Sector Compass Q4 2025 Sectors in focus for Q4

- Health Care - US/ World/ Europe

- Information Technology – US/World/ Europe·

- Financials – US

- Industrials - World/ Europe

Themes and Outlook

The great sector diversification

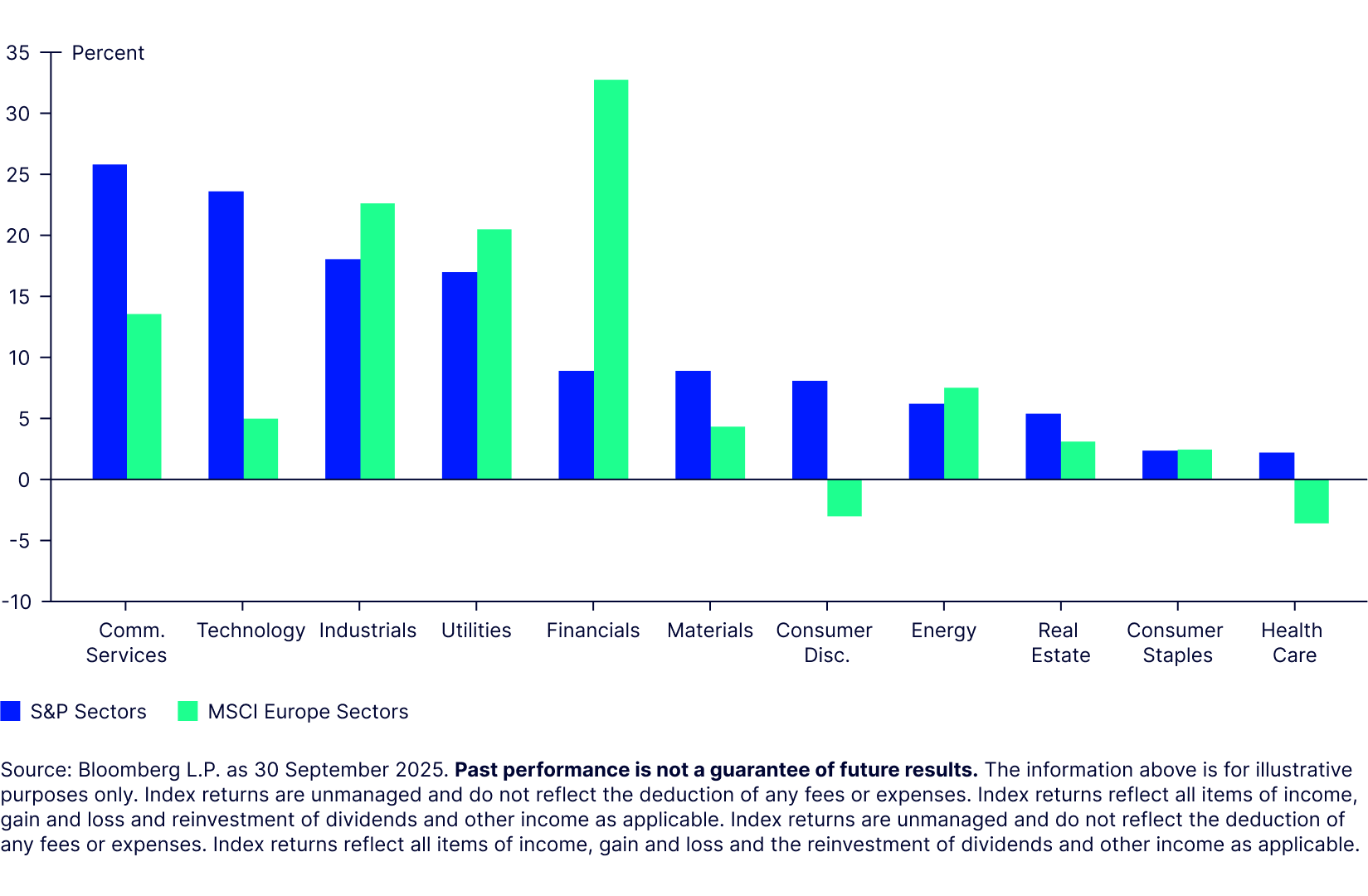

The dispersion of equity performance across regions extends to sectors. Mixed sector leadership continues to define 2025. US tech sectors led in Q3, while European Financials and Industrials showed strength earlier in the year. This dispersion is illustrated in Figure 1 below and highlights, for example, the contrasting performance between US Information Technology (Tech) and Consumer Staples.

