Emerging Market Debt Market Commentary: May 2023

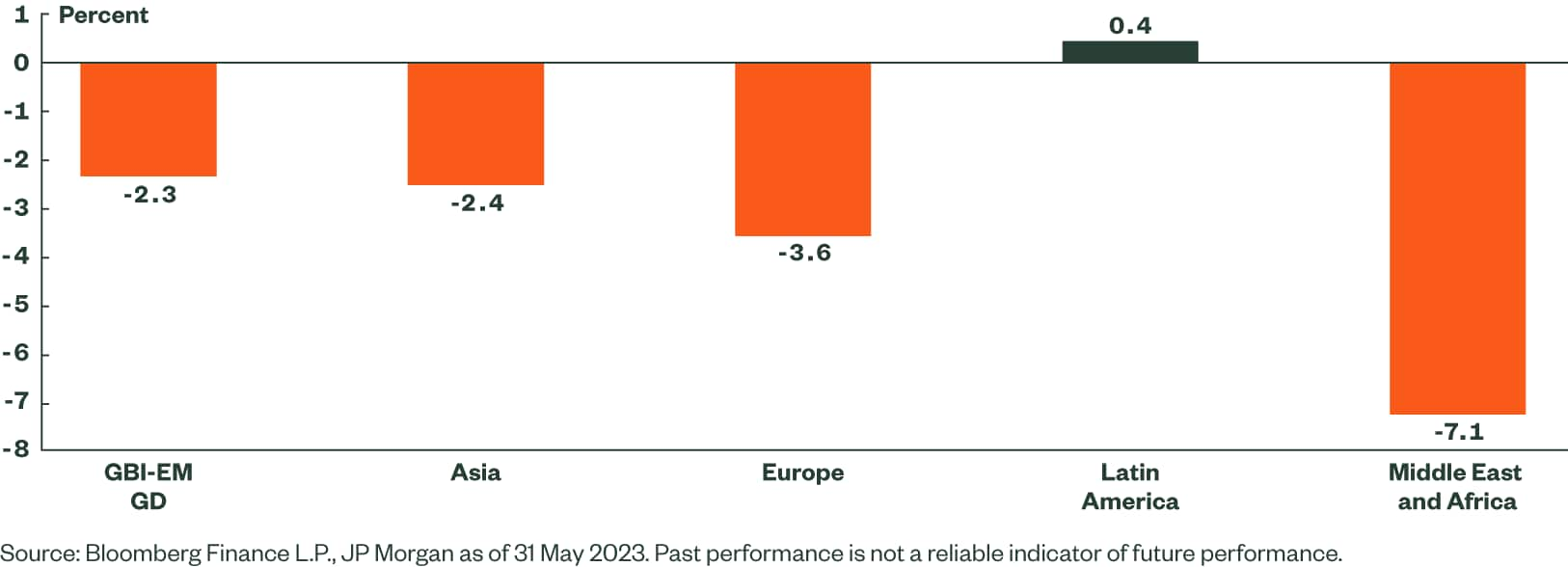

Chart of the Month: Local Currency Returns Hit by Renewed US Dollar Strength

Stronger-than-expected growth data in the US and diminishing expectations of near-term Federal Reserve rate cuts fueled support for the US dollar. Dollar strength in tandem with EM central banks’ interest rate dynamics weighed on overall EM local currency returns.

