Next for US Equities: Will the Fed Deliver a Soft Landing?

We appear to be entering a new phase of the Fed’s post-pandemic monetary policy regime. The first phase was dominated by the value trade, phase two by the tech recovery. What will phase three be?

US equities have experienced a volatile 18 months. In the first three quarters of 2022, the S&P 500 declined 25%, as the Fed began a process that would ultimately result in 10 consecutive rate hikes. The market bottomed on 12 October 2022 and has rallied nearly 25% during the ensuing three quarters. The shift in market sentiment can be attributed to both micro (US tech sector innovation) and macro (engineering a soft landing) factors. This article highlights two potential trades based on investor expectations for the macro backdrop going forward: US dividends and US mid caps.

Growth stocks appear to have digested higher interest rates in 2023 and continue to drive gains in the highly concentrated S&P 500. While many investors remain bullish on US equities, some will consider the potential to take profits and diversify away from the leadership. The premium price on earnings in growth sectors has become a cause for concern for investors in mega-cap US equities. We would recommend investors consider US dividends or US mid caps as diversification opportunities. In choosing one or the other, consider two macro scenarios:

- The Fed successfully engineers a “soft landing”. Employment remains strong and core disinflation continues, supporting domestic demand. Recession is avoided.

- Fed policy remains too hawkish, for too long. Employment and economic activity decline sharply, sending US into near-term recession. There’s a market correction.

Under scenario #1, we would favour exposure to US mid caps. As we noted in a previous article, A Big Moment for US Small & Mid Caps?, the resilience of the US consumer remains the basis for this call. The Fed is seeking to hold rates high as disinflationary forces continue to push prices into the target range. As long as employment remains robust, this should go a long way to supporting consumer demand.

Under scenario #2, we would favour exposure to US dividends. As originally published in the Q3 Smart Beta Compass, investors should consider a cautious approach on the basis of an inverted bond market, a less robust employment outlook, and other leading economic indicators. These factors suggest the Fed may have “overplayed its hand” on monetary policy, keeping rates too high for too long, which may cause the economy to fall into a near-term recession.

