How Home Bias Can Undermine Diversification

Diversification of risk is a foundational approach to portfolio construction. Yet many investors show a significant preference for overweighting equities from their own countries. Why does this “home bias” persist and what are its effects on a diversified portfolio?

In principle, an investor’s equity portfolio should hold a broad range of equities, diversified across countries. In practice, however, we see a significant and persistent preference for domestic securities in our clients’ portfolios.

This “home bias” may lead investors to forego important diversification benefits. When the investment climate is volatile, a heavy tilt towards a single country can prove costly if sentiment shifts quickly against the entrenched position.

The significant nature of home bias can be illustrated using the example of UK pension funds. In 2021 these funds held nearly 36% of their equity portfolio in domestic stocks, which then represented about 4% of the free-float market capitalization of the MSCI World index. This bias is also apparent outside of the UK. Although the proportion of equities invested outside the domestic market varies considerably by country, an overarching home bias persists, with domestic exposure currently representing around 38% of the average plan’s equity portfolio.

Figure 1 shows the average strategic asset allocation of the top three pension markets in Europe i.e., the UK, Netherlands and Switzerland.

And although the evidence is that the home bias has come down over the years, it is still significant. A simple two-country example, focused again on the UK, makes the puzzle clear.

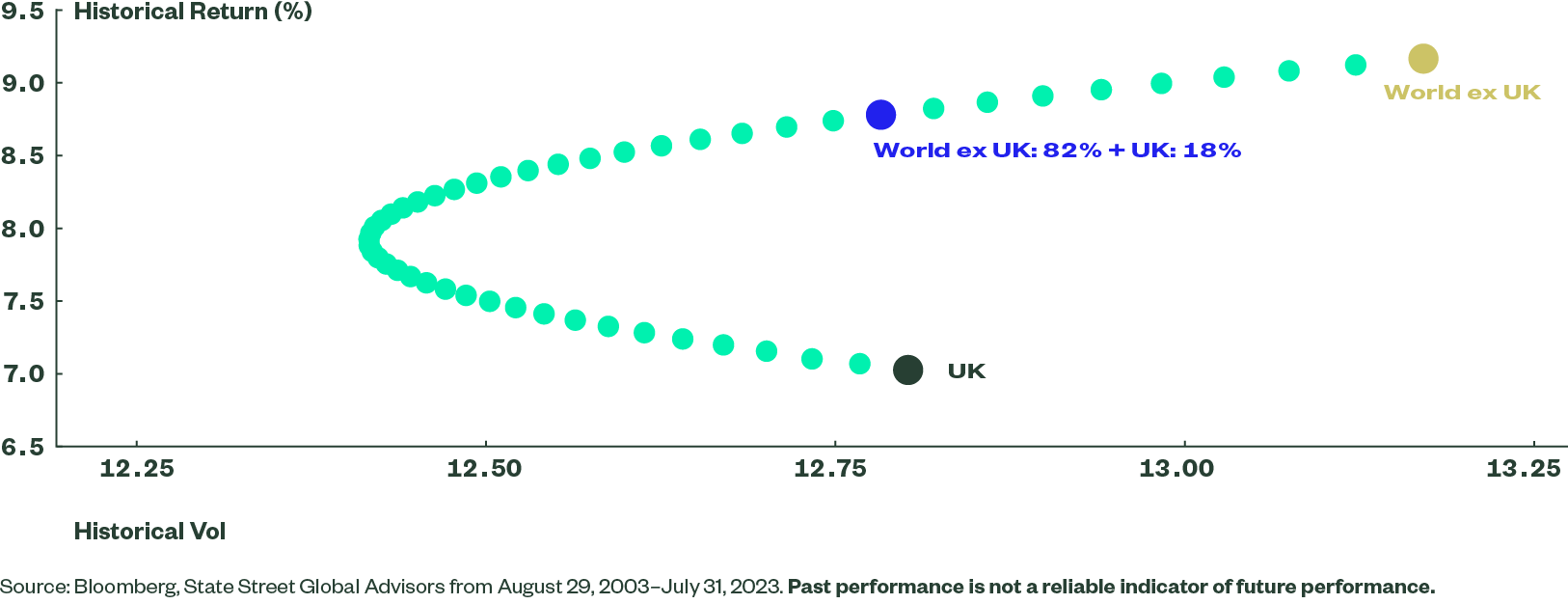

Figure 2 shows the historical risk and return of a portfolio consisting of two assets in various proportions: The FTSE 100 and the FTSE World ex-UK Indices. The worst return comes from a 100% UK portfolio. On the other hand, a 18% UK/82% non-UK equity portfolio has similar risk to this UK-only portfolio, but would have returned 1.8% more (8.8% relative to 7.0%) over the 20-year period.

