US tariffs: Sector risks and legal challenges ahead?

The vast majority of imports to the US are now covered by formal trade agreements or inter-governmental understandings. This has helped stabilize markets, but tariffs’ potential impact on sectors continues to pose narrow risks and the legal foundations of US trade policy itself will be tested.

Markets stable as US trade resets

More than 85% of US imports are now governed by formal trade agreements or inter-governmental understandings. This broad coverage has helped stabilize markets following disruptive trade policy shocks earlier this year.

Notably, the US has established a fragile equilibrium with its largest trading partners that are the sources of the majority of its imports—including the EU, China, Japan, UK, South Korea, and most of Southeast Asia. It has a partial understanding with Mexico and Canada, too.

The residual uncertainty that persists involves issues that are far less significant than those that ignited the initial wave of US tariff-led volatility in April, including:

- Finalizing the details of existing agreements

- Ratifying the more precise deals

- Adjusting the US-China tariff track, up or down

- Renegotiating the United States-Mexico-Canada trade agreement (USMCA), which governs North American trade

While there is headline risk for future volatility, none of these developments should pose a material risk to market repricing, given the narrower range of outcomes compared to the beginning of the year.

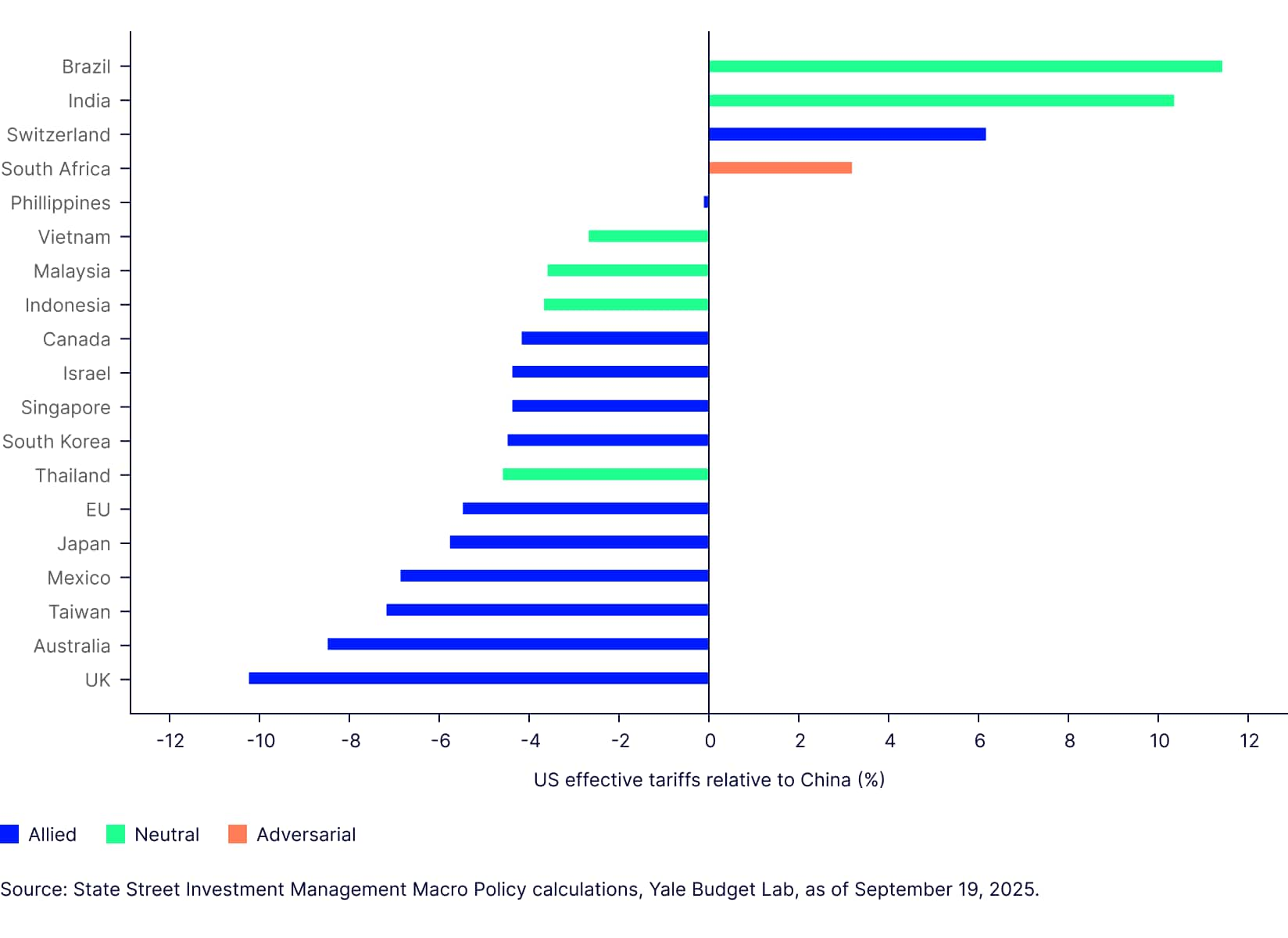

Compared to the current effective tariff in place on China, most US allies have greatly improved their competitive position vis-à-vis China (Figure 1). This reaffirms that US trade policy continues to operate in the established geopolitical context.

