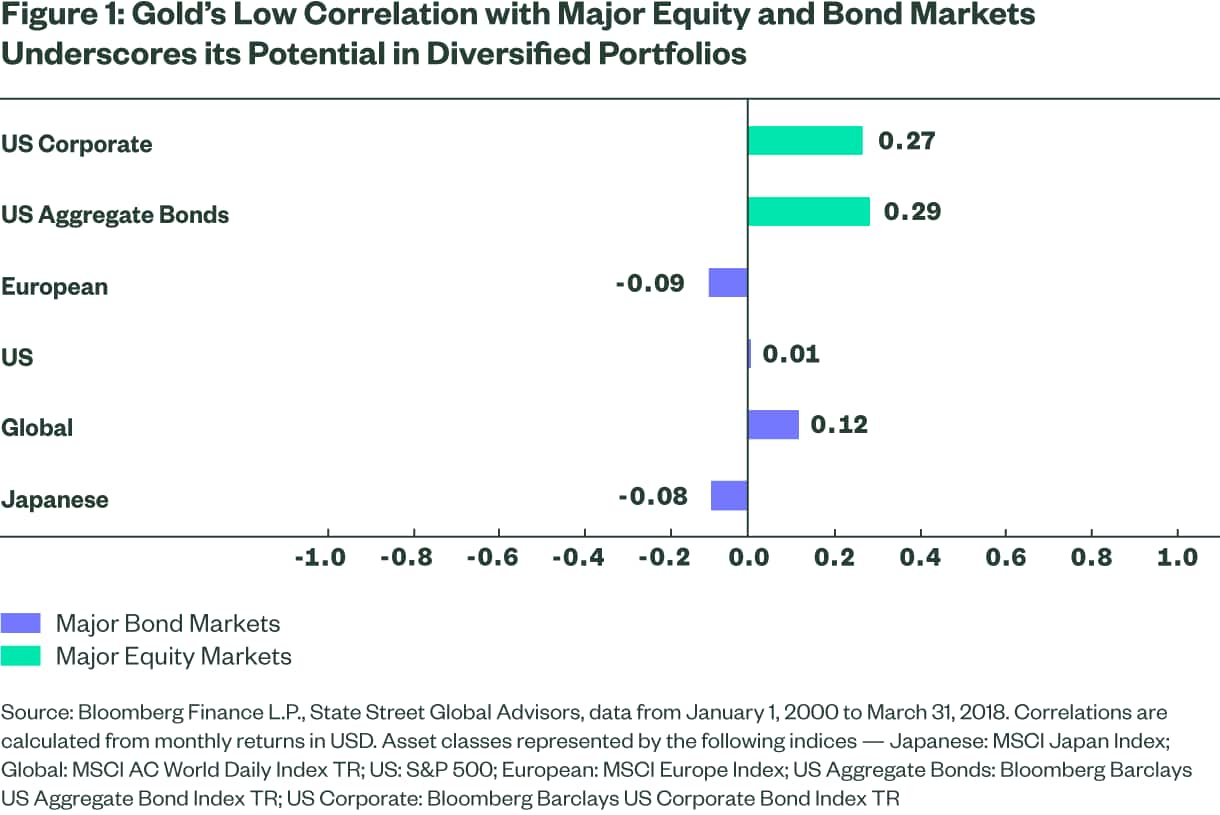

Gold’s low correlation with major equity and bond markets underscores its potential in diversified portfolios.