Figure 2: Efficient Frontier UK Versus Non-UK Portfolio

Our illustration shows that when UK investors choose their local market only, they invest in a portfolio on the lower (inefficient) half of the mean-variance frontier and the size of the inefficiency is meaningful. While mean-variance optimization using ex-post returns and volatility has limitations, it still showcases the efficiency of diversification in terms of risk and return.

Historically, the UK and generally Eurozone equity returns have lagged those of global equity indexes. In fact, those stock markets have underperformed the global market index over the last 5-, 10- and 20-year periods ending July 30, 2023. While the Swiss Market Index (SMI) outperformed the broader market over the 20-year period, it lagged the global market index in the most recent 10-year period, underscoring the need for a diversified global positioning.

Figure 3: Performance

| FTSE 100 Index | MSCI World Index (GBP) | Switzerland SMI Index | MSCI World Index (CHF) | MSCI EMU Index | MSCI World Index (EUR) | |

| 1Y (%) | 7.8% | 7.9% | 4.7% | 3.8% | 18.8% | 5.5% |

| 3Y (%) | 13.3% | 12.9% | 7.3% | 10.4% | 13.7% | 14.8% |

| 5Y (%) | 3.8% | 10.1% | 7.5% | 6.8% | 6.5% | 11.0% |

| 10Y (%) | 5.5% | 11.7% | 7.1% | 9.1% | 8.3% | 11.9% |

| 20Y (%) | 7.0% | 10.2% | 7.2% | 6.5% | 7.1% | 9.1% |

| 20Y Volatility (%) | 12.8% | 12.8% | 12.4% | 14.8% | 16.4% | 13.1% |

| 20Y Risk/Return | 0.55 | 0.80 | 0.58 | 0.44 | 0.43 | 0.70 |

| Max Drawdown (%) | -39.8% | -32.6% | -48.3% | -53.8% | -55.7% | -48.5% |

Source: FactSet, State Street Global Advisors. Gross index returns in GBP, CHF & EUR for the period August 31, 2003 to July 31, 2023. Past performance is not a reliable indicator of future performance.

Why Does the Equity Home Bias Exist?

For many investors, the home bias may have historically stemmed from the perception that investing in foreign securities was challenging because of structural features such as lack of custody accounts or convertibility of currency. Over a period of decades, however, many countries have liberalized their financial markets, resulting in improved market accessibility.

Indeed, indices such as the MSCI All Country World Index (ACWI) are designed to reflect the investment experience of international institutional investors. As a result, they tend to include and give relatively higher weights to those countries and their stocks that offer better liquidity and accessibility.

Another explanation for the home bias is transaction costs, including banking commissions and variable fees, as well as exchange rate transaction costs. As a result, actual realized returns can differ depending on the investor’s domicile, affecting both expected returns and risk.

In addition, investors may choose to deviate from the market portfolio as a result of information asymmetries. That is, risk-averse investors prefer the stocks about which they can easily access better information — these are typically domestic stocks — because they perceive them as less likely to deliver negative surprises.

Lastly, a very popular potential explanation for the home bias is behavioral quirks. Investors think of foreign stocks as riskier than they really are, resulting in an economically irrational preference for local shares, regardless of their financial characteristics.

Reasons to Diversify — Key Risk Metrics

Our research suggests that greater international diversification could have helped reduce risk from portfolios biased towards domestic stocks, over both the short and long term.

Home Bias and a Slowing Local Economy

Because many of today’s larger companies listed on local stock exchanges have global sales and suppliers, some might argue that there is little benefit to diversifying stocks by geography. And while it is true that many companies have more globally diversified businesses now than say 30 years ago, the risk diversification from foreign earnings that they offer is still limited, particularly in the eurozone, where close to 46% of revenues are still derived from the region.

Consequently, in these regions, domestic equities are a poor hedge against one of the biggest hazards to wealth — the loss of revenue due to a faltering economy. The following charts show the relationship between stock market returns and GDP growth. Although we are not suggesting a perfect match between the two variables, stock price movements seem to precede developments in the underlying economy.

