Investor Sentiment: Pockets of Optimism With a Continued Preference for Relative Safety

This data captures behavioral trends across tens of thousands of portfolios and is estimated to capture just over 10% of outstanding fixed income securities globally.

Q1 2023

Piquing Interest in Peaking Rates

Central banks kept the pedal to the metal at the end of 2022, hiking rates another 19 percentage points and bringing total annual hikes to almost 100 percentage points across developed and emerging markets. Developed central banks were a larger portion of this tightening, as they tried aggressively to catch up after falling far behind the inflation curve. As overall financial tightening accelerated, the global impact of higher rates had a greater impact on financial conditions in the US, eurozone and UK than in smaller economies. And while more economies now face rates that will restrict economic activity, central banks have held to their hawkish message, by either continuing aggressive hikes or surfacing the prospect of higher rates for longer.

The implicit goal of slowing economic growth has raised the spectre of recessions across the globe, with the IMF projecting that one third of countries may see GDP contract, while the US, eurozone, and UK are precariously close to stall speed. As a result, many recession indicators are flashing more brightly, with the curve inversion in the US reaching levels last seen in the 1980s.

Fixed income investors interpreted these developments as growing signs that the tightening cycle would be nearing a conclusion, if for no other reason but to counteract a recession. In response, fixed income rallied into Q4 2022, with investors starting to expect rate cuts this year. Gains for the asset class were fairly wide ranging, as sovereign debt, corporates and emerging market (EM) bonds finally reversed three quarters of losses.

