Consistency as a compass in emerging market equities Using Information Ratio to select disciplined, risk-adjusted strategies

In emerging markets (EM), the pursuit of high excess returns often leads to unpredictable outcomes and disappointment. We believe efficiency and predictability beats chasing returns and, in this paper, we make the case for a disciplined, risk-adjusted investment approach that seeks to maximize Information Ratio (IR).

We have often heard the comment that “you can’t eat risk-adjusted returns.” We very much disagree and in this article, we’ll explain why and make the case that risk-adjusted returns are indeed the best way to assess the skill of a manager.

Before diving in, we would like to highlight a few key concepts to keep in mind as we explain the importance of risk-adjusted returns.

- Skill Managers should strive to generate a return for the risks they take and minimize risks where they lack ‘skill’; an essential concept when building an efficient portfolio. The optimal measure of manager skill in benchmark-relative performance is IR.

- Predictability In real life, predictability matters. The large dispersion of EM equity returns offers a wider opportunity set for skilled managers, but it also means more risk. EM equity returns exhibit fat tails and negative skew, which means greater downside and idiosyncratic risk threatening your capital if your manager has low skill or bad luck.

- Consistency Even if a manager has skill over the long term, dramatic swings in performance create complications for asset allocators and investors who may face benefit payments, regulatory scrutiny, and other capital expenditure needs. Consistency provides assurance. In our view, it would be better for clients focusing on their asset allocation strategies to avoid big style positions.

- Core is always in style In an industry that loves to chase themes and the latest shiny object, always remember that today’s hero can become tomorrow’s goat. In an investment area that has higher levels of idiosyncratic risk, the best approach is a conservative one. While it may be tempting to think that it is always best to use one’s risk budget in the most inefficient areas, risk control matters. Extreme events happen.

Next, we will provide insights using real world-data to help enhance your asset allocation strategy in this fertile ground for generating alpha. We will also highlight the benefits of adopting a bottom-up Core approach, with an emphasis on maximizing IR, as the most effective strategy for deploying your risk budget.

First, Information Ratio—what is it?

Information Ratio (IR) is best conceptualized as a method of measuring excess returns adjusted by their historical variability. It provides a framework for equal comparison using risk-adjusted returns of alpha efficiency, measuring the level of excess return a portfolio generates for each unit of active risk.

Information Ratio = Alpha (excess return over the benchmark)/Tracking error (volatility of alpha)

Manager selection is difficult

Evaluating managers is undoubtedly a challenging task that requires a complex and sophisticated holistic approach, focusing on multiple characteristics alongside returns. However, an overemphasis on excess returns can complicate this exercise.

