Equities favored as outlook brightens

Each month, the SSGA Investment Solutions Group (ISG) meets to debate and ultimately determine a Tactical Asset Allocation (TAA) to guide near-term investment decisions for client portfolios. Here we report on the team’s most recent discussion.

Macro Backdrop

The US economy appears to be in a transitional phase, marked by slower growth rather than a full-blown recession. Despite negative headlines, economic data has generally exceeded expectations, as shown by the Citi Economic Surprise Index. Although the labor market has weakened, this has not yet dampened consumer activity, while personal income and spending remain stable. Second-quarter GDP was revised upward, reflecting strength in business investment and consumer spending. Investment is being driven by AI-related capital expenditures, strong earnings, and business-friendly policies. Overall, the economy has shown resilience and seems positioned to avoid a recession, barring a major policy misstep by the Federal Reserve or a sharp deterioration in labor market conditions.

In August, the labor market continued to soften, with only 22,000 jobs added and average monthly gains from June through August falling to 29,000, which is well below the 2024 average of 168,000. Unemployment rose to 4.3%, and labor force participation remains subdued. Tariff-related uncertainty may weigh on near-term hiring, but signs of improvement are emerging. Small business sentiment has strengthened, with the NFIB Small Business Optimism Index rising to 100.3 in August, slightly above its long-term average. Business owners reported better operating conditions and increased confidence. While labor quality remains a concern, expectations for future conditions and capital investment have improved, suggesting cautious optimism. Notably, hiring plans in the NFIB survey appear to have bottomed and improved over the past two months. CEO sentiment among large firms has also rebounded, with the Conference Board’s Q3 survey showing a less pessimistic outlook.

Despite rising consumer delinquencies, households still appear capable of supporting economic growth. Continuing jobless claims have been trending higher, but companies are not aggressively laying off employees, which is a supportive signal. Debt service ratios remain relatively low, and although wage growth has moderated, it continues to exceed pre-pandemic levels and remains positive in real terms. The labor market slowdown has disproportionately affected lower-income households, who account for a smaller share of total consumer spending. In contrast, higher-income households, who spend a smaller portion of their income on essentials, are better positioned to sustain consumption, provided job losses don’t become widespread.

Monetary policy remains a key factor in determining whether the US economy can achieve a soft landing. The supercore CPI—core services excluding housing—has been rising and remains above the Federal Reserve’s comfort level. However, rental inflation is expected to ease, and broader inflationary pressures appear manageable, giving the Fed room for further rate cuts. The Fed has also expressed concern about downside risks to employment. Given the weakening labor market and expectations for contained inflation, we continue to believe that a total of 75 basis points in rate cuts is warranted through year-end, followed by an additional 50 basis points in 2026.

We remain mindful of the risks facing the US economy and expect growth to stay subdued through 2025. However, we anticipate a rebound heading into 2026, supported by fiscal stimulus, monetary easing, resilient corporate profitability, and business-friendly policies. Key risks to this outlook include a potential resurgence in inflation and a more pronounced deterioration in labor market conditions, either of which could challenge the recovery trajectory.

Directional Trades and Risk Positioning

Our outlook for risk assets remains constructive, supported by a strong equity forecast and firm signals of investor risk appetite. While our Treasury outlook has improved, our assessment of credit conditions has softened slightly, though it remains positive overall. In response, we’ve continued to increase our equity exposure, reflecting favorable signals from our quantitative models.

Despite ongoing risks and uncertainty, investor sentiment remains resilient. Our Market Regime Indicator (MRI) has held steady since late July, suggesting a sustained risk-on environment. Rather than focusing on headwinds, market participants are encouraged by improving business sentiment, expectations of further rate cuts, and the potential for a soft landing in global economies. Quantitative models show strong risk sentiment across multiple factors, particularly equity trend stability and supportive levels of implied volatility. Although volatility has ticked up recently, it remains consistent with a risk-seeking environment. Sentiment spread analysis also indicates solid investor confidence, reinforcing the MRI’s constructive outlook for equities.

We maintain a positive view on global equities, supported by a broad set of indicators. Our sentiment indicator has strengthened further and remains firmly positive. Since bottoming in April, analysts’ expectations for both sales and earnings have improved significantly, bolstering the case for equity gains. While valuations have become more stretched, corporate balance sheet strength and earnings efficiency continue to support the market. Although price momentum has softened slightly, it remains in favorable territory. Overall, our quantitative model reflects a supportive environment for equities.

Our fixed income outlook has also improved, with the most notable shift being a revised view on interest rates. Unlike last month’s forecast of rising yields, the model now expects rates to remain stable. It continues to project a modest steepening of the yield curve and tighter credit spreads, though less pronounced than previously anticipated.