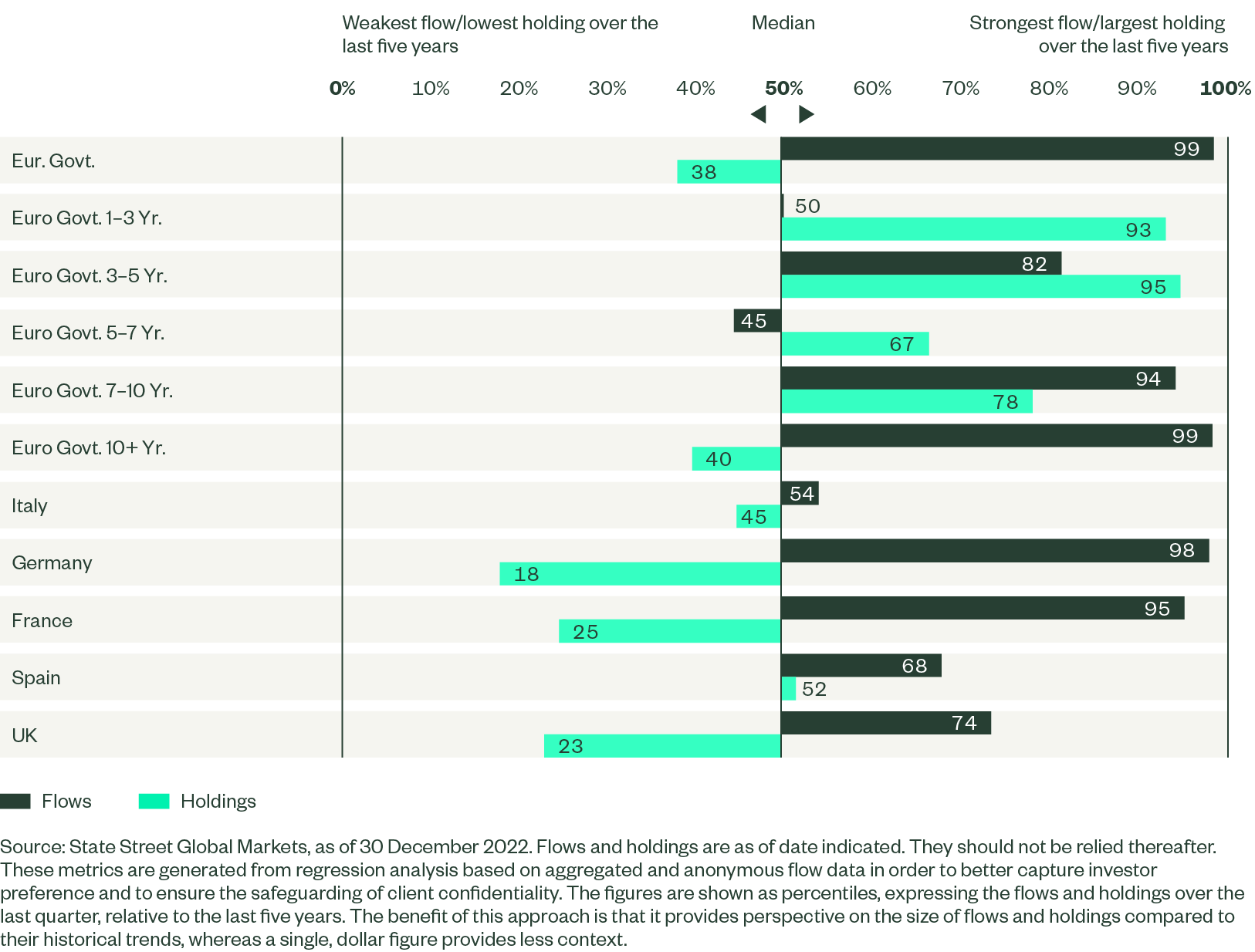

While the risk rally was widespread, investor behaviour showed a preference for relatively safer fixed income assets. Treasury debt was at the top of this list, with overall 60-day flows remaining in the 90th percentile throughout December. From a maturity perspective, real money Treasury investors favoured duration, with the 5-7 year part of the curve showing the greatest strength. Buying safe duration was also apparent in the eurozone, with inflows among the strongest in five years, led by the long end. From a country-specific perspective, buying was led by Bunds and OATs, while BTPs and Bonos lagged with at least neutral activity. Overall corporate bond flows also improved, although investment grade saw a far stronger gain in activity relative to high yield, where flows improved just to neutral. The glaring laggard among our fixed income coverage was EM debt as the risk of recession kept investors closer to domestic markets.

Support for Treasuries, Not So Much for TIPS

The Federal Reserve (Fed) continued its aggressive campaign of tightening financial conditions in Q4, with the final two meetings of the year adding 125 basis points (bps) to short-term rates. Despite the Fed’s consistently hawkish policy actions and rhetoric, the market focused on the end of the tightening cycle. So, while acknowledging a higher terminal dot in the year-end Fed forecast, investors nonetheless maintained their view that a 5.125% federal funds rate would be followed by aggressive cuts near the end of 2023.

This aggressive pivot remains priced into expectations despite the Fed essentially stating that no one on the FOMC felt rate cuts would be appropriate in 2023. This outlook created a supportive environment for risk assets in Q4, with both fixed income and equity asset classes posting their strongest quarterly gains of the year. Longer Treasury yields also appear to have reached peak levels, topping out at 4.25% before retracing back toward 3.5% on growing recession fears. The short end nonetheless remained hostage to continued rate hikes, thereby inverting the curve to its most negative levels since the 1980s.