In addition, country equity markets can be highly concentrated in a few companies which then pose significant stock-specific risk. For example, the FTSE 100 Index, which is designed to capture the 100 largest UK stocks by market capitalization, currently has the largest five, representing 33% of the index weight.

Given its concentration, an investment into the FTSE 100 is effectively invested into 30 stocks. The picture is even more dramatic for Swiss investors. The MSCI World, by contrast, contains 1,512 constituents and its five largest companies comprise 15% of the weight of the index, with over 130 effective securities.

Figure 6: Home Bias Introduces Company- Specific Risk

| Number of Securities | Weight of top 5 Sec (%) | Effective No. of Securities | |

| FTSE 100 Index | 100 | 33% | 30 |

| MSCI Switzerland | 44 | 57% | 11 |

| MSCI EMU | 228 | 18% | 73 |

| MSCI World Index | 1512 | 15% | 133 |

Source: FactSet, State Street Global Advisors, as of July 31, 2023.

The Globalization Argument and Sector Biases

Some may argue that with globalization, regional equity markets have converged and seen their correlations rise in recent decades, reducing the benefit of diversification. But individual domestic markets have nonetheless continued to display significant regional variance (Figure 7) given their different sector footprints and exposures to varying local fundamentals.

A domestic bias can also lead to significant sector tilts vs. the MSCI World. For example, a bias to the UK market will provide an overweight to consumer staples and energy and a large underweight to technology. These differences in sector exposures can leave investors with unintended risks.

Figure 8: Sector Tilt vs. MSCI World Index

| UK - FTSE 100 | MSCI Switzerland | Eurozone - MSCI EMU | |

| Communication Services | -4.3 | -6.2 | -3.1 |

| Consumer Discretionary | -3.9 | -4.8 | 6.4 |

| Consumer Staples | 10.6 | 15.6 | 0.5 |

| Energy | 7.5 | -4.7 | -0.3 |

| Financials | 3.7 | 0.8 | 2.4 |

| Health Care | -0.5 | 22.5 | -4.5 |

| Industrials | 1.4 | -1.9 | 5.0 |

| Information Technology | -21.1 | -21.0 | -10.3 |

| Materials | 6.7 | 4.0 | 2.1 |

| Real Estate | -1.3 | -1.9 | -1.5 |

| Utilities | 1.1 | -2.5 | 3.2 |

Source: FactSet, State Street Global Advisors, as of July 31, 2023.

Risks: A Diversified Market Exposure Introduces Additional Currency Risk

Global currency exposure is a by-product of investing in global equities; it impacts investor return and introduces additional risk. For example, buying the MSCI World Index includes exposure to an equity market capitalization-weighted basket of developed currencies versus your home (or base) currency. Figure 9 highlights the return impact for a UK unhedged investor: between 2001 and 2007, nearly half the gain on foreign equities — represented by the MSCI World ex-UK — was reversed by currency.

Since the Global Financial Crisis, however, leaving sterling unhedged added some value for a UK investor in overseas equities, which was boosted after the Brexit referendum and the UK’s subsequent exit from the European Union. Although leaving currency unhedged has worked recently for UK overseas equity investors, such moves can reverse sharply and the brutality of a potential reversal should be weighed up against the cost of hedging. For a UK investor, hedging costs versus the US dollar have been around 15 basis points (bps) per year in the last 10 years, while investors were paid to hedge their exposure if we consider the data since December 2001. This trend is likely to re-emerge with the currently high inflation in the UK leading the foreign currency markets to price a positive cost of carry for sterling versus the US dollar over the next decade. If markets are correct, then the UK investors might be paid to hedge net of transaction costs and management fees.

Conclusion

Diversification of risk is central to practical investing, but the evidence is that people over-invest in domestic stocks relative to globally diversified market capitalization indices. While several pension plans have already adopted a more global approach in their equity asset allocation, we believe many others should reconsider their approach. Otherwise, investors may be missing out on international equity income and growth opportunities, not to mention the potential diversification of both growth and risks compared to local based holdings.

Although international investments can present a unique set of risks — particularly currency risk — that investors should consider carefully, adding foreign exposure can allow investors to take advantage of growth potential outside their domestic economy. Indeed, we believe that over time, returns are driven by fundamentals in each economy.

As a result, it is far better to be exposed to a global index rather than being over-exposed to one market. A global portfolio typically performs better than the worst-hit individual markets, highlighting both the risk, and missed opportunity, of not diversifying internationally.