Global alternatives, local ambition: How SWFs, regulation, and integration are shaping GCC private markets

As the Middle East emerges as a new hub for private markets, sovereign wealth funds, strategic positioning, and regulatory innovation are playing key roles. In this article, we dive into the dynamics that are transforming the region and attracting international investors.

Over the past few years, the private markets landscape in the Middle East has undergone a profound transformation—one that is increasingly shaping the strategies of global managers and influencing the broader dynamics of the private capital ecosystem.

Driven by robust growth fundamentals, a maturing investor base, and the assertive capital deployment of some of the world’s largest sovereign wealth funds (SWFs), the region is steadily emerging as a pivotal geography for private markets. This evolution is underpinned by three main forces:

- Proactive SWFs leveraging their scale and influence to attract both capital and talent from top-tier international GPs—a trend particularly pronounced in Saudi Arabia.

- Strategic geopolitical positioning, which has enabled the UAE to establish itself as a new global financial hub and to develop a dynamic and growing early-stage investment ecosystem.

- Regulatory reforms across local stock markets and the introduction of seeding agreements, which are fostering domestic investment ecosystems, as well as paving the way for future exit opportunities.

This paper explores the forces reshaping private markets in the GCC, examining how sovereign wealth funds, strategic positioning, and regulatory innovation are transforming the region into a critical hub for global private capital.

The role of SWFs negotiating a “local angle”: The case of The Kingdom

With average private market allocations per investor significantly larger than those of European and American counterparts—nearly 50% of GCC investors allocate more than 20% of AUM to private markets1 , compared to 10-12% for European institutions2 —the region has long played a pivotal role in the fundraising strategies of private market General Partners (GPs) globally.

The region’s Sovereign Wealth Funds are among the world’s most active deal-makers: five of them—PIF, Mubadala, ADIA, ADQ, QIA—invested a record $82 billion in 2024 alone3.

This scale, combined with a strategic imperative to diversify away from hydrocarbons, has led to the development of some of the most sophisticated and diversified private markets portfolios globally, spanning both direct and indirect investments.

In fact, collectively, GCC sovereign wealth funds accounted for approximately $40 billion in private equity co-investment capital in the first seven months of 2025. Their total assets under management are projected to double to $8.1 trillion by 2030—a pace of growth that is outstripping even the expansion of their home economies.

Investments by Mubadala, ADIA, ADQ, PIF, and QIA in 2024 3

SWFs Private Equity co-investments, 7M 2025 (vs $45B FY 24) 4

SWFs 2030 AuM 9% 2025-30 CAGR 5

For years, global private markets managers have actively courted these capital-rich institutions. In many cases, GCC SWFs now represent a significant share of total fund commitments of the most reputable international GPs, with prominent representation on limited partner advisory committees. Yet, despite their importance, many international firms have historically opted for a “fly-in, fly-out” approach—managing relationships from London or Paris, or through high-level intermediaries.

That model is now being redefined.

Since late 2022, and more decisively between 2023 and 2025, a fundamental shift has taken place, led by Saudi Arabia and the strategic deployment of capital by the Public Investment Fund (PIF).

As part of its ambitious Vision 2030, the Kingdom has set bold targets: increasing foreign direct investment to 5.7% of GDP, raising the private sector’s contribution from 40% to 65% of GDP, and positioning Saudi Arabia among the world’s top 15 economies by the end of the decade6.

To support these goals, PIF—followed by other regional SWFs—has begun to actively shape local investment ecosystems. This includes converting public assets into private capital opportunities and partnering with leading global private markets investors to simultaneously stimulate private sector growth and attract foreign capital.

Private capital investment, management, and oversight have increasingly flowed into state-owned sectors such as energy and infrastructure, with landmark transactions including the most recent $11 billion Jafurah gas processing facilities sale-and-lease-back transaction led by GIP (part of BlackRock), alongside Hassana Investment Company, The Arab Energy Fund (TAEF), Aberdeen Investcorp Infrastructure Partners and other institutional investors from North and Southeast Asia and the Middle East7.

In addition, more than ten memoranda of understanding signed between 2022 and 2025 have included commitments to establish local offices, hire regional talent, enforce knowledge transfer, and allocate capital directly within the region, particularly in Saudi Arabia8. Notable examples with a private markets angle include those signed with PIF in 2025 by Goldman Sachs Asset Management and Macquarie. Goldman Sachs’ MoU, focused on private credit, targets directly originated senior and junior loans to companies domiciled in the GCC and includes plans to expand GSAM’s local footprint by opening an office in Riyadh9. Macquarie’s MoU centres on Saudi Arabia’s digital infrastructure and energy transition projects and similarly requires the establishment of a regional office in Riyadh, alongside structured knowledge-transfer programs10.