One of the most notable trends earlier this year was the performance returns and flows into European equities, not just in the broad equity benchmarks, such as MSCI Europe, but also in sectors, particularly Financials and Industrials. Strong US equity returns in Q2 narrowed the performance gap versus Europe investors focussed on earnings expectations. In Q3, US Tech or tech-adjacent sectors (particularly, Communication Services) led.

Record equity ETF inflows and dynamic sector ETF inflows, shown in part 2, reflect the progress of the equity indices.

Be ready for fourth quarter shocks

Q4 is another quarter where we believe diversification beyond US equities or the IT sector is necessary to contain risks. Investors may need to be ready to pivot.

- US policy change

Volatility remains elevated due to new US policy changes, as demonstrated by threats of sectoral tariffs on pharmaceuticals. Diversification—not divestment—is essential. The US remains a core allocation, with Tech and Health Care offering lower correlation and resilience.

We expect the US to retain its regained exceptional status, but some of the key tailwinds that have historically supported its relative earnings, GDP growth, and, by extension, the high valuations of US assets, could be challenged. The US remains the core allocation for most global investors and there are three US sectors we believe are well positioned for a soft landing. One diversification method is to barbell IT and Health Care which are lowly correlated.

- Tariff uncertainty

The re-emergence of tariff policies at the end of Q3 (particularly sectoral tariffs on pharmaceuticals) has again stirred inflation concerns. Some tariffs were delayed or softened in Q3, and uncertainty over tariff and inflation impact led to both market volatility and defensive positioning. This could continue in Q4.

Amongst our Sectors in Focus, Financials gives a relative domestic haven in the US.

- AI dominance

AI developments continue to dominate investor thinking. Tech earnings forecasts have benefited and Tech has outperformed other S&P 500 sectors throughout the year.

As a result of its sizeable index weight globally, Tech is under intense scrutiny and any weakness in cloud computing, AI investment, or digital advertising could be punished. But we stick with this Sector in Focus in Q4—huge capital deployment in data centres and cloud infrastructure will continue to drive earnings and outweigh those risks.

- Fed’s one direction

Central bank interest rate policy remains the dominant factor in equity performance this quarter—influencing the cost of capital, discount rates for valuing future earnings, and investor risk appetite. The Federal Reserve (Fed)’s decisions of course have global implications beyond the US, especially for emerging markets (EM). State Street Investment Management forecasts (LINK) two further rate cuts this year.

Why so sensitive?

Sectors that have been historically most sensitive to easing rates are:

- Tech—lower rates boost the valuation of companies with high future earnings potential as their discounted cash flows appreciate.

- Real Estate—borrowing to finance properties is cheaper.

- Utilities—the capital-intensive sector benefits from cheaper debt financing.

Does Europe’s diversification story have further to run?

Some of the air has come out of the European equity balloon following the US’s economic bounceback, and the absence of a Ukraine peace dividend—but we still believe infrastructure and defence spending will help improve the GDP growth outlook.

Sectors that are traditionally most sensitive to stronger economic-growth-enhancing rate cuts tend to be cyclical, including:

- Industrials—machinery and logistics demand rises.

- Materials—mining and chemicals demand also increases.

- Energy—rising growth benefits oil and gas operators.

- Consumer Discretionary—benefits from increased High-Street Confidence.

Of these, we prefer Industrials., as it plays to many structural growth themes.

Our other two European Sectors in Focus – Health Care and Technology - are more reliant on international trends, than the macroeconomic case in Europe.

Most of our sector opinions depend on macroeconomic factors but other trends could impact performance. When selecting sectors, investors can draw on two unique resources provided by State Street Investment Management to support their decisions:

- Institutional and investor behaviour from our custody business - flows and holdings for last quarter can be seen below to Institutional and investor behaviour from our custody business - flows and holdings for last quarter can be seen here.

- SPDR’s Sector Momentum Map* which provides a visualisation of price momentum