Figure 1: Change in US effective tariffs relative to China as of August 7, 2025

The fraction of US imports—less than 15%—without set tariffs is largely immaterial for the US market. But the eventual tariffs will matter for the valuation and outlook of respective local markets—notably, India, Taiwan, and Switzerland. Expectations are for the US to ink trade deals with all three before year end, though the India deal faces the steepest hurdles.

Sectors remain vulnerable to tariffs

But despite this macro calm, specific industries remain vulnerable to trade-related risks.

Tariffs have been instituted for autos, steel, aluminum, copper, and most recently for pharmaceuticals, furniture, and heavy trucks. And still to come are the muted sector tariffs for semiconductors, aircrafts, critical minerals, and polysilicon. Together, these products amount to less than 3% of total US imports, but any tariff will change the economics in the affected industries and regions.

Legal disputes could disrupt trade policy

Beyond sector-specific vulnerabilities, a more systemic risk looms. The Supreme Court will rule over the coming months whether it was legal for the Trump administration to resort to the International Emergency Economic Powers Act (IEEPA) to enact tariffs. If the Court rules against the administration and declares the imposition of tariffs illegal, market volatility may rise.

Importantly, the administration could then use other legal instruments—in particular, sections 122, 338, and 201 of the 1974 and 1930 Trade Acts—to replace the IEEPA framework and quickly re-anchor trade policy.

Because some of these tactics are equally untested, they also could be subject to legal challenges. But any uncertainty would be short lived, as a quick mix of these substitutes could anchor existing trade frameworks in US law.

Figure 2: Overview of US trade policy: Trade deals, sector tariffs, and legal issues

| Status? | Residual uncertainty | |

|---|---|---|

| Trade deals | ||

| EU | ✓ | Ratification |

| Japan | ✓ | Ratification |

| Mexico, Canada | ✓ | USMCA share of steel, aluminum, cars |

| China | ✓ | Fentanyl relief, extension of tariff, cease-fire |

| UK | ✓ | Details TBC |

| Korea, Thailand, Vietnam, Malaysia, Indonesia | ✓ | Details TBC |

| Taiwan | X | In progress |

| Switzerland | X | In progress |

| India | X | Potential deal due to geopolitics |

| Brazil | X | Geopolitics make resolution unlikely |

| Sector Tariffs | ||

| Auto, Steel, Aluminum, Copper, Pharmaceuticals, Heavy Trucks | ✓ | |

| Semiconductors, Aircraft, Critical Minerals, Polysilicon | X | Semiconductors is highly complicated due to supply chains and strategic importance |

| Legal Issues | ||

| IEEPA | X | Can other legal frameworks (sections 122, 338, 201) substitute quickly and fully? |

| Section 122 | X | Legally untested, but instant tariffs albeit with 150-day limit, then congressional extension |

| Section 338 | X | Legally untested, with limits up to 50% and 30-day rollout |

| Section 201 | X | 120-day rollout for USTC investigation |

Source: State Street Investment Management Macro Policy, as of September 25, 2025.

Investment implications: From global trade to domestic stimulus

Certainly, any legal cancellation of existing tariffs without a rapid replacement would have macro consequences. Namely, if it forced refunds of paid tariffs and delayed future trade policy.

This would be marginally stimulative for the US economy, akin to a fiscal stimulus. Nevertheless, refunds likely would occur slowly and be hoarded by businesses that have paid tariffs. A worsening fiscal picture would then presumably be expressed in a steeper US bond curve—a low likelihood, but medium impact event.

More narrowly, for the Swiss and Indian markets, any trade deal should be positive. Both equity markets have trailed their peers this year, in our view, in large part due to trade frictions. A trade deal finalized before year-end likely would lift both equity markets and, to a lesser extent, be currency positive. A bilateral deal with Brazil seems unlikely, given the political friction between the two countries, though not impossible.

Regarding sector tariffs, companies with higher pricing power (ability to pass on higher costs) and a stronger research & development pipeline should be better insulated.

Bigger picture, while the risk of abrupt trade policy shifts has diminished, investors should remain alert to ongoing trade negotiations, potential retaliatory measures, and sector-specific regulatory changes that could reshape supply chains and pricing power.

Stay current on how tariffs are impacting inflation, growth, and policy.