Mapping the sustainable investing spectrum of capital

Examining the sustainable investing spectrum can help clarify the interplay between investors’ specific financial objectives—measured by risk and return—and their sustainability-driven objectives.

As some investors, particularly in Europe and APAC, increase their focus on the sustainability characteristics of their portfolios, there are both links and implications when it comes to the order of priority between their sustainability-related and financial objectives.

Many are now seeking to understand—and in some cases, actively target—a specific impact that they want their investments to have on the world.

As investors introduce sustainability objectives into portfolio construction, we believe it becomes essential to understand and articulate the interplay between their financial and sustainability-related goals.

Identifying investor objectives: A conscious prioritization exercise

Financial and sustainability-related goals can, at times, appear to be made independently. However, it is important for investors to understand the interaction between the two.

Some investors maintain a primary focus on their financial objective—managing risk and return effectively. If these investors have sustainability-related objectives, they are likely secondary to meeting their primary objective.

On the other hand, some investors explicitly aim to prioritise sustainability considerations—though the way in which they incorporate these considerations may differ. Some investors may seek to understand how companies operate, looking to invest in companies that manage sustainability risks effectively to improve their operational resilience. Others may be focused on the impact that their investment could have on people and/or the planet. These investors may consider what products and services a company creates and how they contribute to a sustainability goal.