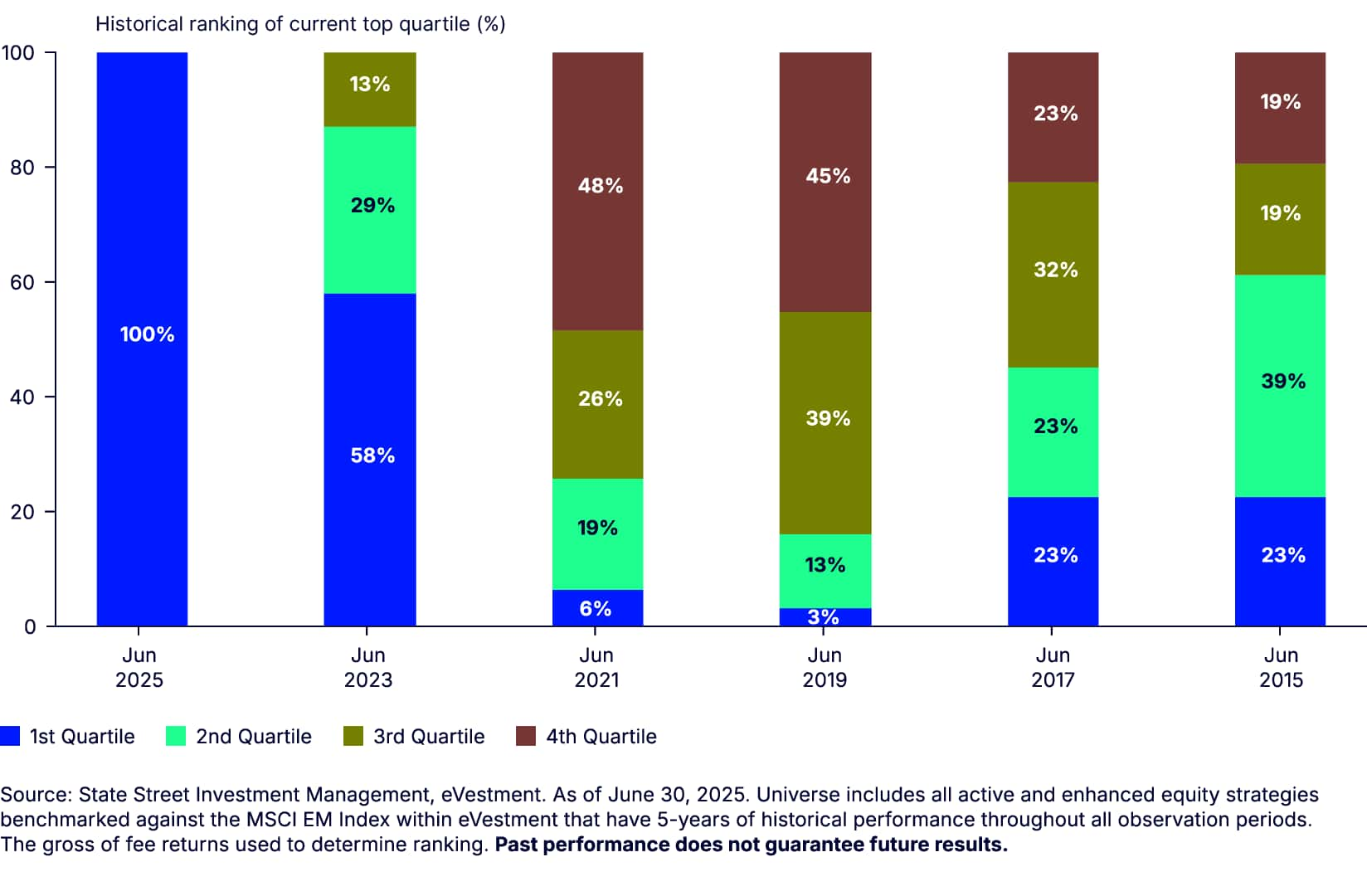

To demonstrate the difficulty, let’s start by identifying the top quartile ranked strategies1 based on 5-year excess returns and trace their rank over the past 10 years in 2-year increments. Going back two years, we find that less than 60% of these managers were in the top quartile two years prior. Looking back to 2021, just over 5% were in the top quartile, with nearly 50% falling into the bottom quartile. Extending our view back 10 years, we observe a fairly even distribution across the four quartiles.

Figure 1: Don’t just chase returns

Historical ranking of current top quartile—trailing 5-year excess return

It’s safe to say, while effective marketing can highlight favorable periods of performance, finding managers with a consistent track record over a longer-term horizon is a challenging endeavor without risk considerations. The temptation to “buy high” or chase performance is simply unhelpful to asset owners. Therefore, it is essential to focus on more than just returns.

Instead, focus on IR

Information ratio provides a better and more stable yardstick for comparison.

