Making Private Credit Allocations vs Leveraged Loans and High Yield

The growth of private credit assets under management in recent years has drawn increasing interest and scrutiny from investors. The scale of the expansion suggests a strong appetite among investors, but the lower liquidity and naturally opaque nature of private credit can make comparisons with public credit alternatives such as leveraged loans and high yield bonds difficult.

While the three categories exhibit similar characteristics in the underlying exposures, there are notable differences and performance variations depending on the scenario. In this article, we focus on the characteristics, performance, and portfolio allocations to private credit relative to high yield bonds and leveraged loans, and consider how these should inform investors’ allocation decisions.

Private credit typically forms part of the alternative investments allocation in investor portfolios, while high yield bonds and leveraged loans fall within general fixed income allocations. However, the high correlations between the total return performance of the three categories serve to highlight the similarities that exist in the underlying credit exposures, including credit sensitivity and cyclicality. Private credit has typically focused on small and mid-sized borrowers, while syndicated loans and high yield borrowers also tend to fall at the lower end of the credit spectrum. In private credit, the average size of the borrower has been growing, although lending to investment grade companies is still at a relatively early stage.

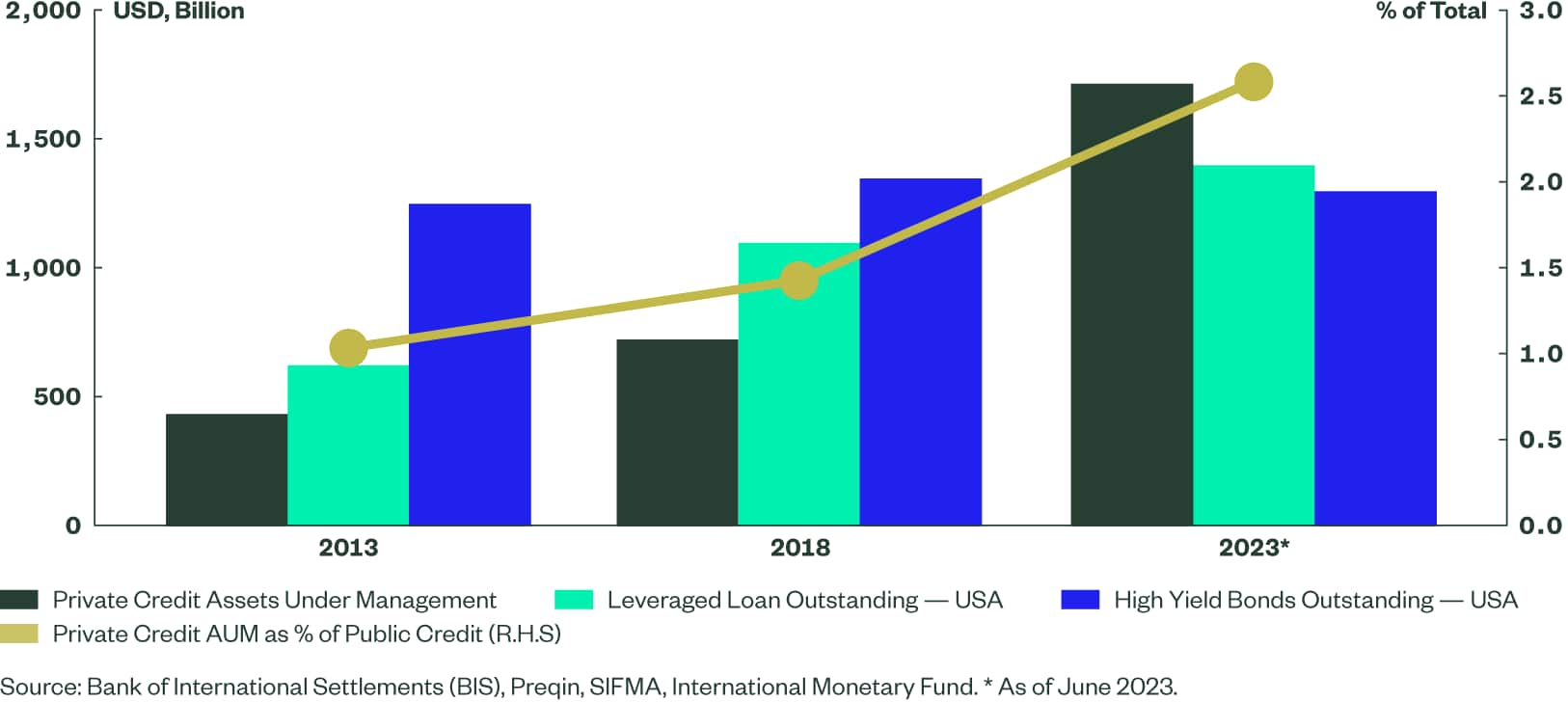

Figure 1: Evolution of Private Credit as a Percentage of Public Credit Markets

Over the past ten years, private credit assets under management have grown at an annualized rate of approximately 16% to reach more than US$1.7 trillion at the end of Q2 2023, according to data from Preqin. This far exceeds the annualized growth of 5% p.a. seen in public credit markets. In absolute terms, private credit is still just a small fraction (2.6%) of total public credit markets (of US$66.3 trillion), albeit up from 1% a decade ago. However, the size of the private credit markets today is now comparable to that of both leveraged loan and US high yield markets.