Impact Investing vs. Sustainable Outcome Investing

Part two of our series on Sustainable Outcome Investing. This paper defines impact investing and introduces the complementary concept of Sustainable Outcome Investing.

Clear and consistent terminology is a foundational element of sustainable investing. For investors that have sustainable investment objectives, those objectives can be viewed along a spectrum, from an analysis of financial materiality to an emphasis on targeting real-world outcomes. Along this spectrum, the term “impact investing”1 has often been used interchangeably with other sustainable investing approaches, which can create a lack of clarity and the potential for “impact-washing.”

This paper outlines State Street Investment Management’s perspective on this challenge. We will first establish a definition for impact investing and then introduce a complementary framework, Sustainable Outcome Investing (SOI), designed for investors targeting outcomes in public markets.

The Three Tenets of Impact Investing

The Global Impact Investor Network (GIIN) defines impact investing as “investments that intend to contribute to positive, measurable social and/or environmental impact alongside financial returns.”2 This definition is built on several core components. If “impact” is understood as a change in an outcome, then intentionality and contribution are the key tenets required to generate that change.3 Notably, for an investment to be classified as impact, its contribution must be additional, meaning the contribution must create a positive outcome that would not have occurred otherwise.4 This concept is often referred to as investor additionality.

The third core tenet is measurement: quantifying the actual change in outcome to verify that the intended impact is achieved. Together, intentionality, contribution, and measurement form the foundation of impact investing.

Intentionality

Intentionality within an investment strategy is a key differentiator from strategies that assess sustainability factors based primarily on financial materiality. This principle requires an explicit statement of intent to target a specific social or environmental outcome alongside a financial objective.5 Impact can therefore be treated as a third element in portfolio construction for impact investing strategies, alongside risk and return.

The sustainability objective of an impact investment strategy is typically framed around a real-world issue, with the intended outcome defined as a clear, specific, and measurable target. A key feature of this target is that it is absolute, not relative to a benchmark. For example, an impact objective might be to directly contribute to a reduction in real-world greenhouse gas (GHG) emissions, which is distinct from an objective to lower the carbon intensity of a portfolio relative to its benchmark.

However, intentionality alone is insufficient to classify a strategy as impact investing. An explicit intent does not explain the mechanism by which the impact is achieved or to what extent. This requires an analysis of the other core tenets: contribution and measurement.

Contribution: Asset vs. Investor

Contribution explains the mechanism by which an investment is expected to generate its intended impact. This concept operates on two distinct levels: asset contribution and investor contribution.

Asset contribution refers to the impact generated by the activities of the underlying asset itself. Within this logic, a company’s products and services are its outputs. A common method for assessing the impact of these outputs is through revenue alignment, where revenues are mapped to specific environmental and social activities that drive a desired outcome.

Investor contribution considers how the investor’s own actions lead to the intended outcome. This requires a demonstration of additionality, the principle that the investment causes a change that would not have occurred otherwise. This distinction between asset contribution and the additional impact of the investor is a critical component of impact investing. Hence, an investment strategy that does not demonstrate a credible link to investor contribution would therefore not be classified as an impact strategy.

Theory of Change (ToC)

A well-articulated Theory of Change (ToC) is a critical framework for demonstrating the logic behind both asset and investor contribution. The ToC model is a logic chain that clarifies how different components lead to an ultimate impact. Specifically:

- It demonstrates asset contribution by clarifying how a company’s activities and outputs (e.g., from its products and services) lead to real-world outcomes.

- It demonstrates investor contribution by clarifying the role of the investor’s capital as a key input that enables the entire causal chain.

- Inputs: Resources used to enable an activity (e.g., capital, materials, personnel).

- Activities: The core operations performed (e.g., manufacturing, service delivery).

- Outputs: The direct products or services resulting from the activities.

- Outcomes: The tangible changes experienced by stakeholders due to the outputs.