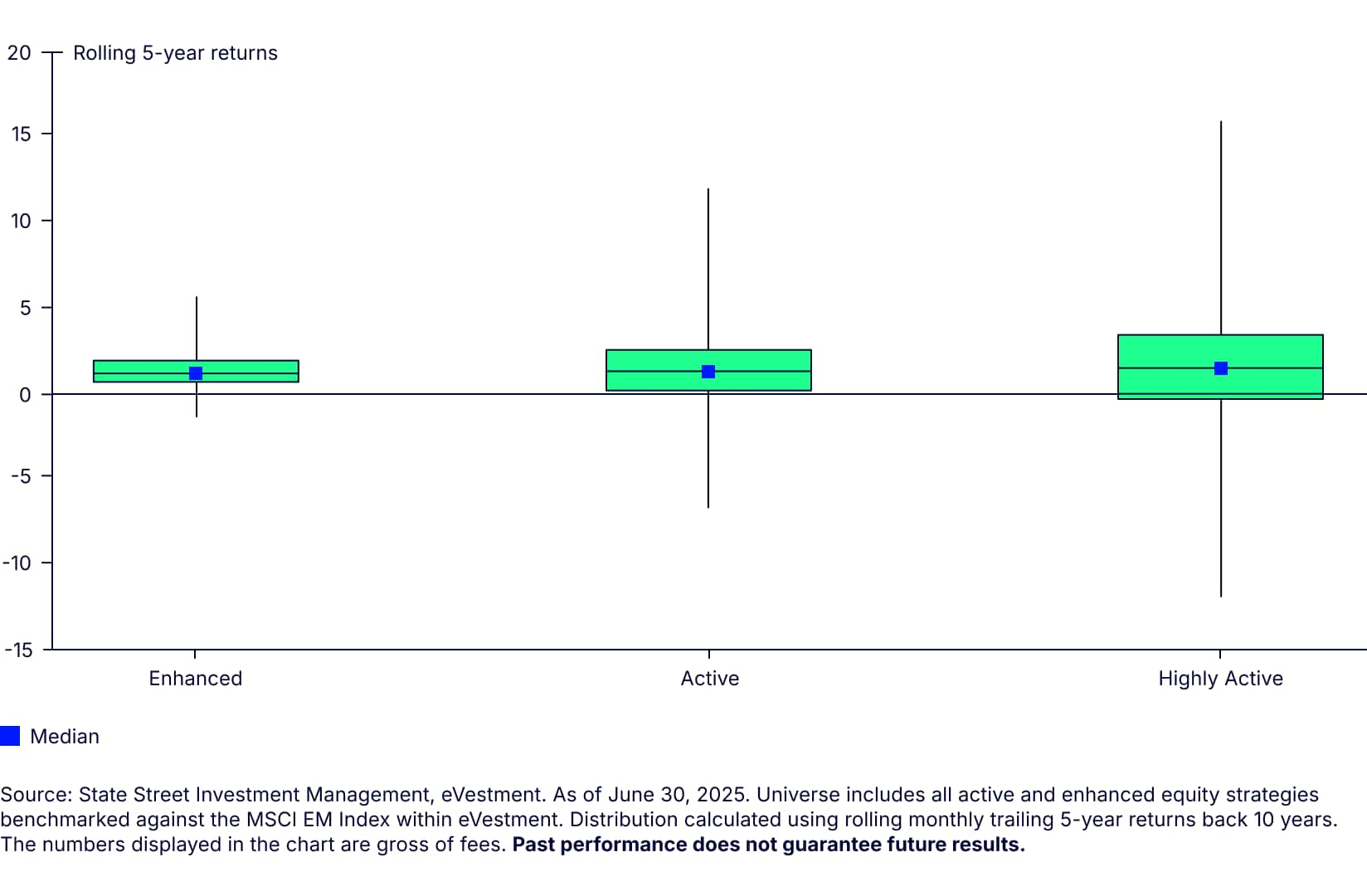

To prove this point, let’s first examine the variability of returns across three distinct risk cohorts based on Tracking Error (TE): Enhanced (TE <2.5%), Active (TE 2.5%-5%) and Highly Active (TE >5%). As expected, the dispersion of returns increases as we move up the risk spectrum. However, contrary to expectations, we find the average excess returns are quite similar. Although Active and Highly Active strategies have the potential of generating greater excess returns, on average there is little gain over the lower-risk Enhanced group—which comes at the cost of the increased probability of experiencing painful drawdowns.

Figure 2: Predictability matters—understand your drawdown risks

Distribution of 5-year returns—enhanced and active emerging market strategies

In general, higher active risk requires fewer bets with higher concentration, reducing diversification benefits. This implies that as one assumes more risk (higher tracking error) the incremental increase to excess return declines, a diminishing trade-off between risk and reward. The effect is a decay in the efficiency of the alpha (IR) or the portfolio’s return per unit of risk.

