Risk Reduced Slightly in Favor of Cash

Each month, the State Street Global Advisors’ Investment Solutions Group (ISG) meets to debate and ultimately determine a Tactical Asset Allocation (TAA) that can be used to help guide near-term investment decisions for client portfolios. By focusing on asset allocation, the ISG team seeks to exploit macro inefficiencies in the market, providing State Street clients with a tool that not only generates alpha, but also generates alpha that is distinct (i.e., uncorrelated) from stock picking and other traditional types of active management. Here we report on the team’s most recent TAA discussion.

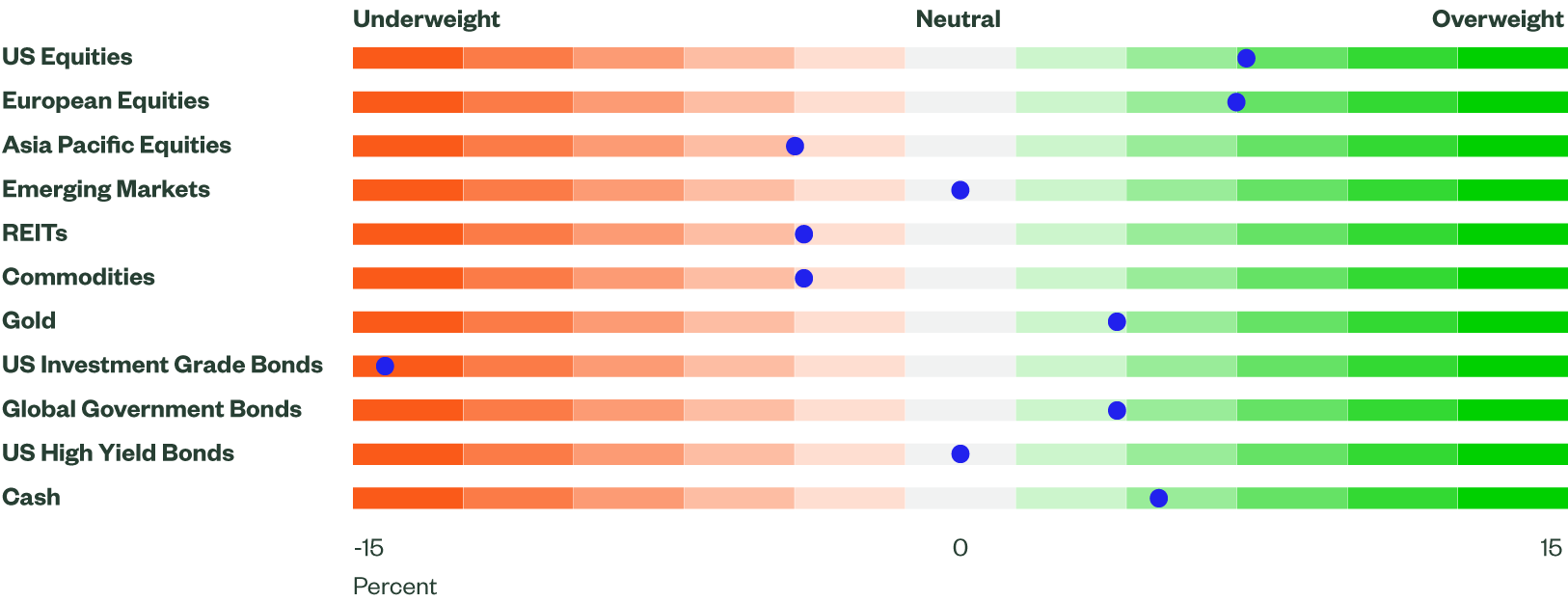

Figure 1: Asset Class Views Summary

Source: State Street Global Advisors, as of 11 May 2023. Investment grade bonds consist of investment grade credit, Treasuries and aggregate bonds.

Macro Backdrop

We have long refrained from jumping on the “recession is inevitable” train as we believe that the US economy will remain resilient; but we do expect economic growth to slow. We also recognize that headwinds continue to mount and create uncertainty, which only increases the chance of a recession, even if by a little.

The debt ceiling deadline is a moving target, but all options could have a negative impact on growth, although the impact is uncertain. Failure to raise the debt ceiling for an extended period of time could result in higher rates and lower demand as government assistance/payments would be in jeopardy. The proposed spending cuts would be a drag on growth, but unbounded spending could pose longer-term risks and further stoke inflation.

US inflation continues to cool with year-over-year numbers for both headline and core CPI declining in April. While we still believe progress is being made on reducing inflation, a handful of upside surprises point to a slower path toward the Fed’s 2% target than is desirable. The Fed’s favored inflation gauge, the core personal consumption expenditures (PCE), surprised to the upside while prices paid measures in both the services and manufacturing purchasing managers index (PMI) surveys remained above 50, the threshold for expansion.

