ESG in Emerging Market Sovereign Debt: An Evolving Conversation

State Steet Global Advisors is one the largest managers of Emerging Market Debt globally with nearly $38bn in assets under management at the end of September 2023.* As investors look for ways to apply ESG to EM Sovereign Debt, Lyubka Dushanova, EMD Portfolio Strategist, addresses the key questions we hear from clients and highlights some of the challenges and opportunities that investors face in this area.

What are investors’ options in applying ESG to EM sovereign debt?

Economic, social, and governance (ESG) matters are an increasingly important consideration for investors. There are various ways in which an ESG framework can be applied to EM sovereign debt:

- Best-in-Class Approaches Optimization or rules-based approaches that are based on internally-produced or third-party ESG scores.

- Screening This may be both positive and negative. An example of negative screening is the exclusion of a sovereign issuer for failing to achieve a specified civil and political rights score based on the Freedom House Index. An example of positive screening is the deliberate inclusion of green-labelled bonds.

- Thematic Approaches Investing in themes or assets specifically aimed at solving social or environmental problems (e.g. align portfolios with the transition to a low carbon economy and a reduction in global warming to well below 2°C).

- Impact Investing These typically target measurable positive social or environmental impacts. Investments are generally project specific.

Investors can use these approaches individually or as a combination. They can be applied either by adopting an off-the-shelf ESG benchmark or through a customized solution that can be applied on the portfolio or index level through a bespoke benchmark.

And what are the key challenges investors face?

There is no uniform standard in how to apply ESG to EM sovereign debt and, whether used separately or together, the approaches cited present their own particular pros and cons.

ESG approaches and methodologies were initially established for equity investors in publicly-listed companies where information is typically more widely available. However, transposing this to sovereign debt investments presents its own challenges; sovereigns do not behave in the same way as for-profit companies and don’t have the same ability to implement ESG policies and change course. They also face very different ESG threats and opportunities.

Best-in-Class Approaches Based on ESG Scores

A key challenge, particularly when it comes to best-in-class approaches based on ESG scores, is that there is a high correlation between ESG scores and the income per capita of the respective country — this is known as income bias1. This means that ESG frameworks based on best-in-class approaches will end up overweighting higher-income EM countries at the expense of lower-income ones. The main issue here is that reducing the access of lower-income countries to capital does not solve their ESG problems. Indeed, it may well contribute to exacerbating them.

Another problem is that sovereign ESG data, which is typically sourced from public sources like The World Bank, World Health Organization, and EIA among others, tends to be issued only annually and with long lags. Hence, the metrics used in a sovereign’s ESG rating may not reflect the most recent ESG policy framework or pathway which a country has undertaken.

Negative Screening

A challenge with negative screening approaches is that they can lead to a very different investment universe compared to the original one. This is especially the case in local currency debt where the number of index-eligible countries is quite small to begin with; screening out some of them can lead to a concentrated investment universe.

Thematic and Impact Investing Approaches

Thematic approaches and impact investing are emerging as investors seek more meaningful ways to apply their ESG beliefs. However, not all thematic approaches are applicable to sovereigns; for instance, targets such as gender equality and United Nations Global Compact (UNGC) principles cannot be easily traced to the sovereign. The issue with impact investing, on the other hand, is sourcing enough sizeable projects.

Overall, what we have noticed over the past three years is that ESG means different things to different investors. ESG indices offer somewhat of a standardized approach, but it is by no means universally accepted; many investors prefer a bespoke solution that corresponds more closely to their ESG values and investment objectives.

How can investors determine the right option for them?

Investing in a strategy that follows an off-the-shelf ESG index is the most hassle-free way to implement ESG in EM sovereign debt. However, this is essentially outsourcing the approach to the index provider and therefore the investor needs to understand the methodology in detail to ensure it aligns with their ESG goals and priorities.

Bespoke solutions, on the other hand, offer tremendous flexibility for customization. But they are more complex to design and implement and are thus generally best suited to larger investors with a long-term investment horizon in the asset class. We have seen investors applying an ESG framework on the portfolio level while benchmarked against a standard index, in which case tracking error volatility (TEV) tolerance versus the base index should be considered. Other investors are opting for a bespoke index altogether.

