Insights

COVID-19 benadrukt het belang van ESG

11 May 2020

At the start of 2020, optimism was high on the ESG front. We looked forward to seeing the fruition of the Paris Agreement, progress towards the European Green Deal (what Ursula van der Layden called Europe’s ‘man on the moon moment’), the launch of an EU sustainability classification system or ‘green taxonomy’ and introduction of new climate benchmarks. Whilst some actions have been delayed out of necessity, for example the postponement of COP26 in Glasgow, ESG has remained top of mind for many investors during the COVID-19 crisis.

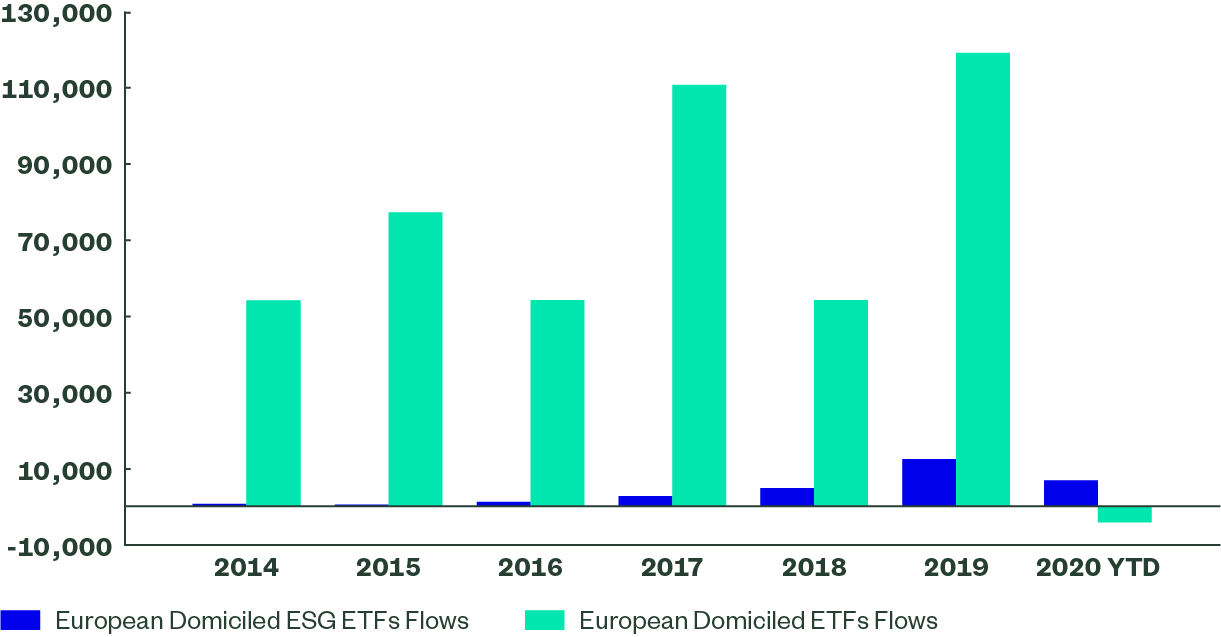

In the first quarter of this year, European-domiciled ESG ETFs enjoyed net inflows of $6.8 billion, taking the combined AUM to $35.3 billion.1 Remarkably, inflows have been constant throughout recent months, even with flows into equity ETFs turning negative in March. And this built on record flows in the precious year as shown in the chart.

Clearly, in absolute terms ESG investments are still not mainstream, and this helps the momentum. Investors are still transitioning, making sustainability integral to portfolio construction and risk management, exiting investments that present a high sustainability-related risk and buying into the growing range of ESG ETFs available. So far, the economic and health crisis surrounding the COVID-19 pandemic has reinforced the trend, knocking earlier critics who thought ESG would not survive difficult markets.