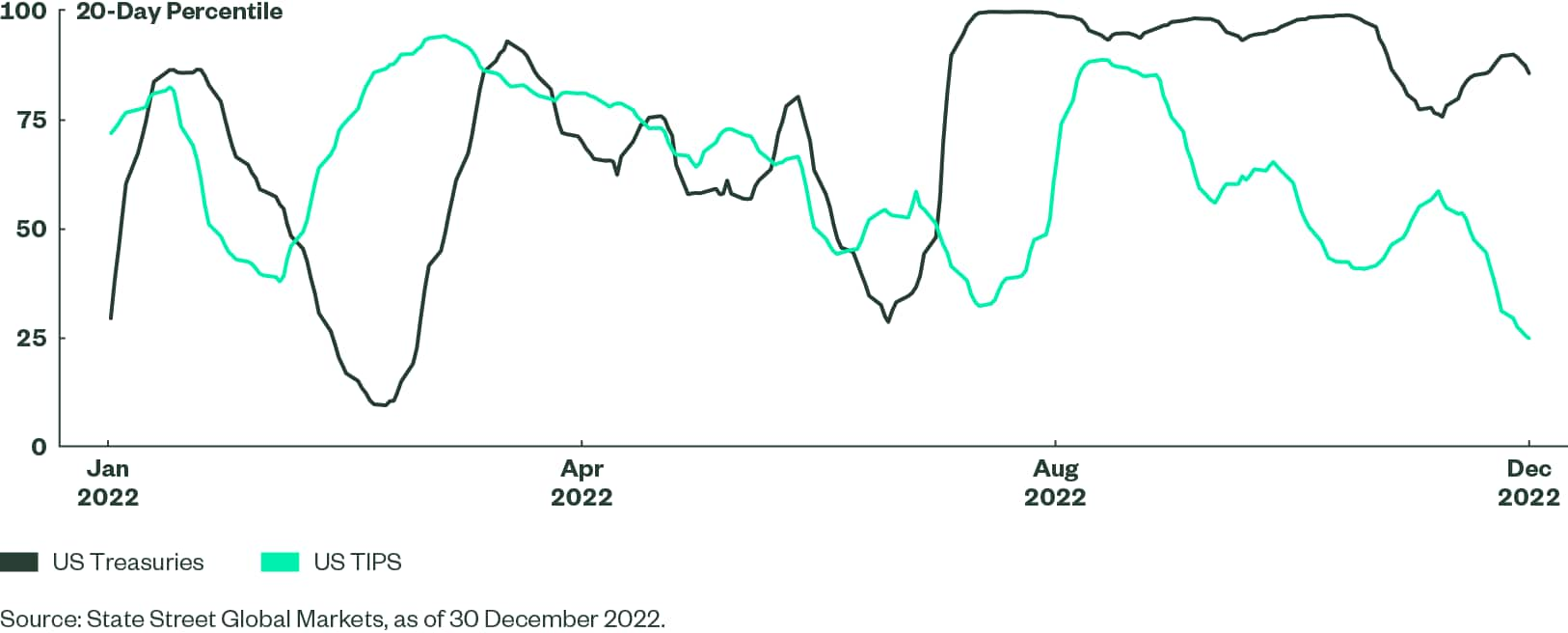

Our investor behaviour data – with 20-day duration-weighted Treasury flows in the 85th percentile – shows that real money asset managers continue to anticipate an end to the hiking cycle and a subsequent pivot. In a sign of waning inflation concerns, flows into the Treasury inflation-protected securities (TIPS) market have recently fallen to the 25th percentile, the lowest level of the year.

US Treasuries See Investor Demand While TIPS Lag

Investment Grade Over High Yield

Credit joined the risk rally in Q4, as both investment grade and high yield asset classes finally halted three consecutive quarters of negative returns to post their strongest quarterly gain in more than two years. Hopes of a Fed pivot, compressing volatility and generally scant issuance all supported corporate bonds, which gained from both lower Treasury yields and compressing spreads. The broad investment grade index saw spreads fall by 30 bps to 130 bps, while high yield spreads narrowed by 84 bps to 450 bps. And while recessionary concerns increased throughout the quarter, tight labour markets and a resilient consumer continued to provide a path for a soft landing.

For the moment, default rates remain benign and generally near cyclical lows, despite the souring outlook from business surveys and tightening credit conditions after 450 bps of Fed rate hikes. This worsening outlook has made it into company earnings estimates, which despite a series of cuts throughout Q4 remain positive for 2023. Ultimately, this sanguine outlook requires a less aggressive Fed, which has stated its policy will remain restrictive until both sustained inflation progress and a loosening labour market become evident.