- Impacts: The broader, long-term social or environmental effect of the outcomes.6

For example, a simplified ToC for a direct investment in a new wind farm might look as follows:

- Inputs: The provision of additional investment capital.

- Activities: Construction and operation of the wind farm.

- Outputs: Production of low-carbon energy.

- Outcomes: Displacement of fossil-fuel-based energy on the grid.

- Impacts: A reduction in GHG emissions.

Measurement

The third tenet, measurement, is the process of quantifying the real-world impact to verify that the intended outcome is achieved. While intention and contribution are based on assumptions, measurement tests the validity of those assumptions. It assesses whether the investment approach is delivering its targeted impact.

The three tenets of intentionality, contribution, and measurement are interconnected. However, it is the specific nature of the contribution tenet, which requires a credible demonstration of investor contribution and additionality, that fundamentally defines and distinguishes an impact investing strategy. Consequently, an approach that does not feature this specific element, even if it has intentionality and measurement, would fall into a different category on the sustainable investing spectrum.

Application: Challenges in Public Markets

The principle of investor contribution has significant implications for investment strategy design. Because the most direct mechanism for investor contribution is the provision of new capital, impact investing aligns most naturally with private and, to a certain extent, primary market investments. Demonstrating investor additionality in public secondary markets, however, presents a fundamental challenge.

In public equities, for example, the vast majority of trading occurs in the secondary market. In these transactions, capital is exchanged between investors, and no new capital flows directly to the issuer. This structure makes it difficult to demonstrate additionality, as the direct causal link between the investment action and a specific impact is not clear.

Nevertheless, there is investor interest in considering outcomes into the investment process in the public markets. To address this need, this paper introduces the concept of Sustainable Outcome Investing (SOI). This is not a replacement for impact investing, but a distinct approach on the sustainable investing spectrum. It focuses on asset contribution and is designed specifically for the structure of public markets, offering a useful framework for investors who target certain sustainable outcomes but cannot demonstrate direct investor additionality.

Sustainable Outcome Investing (SOI)

The primary differentiator between SOI and impact investing is its focus and the priority of its objectives. In the context of public markets, SOI focuses on asset contribution rather than investor contribution.

The goal of an SOI strategy is to construct a portfolio of assets whose products and services contribute to certain environmental or social outcomes. While this approach has been described by others as “impact-aligned,” or “secondary impact,” the term Sustainable Outcome Investing is used here to emphasize the continued focus on targeting measurable, sustainable outcomes.7 The analysis centers on the outcomes generated by the assets (asset contribution), and not on a claim of additional impact generated by the investor’s actions (investor additionality).

