Diversification: A Key to Consistency

As market concentration is on the rise, diversification provides investors a critical tool to mitigate concentration risk and to generate more consistent returns.

Market concentration has been on the rise since the 2010s in most equity markets, and has accelerated in recent years. The Systematic Equity-Active1 team believes that diversification is a critical factor for investors to not only combat concentration risk, but to also generate more consistent performance in portfolios. Our approach centers around building broadly diversified portfolios. This allows us to capture exposure to the themes we believe drive equity markets over the long term, but minimizes concentration to individual stocks or segments with the market.

2023: A Wild Ride

While the first few months of 2023 have been unusual to put it mildly, there is an air of familiarity about the market conditions we find ourselves in currently. The year began in January with a strong reversal — characterized by a rally in higher risk, lower quality, and more speculative names. February soon followed with a shift to a more realistic assessment of the market environment, as stubborn inflation, coupled with stronger-than-expected labor markets, led investors to rethink the outlook in the face of higher rates for longer. Fast forward to March, two US regional banks, with over $100 billion in deposits, collapsed in the first two weeks, closely followed by the demise of the venerable Swiss bank Credit Suisse.. While the month of April, by comparison, was fairly uneventful, the first four months of the year represent an atypical period from most perspectives. However, there is one distinct characteristic that is reminiscent of just a few years ago — the tight concentration of market performance attributed to a small circle of names.

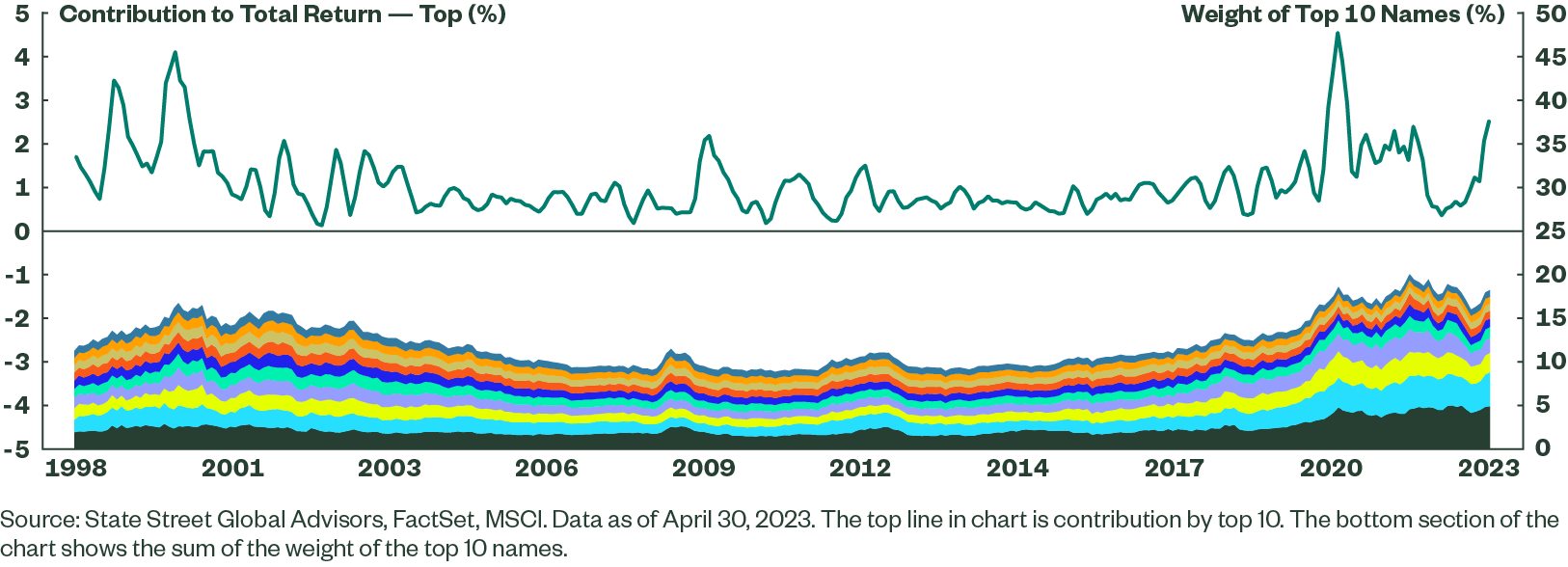

Year-to-date, the top 10 names in the MSCI World Index have contributed over half the 9.62% total return of the Index. For perspective, the contribution from the top 10 names have the second highest contribution since 2000, with the highest concentration occurring in 2020 (see Figure 1). In 2020, a wash of liquidity unleashed by central banks and governments globally inflated a bubble in expensive growth stocks, which, according to the prevalent narrative, were going to be beneficiaries of the pandemic response (probably into perpetuity). However, that narrative turned, as they usually do, and this time it was when inflation started to raise its head and the bubble started to unwind in 2022.