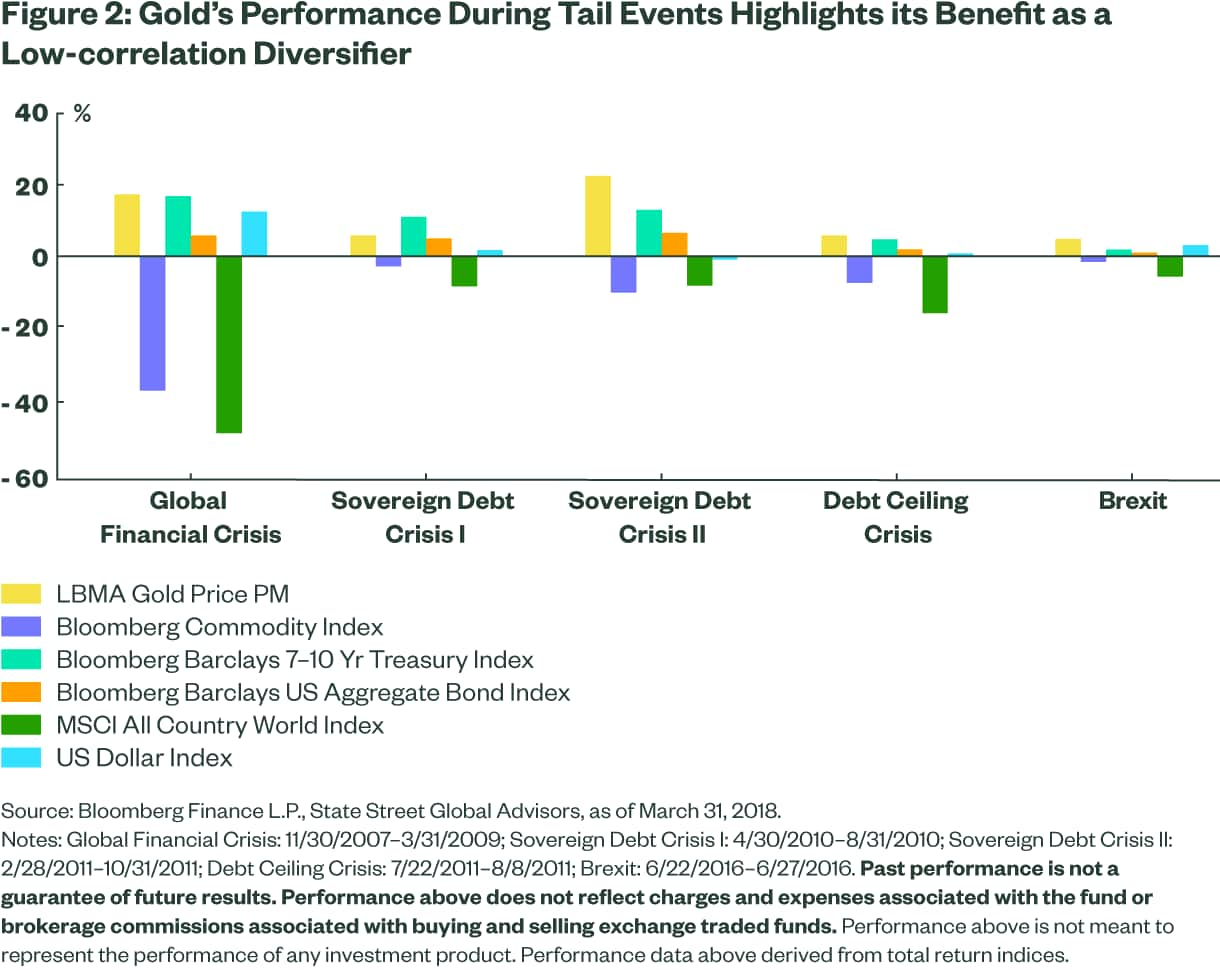

Gold’s performance during tail events highlights its benefit as a low-correlation diversifier.

"7.79% p.a.—the compound annual growth rate for the LBMA (London Bullion Market Association) Gold Price PM since 19711."

Long-term Returns

Since 1971, when President Nixon removed the US dollar from the Gold Standard, the price of gold has increased from $43.28/oz. to $1323.85/oz. at the end of March 2018, generating a compounded annual growth rate of 7.79 percent per year.1 Gold’s prices are influenced by a diverse set of global drivers in pro-cyclical and counter-cyclical markets.

Greater Diversification

Gold’s historically low or negative correlation to other asset classes means the potential for greater diversification that could potentially lower portfolio volatility, enhance overall risk-adjusted returns and preserve purchasing power.

Improved Risk-Adjusted Returns

Because gold has historically tended to rise during stock market pullbacks, a strategic allocation to gold in a multi-asset class portfolio may help temper the impact of market volatility and reduce portfolio drawdown.

Deep Liquidity

The average daily turnover of gold is over $250 billion, equivalent to $62 trillion per year. That makes the gold market larger than that of many stocks and bonds.2