The spectrum of capital

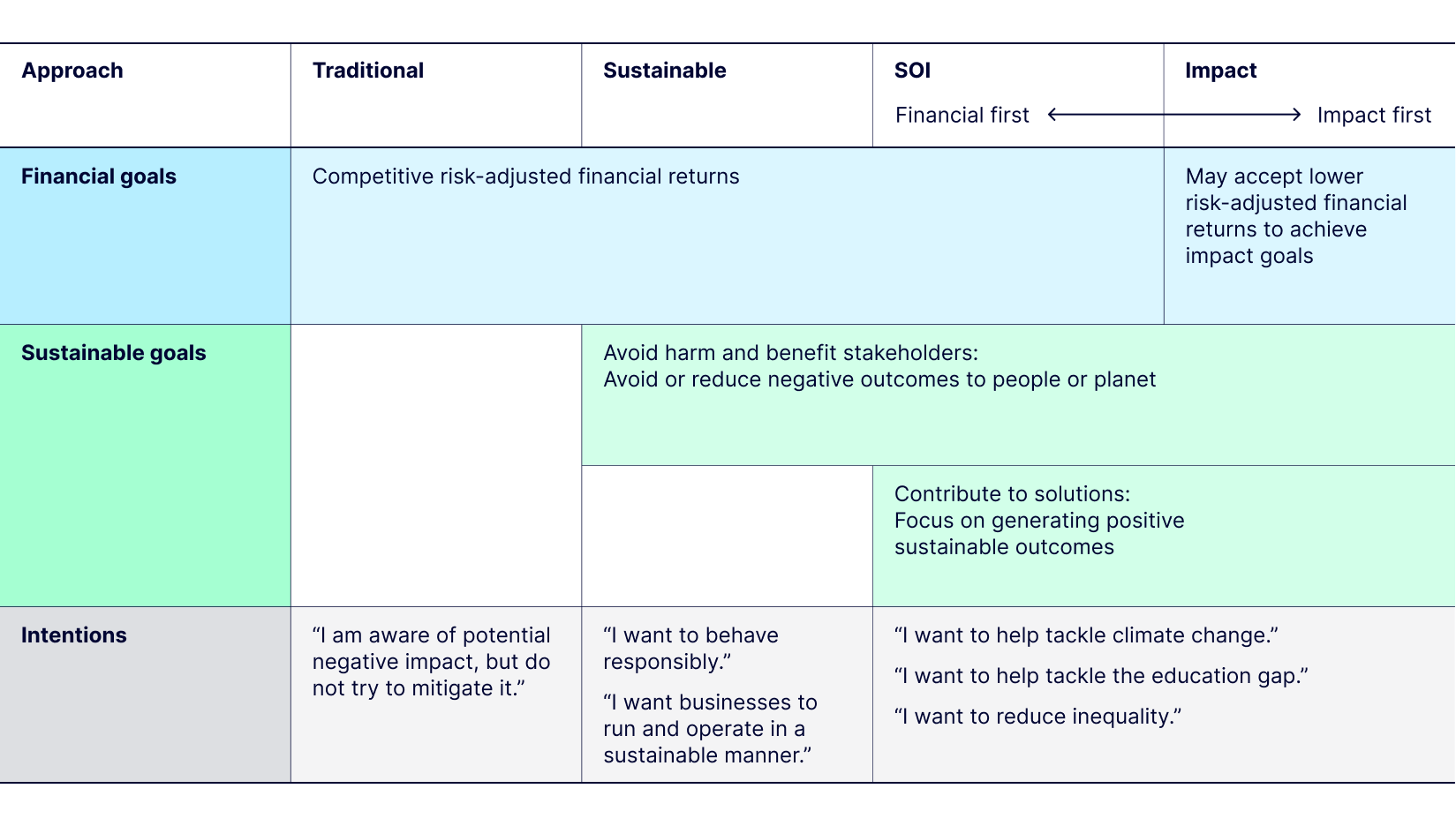

Figure 1 represents State Street Investment Management’s view of the sustainable investing spectrum of capital. Looking at Figure 1, sustainability-related goals become more pronounced and explicit as we move from left to right, and the methods to achieve those goals change accordingly. For example, as an investor increasingly focuses on the impact their investments have on the world, their selection criteria for these assets will naturally change. This can have an effect on their financial objectives, too.

Figure 1: A view of the sustainable capital spectrum

Source: State Street Investment Management’s interpretation of Impact Investing Institute’s Spectrum of Capital, modified to meet State Street Investment Management’s guidelines. Utilises Impact Frontiers ABC Framework and Bridges Spectrum of Capital.

Traditional approach

Investors who don’t explicitly incorporate sustainability elements are in the ‘traditional’ investments column. While they may or may not be aware of the sustainability-related characteristics of their investments, they do not target any sustainability-related improvements as a defined objective. In other words, their investment objective is purely financially driven.

Sustainable approach

These investors incorporate sustainable factors into their investment decision making, though the rationale for why and how can vary. Some may seek to avoid harm by excluding certain business activities and apply norms-based screens. Others may go further to focus on benefiting stakeholders, meaning they consider the wider sustainability factors of an investment, how a company manages its sustainability risk, and if it operates in a sustainable manner. Here, investors may seek to align with their own values or manage towards sustainability frameworks such as a net-zero pathway. But financial returns are typically still a primary objective for these investors.

Sustainable outcome investing (SOI) approach

For SOI investors, sustainable objectives go hand-in-hand with financial objectives. They seek to invest in assets that contribute to solutions and generate positive sustainability-related outcomes through their products and services. In short, these investors consider dual objectives—both financial and sustainability-related objectives— maintaining a primary focus on achieving competitive risk-adjusted returns.

Impact approach

Impact investors are, first and foremost, focused on having a direct positive effect on the world via a pre-defined sustainability-related objective. While these investors also consider both financial and sustainability-related objectives, for impact investors, achieving their sustainability-related objectives retains primacy.

A key distinction between the sustainable approach and an SOI or impact approach is their focus on how their investments contribute to solutions. SOI and impact approaches seek to target assets that are actively generating solutions through products and services—not just reducing their own negative impact.

Implications for portfolio construction

As investors consider these approaches, a key consideration is the effect that each will have on portfolio construction. As an investment approach incorporates specific sustainability or impact criteria—for example, aiming to hold companies that are deemed to be positively contributing to an environmental or social outcome—the composition of the portfolio will naturally diverge from a broad market cap benchmark.

Take a conscious approach

We believe defining objectives consciously is a foundational step when positioning and implementing a sustainable investment approach. Different points along the spectrum correspond with different investor goals, methodologies, and potential impacts on portfolio diversification and, as a result, risk and return profiles.