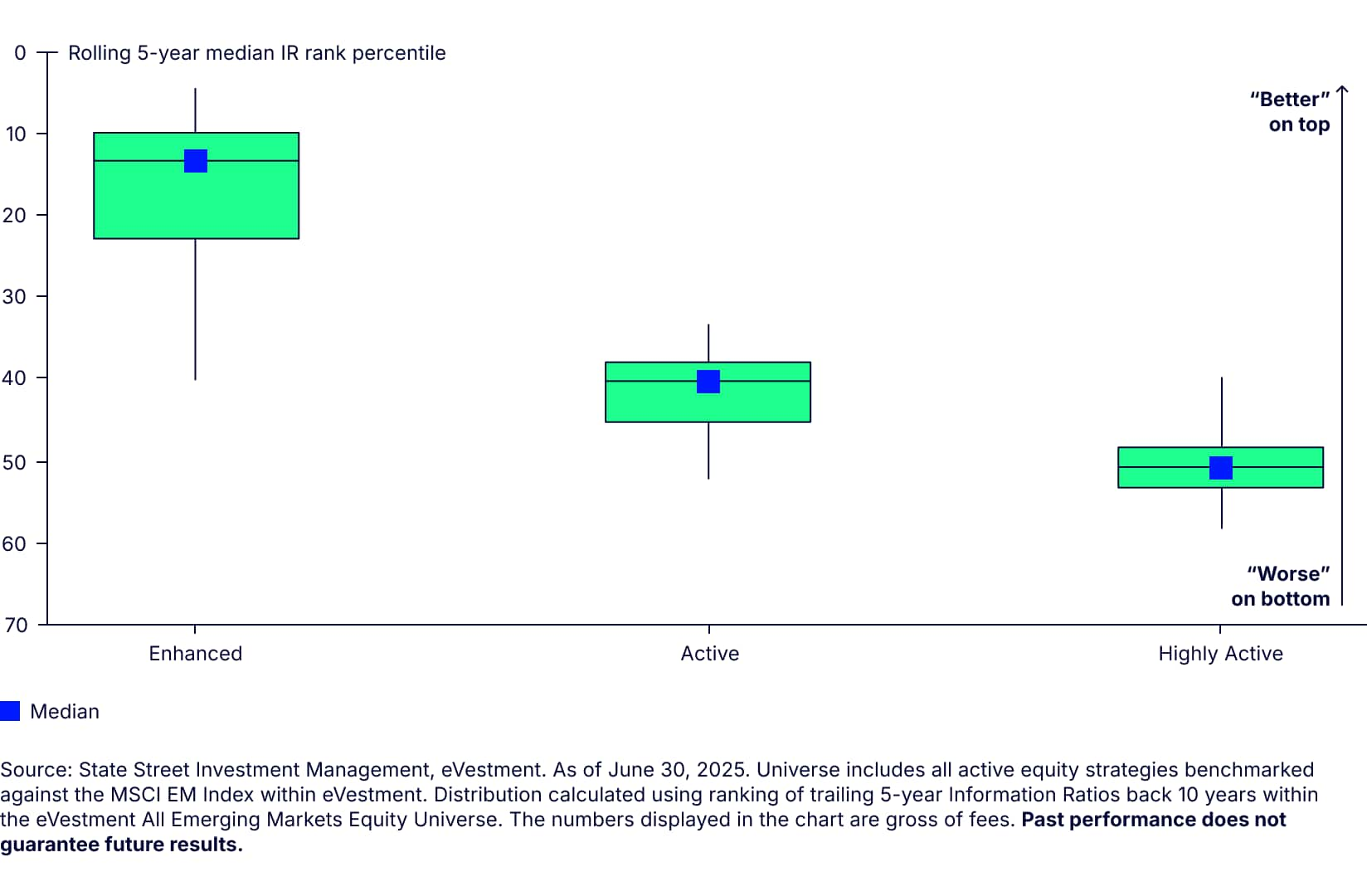

Using the same three cohorts, we find a more stable ranking of IR within the Enhanced approach.

Figure 3: Choosing efficiency over returns delivers consistency

Distribution of 5-year median IR rank percentile—Enhanced and Active emerging market strategies

Lower-risk Enhanced strategies are designed to offer greater consistency and predictability in risk-adjusted returns. By utilizing a highly risk-controlled approach, these strategies help minimize unintended or uncompensated risks while delivering a well-balanced and highly efficient portfolio.

