Using Climate Paris Aligned Benchmarks to Avoid the Cracks

As we progress through the year, we still see a range of possible scenarios for investors to navigate, including sticky inflation, peaking rates and recession. With Paris Aligned Benchmarks, investors can address potential risks while also incorporating sustainability considerations into portfolios.

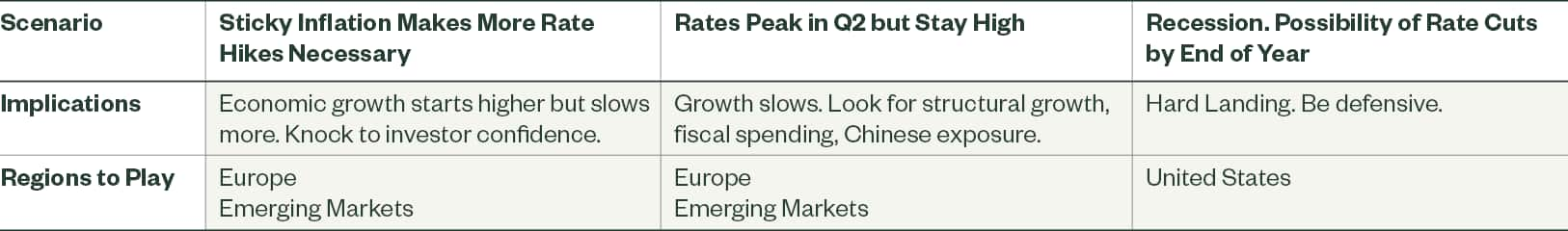

In the Q2 Sector & Equity Compass, Don't Step on the Cracks, we outline three scenarios in our market outlook that all share in common the need for investors to consider a broad-based diversification strategy in this market (see table below). On a more structural basis, investors continue to use portfolio reallocation to integrate sustainability considerations.

Investors seeking to increase broad-based allocation to our highlighted emerging markets, European or US equity themes can use a beta strategy that tracks a Climate Paris Aligned Benchmark (“PAB”). SPDR also offer Climate PAB exposures in broad-based ACWI and World, as well as a country-specific Japan exposure.

Q2 Sector & Equity Compass Themes

Climate PAB indices aim to offer a standardised framework for assessing and comparing the transition risk, physical risk, alignment and opportunities of the carbon economy. PABs are compelling for investors considering risk mitigation with respect to the regulatory changes and physical impacts of climate change, as well as the potential impact of stranded assets and shifts in consumer preferences. By proactively considering these risks, investors can potentially safeguard their investments and avoid value erosion.

Enhancements to the Climate Paris Aligned Benchmark Framework in 2023

SPDR has partnered with MSCI to offer a complete suite of ETFs tracking the Climate Paris Aligned indices, which leverage an optimisation-based approach to connect investor motivations with investment opportunities. Effective at the May 2023 index review, MSCI is implementing the first phase of critical changes to the index methodology associated with the Climate Value-at-Risk (“VaR”) target and definition of Companies Setting Targets.

Going forward, the target for aggregate Climate VaR will be changed to greater than or equal to -5% for the Climate PAB index compared to its market capitalisation weighted parent index. The definition of Companies Setting Targets will be expanded to also include any company that has received approved “Science Based Targets” from the Science Based Targets Initiative. In November 2023, further changes are expected, including the integration of Implied Temperature Rise (“ITR”) and an emission budget objective.

Please visit our webpage on climate investing to learn more.