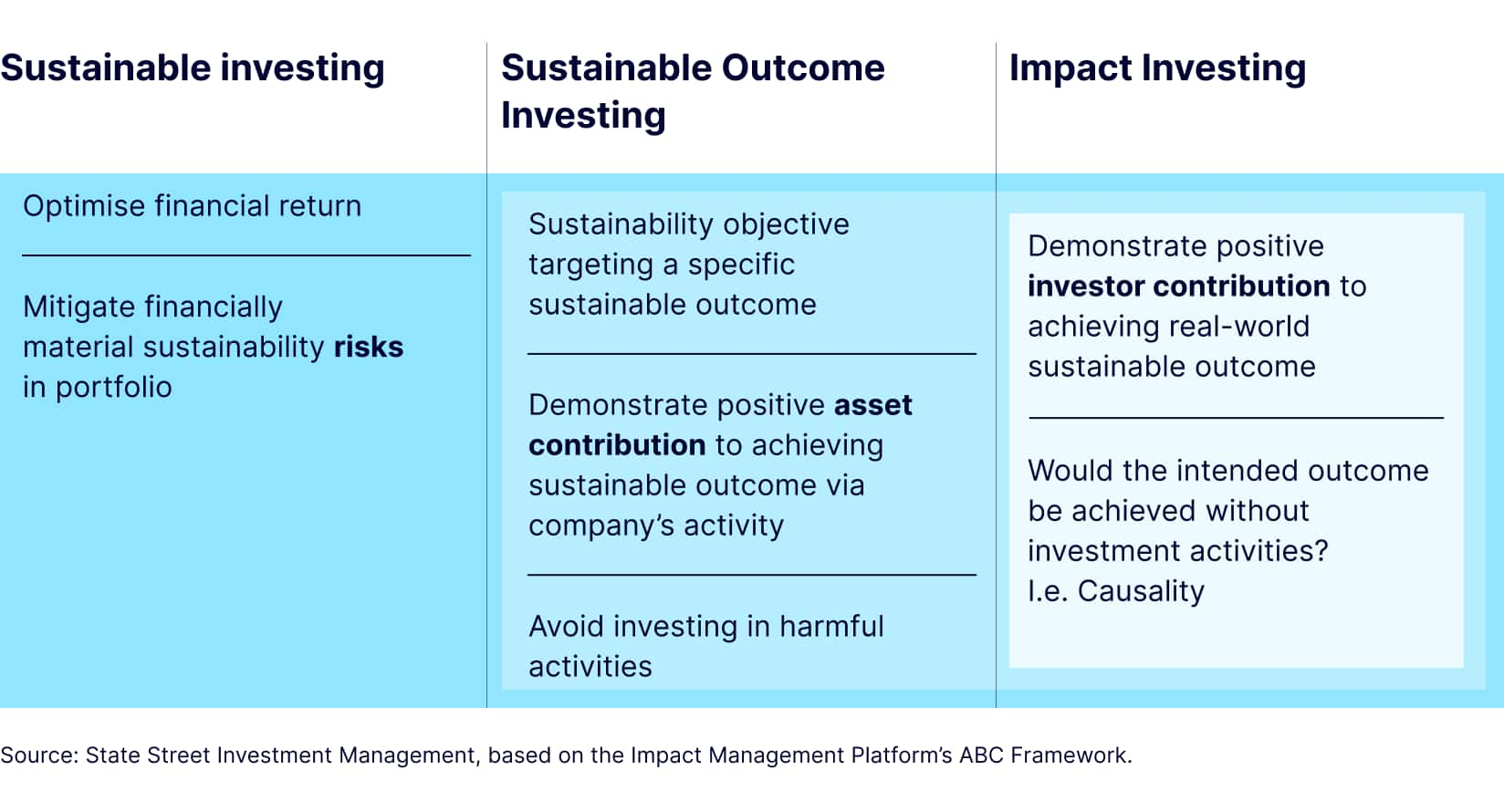

Figure 1: The Role of Contribution in Different Investment Objectives

A critical feature of SOI is that it provides a mechanism to apply the principles of intentionality, asset contribution, and measurement of the stated objective in public markets without making unsubstantiated impact claims. SOI does not claim investor additionality and therefore does not claim to create a direct causal impact. It does, however, seek to invest in companies whose products and services contribute to a positive outcome.