Figure 1: US Dollar Gains on EM FX (May 2023)

EMD Commentary – May 2023

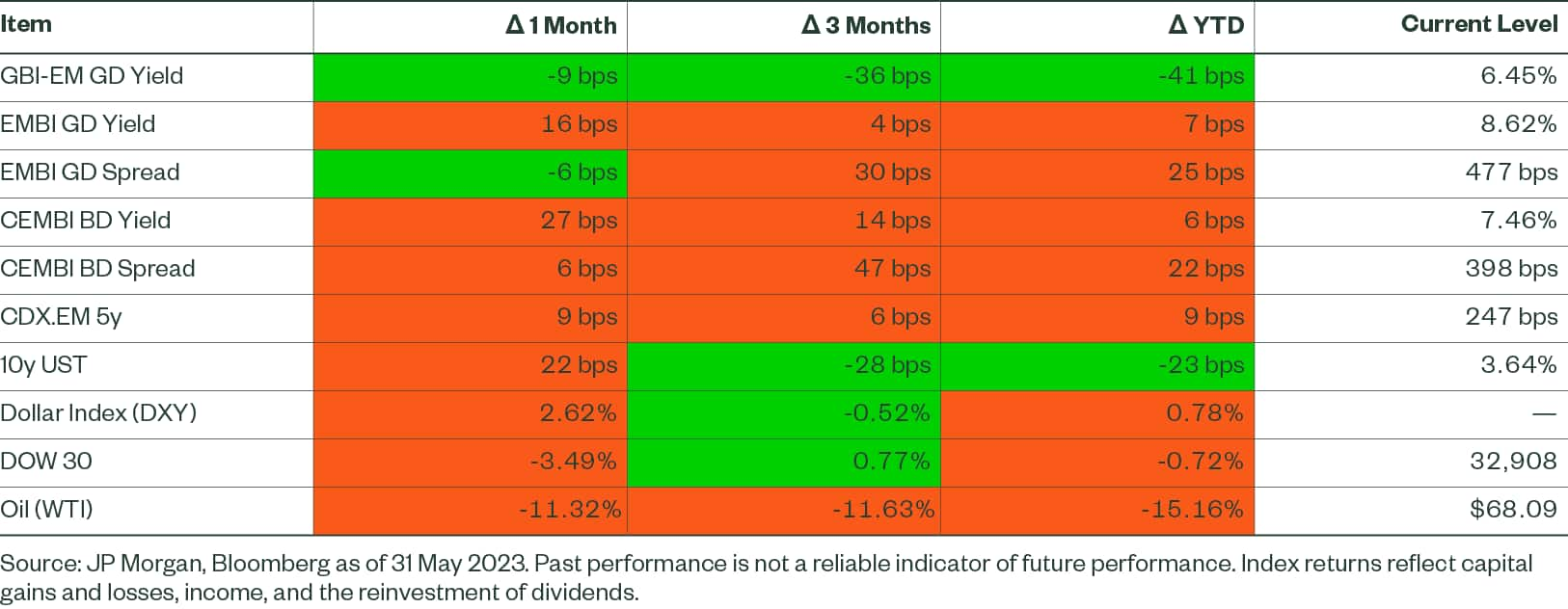

Notwithstanding the tailwinds of easing inflation pressures and high carry, emerging market (EM) debt was negatively impacted in May by concerns surrounding a possible US debt default and the potential for recessionary forces to take hold. Investor concerns eased later in the month when US President Joe Biden and Speaker of the House Kevin McCarthy reached a tentative agreement on raising the US debt ceiling. A bill was passed by the House to suspend the nation's debt limit through January 1, 2025. Market sentiment factored in an additional Fed rate hike as the Federal Open Market Committee expressed concern about persisting high inflation. The uptrend in the US dollar (as evident in Dollar Index performance in Figure 3) as a result of stronger growth data and rising US Treasury yields hit EM FX and dampened EM local bond returns.

The macro backdrop was also impacted by Chinese data releases that surprised on the downside. While softer-than-expected Chinese growth is likely to have only a limited impact on the broader EM economic universe, it could have bearish implications for commodity demand in general. This was reflected in weaker oil prices, despite stable inventory levels in the US and OPEC+ maintaining lower production levels. In Turkey, President Recep Tayyip Erdogan secured victory in the presidential election run-off, which provides him with five more years to deepen his conservative imprint. Results from Thailand’s general election failed to deliver a majority for either opposition party, and any coalition will have to navigate the military-controlled senate to form a government.