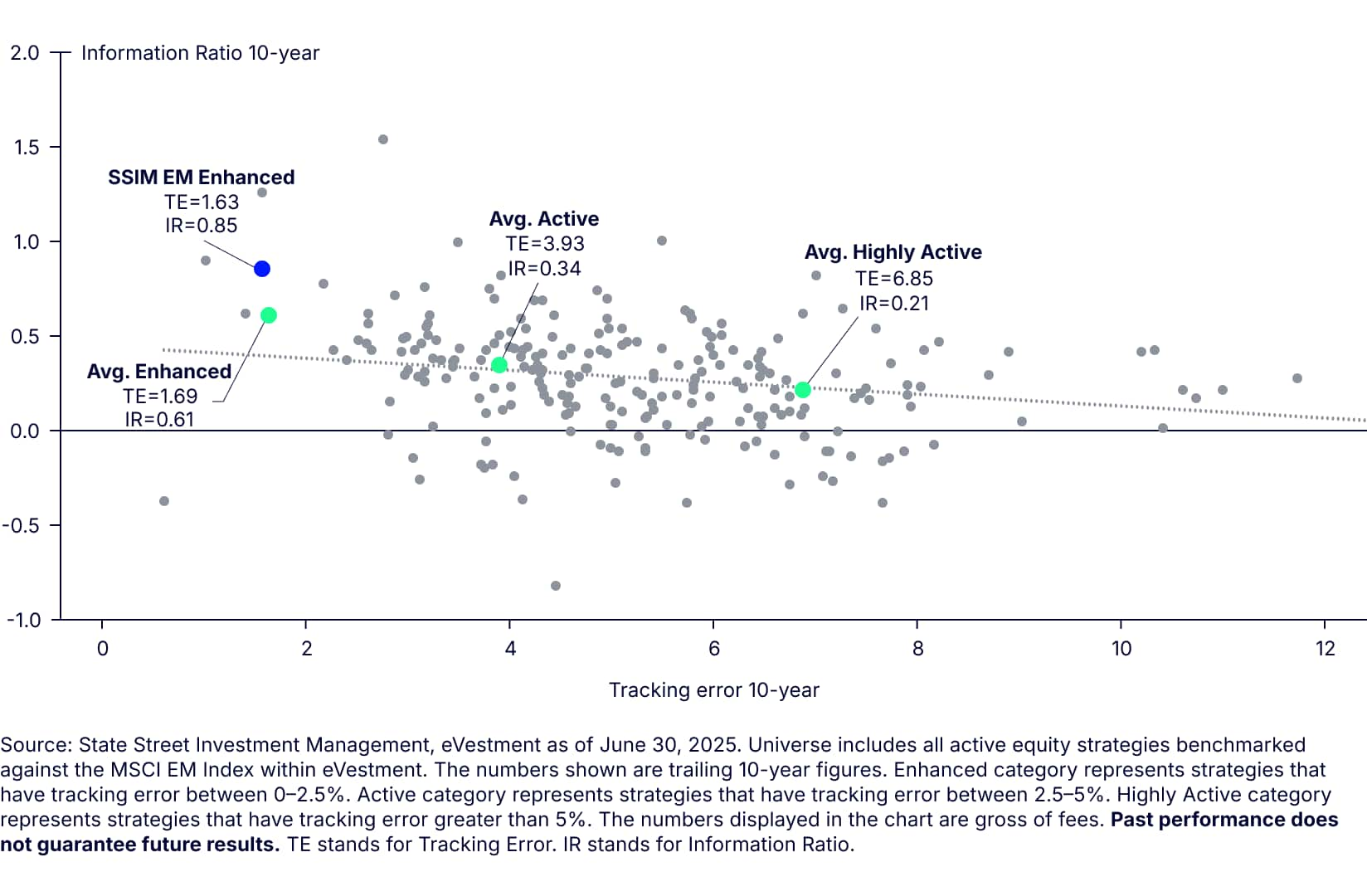

Another way to illustrate this relationship is by comparing the trailing 10-year IR and Tracking Error of the full universe of strategies, again broken down by active risk cohort. First, you’ll notice the downward-sloping trend line, which highlights the strong relationship between increased tracking error and lower relative IR. Focusing on the risk cohorts, we observe the same relationship. Lower-risk Enhanced products deliver the highest IR, with an average 10-year IR of 0.61, declining to an average of 0.34 for Active products and 0.21 for Highly Active products.