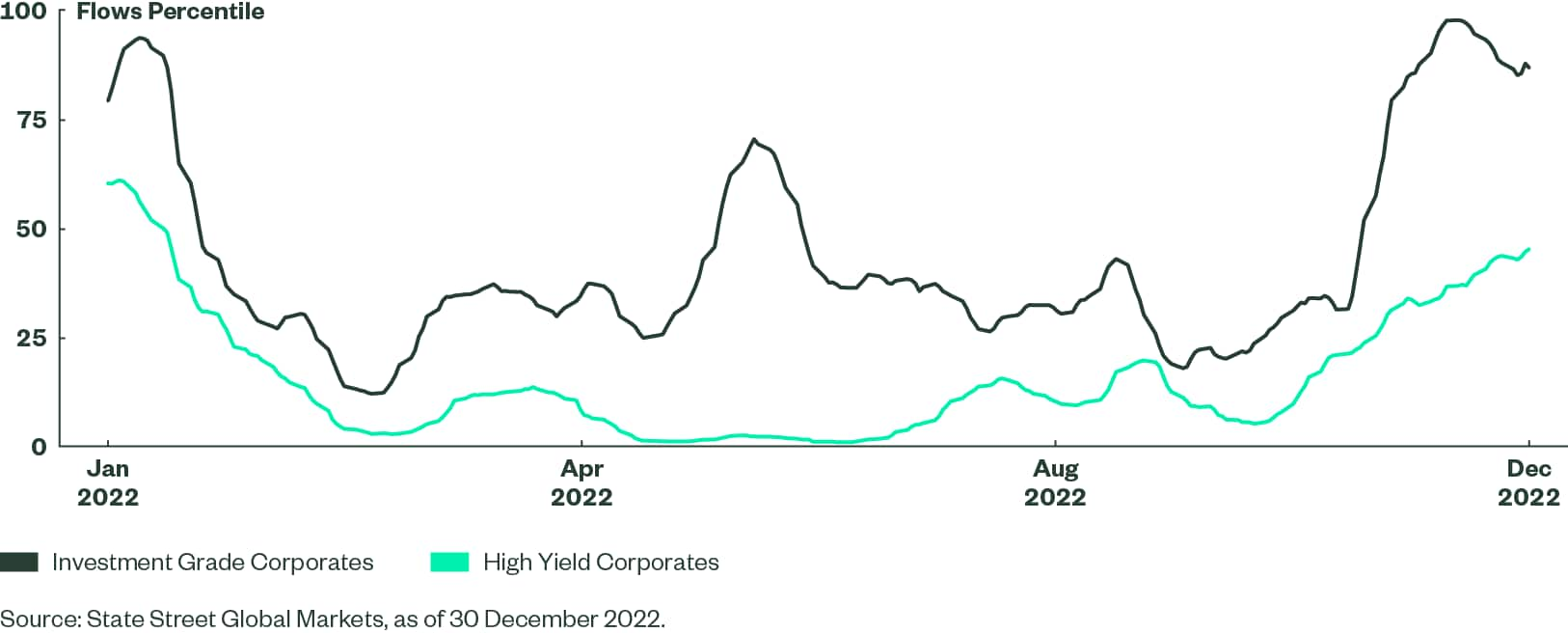

So while both high grade and high yield assets posted gains in Q4, real money investors showed a distinct preference for higher quality assets. Our investment grade flows peaked close to their highest levels in five years during Q4 and remained near the 90th percentile at year-end. In contrast, high yield flows showed less enthusiasm, with flows bouncing higher off their lows, but returning to neutral. Continued uncertainty over growth this year will likely keep investors skittish of lower-rated credits that will likely suffer first in the face of rising defaults.

Investors Show Preference for Investment Grade Over High Yield

Recession Concerns Keep EM Buying at Bay

After weathering challenges throughout 2022, including growth and inflation concerns, the headwind of a strong US dollar and deteriorating current account balances, EM bonds ended the year on a high note, posting their strongest quarter in five years (excluding some of the outsized but temporary gains witnessed in 2020).