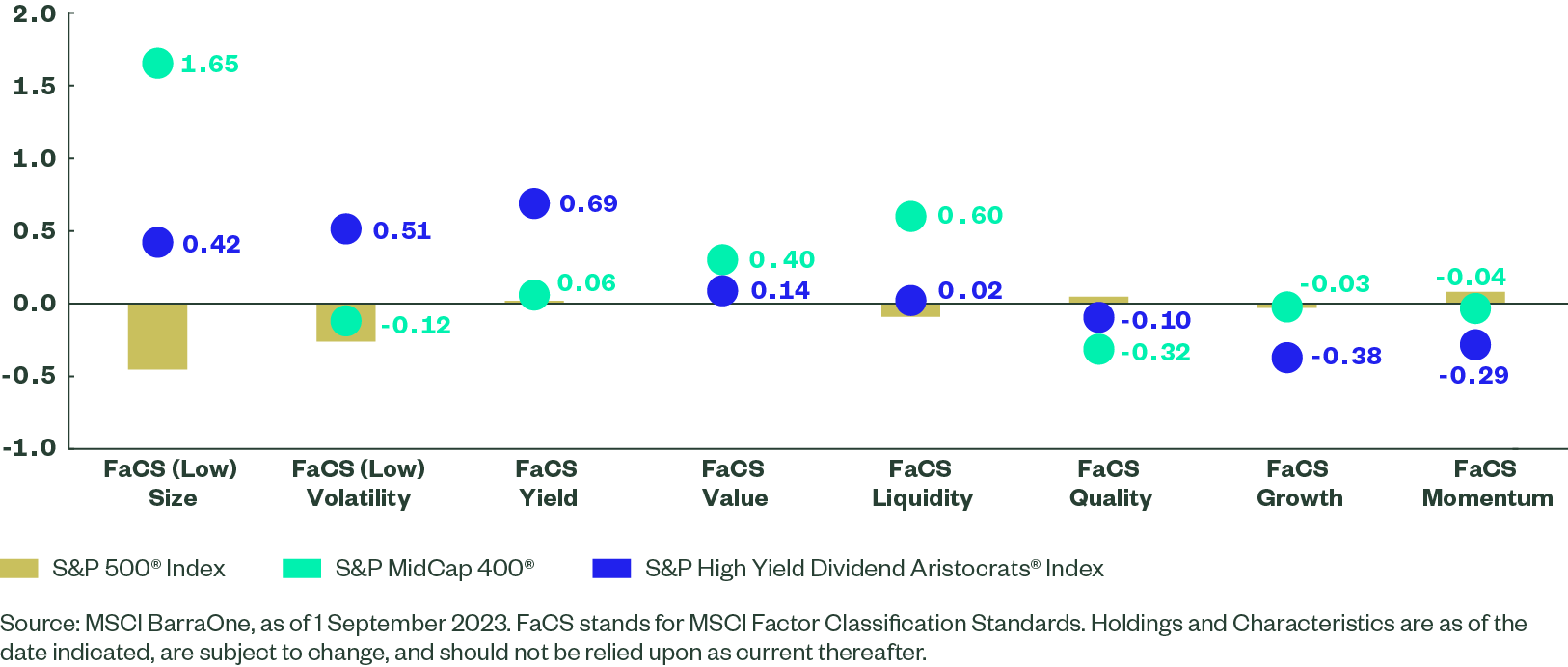

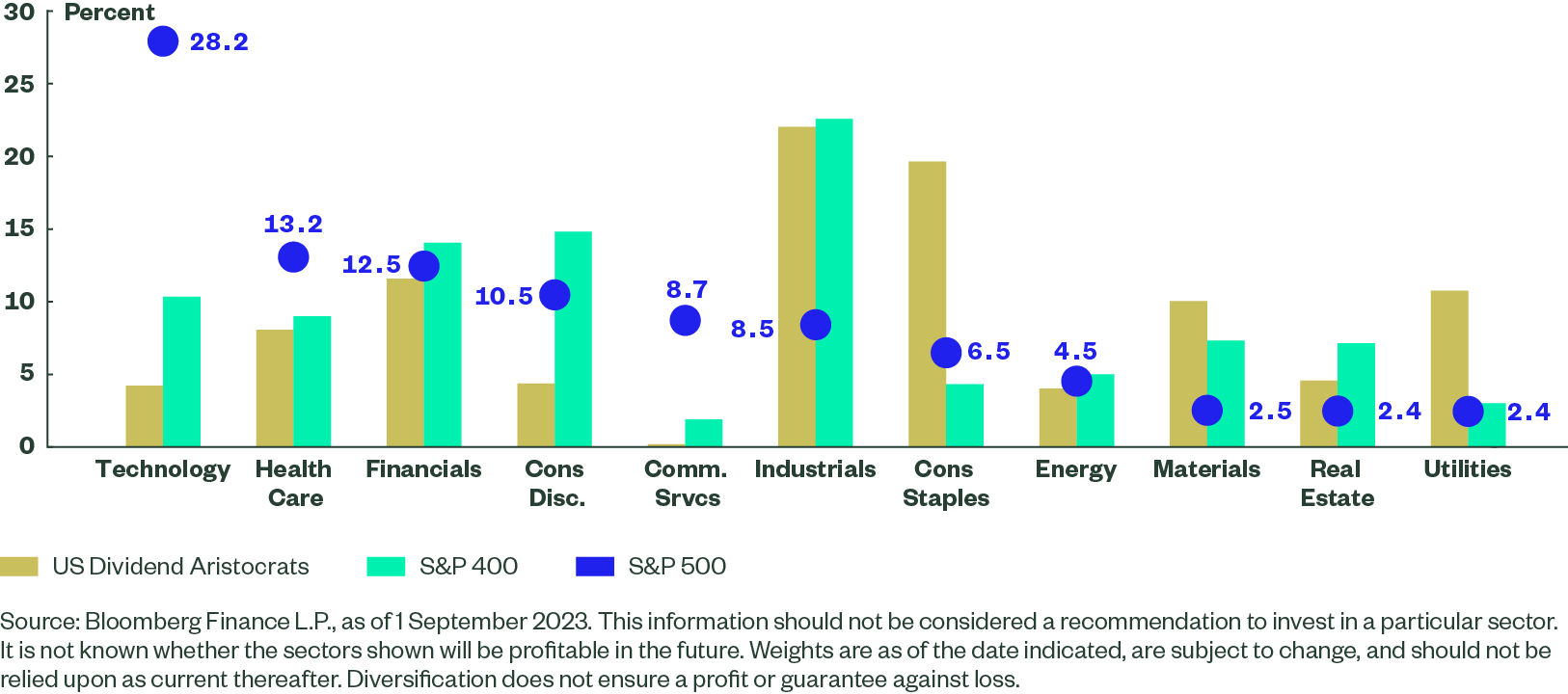

The SPDR® S&P® 400 U.S. Mid Cap UCITS ETF and SPDR® S&P® U.S. Dividend Aristocrats UCITS ETF both offer investors an opportunity to diversify away from the mega-cap, increasingly concentrated S&P 500 Index. Both ETFs offer positive size factor exposure; mid caps are inherently a size play while Dividend Aristocrats achieve this by being yield-weighted. The main difference will be that the Dividend Aristocrats ETF is a more defensive, low volatility exposure (see Figure 1). While both exposures carry a cyclical bias, dividends offer more of an inelastic beta exposure to the consumer by being overweight consumer staples. Mid caps are more concentrated in the higher beta consumer discretionary sector (see Figure 2).

Figure 1: FaCS Exposure

Figure 2: GICS Sector Exposure

How to Access this Theme