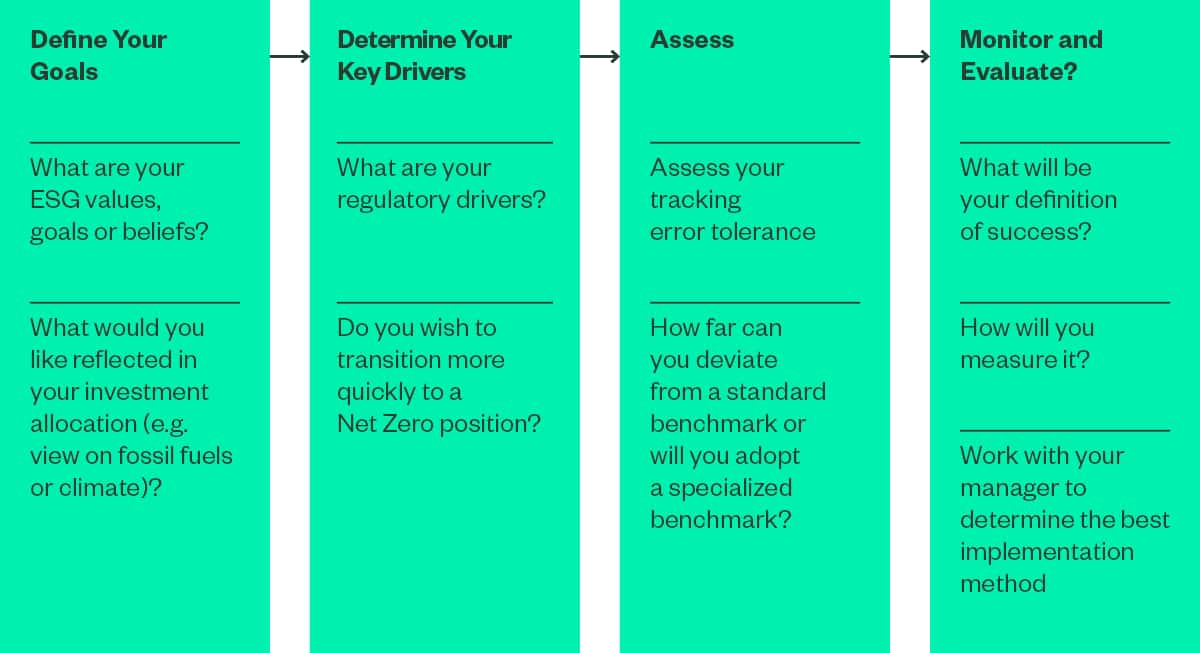

We have developed a step-by-step process, as illustrated below, to help fixed income investors decide what may be best for them, which is outlined in the paper: Fixed Income ESG: Combining Performance and Responsible Investing2.

Cost and time to construct and define the custom index/strategy, size of investment, and investment horizon are also aspects investors should consider when selecting the customized route.

What ESG indices are available to EMD investors? Does State Street Global Advisors offer any EMD strategies benchmarked against such indices?

The EMD ESG index landscape continues to evolve quickly with many index providers entering the space; these include FTSE, ICE, iBoxx, Solactive, and MSCI. However, the two most widely used index providers for EMD exposure are JP Morgan and Bloomberg. JP Morgan has the advantage of having the most widely followed indices in EM debt, as well as being early to launch their EMD ESG indices — the JESG index range — in 2018. The JESG index methodology is a combination of best-in-class approach and negative and positive screening. At the end of September 2023, there was almost $38 billion of assets benchmarked against the JESG EMD indices.

State Street has been managing an EMD Local Currency strategy since December 2021 against the JESG GBI-EM Index, and also has a Hard Currency strategy against the JESG EMBIG Index which is available for seeding.

How does State Street Global Advisors work with investors that want a customized solution and what trends do you see in this space?

State Street Global Advisors’ approach is to seek to form a partnership with investors in order to help them meet their investment and ESG objectives. In many cases, it is a collaborative process where we work with the client to help them understand and incorporate the best approach for them.

Over the past couple of years, we have seen a strong preference for negative screening approaches. These often use a combination of ESG sources and ratings criteria such as the Freedom House Index, Democracy Index, Corruption Perception Index, Environmental Performance Index, Ratification of the Paris Agreement, among others. The expulsion of Russia from indices has increased the urgency for investors to exclude some countries perceived as the “worst offenders”. In some instances, investors want to screen out a large number of countries from their EMD investment universe and we help them determine what the liquidity implications for their portfolio will be and the appropriate index cap. We also work with the index providers to establish the criteria and methodology of the bespoke index. We guide investors through this whole process, from concept through design and on to implementation, while providing insights and analysis of each element of their decisions.

We are also seeing great interest in green bonds with investors asking for “greener” portfolios; this is an example of positive screening whereby investors deliberately include and prioritize green bonds.

