What to Know about an EM Ex China Allocation

At the beginning of 2023, institutional investor allocations to emerging market equity strategies were over $1.2 Trillion in AUM1, underscoring that a large number of global market participants may be seeking to understand their implicit exposure to China—especially given China’s political sensitivities with international governments; youth unemployment; weakening exports; and slowing economic growth that has prompted easing from the People’s Bank of China.

Investors’ concerns are not misguided; China continues to play a commanding role in emerging markets (EM) benchmarks (Figures 1 and 2). China’s nearly 30% weight in the MSCI EM Index is more than double that of the next-largest country weight and more than double the EM EMEA and EM Latin America regions.2

Client interest in managing China risks by separating China from a broader EM allocation cuts across various client types and has been top of mind for institutional clients with a wide range of goals and preferences (see: Why It’s Time for China Equity to Go Solo). In this piece, we explore the implications of a standalone China plus EM Ex China allocation. Our aim is to educate clients on the potential impacts of these strategies to their broader portfolios.

Concentration Considerations

While an EM Ex China allocation removes China’s country weight, it is worth considering how the remaining weights are impacted, and how the sector and country concentrations in EM Ex China may differ from the full EM index.

Figure 3 shows how the country weights may play out in an EM Ex China portfolio. The combined weight of Taiwan, India, and Korea significantly increases from 43% in EM to 61% when looking at EM ex China. Despite the removal of China, Asia remains the highest regional exposure at nearly 70% of the index.

Figure 4 exhibits sector weight changes. We note the roughly 50% decrease in Consumer Discretionary from 13.2% in EM to 6.7% in EM ex-China. The Information Technology concentration increased from 21.17% to 27.48%, which is a surprise to many. Coupled with the 2% increase in Financials, IT and Financials account for over 50% of the MSCI EM Ex China Index.

The increase in IT weight is partly due to the large and important semiconductor industry in Taiwan and South Korea. We note that Taiwanese and South Korean companies have been given exemptions on curbing operations in China, but the export risks tied to China as a global trading partner still loom for those nations and others. At bottom, investors need to make sure to take sector and country dynamics into account, as an EM Ex China allocation will still include certain country/sector overweights/underweights, and may still require a dedication to China in the risk budget.

Performance Considerations

Returns

Over the last decade, the differences in returns3 of MSCI China and MSCI EM ex-China have approached 50% in some periods (Figure 5). This illustrates the meaningful impact that China can have on returns and the importance of remaining nimble in holding or selling Chinese stocks. Investors wanting to express a view on the direction of Chinese equity markets may be well served by ensuring that they have the flexibility to add or reduce exposure.

Diversification

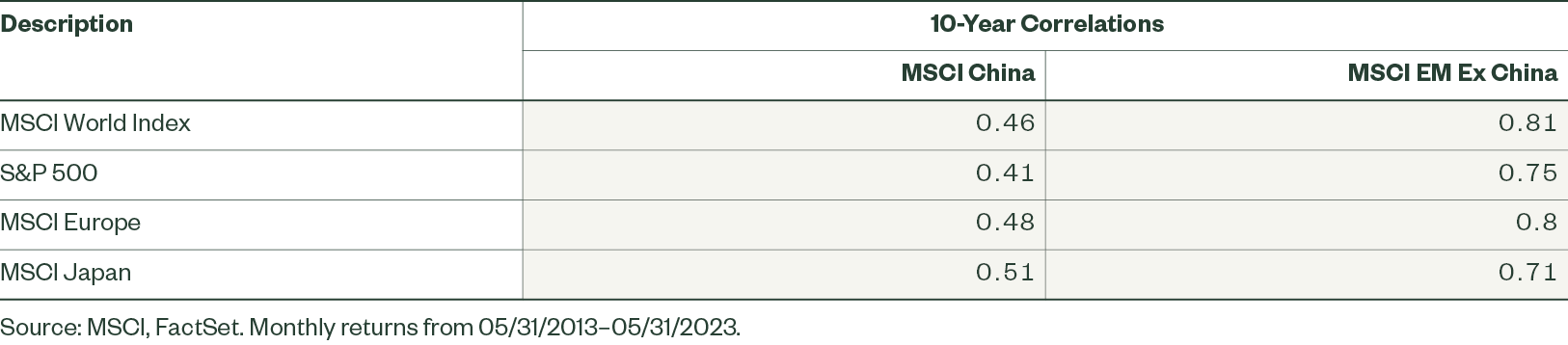

A standalone China allocation tends to be more diversifying to global developed markets than EM Ex China—another potential argument for maintaining exposure to China (Figure 6). This is partly because in EM Ex China, there are more countries that diversify against each other, and reduce the singular characteristics of each region, and as a group tend to be more sensitive to global growth prospects. By contrast, China has idiosyncrasies that can be diversifying on a grand scale.

Figure 6: A Standalone China Allocation May Be More Diversifying to Global DM

Keeping China in Play

As investors consider separating their EM and China allocations, it is important for them to keep in mind the diversification benefits from holding China and the potential opportunities from shifts in Chinese equity fundamentals.

Conclusion

One common client inquiry is whether a standalone China allocation, alongside an EM Ex China allocation, is a sound option. We believe that it makes sense to consider this strategy, as it can help clients contend with some of the offshoots of China’s rising share of the EM benchmark, such as:

- Managing country and sector concentration risk

- Re-allocating China index exposure to active management

- Expressing a China or EM Ex China view while maintaining liquidity

- Getting a better handle on China in the risk budget

However, it is important for investors to take a close look at the concentration risks and tracking error effects of separating China into a standalone allocation or fully divesting from China.