Turning crisis into opportunity: The UAE’s emergence as a global hub

The past six years have been marked by global disruptions—from the COVID-19 pandemic to geopolitical conflicts such as the Russia-Ukraine war and the ongoing Israel-Palestine tensions—that have shaken investor confidence and disrupted capital flows.

Amid this turbulence, the UAE charted a different course.

During the pandemic, Dubai positioned itself as a safe haven for global wealth. Agile government policies, shorter lockdowns, and pragmatic health measures attracted tourists and relocating professionals. What began as a temporary shift became structural: Dubai’s population has grown by more than 21% since 2019, surpassing 4 million, driven by international migration, economic expansion, and visa reforms. In 2025 alone, over 208,000 new residents arrived—a 5.4% annual increase—accelerated by factors such as UK tax reforms11.

This demographic shift fuelled the rise of a local wealth and asset management industry. With a growing population of high-net-worth individuals and institutional investors seeking investment advisory services, family offices were established, and international firms opened regional branches to serve this emerging wealthy client base. Dubai now hosts 72,500 millionaires, 212 centi-millionaires, and 15 billionaires12.

The UAE is following a trajectory similar to Singapore’s rise in the 1990s-where private markets and alternatives, including real estate, infrastructure, venture capital, and digital assets, play a central role.

Family offices/AM-WM firms registered in DIFC

Year-over-year growth in DIFC company registrations (6,920) 2024 vs, 2023

Year-over-year growth in ADGM AuM 2024 vs. 2023

Business metrics underscore this momentum. Between 2019 and 2024, active companies in the Dubai International Financial Centre (DIFC) grew by 25% to 6,920. In 2024 alone, the wealth and asset management sector expanded to over 410 firms, including 75 hedge funds, 48 of which belong to the “billion-dollar club.” DIFC registered 200 new family offices (a 33% YoY increase) and 60 asset and wealth management firms13.

Abu Dhabi Global Market (ADGM) mirrored this trend, recording a 245% surge in Assets Under Management and a 32% rise in operational entities, reaching 2,381 companies in 2024. Today, ADGM hosts 134 asset and fund managers overseeing 166 funds, alongside 79 newly licensed financial institutions14.

The case of venture capital in the UAE

One of the most dynamic developments in the region has been the rapid rise of the UAE’s Venture Capital ecosystem. According to MAGNiTT’s 2024 UAE Venture Capital Investment Report15, the country continued to attract significant inward capital flows despite the global downturn, accounting for 33% of all VC funding in MENA.