Figure 1: Contribution to Total Market Return from Top 10 Names

Concentrated investment approaches are less than optimal in volatile market environments. Specifically, when herding behavior is high and only a few names are driving the majority of market performance, concentrated portfolios misaligned with that primal theme can be left behind from a performance perspective.

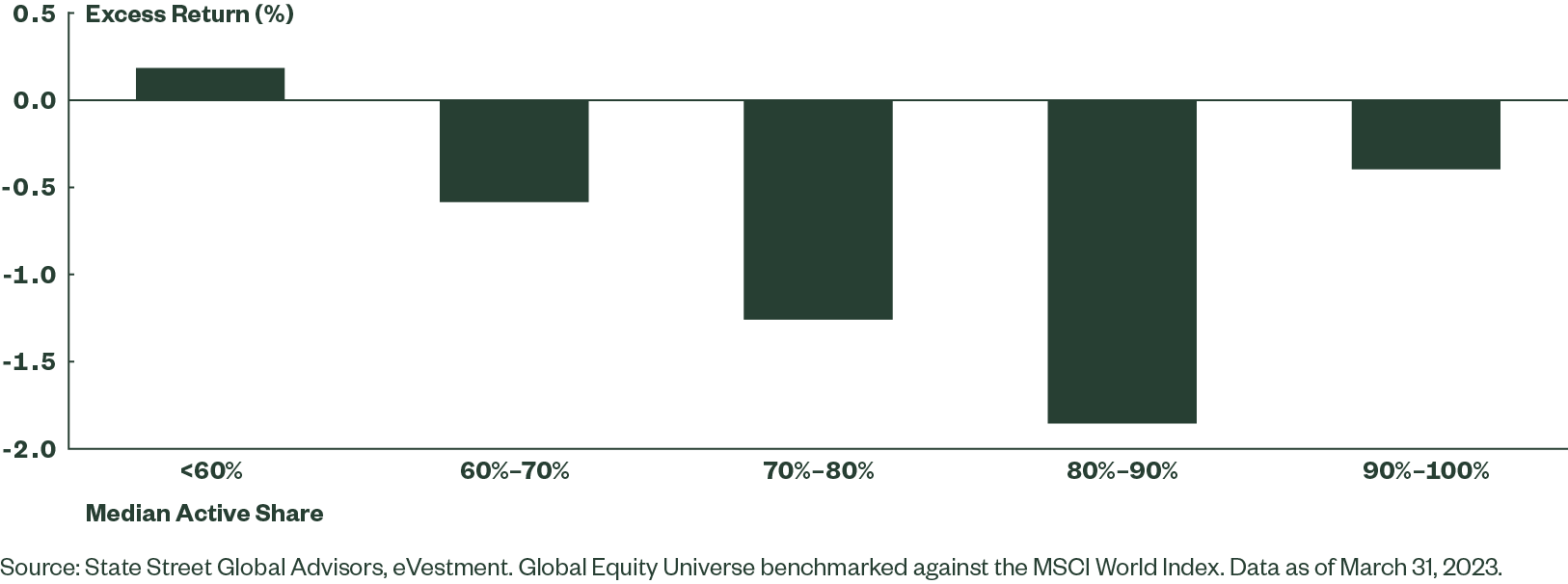

To further illustrate this relationship we evaluated the success of active managers in the first quarter of the this year grouped by portfolio concentration (active share). The empirical evidence supports our belief: namely, as one broadly moves up the active share spectrum, the more challenging a concentrated market environment is for the majority of active managers to generate outperformance (see Figure 2).

If an investor, either through luck or judgement, does happen to catch the wave perfectly, with a

highly concentrated portfolio focused on that consensus trade, then returns can potentially be spectacular. However, the reversal can be equally brutal should the market tide turn.

Figure 2: Global Managers’ Q1 2023 Excess Returns

The Bottom Line

In sum, it is our philosophy that diversification is a key to consistency in portfolio performance. We build portfolios diversified by number of stocks, by sectors and countries, and by the drivers of return we seek to capture. We aim to be compensated for the risk we take, and to balance the risk and return trade-off. Our approach includes taking active bets to gain exposure our alpha factors, yet at the same time, we are focused on minimizing idiosyncratic, or stock-specific risk — factors which we have less confidence in predicting. The result is a well-diversified, balanced portfolio with as few “unknown unknowns” as possible.