Macroeconomic and Geopolitical Outlook 2024 Geopolitical Risks Intensify as Inflation Angst Recedes

Disinflationary trends and decelerating growth support a soft economic landing. Central banks’ hawkish stance and geopolitical conflicts pose viable threats to that outcome.

Simona Mocuta explains why an economic soft landing is still the most likely outcome in 2024.

Global markets experienced a variety of surprises and shocks in 2023, including elevated inflation, muted growth, an abrupt banking crisis, and the continuation of the sharpest monetary policy tightening in decades. Looking at 2024, we anticipate uncertainty to persist, with sub-trend growth projected across the world's economies. While the path to a soft landing appears viable, with growth decelerating but not collapsing, the effects of monetary policy tightening are still working their way through the system. In addition, escalating geopolitical tensions and ongoing macroeconomic headwinds will continue to test economies. 2024 will likely be a year in flux with many factors pressuring the path to global recovery.

We expect 2024 to be a time of “Positioning the Pieces,” as we weigh multiple factors within the macroeconomic environment to assess how they converge in order to refine our outlook and portfolio views. We see fixed income as a bright spot for investors in 2024 given current yield levels, slowing growth, and continued disinflation. Amid heightened volatility and global fragility, we remain cautious on risk assets and favor quality stocks in equity markets. We believe emerging markets will remain vulnerable given the global landscape, but do see pockets of opportunity within emerging market debt and select emerging market equities.

In such challenging markets, it is critical to strike the appropriate balance, get portfolio implementation right, and retain flexibility to respond as clearer signals develop. We explore these themes and more in our latest Global Market Outlook.

2024 Global Economic Outlook

Over the course of 2023, global economies have exhibited surprising resilience in the face of the sharpest tightening cycle experienced in decades. Despite this impressive degree of strength in the global economy, and in the United States in particular, growth is nonetheless slowing (see Figure 1). Resilience has largely exhausted itself. Global trade volumes are outright contracting, and global industrial production is essentially flat on a year-over-year basis (see Figure 2). Services demand has held up much better as post-pandemic pent-up demand was satisfied with a lag, but there are signs of plateauing. Resilience does not equal immunity, especially when it is derived from unsustainable fiscal spending.

Disinflation Endures

Disinflation has been our highest conviction view over the past year and the incoming data bears witness to it being fulfilled. Despite intense anxiety over stubborn inflation, disinflation actually deepened and broadened over the course of 2023. Recent updates, for instance, have shown an impressive retreat in eurozone inflation. In the United Kingdom, inflation levels that inched lower a few months ago have declined more meaningfully. Disinflation will not run forever, but it is not over yet. Supply chain normalization and moderating demand speak to further price moderation in spite of the recent volatility in energy costs. There is a risk that a much larger spike could ensue either because hostilities in the Middle East widen or due to sabotage or other unforeseen events. In our view, unless oil prices stay above $110 for an extended period of time (i.e. three months or more), the disinflationary forces already in motion should overwhelm their inflationary impulse.

Remarkably, the disinflation over the past year has come without much visible damage to the labor market. The outcome reflects the unusually strong starting point for labor markets across most developed economies. What was a hope a year ago has turned into reality: Central banks, in their rate-hiking anti-inflation fight, have managed to restrict increased job openings without eradicating any jobs. That said, the ground becomes shakier from here. Job openings have indeed been declining and the “margin of safety” is rapidly thinning. The time has now come for central banks to end the tightening cycle and allow prior hikes to filter through the economy. In the United States specifically, where the disinflation process is more advanced and where shelter inflation is bound to meaningfully moderate in coming months, we believe the Federal Reserve Board (Fed) should deliver not just the 50 basis points’ worth of 2024 rate cuts envisioned in the September dot plot, but at least double that figure. Absent such a calibration lower, there is a high likelihood that the soft landing morphs into something harder.

While we are confident about our assessment of the economic trajectory, making forecasts about the future is always challenging. This is particularly the case when the geopolitical outlook becomes more turbulent, with the recent spike in oil prices reflective of that. And as we face 2024, increasingly volatile geopolitical conditions will warrant investors’ attention.