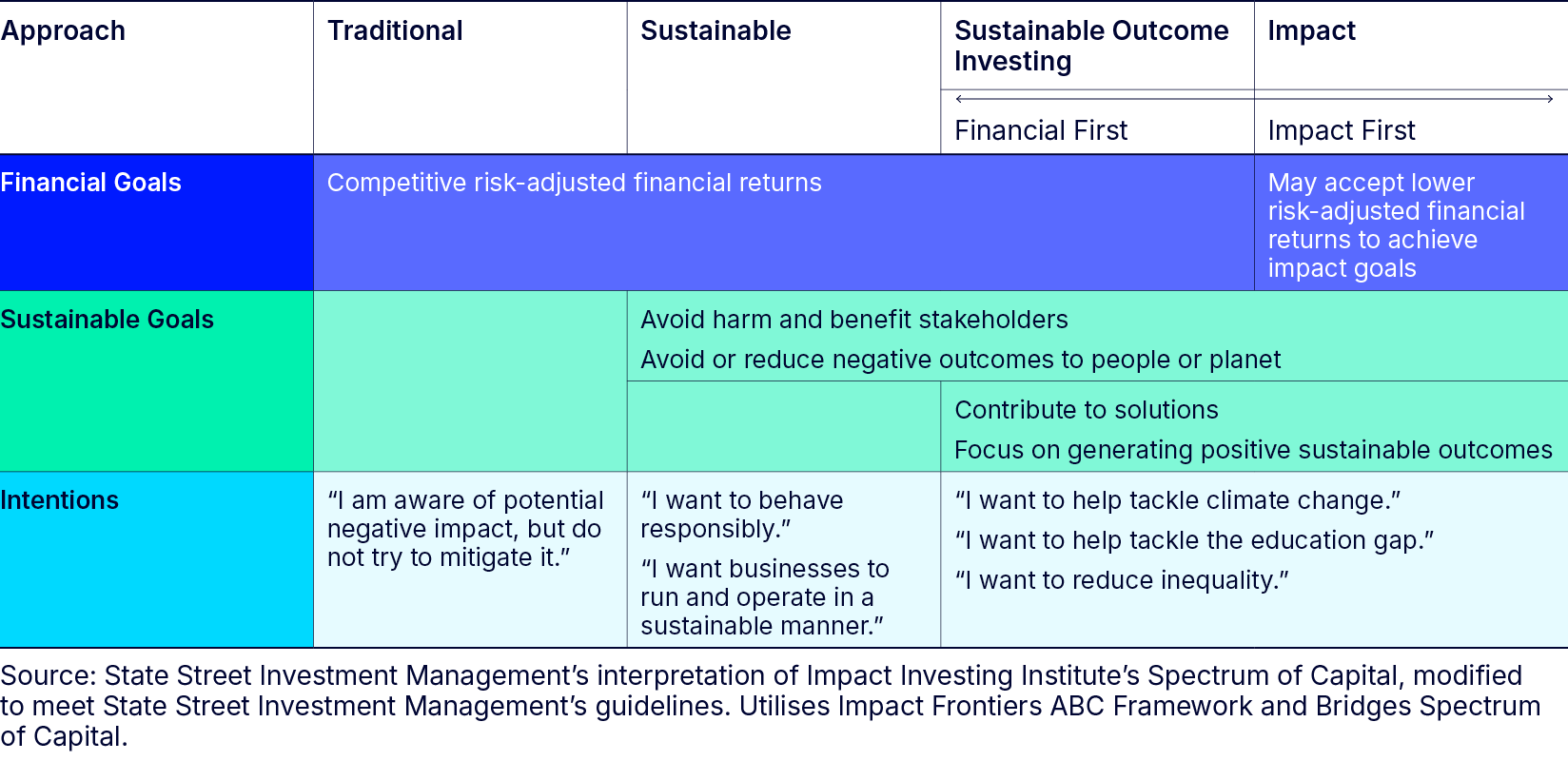

Taking this into account and building on the sustainable investing spectrum of capital discussed in our previous paper, we see that SOI occupies a distinct position. Figure 2 illustrates this positioning, summarizing the key differences in approach, financial goals, and sustainable intentions.

Figure 2: Positioning Sustainable Outcome Investing on the Spectrum of Capital

Conclusion

Understanding the distinction between impact investing and Sustainable Outcome Investing can help investors identify appropriate approaches for targeting sustainability outcomes in public equity markets. Sustainable Outcome Investing, which applies a Theory of Change model, can provide a data-driven framework that emphasizes asset contribution. By leveraging this approach, investors can aim to build portfolios with an emphasis on real-world sustainable outcomes.

The next paper in this series will detail our approach to identifying sustainable outcome investment.