Net flows into Equity & ESG UCITS ETFs

Source: Morningstar, as of 31 March 2020. Flows are as of the date indicated and should not be relied upon thereafter

ESG is highly relevant

Outperformance of ESG indices. It has long been debated how well ESG funds would perform compared to traditional funds during market sell-offs. There have been few opportunities to settle this debate given that the growth of ESG investing in recent years has occurred against a relatively benign market backdrop.

Until now. The highest profile ESG indices from major providers including MSCI, S&P and STOXX have outperformed their parent indices so far this year. This was highlighted by a study from Morningstar, which found that sustainable and ESG equity indices outperformed conventional indices in the Global, Europe and US Large-Cap categories.1 The reasons for the relative performance depend on the methodology of each index but could be a result of excluding some aerospace companies, lower exposure to the energy sector, or the overweighting of companies with quaity criteria (such as stronger balance sheets), which often rank highest under ESG criteria.

New focus on the ‘S’ in ESG. The social part of ESG analysis has often been perceived as rather vague and less significant than other factors. However, social considerations are highly important in this crisis, with factors such as accessibility and affordability of health care (including drug pricing), financial services, utilities, education and telecommunications. Also high on the agenda is a company’s ability to create and maintain a safe and healthy workplace environment.

Asset managers’ engagement is important. At State Street Global Advisors, as shareholders we encourage companies to refrain from undertaking undue risks that are beneficial in the short-term but harm longer-term financial stability and the sustainability of the business model. Communication is always amongst our top priorites for company management. Now shareholders should expect communication on the short and medium-term potential impact the COVID-19 pandemic on the business, overall operations and supply chains, including management preparedness and scenario planning and analysis. We also want to hear how this crisis might impact or influence a company’s approach to material ESG issues as part of their long-term business strategy.

Simple is sometimes the best option

Asset management plays a pivotal role in the financial system, given the industry’s vast portfolios under management, interactions with companies and power in shaping government policy as a key economic sector. State Street Global Advisors uses its voice in far-reaching stewardship activities and has built a large number of ESG solutions.

For investors looking to invest in an ESG strategy for the first time, to show a commitment to this revolution, SPDR offers a straightforward approach. We have two ETFs offering broad exposure to key indices, S&P 500 and STOXX 600, with the most popular exclusions. These ETFs are managed with a transparent methodology and a ‘Fast Exit’ feature to react quickly to breaking ESG controversies.

The exclusion criteria aim to eliminate exposure to controversial weapons and civilian firearms, tobacco and thermal coal, as well as companies that do not comply with the Ten Principles of the UN Global Compact. The aim to is to exclude certain major ESG risks without deviating too far from the market. The methodology has resulted in low tracking error and similar performance characteristics to the parent indices.

Despite the relative simplicity of these ESG exclusion indices, they have also outperformed their parent benchmarks year to date.

How to play this theme

SPDR offers two ETFs through which investors can access these themes. To learn more about these funds, and to view full performance histories, please follow the links below:

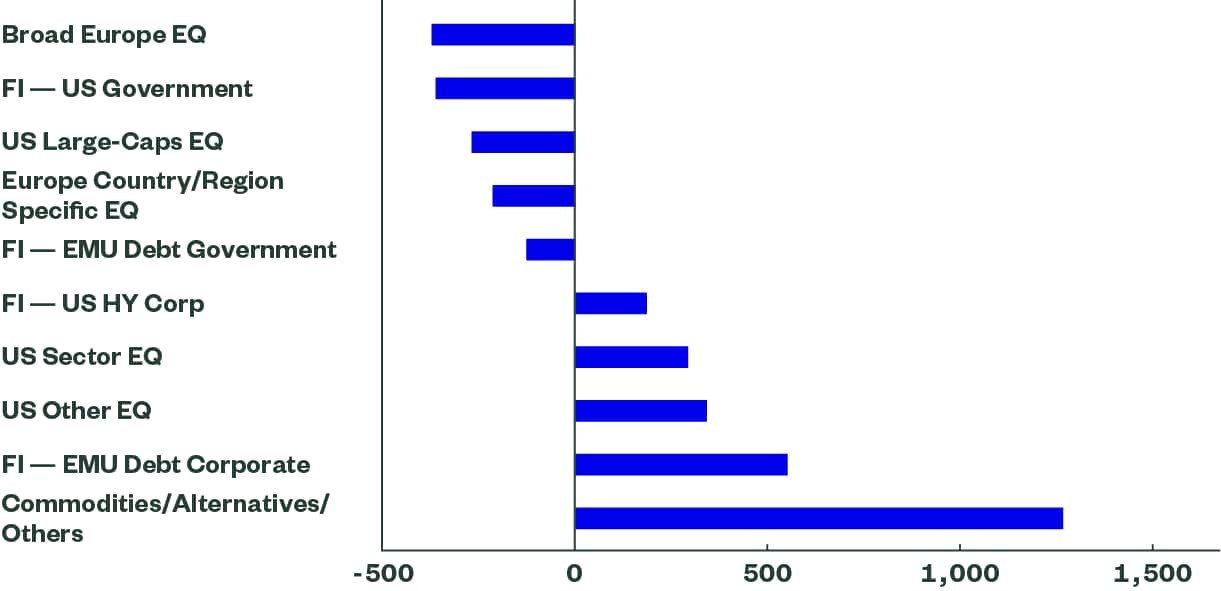

European-Domiciled ETP Segment Flows (Top/Bottom 5, $mn)

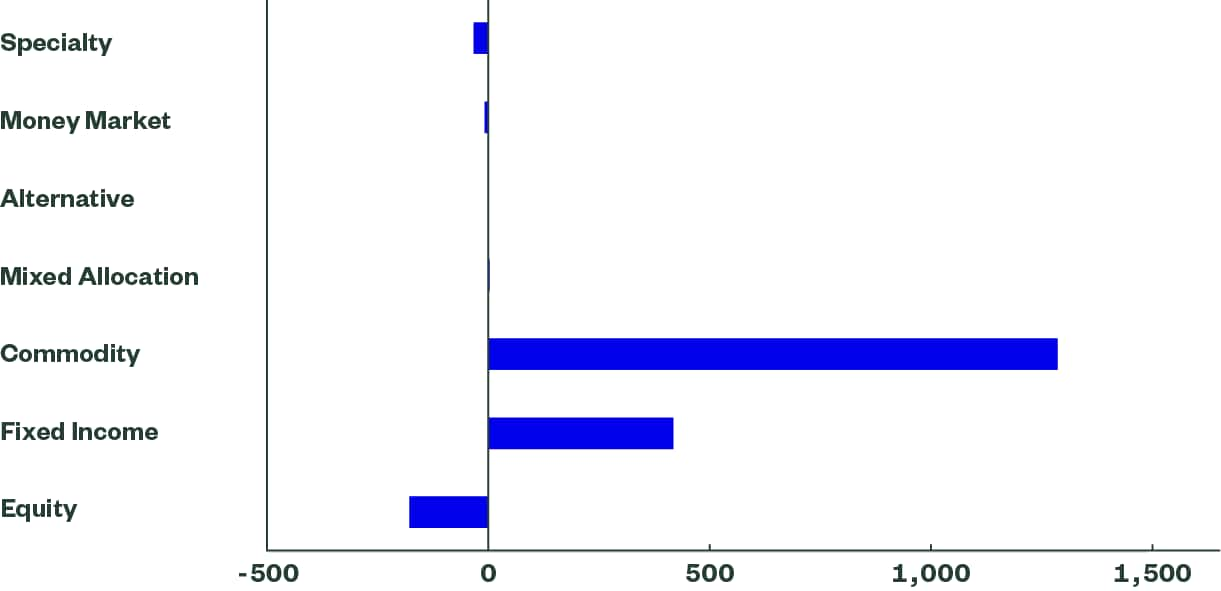

European-Domiciled ETP Asset Category Flows ($mn)

Sources: Bloomberg Finance L.P., for the period 30 April – 7 May 2020. Flows are as of date indicated and should not be relied upon as current thereafter