1

Collaboration with Barclays QPS

Collaboration with Barclays QPS

Our strategies are informed by data-driven, systematic signals developed by the Barclays Quantitative Portfolio Strategy team, or QPS, which is well-recognized as an innovator in quantitative fixed income research.

2

Alpha-Generating Signals

Alpha-Generating Signals

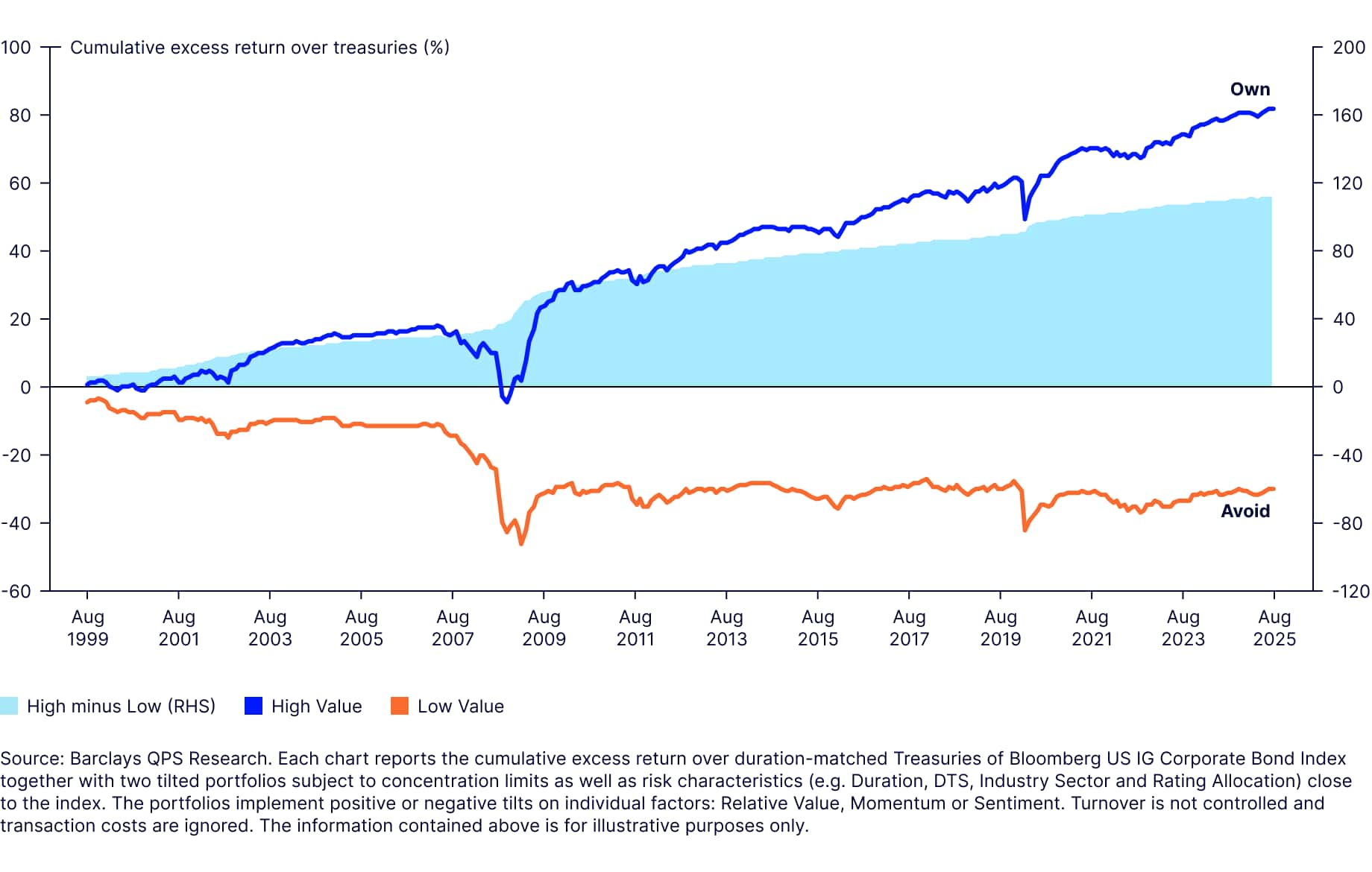

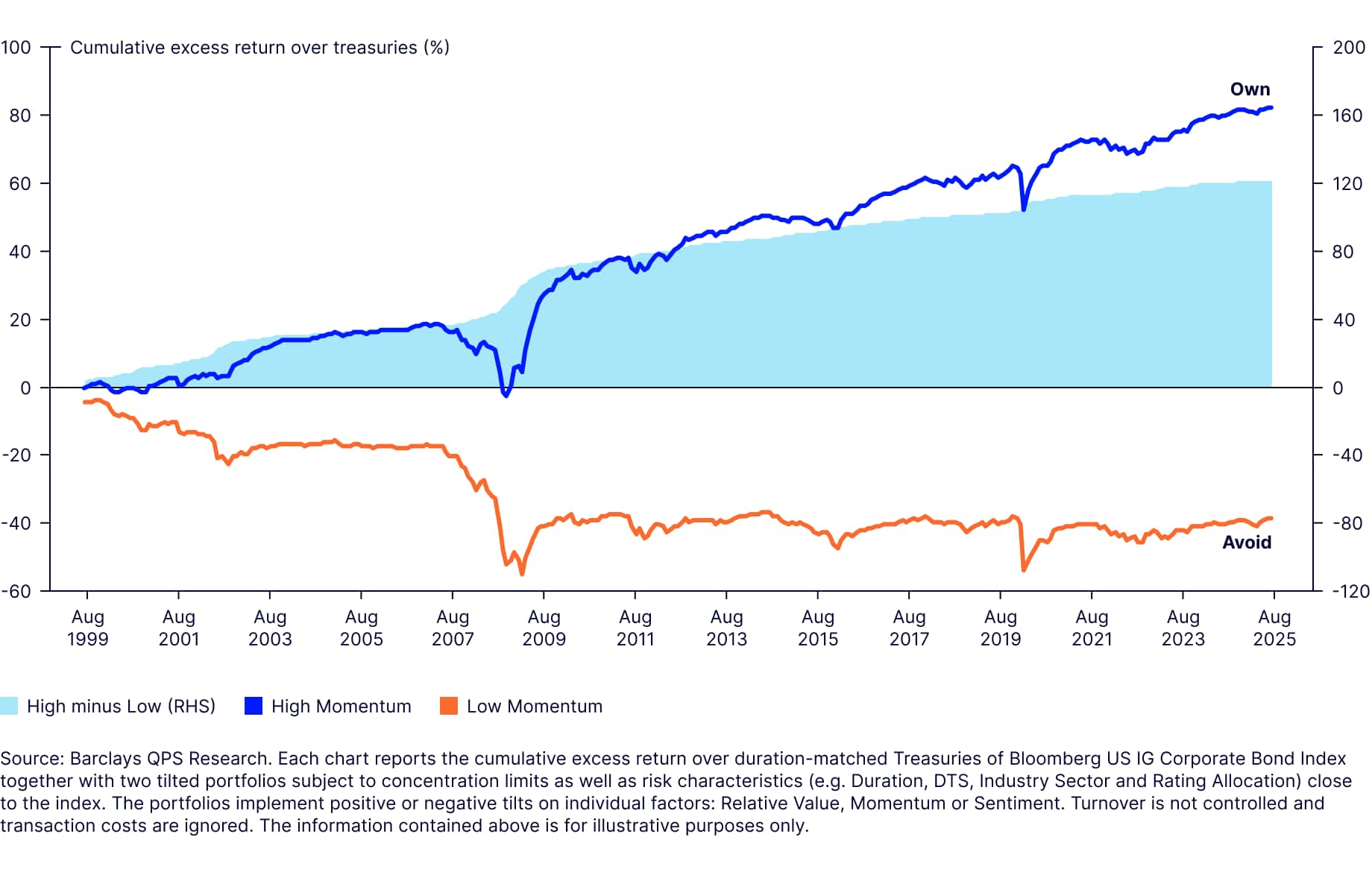

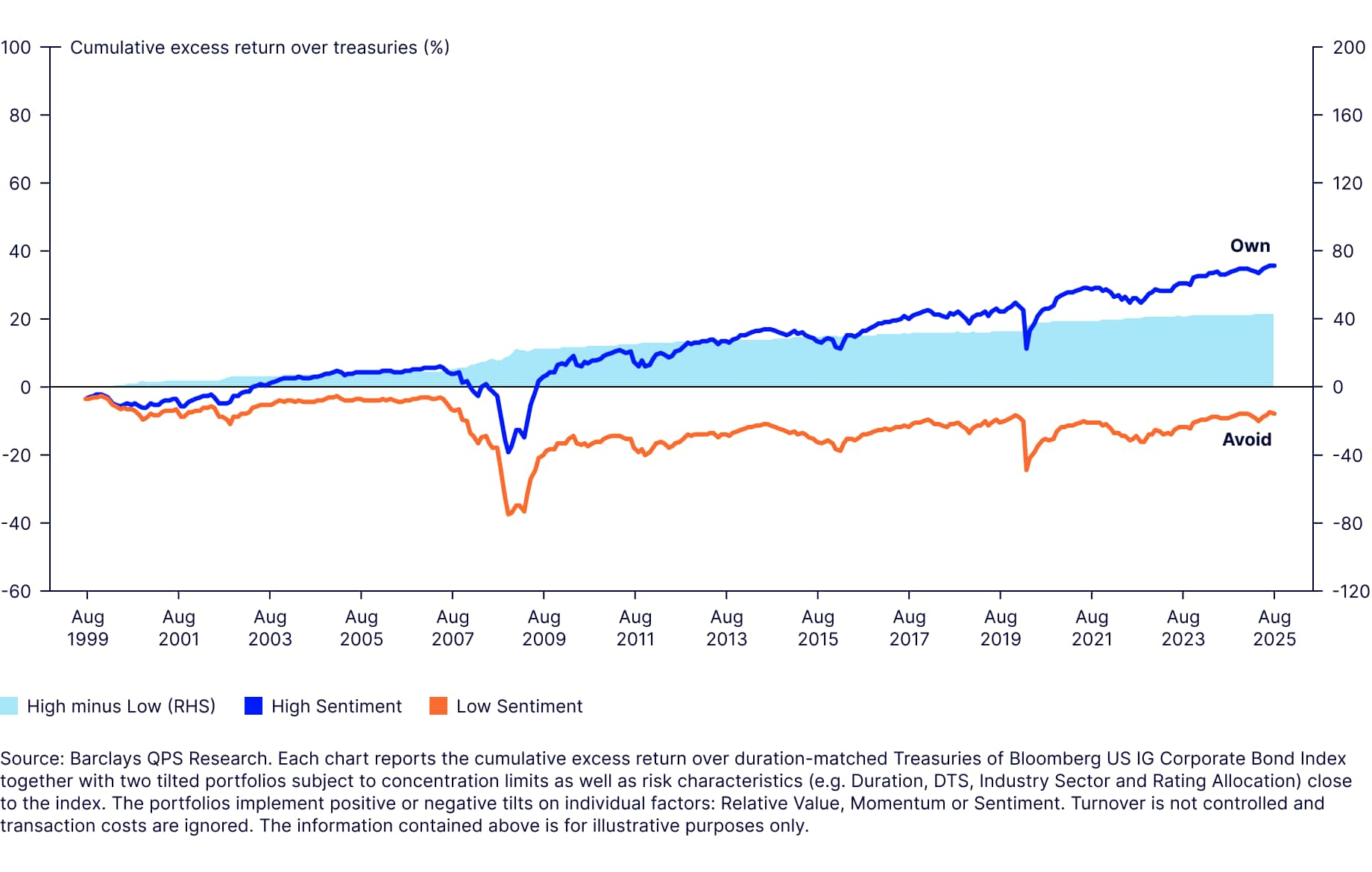

These strategies are based on signals related to 3 factors that have exhibited strong portfolio outcomes: value, momentum and sentiment. Historically, portfolios comprising bonds with high value scores have had higher returns.

3

Index Management Capabilities

Index Management Capabilities

Our index management capabilities, along with the data excellence of Barclays QPS, allow us to build portfolios that maximize signal scores, minimize costs, and have less tracking error than fundamentally-managed portfolios.

4

Over $1Tr in FICC AUM*

Over $1Tr in FICC AUM*

As a large fixed income manager, we can source bonds effectively and maximize signal exposure. Our implementation capabilities are built on our experience, precision, and consistency as both an active and index bond manager.

5

Thoughtful Liquidity Controls

Thoughtful Liquidity Controls

Our screening process ensures that SAFI portfolios include only sufficiently liquid bonds. Our trading capabilities enable strong execution, in-depth market flow insights, and other advantages to harness implementation alpha.

6

Sustainability Integration

Sustainability Integration

SAFI can apply a range of sustainability signals, and the frameworks flexibility allows it to further customize signals if necessary. For example, customization may include the addition/removal of a sustainability signal.