Figure 4: Get rewarded for the risks you take—mitigate the others

Emerging market Active and Enhanced strategies

Core exposure offers the most stability

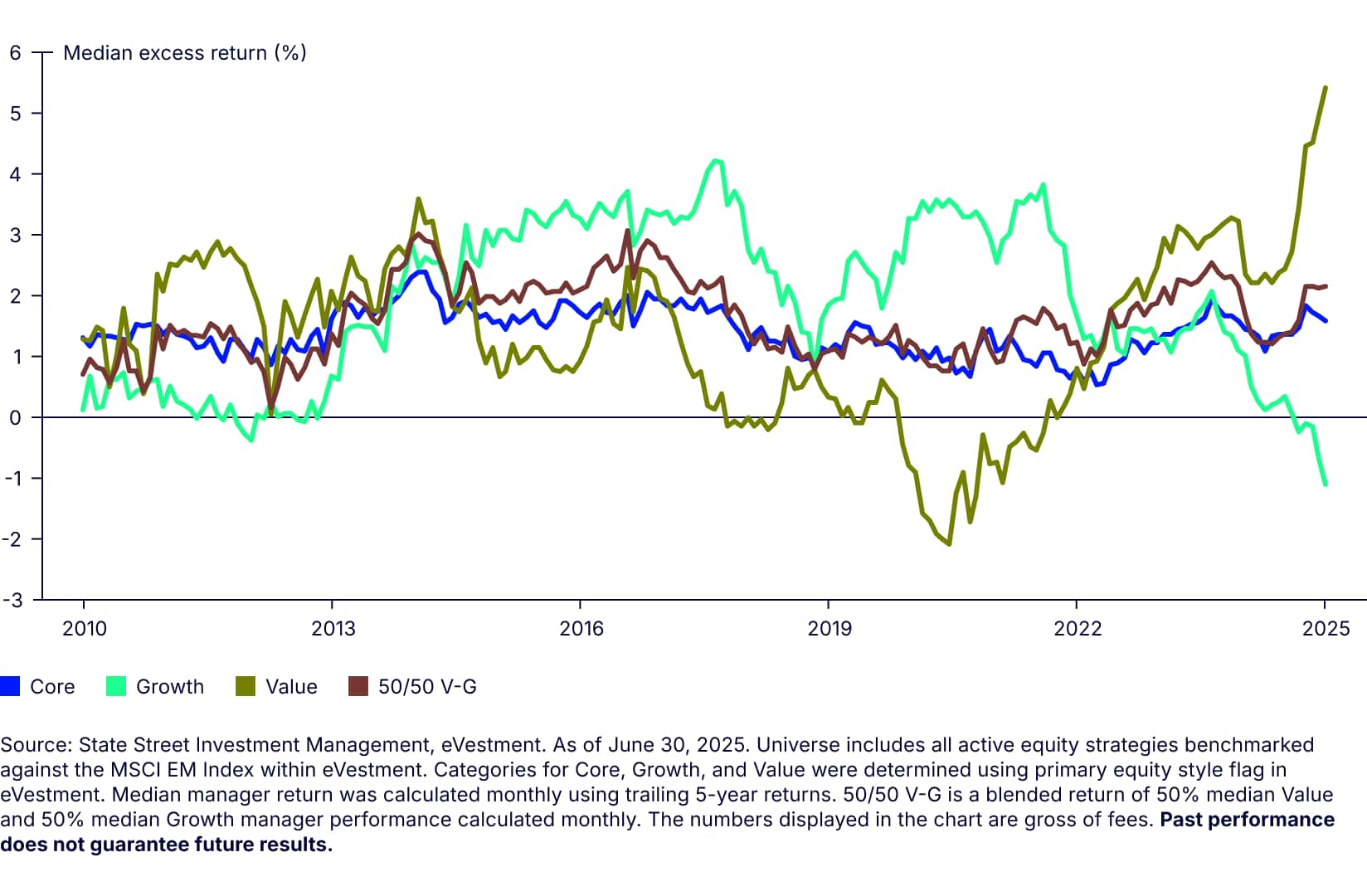

Certainly some of these effects can be attributed to style, which go in and out of favor throughout the business cycle as risk appetites and economic outlooks change. We can visualize this dynamic by charting the median 5-year return for each of the three main style categories—Core, Value, and Growth. There are distinct periods when Value or Growth strategies are favored, while Core strategies offer more consistency throughout the cycle. If we were to adopt a simplistic 50/50 approach to allocating between Value and Growth managers, the end result aligns closely with that of Core managers.

Figure 5: Want stability? Choose core

Style performance—rolling 5-year median excess return

If you believe you have the skill to time the Value versus Growth payoff, there are potential additional benefits. However, this is also undoubtedly a challenging endeavor. We believe that a Core approach is the optimal framework for delivering consistent alpha across varying market environments and throughout full market cycles.

Targeting the most rewarding risk segment

We recommend allocating your risk budget to the most efficient alpha source that offers the greatest potential for maximizing your risk-adjusted returns (Enhanced) and scaling up exposure to achieve a desired return requirement. By allocating to a highly diversified and balanced portfolio with core exposure, you can avoid style, country, sector, geopolitical, and macro risk, mitigate drawdowns, and improve consistency and predictability.

Additionally, this approach provides a portfolio that exhibits characteristics similar to the index (beta near 1), allowing investors to scale up exposure from passive allocations if additional returns are required, all while maintaining cost efficiency.