Signs of Securities Loan Demand Weakening

This semi-annual update discusses the current market dynamics impacting returns and risk in securities lending, State Street Global Advisors’ core views on securities lending programs, and client perspectives on securities lending.

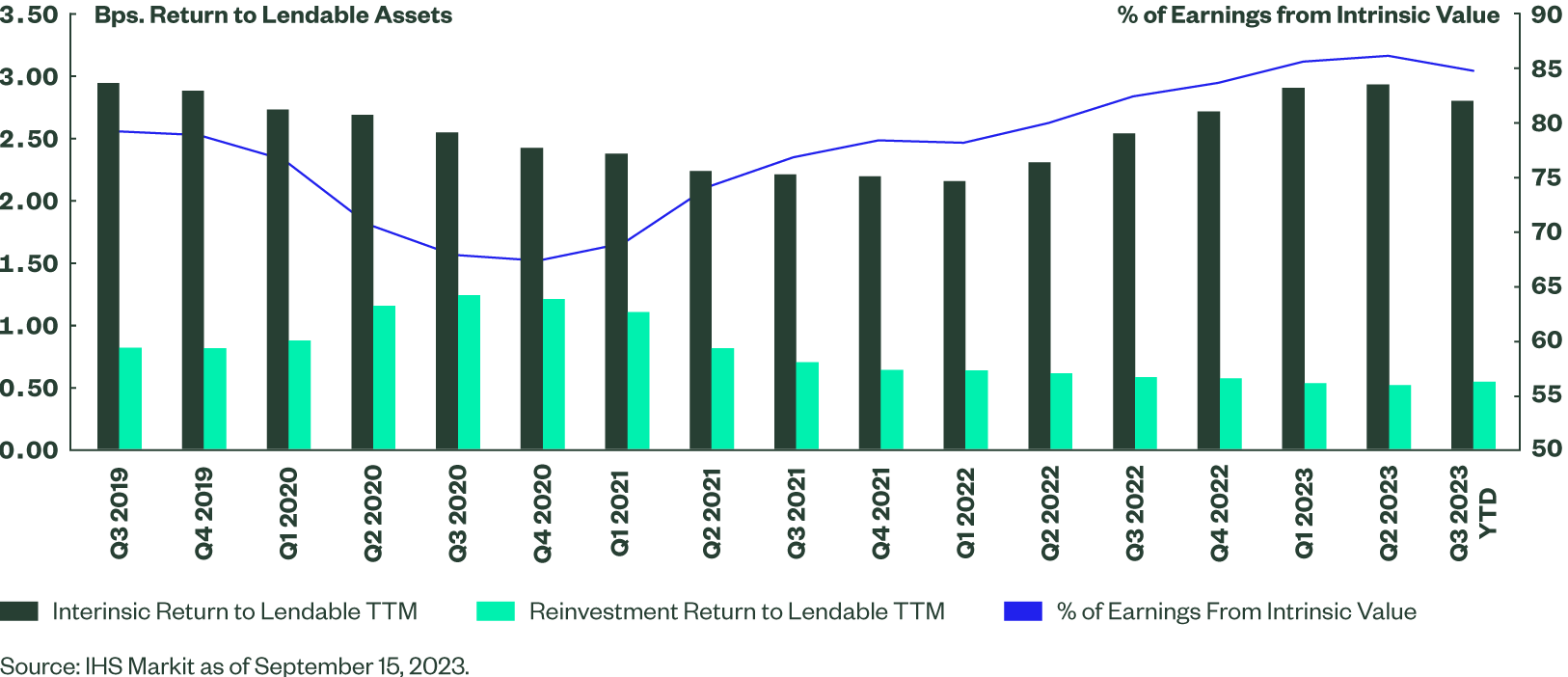

Several macroeconomic developments in the markets earlier this year contributed to sustained high market volatility and securities lending demand. The regional banking crisis, the debt ceiling standoff, and general concern regarding the direction of economic growth and interest rates supported lending returns. However, much of this turbulence subsided in the second and third quarters of this year with the CBOE Volatility Index hitting new lows since the pandemic outbreak in 2020 (closing below 15). Securities lending returns have begun reflecting this malaise and intrinsic returns have begun declining in the quarter-to-date (QTD) numbers for the third quarter in 2023 (Figure 1). Further, this decline occurred despite a large corporate action trade (Johnson & Johnson’s spin-off of Kenvue Inc.) that bolstered securities lending earnings in late August. Several particularly profitable lending trades have collapsed including meme stocks AMC and GameStop, as well as securities in the battery and electric vehicle industry such as EVgo and Lucid. This does not bode well for securities lending earnings in the short-run.