There is reason for continued optimism as many EM economies started the hiking cycle much earlier than their developed market (DM) counterparts, and high rates in certain countries now mean positive real yields, something no advanced economy presently offers. The growing theme of DM peak rates, particularly from the Fed, may also alleviate some of the risk for EM investors. But expectations of a pivot from central banks are often driven by the rising risk of recession, which has historically created a challenging environment for EM.

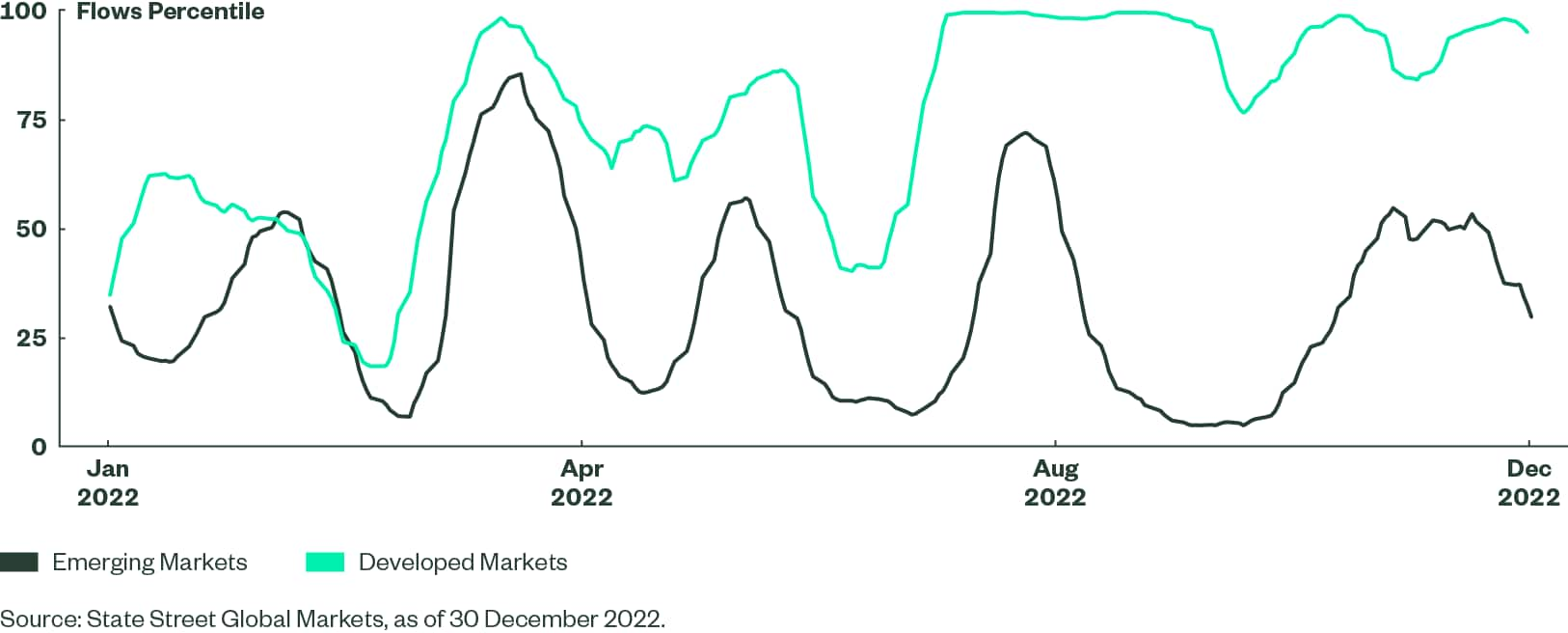

So while we have seen growing demand for DM sovereign debt, that enthusiasm has not translated to EM bonds. Our DM sovereign bond flow indicators moved into the 90th percentile during the autumn on growing hope that peak rates were on the horizon. And although there has been volatility around terminal rate pricing, higher rates have accompanied rising recession risk, which has also supported real money DM flows (which still remain in the top decile). In contrast, EM sovereign flows peaked near neutral in November and have fallen back toward the bottom quartile given growing concerns.

Enthusiasm for DM Sovereigns Not Yet Translating to EM