Geopolitical Outlook: Caution, 2024 Coming!

Coming into 2023, we held a relatively sanguine outlook in terms of geopolitics. We did not anticipate large market impacts following the Russian invasion of Ukraine in 2022 and an escalation in US-Chinese sanctions. Looking ahead into 2024, however, we consider that the coming year is fraught with potential fracture points, particularly around territorial conflicts and geopolitically critical elections. In total, we consider they pose enough risk to be more inflationary, thereby derailing the disinflation trajectory, and disrupting terms of trade for large economies. In short, geopolitical events could deliver smaller stagflationary impulses.

Armed conflicts and violence are rising rapidly. Disturbingly, this trend also applies to the sheer number of global conflicts, and they are becoming deadlier — Figure 3 confirms conflicts hovering near all-time highs. The breakdown also shows the recent rise in internationalized intrastate conflicts — i.e., how civil wars are increasingly fought as proxy wars, such as in Syria or Yemen. This reflects an increasingly multipolar, unstable world, which suggests that interstate warfare is easier to imagine than in the past. Harder to capture is that these conflicts have gradually moved from the periphery toward the center of the global economy. Most notably, Russia’s war in Ukraine delivered a global macroeconomic shock via the commodity supply channel.

Geopolitical Fracturing and Energy Markets

Focusing on possible outbreaks of war underestimates the risks to energy markets. The geopolitical fracturing of the global system means that all large energy producers have oil policy interwoven with other foreign policy objectives. In other words, there are more variables factoring into oil prices than in the past, and therefore also more sources of risk premia. In practice, this dynamic has made OPEC+1 supply less elastic than pre-2020. That US energy production has also become more inelastic — even if for different reasons — suggests that energy prices are asymmetrically tilted upwards.