Figure 1 :Quarterly Trailing Twelve Month Securities Lending Returns to Lendable Assets Breakdown

Securities lenders thrive on market volatility, and while the current volatility is relatively low, there are some potential events in the future that may change that. In the US, the government faces a prolonged budget negotiation that could result in a government shutdown, commercial real estate markets are in a precarious state, and the Chinese economy has been showing cracks. Hence, there is potential for market volatility to return.

Considerations for Lending Approaches

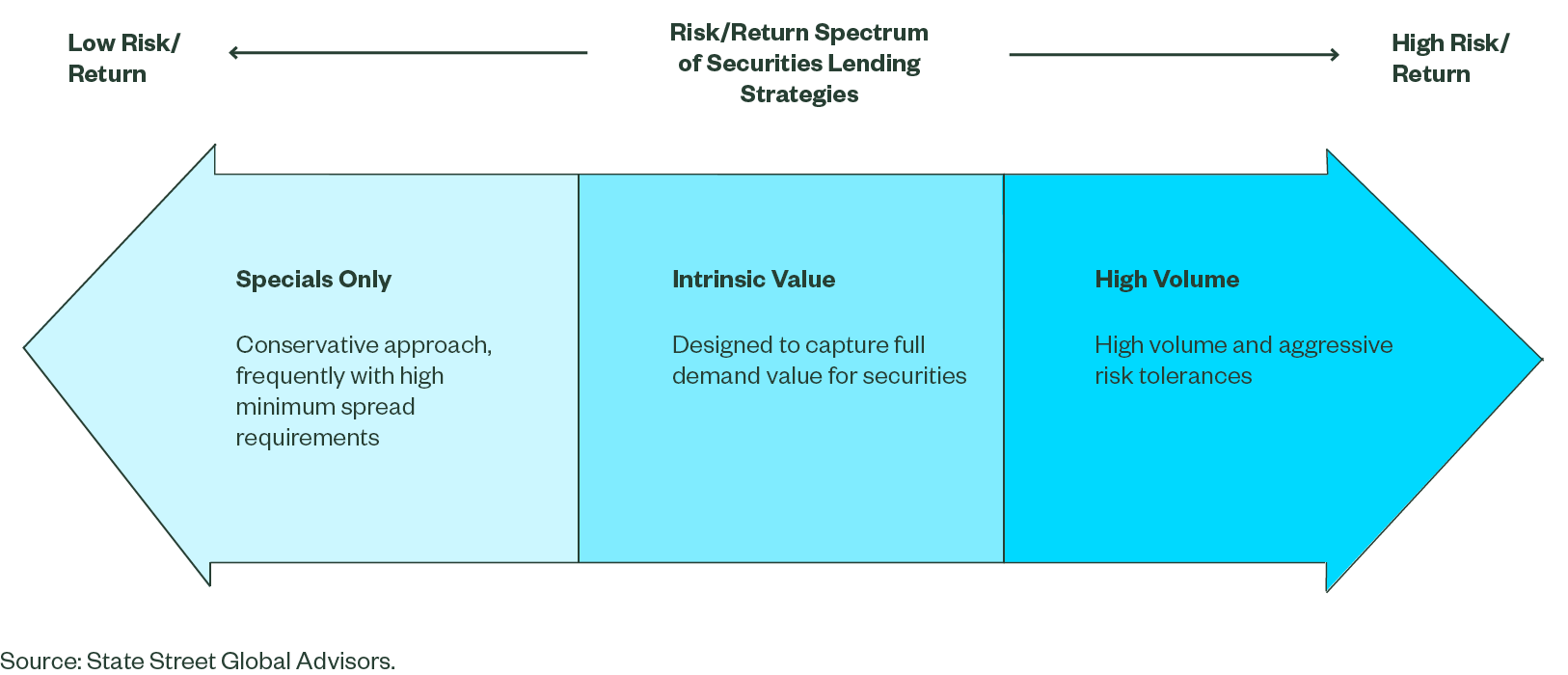

In this update, we also take a quick look at lending approaches. Securities lending programs exist along a spectrum of risk and return. On the low risk/return side are “Specials Only” programs designed to limit risk as much as possible, while still capturing deep special value in some securities. On the other end of the spectrum are “High Volume” programs that are designed to maximize returns within certain risk constraints through more aggressive reinvestment parameters. In between are “Intrinsic Value” programs designed to capture all demand value for securities loans while limiting the amount of associated reinvestment risk. There are no right or wrong approaches. Rather, a program should be aligned with investors’ risk tolerances and expectations for returns. For example, a public pension fund with predictable liquidity requirements, might be comfortable with a “High Volume” program that earns incremental reinvestment returns on cash collateral by utilizing a collateral reinvestment vehicle with lower liquidity requirements than typical money market funds. Alternatively, a highly risk averse mutual fund with unknown liquidity requirements, and a relatively unsophisticated investor base may be more comfortable in a “Specials Only” program that reinvests cash collateral into a highly liquid SEC-registered government money market fund. While “Specials Only” programs may miss capturing some attractive demand for securities loans, they are typically lowest on the risk spectrum. Indeed, some regulatory bodies around the world limit registered retail funds from participating in “High Volume” programs with aggressive reinvestment parameters. “Intrinsic Value” programs may be appropriate for investors focused on risk-adjusted returns seeking to optimize the value capture from the demand for securities loans while limiting reinvestment risks. Both “Specials Only” and “Intrinsic Value” programs limit the reinvestment risks, and hence have the least impact on the risk profile of the underlying portfolio of securities.

Figure 2 : Risk/Return Spectrum of Securities Lending Strategies

State Street Global Advisors’ Strategic Approach to Lending