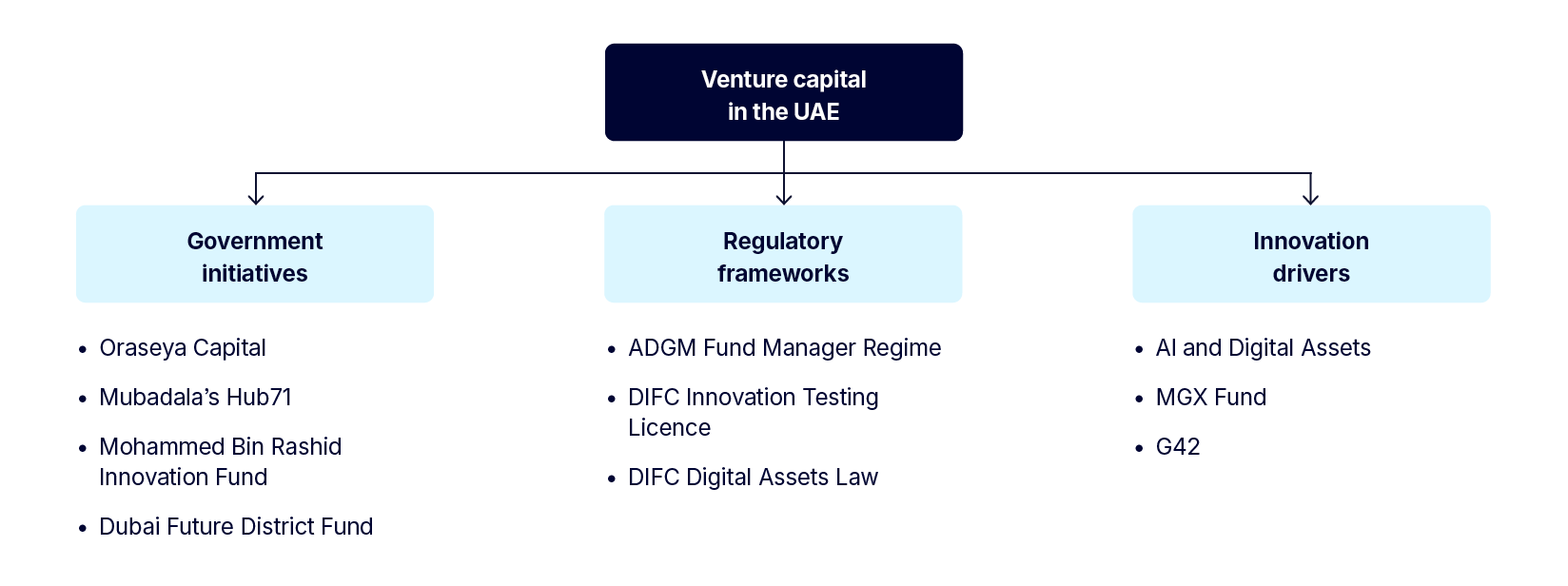

Several factors have fuelled this growth. First, the UAE benefits from a younger investor base compared to Europe or the US, with a higher risk appetite and willingness to back early-stage opportunities. Second, government support has been instrumental, with initiatives such as Oraseya Capital, Mubadala’s Hub71, the Mohammed Bin Rashid Innovation Fund (MBRIF), and the Dubai Future District Fund, complemented by accelerators like the National Founders Program launched in Abu Dhabi in September 2025.

Third, the regulatory environment has evolved to reduce barriers to entry. Both DIFC and ADGM have introduced VC-friendly frameworks, including the ADGM Fund Manager Regime, which enables VC funds and fund-of-funds structures under proportionate regulation, and the DIFC Innovation Testing Licence (ITL), allowing fintech startups to pilot products in a controlled environment with lower upfront costs. Tiered licensing models and clear guidance on digital assets - such as the DIFC Digital Assets Law enacted in 2024-have further enhanced market accessibility.

Finally, the UAE has positioned itself at the forefront of AI and digital asset innovation. A notable example is the launch of MGX Fund Management Limited, a platform focused on AI technologies and startups, backed by US tech and investment giants, alongside G42’s leadership in AI development, which includes major partnerships such as Microsoft’s investment.

Despite global VC contraction in 2023–2024, the UAE demonstrated resilience: deal volume increased 9% year-on-year in 202416, even as total funding dipped slightly, underscoring the strength and momentum of its emerging venture capital hub.

The role of regulatory reforms

A supportive regulatory environment is as critical to the establishment of local private capital ecosystems as it is to their long-term growth. The forward-looking frameworks introduced by DIFC and ADGM have laid the foundation for highly attractive hubs, enabling fund managers and investors to operate under globally recognized standards. However, building a thriving private markets ecosystem requires more than early-stage support—it also demands robust exit pathways. For global investors to commit significant capital, they need confidence that local markets can provide liquidity and transparent pricing.

This is where recent stock market reforms across the GCC play a transformative role. Saudi Arabia’s Tadawul has led the way, introducing measures to deepen liquidity, streamline IPO processes, and attract foreign participation17. Similar initiatives in the UAE, such as enhanced listing rules and the push for dual-class share structures, aim to make public markets more accessible for high-growth companies. These reforms are not only creating viable exit routes for startups and private equity-backed businesses but are also signalling a commitment to global best practices—an essential ingredient for attracting institutional capital at scale.

As these regulatory enhancements converge with strong sovereign backing and a maturing investor base, the GCC is positioning itself as a region where private capital can thrive from inception to exit, reinforcing its ambition to become a global hub for alternative investments.

Opportunity and challenges ahead for the GCC

The Middle East has rewritten its private markets narrative, transforming from a capital-rich outlier into a fast-emerging global hub. Sovereign Wealth Funds have acted as catalysts, regulatory frameworks have matured, and demographic shifts have fuelled demand for sophisticated investment solutions. Yet, beneath this momentum lie structural questions that will define the next chapter.

Can the region bridge the gap between mega-infrastructure deals and the missing middle—growth capital and mid-market buyouts, where incentives remain scarce? Will trust and transparency overcome the lingering shadow of Abraaj, restoring confidence among global fund-of-funds and institutional investors? And can Abu Dhabi convert ambition into reality by building a true private credit hub, overcoming cultural barriers and scaling origination capacity?

The answers will determine whether today’s surge becomes a sustainable ecosystem. For now, one thing is clear: the GCC stands at an inflection point—where opportunity and challenge converge, and where bold decisions will shape the future of private capital in the region.

Questions? Email Benedetta Balducci, Managing Director, Head of Private Markets EMEA and APAC.