Focusing on the Fundamentals

While recent market concentration has in part been driven by earnings, we caution against relying too much on one factor, and believe a multi-faceted approach to investing should yield benefits over the long term.

In our previous monthly note we discussed the extreme concentration in developed markets this year, as evidenced by the top 10 names in the MSCI World Index driving almost 40% of the benchmark return. This concentration has continued to intensify over the course of 2023; year-to-date through the end of May, these top 10 stocks now account for more than 70% of the index returns. These top 10 names are concentrated in technology, and technology-enabled media and consumer sectors, further limiting the breadth of this rally. The Systematic Equity- Active1 team has been analyzing these trends to better understand what is driving this notable herding of investors into a very few names.

Focus on (All) the Fundamentals, not Just the Narrative

To better understand this trend, we start with a close look at fundamentals, and earnings in particular. The narrative since the beginning of the pandemic period has been that these stocks have strong and resilient earnings profiles that should be rewarded. The story has shifted gears again into an Artificial Intelligence-driven frenzy that speculators suggest will further support earnings growth far in excess of the rest of the market.

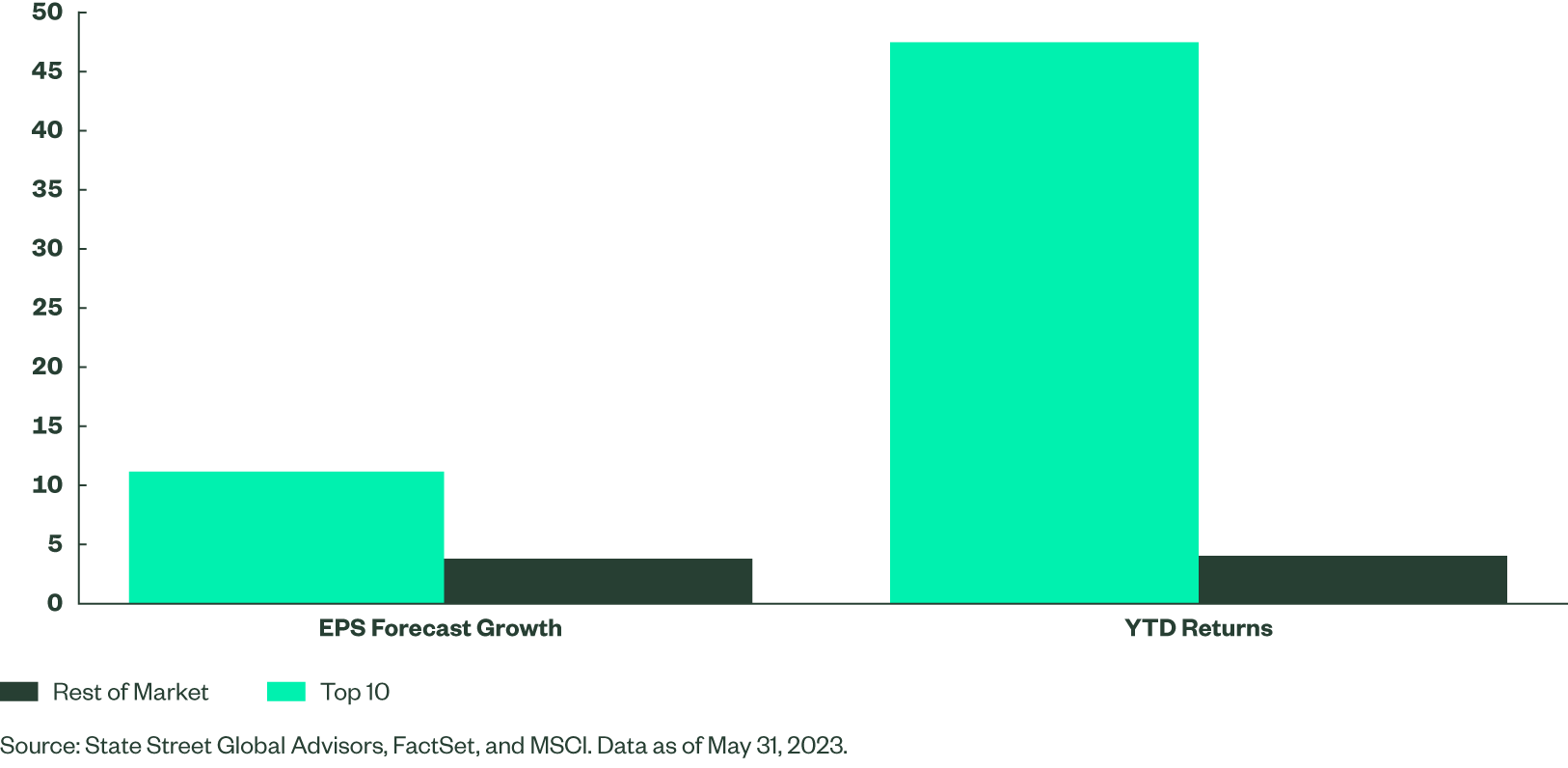

We analyzed consensus earnings forecasts for all stocks in the MSCI World Index for the twelve month period as of the end of May and compared them to the beginning of the year. What we found was that earnings estimates for the top 10 names have increased by 15% on average year-to-date in 2023, compared to only a 6% increase for the rest of the market. (See Figure 1.) We note, however, that even within the largest names, there is considerable variation in the expected earnings growth. While the returns differential may in part be attributable to this superior expected growth, the magnitude of the outperformance of these largest stocks is still notably stark compared to the other 1,500 names in the index where, on average, returns have kept pace with changes in earnings expectations.