This change is driven by a moderation in equity momentum and risk sentiment. While both indicators still reflect strong underlying conditions, the pace of improvement has slowed, resulting in a neutral signal. This removes support for higher yields, with both factors now exerting a more balanced influence. Meanwhile, our mean reversion factor favors lower rates, offsetting upward pressure from commodity momentum. The net result is a muted outlook for yields. From a curve shape perspective, the model continues to favor steepening, driven by weaker economic data—evident in leading indicators and the gap between nominal GDP and long-term yields—as well as curve momentum. However, persistent inflation suggests the Federal Reserve may remain on hold, which could introduce flattening pressure. On the credit side, the moderation in equity momentum and risk sentiment is less supportive, but lower Treasury yields continue to provide a favorable backdrop for tighter spreads.

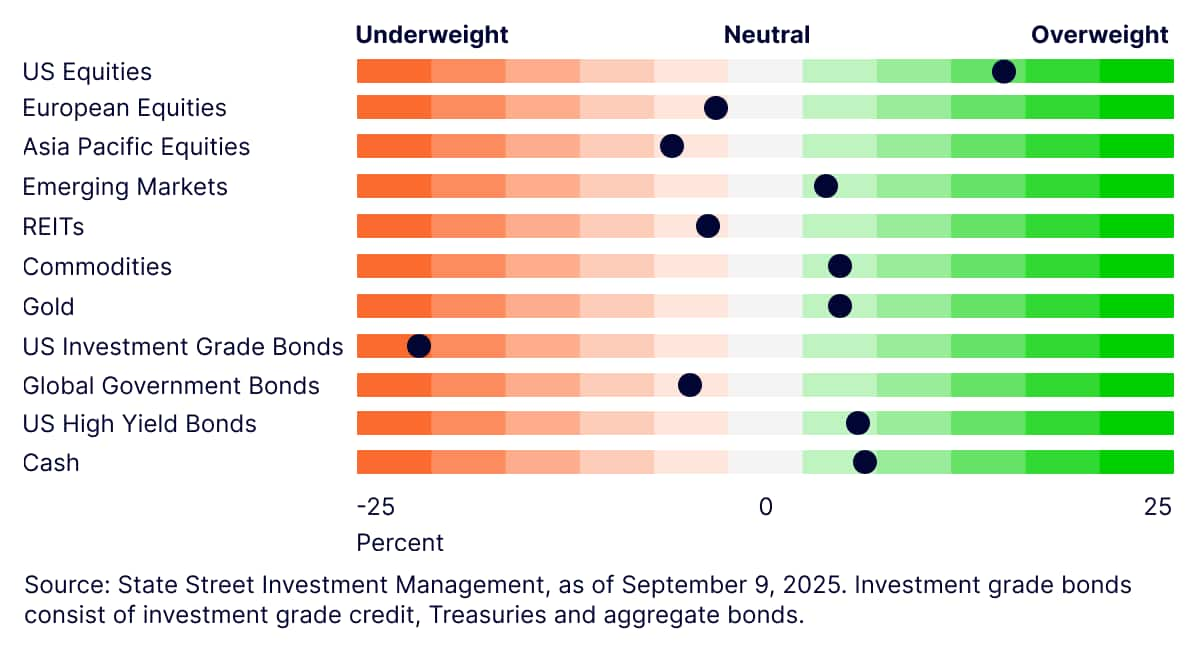

In response to the strong risk-on signal from our MRI and a constructive equity outlook, we have increased our equity overweight. This adjustment was funded by reducing our high yield allocation, which has become less attractive on a relative basis. Additionally, we sold aggregate bonds, increasing our underweight. As a result, we now hold a meaningful overweight to equities while maintaining a more modest position in high yield.

Relative Value Trades and Positioning

Our regional equity outlook continues to favor US equities, with emerging markets also receiving support, albeit to a lesser extent. The US remains our strongest forecast, driven by improving sentiment indicators, particularly in sales and earnings expectations, which reflect growing analyst optimism. Strengthening price momentum and superior financial health, as captured by our quality factor, further enhance the relative attractiveness of US equities.

Emerging markets also show encouraging signals, with both price momentum and quality metrics trending upward. In contrast, non-US developed markets continue to lag. Although valuations in these regions are relatively attractive, sentiment remains subdued and price momentum offers limited support. Reflecting these views, we made no changes during the recent rebalance and maintain our overweight allocations to US and emerging markets, funded by underweight positions in non-US developed equities.

On the fixed income side, our forecasts have largely converged, resulting in no significant changes to sector rankings. Consequently, we did not execute any trades this month and continue to maintain our positioning, with a preference for high yield, investment grade credit, and cash within the fixed income allocation.

In our US equity sector positioning, the top three sectors are:

- Communication Services: Stands out across most indicators, particularly in price momentum, quality, and investor sentiment—ranking among the highest.

- Health Care: Remains attractive due to improving sentiment, especially analysts’ expectations for sales, which have turned positive. Valuations are compelling, and quality factors remain strong.

- Consumer Staples: Has moved up in our rankings due to slightly improved forecasts, attractive valuations, and supportive macroeconomic conditions

In contrast, Financials have declined in our rankings, driven by weakening price momentum—now negative—and softer sentiment indicators.

To see sample Tactical Asset Allocations (TAA) and learn more about how TAA is used in portfolio construction, please contact your State Street relationship manager.