How developed is the EM green bond market?

Green bonds are the largest segment of the growing sustainable debt market which also includes social, sustainability, sustainability-linked bonds and climate transition bonds amongst others. According to the Climate Bond Initiative (CBI), an NGO with an objective to mobilize the global debt market for climate change solutions, the cumulative issuance of green bonds globally stands at over $2.3 trillion as of November 2023. Of this amount, the cumulative issuance of EM green bonds stands at $452 billion.

As illustrated in Figure 1, financial and non-financial corporates dominate green bond issuance in EM. Sovereign issuance of green bonds still comprise only 6% of the total EM green bond issuance. Amongst the more prominent EM green sovereign bond issuers are Chile, Hungary, Indonesia and Poland. Including green bonds in EM Debt portfolios can be beneficial, not only from the perspective of making the portfolio “greener”, but also from a performance point of view. Because green bonds are less prevalent and demand is high, they tend to outperform regular bonds of similar maturities. However, “greenium” in the form of premium that investors may sometimes pay for those highly sought after bonds should also be weighed in investment decisions.

In terms of country break-down, China dominates green bond issuance with over $318bn of cumulative green bond issuance; however, this is largely dominated by financial and non-financial corporates. Although China doesn’t have a sovereign green bond, it has a significant green bond issuance by government-backed entities as well as some issuance by local governments. It is worth noting that there is a sizeable amount of bonds self-labelled as green by Chinese issuers but these are not included here as it does not meet the Climate Bonds Initiative’s criteria for inclusion (for example, 100% of the proceeds need to be identified as being for green purposes).

From a currency perspective, given that China dominates EM green bond issuance it is not surprising that the largest proportion of EM green bonds are denominated in CNY ($248bn). This is followed by USD ($125bn) and EUR ($36bn), indicating that most EM green bond issuance is still in hard currency.

An important point with regard to green bond investing is that the lack of standards and risk of greenwashing means investors should look to invest in green bonds that follow a well-recognized standard. Independent bodies like the Climate Bond Initiative, with whom State Street Global Advisors has a partnership, have developed a green bond taxonomy against which the whole market is screened and a process for green bonds to get certified (which issuers can select to use voluntarily to signal an adherence to high standards); hence, the numbers quoted here are for green bonds that are aligned with the CBI taxonomy.

Are active managers’ claims to be better suited to managing ESG strategies accurate?

Active managers argue that they are better suited to manage ESG strategies because they have greater flexibility in portfolio construction and can also regularly engage with companies and sovereigns in their issuer evaluations and thus can include ESG criteria in this process. However, we see two potential problems with this — firstly, their evaluation is subjective and not always transparent; secondly, and possibly more importantly, is how adopting an ESG framework may conflict with active managers’ objective to add value and beat the benchmark. These two objectives can be competing, introducing potential conflicts of interest in security selection that may give rise to a lack of transparency or consistency with ESG objectives. By contrast, an index approach that follows an ESG benchmark offers that transparency without the conflicting objectives between ESG compliance and alpha generation.

When we are mandated to replicate an ESG benchmark, the objective is clear: to deliver the performance and characteristics of the benchmark as efficiently as possible. We aim to align the portfolio with the key characteristics of the benchmark, including country exposure, currency exposure in the case of local currency debt, issuer exposure and term structure; for strategies that follow an ESG benchmark, we have the added objective to align with the ESG scores as well.

For customized solutions, we believe that a sophisticated index manager like State Street Global Advisors is well positioned to respond to the complex requirements of investors. As mentioned, solutions with negative screens are becoming widespread in the EM sovereign debt space; in some cases, we have seen investors exclude as many as 30 countries from their investment universe. Even with far less exclusions, a more limited opportunity set also constrains the ability of active managers to generate alpha. In such cases, other considerations become increasingly important. These include liquidity and identifying the most appropriate capping that optimizes performance and at the same time ensures the index is implementable. Implementation is not a key focus for active managers, whose main objective is to generate alpha, but it is one of the main ways that an index manager like State Street Global Advisors adds value and hence is a key focus for us.

Final Thoughts

We believe that the next five years will be a critical juncture for ESG as we are fast approaching a tipping point due to the range of issues which affect society. These include, at the core, climate change but also the COVID-19 pandemic and Russia’s invasion of Ukraine. The COVID-19 pandemic was both a health emergency as well as a social crisis for many countries, drawing attention to the importance of developing viable social policies. Russia’s invasion of Ukraine, on the other hand, was a wake-up call for many investors as to the importance of excluding the worst offenders from their portfolios.