Further, wages continued to move higher with the employment cost index (ECI) advancing in Q1 and outpacing expectations while the average hourly earnings measure also reflected rising wages. Households appeared to have noticed as one-year inflation expectations in the University of Michigan’s survey jumped to 4.6% from 3.6%, with the five-year outlook unchanged at 2.9%, both above Fed’s expectations.

Lagged effects from the previous rate hikes and tighter credit should slow inflation, but will it come soon enough? Currently, the labor market and inflation remain too high and the Fed must balance banking concerns and a looming debt ceiling with sticky inflation. Investors are pricing in between 50 and 75 bp worth of cuts over the remainder of 2023; however, it is hard to visualize this number, with Fed Chairman Jerome Powell pushing back against any near-term cuts. The Fed is likely close to pivoting, but a pause seems more realistic until more progress is made on the inflation front or the US is thrust into a recession.

Overall, strong labor markets, healthy corporate balance sheets and resilient consumers provide support. However, growth should continue to moderate and mounting risks cloud the outlook.

Directional Trades and Risk Positioning

On the surface, investor risk appetite has been resilient with our Market Regime Indicator (MRI) anchored in a low risk regime. However, under the surface, there is a disconnect between equity and bond markets, with our implied volatility on equity factor finishing in a euphoria regime while our measure for risky debt spreads in a normal regime. It is worth noting that both factors advanced higher over the final week of April.

Hotter-than-expected inflation prints, another bank failure and the fast approaching debt ceiling deadline have added more uncertainty. Implied volatility on currency also remains very benign with our measure residing in a euphoria regime. Overall, our MRI still points to a favorable risk environment for equities, but we are cognizant of overhanging risks.

Our fundamental driven model remained constructive on global equities. Sentiment indicators, analysts expectations for both sales and earnings, have improved, while top- down macroeconomic factors remained supportive. Last, our evaluation of valuation metrics, including free-cash-flow and buyback yields, remained slightly positive.

Commodities have remained under pressure and our quantitative assessment forecasts further pain as still unfavorable curve structures imply future prices may fall further.

Bonds have benefited from the banking turmoil and expectations for a Fed pivot, but our model is forecasting higher rates. With nominal US GDP still exceeding the yield on long treasury bonds and headline inflation numbers receding quickly, our model suggests that yields might rise. Additionally, interest rate momentum also points to higher rates.

Overall, our quantitative forecast supports an overweight in equities, but we are mindful of the increased risks and decided to slightly reduce risk in our portfolios. We sold a small portion of our equity allocation and reduced our commodity exposure, going further underweight. Proceeds were deployed to cash, which boasts an attractive yield and can provide some insurance in case investors become more fearful.

Relative Value Trades and Positioning

Within equities, we continued reducing exposure to Pacific equities, now a healthy underweight. The offsetting buy was into emerging market equities, bringing our allocation to neutral. Our examination of Pacific equities points to weaker expected returns. Price momentum, both short and longer-term measures, is weak, while valuations have become unattractive. Further, sentiment measures deteriorated as analysts have revised expectations for both sales and earnings. Our expectations for emerging markets have increased due to improvements across a few factors. Valuations remain attractive while better top-down macroeconomic indicators and healthier balance sheets support emerging market equities.

Within fixed income, we sold intermediate government bonds, maintaining an overweight, with proceeds invested in cash. As mentioned above, our model is forecasting higher yields and cash is more attractive on a relative basis.

At the sector level, we maintained our allocation to industrials, but rotated out of materials and consumer discretionary into energy and communication services. Industrials remains our top sector, exhibiting strength across all factors. Robust price momentum, strong sentiment and health balance sheet measures buoy the sector. Our forecast for materials is positive due to decent price momentum and attractive valuations, but weak downgrades to both sales and earnings expectations drove the sector down our rankings. Consumer staples benefits from sturdy price momentum and strong corporate balance sheets, but our evaluation of top down macroeconomic factors and valuations dent the outlook and pushed the sector down our rankings.

The rapid increase in rates during 2022 weighed on the tech-heavy communications sector, but positive performance recently has improved short-term price momentum which supports the sector. Elsewhere, expectations for earnings have improved and valuations remained attractive. Lower oil prices and recession fears weighed on commodities and any sector closely associated, such as energy. This is reflected in ongoing earnings and sales estimate downgrades and weaker short-term price momentum. However, longer-term measures of price momentum, still healthy balance sheets across energy companies, and attractive valuation metrics strengthen the outlook for energy.

Click here for our latest quarterly MRI report.

To see sample Tactical Asset Allocations and learn more about how TAA is used in portfolio construction, please contact your State Street relationship manager.