State Street Global Advisors focuses on the Intrinsic Value approach to securities lending across most securities lending programs. We believe that the demand side of securities lending returns present a positive risk-adjusted return to our portfolios, and should be fully captured, while the reinvestment returns present a more equally-weighted risk-adjusted return that is only appropriate for some investors. Two key characteristics of the Intrinsic Value Approach include: 1) acceptance of non-cash collateral which eliminates reinvestment risk entirely (including duration risk) for loans collateralized by non-cash, and 2) when cash collateral is accepted, a conservative approach to cash collateral management.

Client Perspectives and Flows

State Street Global Advisors has continued to see increased demand for our securities lending programs from clients confident in our risk-managed approach. Clients with concerns stemming from the 2008 Global Financial Crisis, which have been reluctant to re-enter the securities lending market, are re-evaluating their stance on securities lending. There have been numerous changes in the risk profile of securities lending programs since 2008. On the surface it can be hard to understand the impacts of these differences, so at State Street Global Advisors we invest the time with clients – explaining and providing the transparency needed to understand these differences. While we experienced increasing returns from securities lending in 2022 and 2023, our clients understand this is largely driven by increasing intrinsic value returns and not by the assumption of incremental reinvestment risk in the programs. We have heard appreciation for the quarterly factsheets produced for our securities lending programs that profile the risk and returns of the securities lending funds offered by State Street Global Advisors. The factsheets not only provide a snapshot individually, but also, taken together over time, provide the clarity of trends in risk and returns of the lending program, and enable our clients to confirm that we continue to adhere to our risk and return objectives.

About State Street Global Advisors

Our clients are the world’s governments, institutions and financial advisors. To help them achieve their financial goals we live our guiding principles each and every day:

- Start with rigor

- Build from breadth

- Invest as stewards

- Invent the future

For four decades, these principles have helped us be the quiet power in a tumultuous investing world. Helping millions of people secure their financial futures. This takes each of our employees in 29 offices around the world, and a firm-wide conviction that we can always do it better. As a result, we are the world’s fourth-largest asset manager* with US $3.8 trillion† under our care.

* Pensions & Investments Research Center, as of December 31, 2022. † This figure is presented as of June 30, 2023 and includes approximately $63 billion USD of assets with respect to SPDR products for which State Street Global Advisors Funds Distributors, LLC (SSGA FD) acts solely as the marketing agent. SSGA FD and State Street Global Advisors are affiliated. Please note all AUM is unaudited.