Figure 1 EPS Forecast Growth and YTD Returns for Top 10 Names Compared to the Rest of the Market

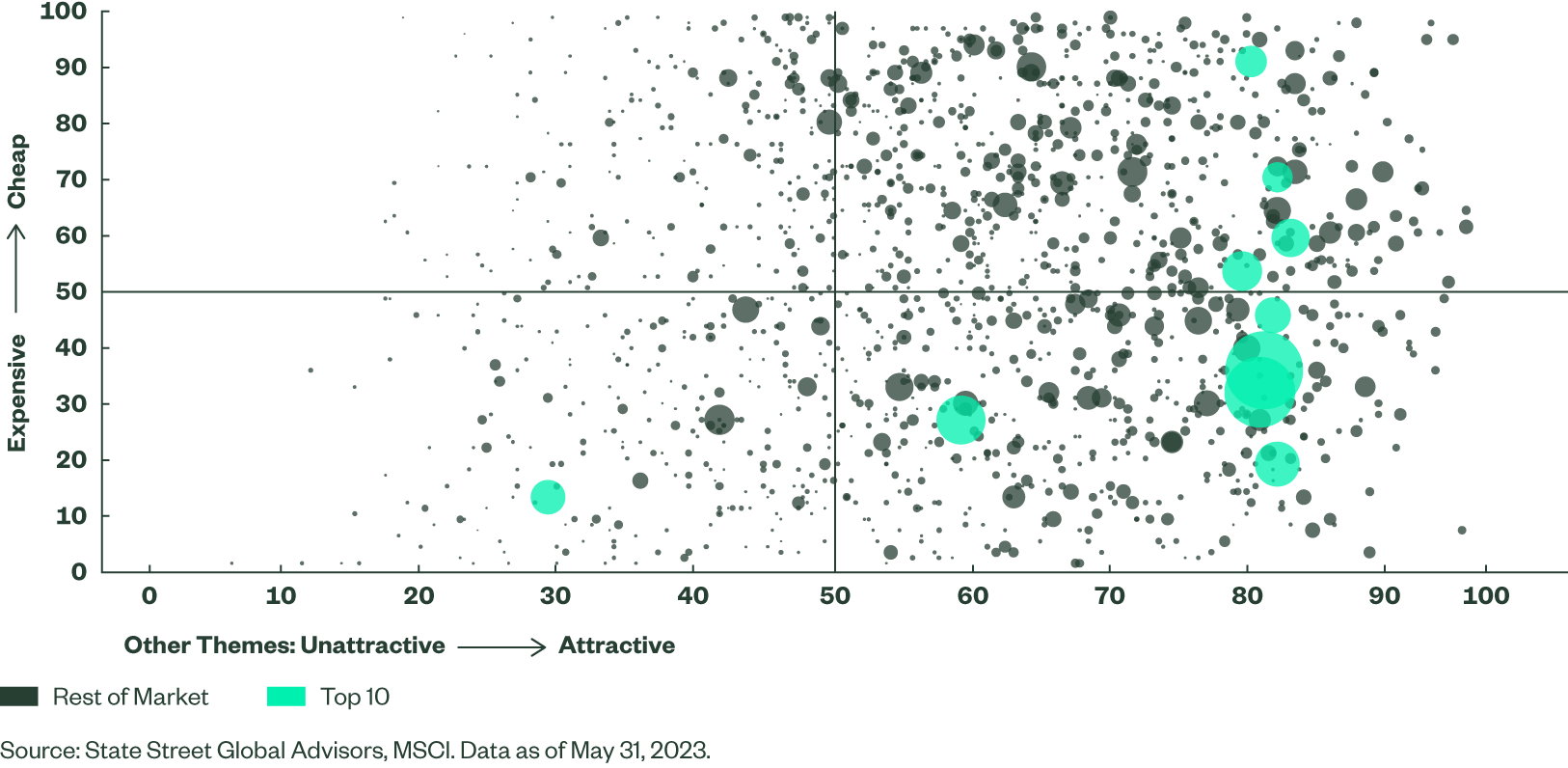

As critical as growth is, we believe other features should be equally considered when making an investment. Valuation is one such important factor, and the valuation is considerably stretched for these largest names. The average forward price-to-earnings (P/E) ratio for the top 10 stocks is 38x the next twelve months earnings, compared to only 16x for the market as a whole. Within our investment process we deploy diversified signals, many of them advanced and nuanced, to assess valuation of securities. Even based on this in-depth multi-faceted view, as well as the more straightforward P/E ratio measure, many of the largest names qualify as expensive.

Valuation is only one input in our investment decision making process, however. We also identify other characteristics that make a security an attractive, or unattractive, investment proposition such as measures of quality, market sentiment towards a stock, and potential for excess return. Based on these other themes, many of the largest names do score reasonably well. Yet, when we combine all the information in our returns model, including valuation, we find only a few of these stocks rank well overall. (See Figure 2.)

Figure 2 Ranking of the Top 10 Names and MSCI World Securities Based on Valuation and Other Themes Within Multi-factor Returns Model

The Bottom Line

Based on our diversified approach we still like some of these top 10 securities, but we do not favor others. We believe it is important not to get caught up in the hype, or external buzz around a name, but rather to be critically selective in investment decision making. This means taking in as much information as we have at our disposal to prevent over-extrapolating a single narrative. Importantly, we remind ourselves that there is a large universe of investment opportunities from which to choose and we do not need to follow the crowd.