Net flows during May for hard currency and local currency funds were -$3.2bn and +$0.6bn, respectively (source: JP Morgan).

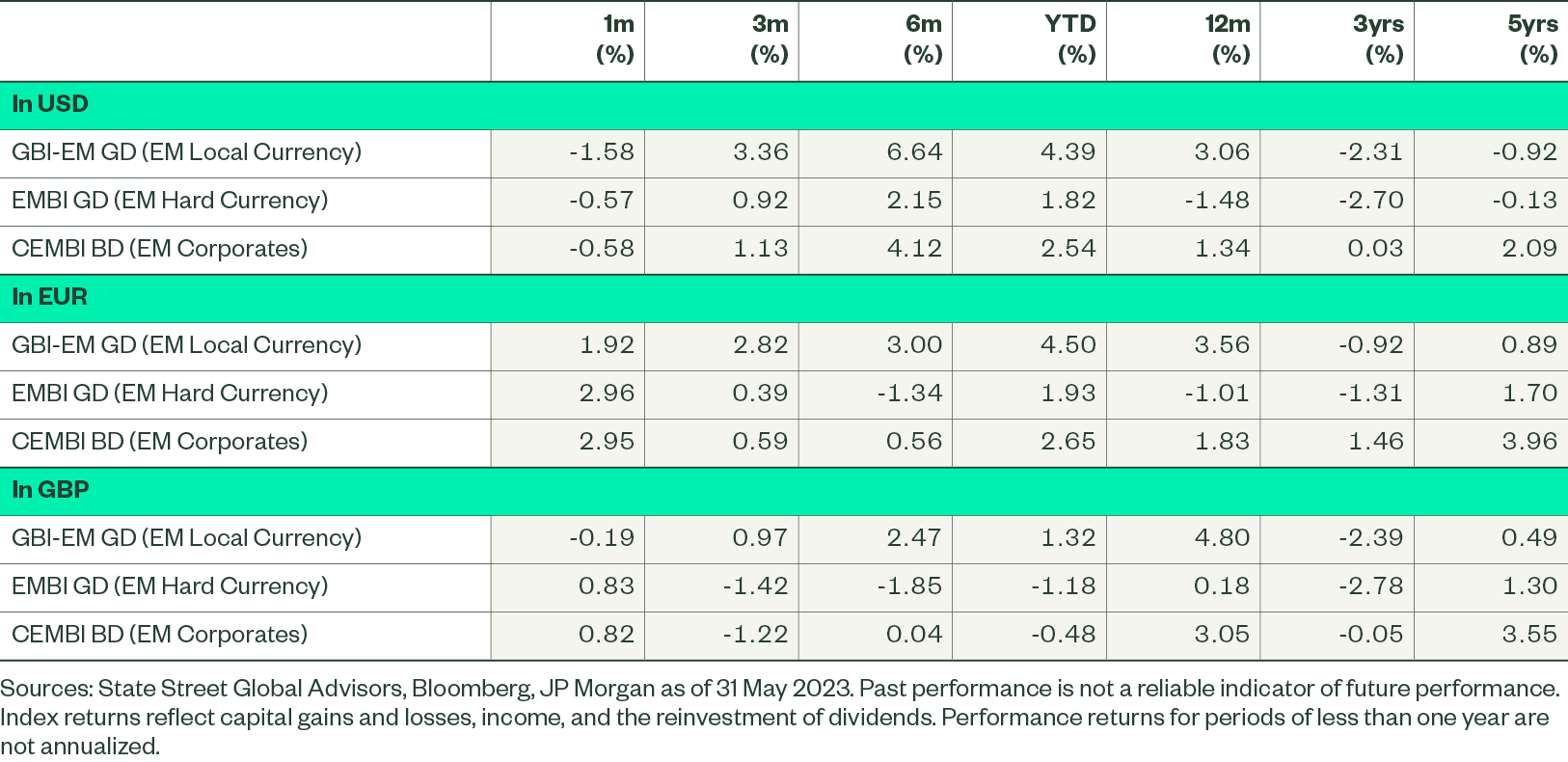

Figure 2 - Emerging Market Debt Index Returns – As of 31 May, 2023

Figure 3: Key EM and Macro levels as of 31 May 2023

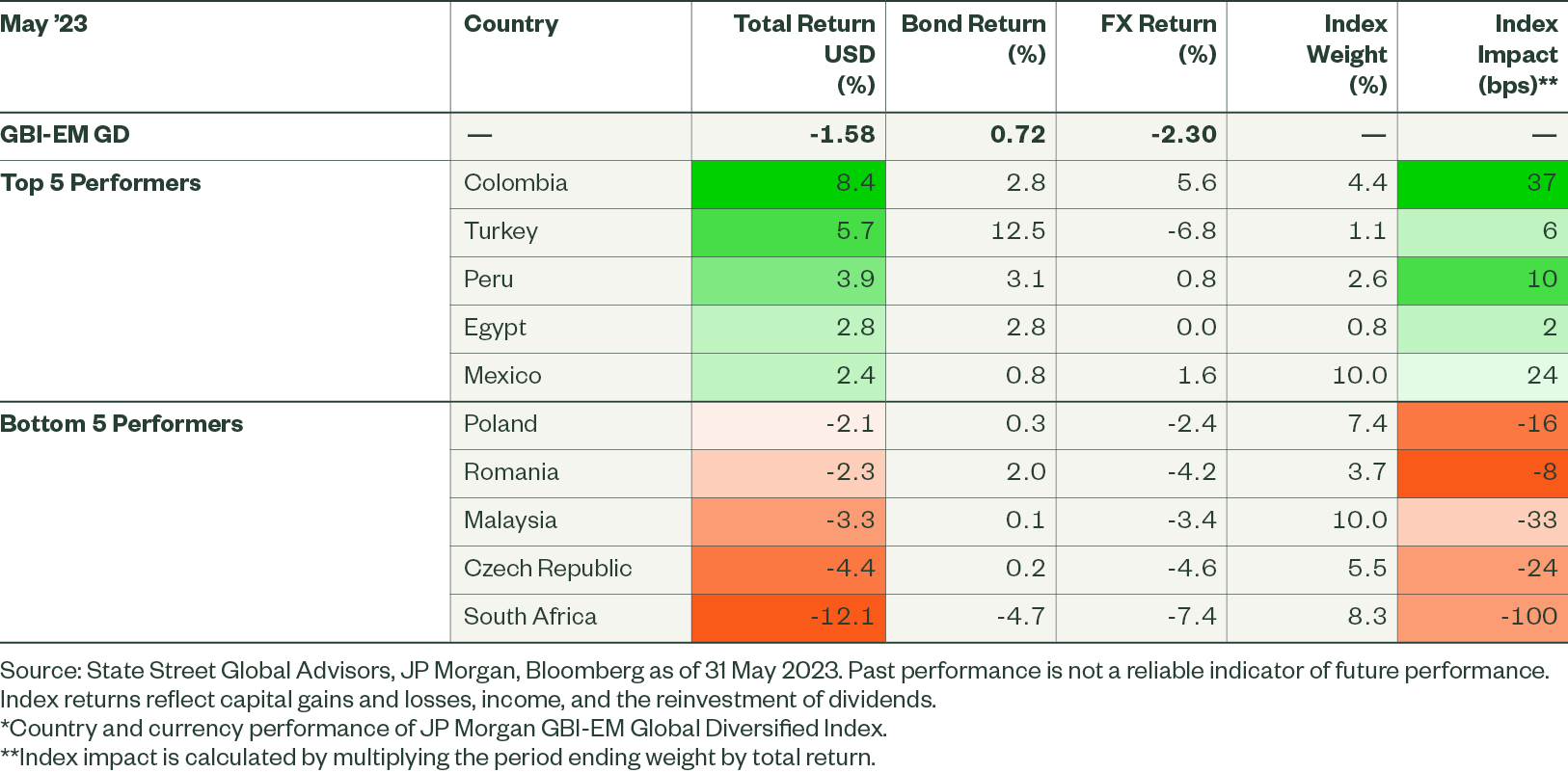

Local Currency Market Highlights

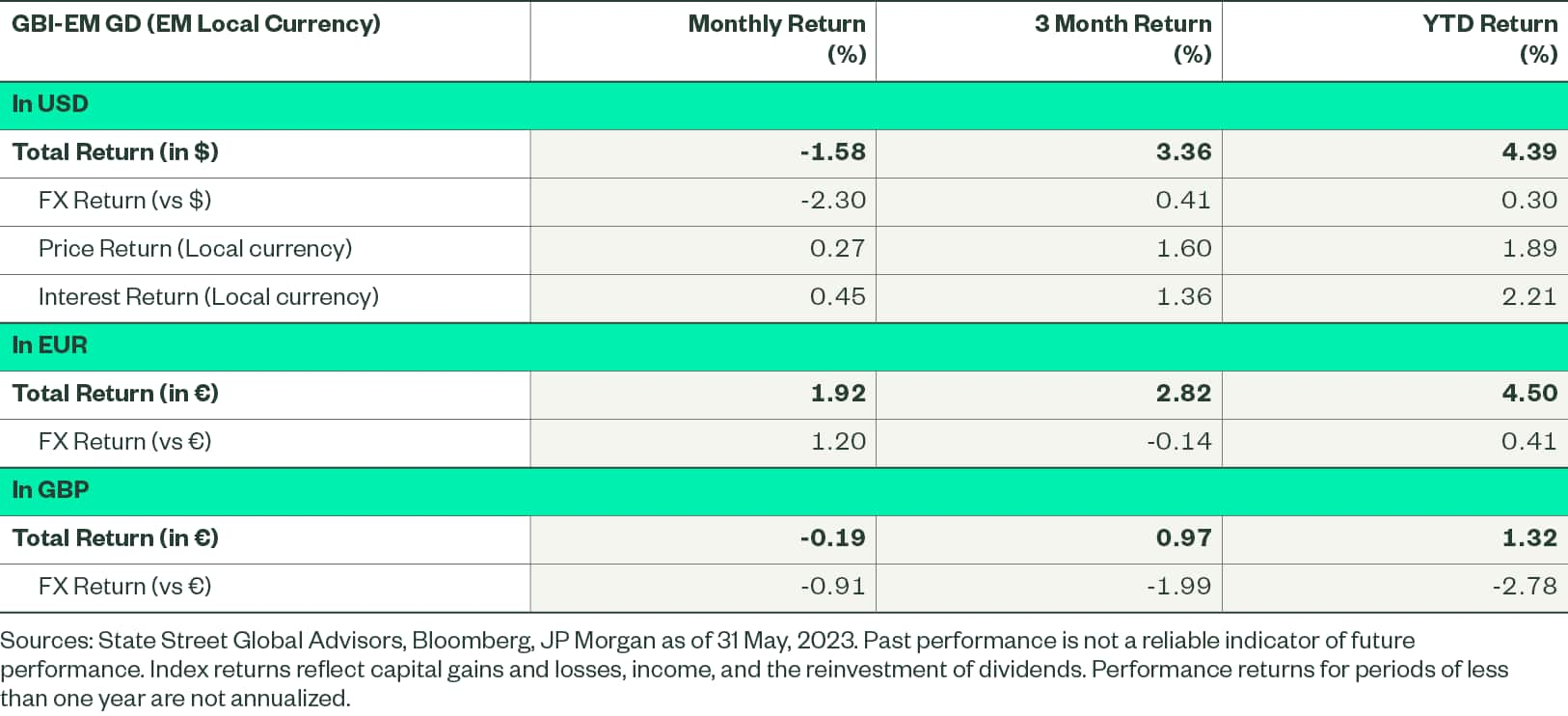

EM local currency debt returned -1.58% (in USD terms) in May 2023, as measured by the JP Morgan GBI-EM Global Diversified Index. A major contribution to the negative return came from foreign exchange (FX) underperformance (-2.30%). Stronger growth data from the US, coupled with persistent inflation, increased the possibility of additional Fed rate hikes. This underpinned broader US dollar appreciation that resulted in 14 out of the 20 EM currencies