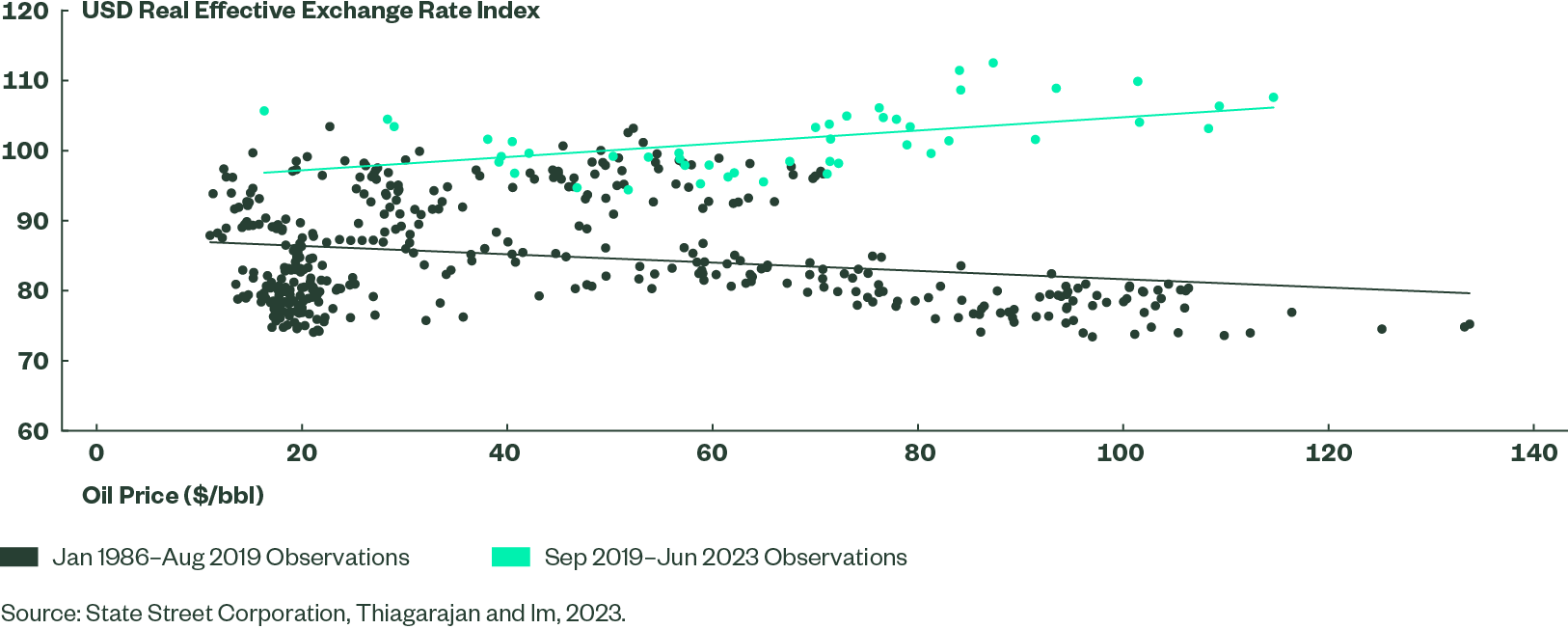

The United States has ceased being a net consumer and has emerged as a net energy exporter. This shift has flipped the historically modest negative correlation between the US dollar and oil (see Figure 4). The US dollar and oil correlation makes it worse for all importers (and better for exporters) as each boom/bust cycle is exacerbated. Relying on more recent data, the positive correlation is even more pronounced. This relationship has geopolitical implications, as it further increases the incentives for swing oil producers (namely key Gulf Cooperation Council (GCC) states) to underpin tight supply. The US’s relationship with the Gulf states has had implications in global oil supply. The marginal supply is in fewer places that are less likely to deliver it, thus resulting in an asymmetric risk for prices to spike if demand holds up. Lower oil prices, therefore, require more pronounced demand drops, particularly in the two largest consumer economies, the US and China.

Figure 4: Correlation Between US Dollar and Oil Prices (1986–2023)

A Riskier Horizon Ahead?

The United States and China are also the two main geopolitical poles where the 2023 détente could give way to more market-impactful tensions. The wars in Europe and the Middle East show how much tighter the respective geopolitical blocs are operating, namely G7 unity on extensive Russia sanctions, and Russia-China-Iran message coordination during the Israel-Hamas war. Hence, global fracturing in any remote place now has a transmission mechanism to global politics, in an echo of the Cold War. In this respect, we can identify several events on the horizon that pose risks to the status quo and could provoke disruption. Firstly, the war in Ukraine could engender the beginnings of a diplomatic process. While this holds promise for stabilizing the conflict, it also carries risks for further frictions. In particular, EU-China relations are highly sensitive to Beijing’s role in any potential peace process.

Secondly, the election calendar across the globe in 2024 is unfriendly. January’s presidential election in Taiwan only carries downside risk. A variety of triggers could lead to deterioration in the status quo (e.g., big shifts in Taiwanese public opinion, miscommunication by any new administration, etc.). Taiwan’s centrality in the global economy as the dominant producer of semiconductors means changes in perceptions of regional security alone could impact global risk positioning in financial markets. And lastly, the US elections in November offer another canvas for geopolitical turmoil. Highly polarized electorates like in the US mean that external powers have outsized influence on election outcomes. This can invite foreign policy adventurism in the hope of tilting the election in one direction.

The above is a non-exhaustive list, but the financial expression should be higher average cross-asset volatility over the coming year. In particular, the past summer lulls in foreign exchange (FX), equity, and oil price volatility are not likely to return (see Figure 5). Meanwhile, bond volatility trends lower on reduced inflation uncertainty and safe haven buying due to geopolitical concerns.

The Bottom Line

Investors plotting a path through the coming year must do so amid sub-trend economic growth, a volatile geopolitical backdrop, and worries about the ability of central banks to manage the transition from a monetary policy built to bring down inflation to one that limits the recession risks. Our base case is that central banks will move more quickly to lower policy rates than markets are anticipating, particularly in the United States, but downside risks remain. The shifting geopolitical landscape also warrants close monitoring given the uncertainty around international/trade relations, the potential for violent conflicts to begin and/or escalate, and the ability of elections to reshape political rhetoric.