in the index recording negative returns. Local bond yields declined in May as markets continued to price in the likelihood that EM central banks are at the final stage of the rate tightening cycle.

Figure 4 - Key return drivers of EM local government bond markets

Figure 5 - Best and worst performers across EM local government bond markets in USD*

South Africa was the worst performer in May. Early in the month, markets priced in the possibility of South Africa being sanctioned after the US alleged the country had supplied arms to Russia. The annual inflation rate cooled to 6.8% in April, which is still above the central bank’s target range of 3% to 6%. The central bank announced its tenth consecutive rate hike, with a 50bps increase taking the benchmark interest rate to 8.25%. The South African rand depreciated against the US dollar by 7.8% in May and closed at 19.73.

Czech Republic local bonds performed poorly in May. The country’s central bank raised its inflation forecast for 2023 to 11.2% from 10.8%, but kept the interest rate unchanged as expected at 7%, thus maintaining the same level since June 2022. Broader appreciation of US dollar and the interest rate differential contributed to the Czech koruna weakening against the US dollar by 3.9% in May to close the month at 22.19.

Malaysia was another underperformer. Inflation has been subdued in Malaysia due to government subsidies on petrol, electricity, and food items. However, to avoid risk of financial imbalance, the Monetary Policy Committee of Bank Negara Malaysia (BNM) surprised markets by raising the overnight policy rate by 25bps to 3.00%. The Malaysian Ringgit fell by 3.4% against the US dollar in May to close at 4.6.

Colombia was the best performer in May. The country’s annual inflation rate eased to 12.82% in April, with price increases slowing for food, goods and services. According to the central bank governor Leonardo Var, the bank’s steepest ever tightening cycle is beginning to have the desired effect on the economy. The Colombian Peso appreciated by 5.2% against the US dollar in May, closing at 4,451.

Mexican local bonds also performed well in May. The annual inflation rate dropped to an 18-month low of 6.25% in April, with the core inflation rate declining to a nine-month low of 7.67%. The Bank of Mexico (Banxico) reiterated its intention to hold the benchmark rate steady at the current level (11.25%) for longer. The yield on Mexico’s 10-year government bond increased by 19bps in May. The Mexican peso appreciated against the dollar by 1.8% and closed at 17.7.

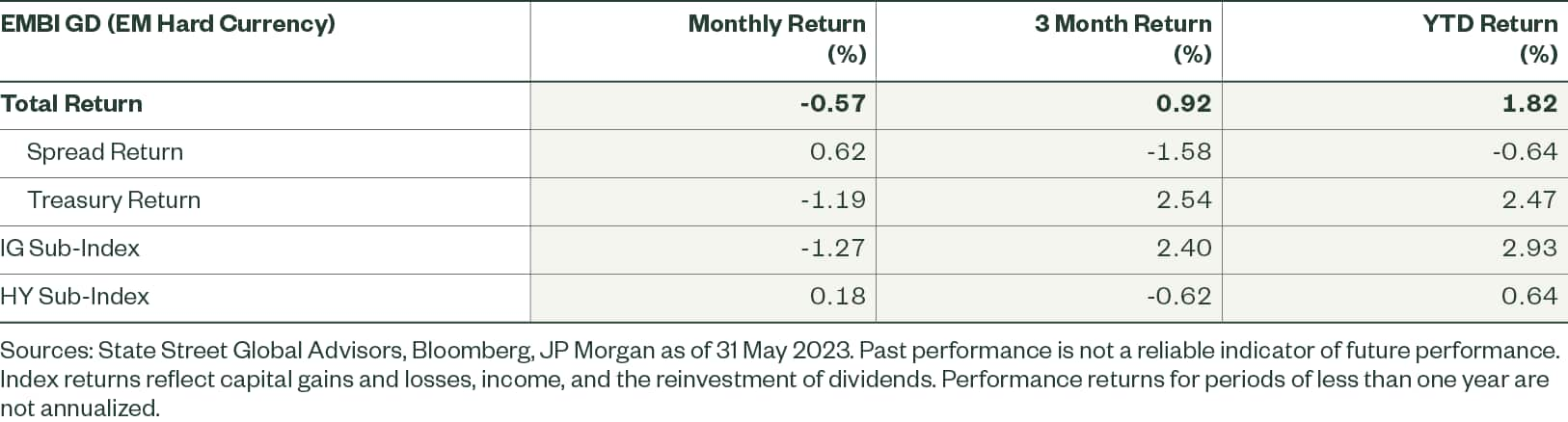

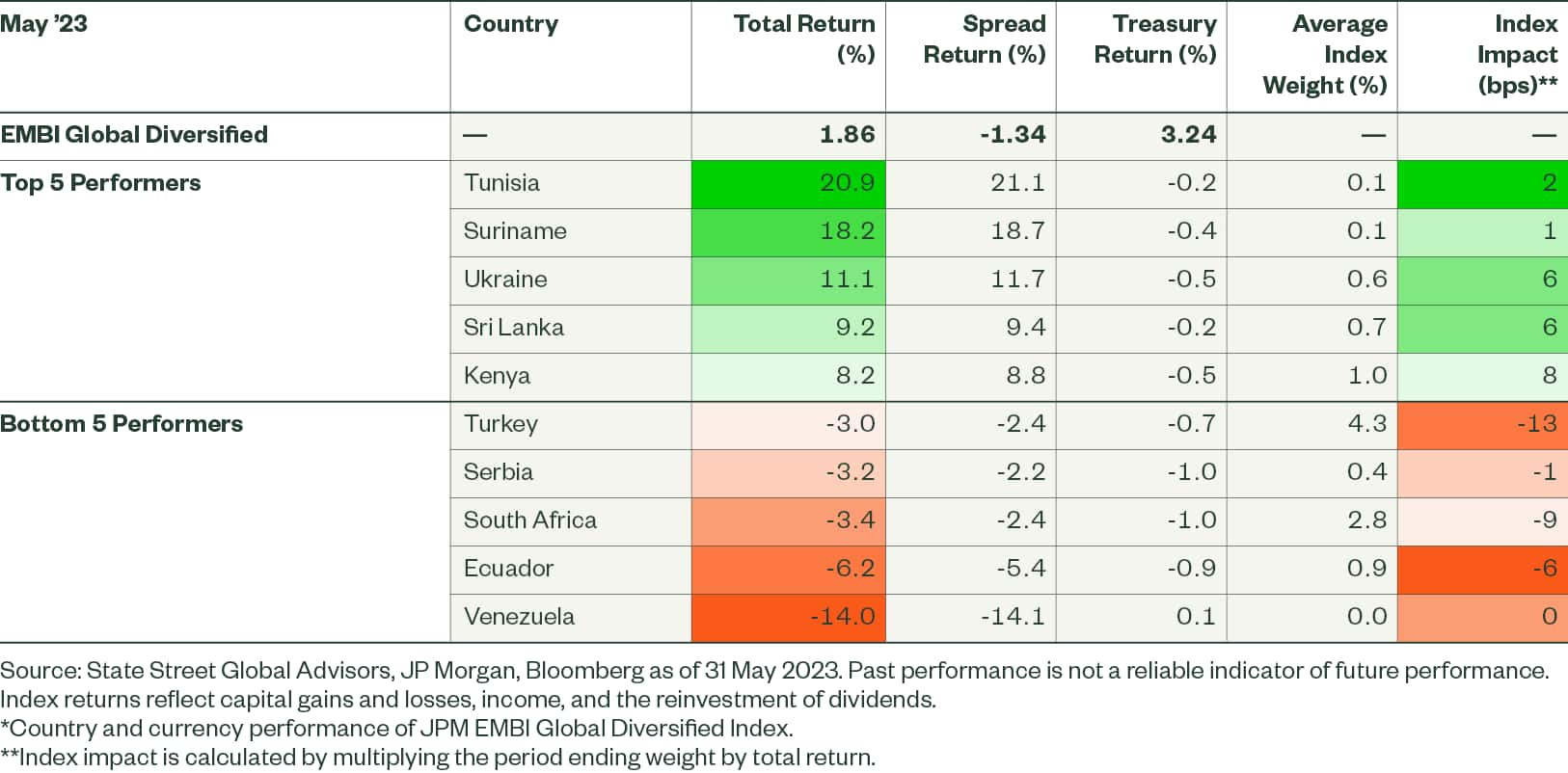

Hard Currency Market Highlights

EM hard currency sovereign debt returned -0.57% (in USD terms) in May 2023, as measured by the JP Morgan EMBI Global Diversified Index. The Treasury component (-1.19%) was the major contributor to underperformance. The 10-year US Treasury yield increased 22bps in the month as markets continued to assess the US economic outlook against the backdrop of debt ceiling negotiations and potential outcomes. The announcement late in the month of a deal to raise the debt ceiling facilitated a partial recovery in risk sentiment. Overall, the lack of clear direction in EM credit weighed on investor sentiment, as reflected by six consecutive weeks of outflows from EM hard currency markets (source: JP Morgan). These factors weighed on the EMBI GD yield, which increased by 16bps in May.

Figure 6 - Key return drivers of EM hard currency government bond markets in USD

Figure 7 - Best and worst performers across EM hard currency government bond markets*

Ecuador was one of the poorest performers in May. Political uncertainty and the potential for social unrest weighed on market sentiment as President Guillermo Lasso dissolved Ecuador’s National Assembly on May 17. This dissolution decision was announced against the backdrop of an impeachment trial conducted by the opposition majority against Lasso. Fitch revised Ecuador’s outlook to Negative, while affirming its Long-Term Foreign Currency Issuer Default Rating at B-.

South Africa was another underperformer, detracting 9bps from the index return. The possibility of the country being sanctioned for allegedly supplying arms to Russia weighed on performance. Longer-dated maturities were impacted the most, especially the Eurobond with a maturity in 2047. The country is also facing an ongoing power crisis that is also feeding into weak investor sentiment.

Turkey was another underperformer, detracting 13bps from the index return. The country’s sovereign US dollar bonds fell as Erdogan moved into pole position for the run-off in the country’s presidential elections — he subsequently won with 52.18% of the votes. Markets continued to factor in the potential fallout should Erdogan persist with his unorthodox policy of fighting inflation via low interest rates.

Sri Lanka was one of the best performers in May, contributing 6bps to the index return. The annual inflation rate eased to 25.2% in May, from 35.3% in April. Sri Lanka’s parliament voted in favour of implementing the “four-year International Monetary Fund Program”, which aims to tackle the nation’s debt burden and economic crisis.

Kenya was one of the best performers in May, contributing 8bps to the index return. The World Bank approved a $1 billion loan to Kenya to support its budget as the economy is battling high debts and a weakening currency. Despite the slowdown in prices, the Central Bank of Kenya held its benchmark rate at 9.5% at its latest meeting in May.