Credit Style Factors Explained Monthly Credit Commentary – January 2024

Environment and Outlook for US Credit

Investment grade (IG) corporate credit performance was flat in January, following solid monthly returns in November and December due to greater clarity around the timing of a Fed pivot (expected H1 2024) and more optimism around an economic “soft landing.” Investment grade corporate generated more than 10% in total return over these two months on the back of high carry, a significant decline in rates, and tightening credit spreads, as correlation between yields and spreads was strongly positive at that time. Valuations have moved further to the rich side of long run fair value, and fundamentals are softening, but from a strong starting point.

Fundamentals

Investment Grade Corporates

From a fundamental perspective, macro and credit conditions have started to soften, but from a solid position that was buoyed by healthy household and corporate balance sheets. Within IG corporates, revenue and EBITDA growth have slowed, with year-over-year figures approaching negative territory, per Bank of America. Leverage ratios have ticked back up, and with inflation still elevated, margins have also eroded modestly. Interest expense is up substantially, as yields have climbed rapidly since the Fed started its hiking cycle. The higher rates have led to a deterioration in interest coverage, falling to 10.7x as of September 2023 versus the COVID-era highs of almost 14x. However, interest coverage remains above the 20-year pre-COVID average.

These metrics point to an ongoing slowdown, but we are not seeing signs of alarm bells in the data. Credit quality continues to improve, with a record number of upgrades from BBB to single-A. The BBB segment of the investment grade corporate index grew to a concerning 52% at its height, but that is now back down to 47%. The consumer and labor markets continue to be resilient. Therefore, our economist still believes that a soft landing remains a higher-probability event than a recession at this point. Nevertheless, given where valuations are, we are positioned defensively and up in quality. We expect modest IG spread widening in 2024.

High Yield Corporates

Within high yield (HY), we are seeing similar fundamental trends as in IG, in the sense that fundamentals are softening, but not raising any red flags. Defaults are ticking higher at 2.6% per Bank of America, but remain below the long term, 20-year average of north of 3.5%. The distress ratio, which is defined as the percent of the total HY par value outstanding trading at an OAS > 1,000 basis points (bps) – typically a reliable leading indicator of where default rates are heading – is also moving higher, but still well below the 20-year average of 10.6%. We view these trends as a normalization in credit quality given the withdrawal of extraordinary monetary and fiscal support over the last two years, as well as late-cycle dynamics.

There are challenges on the horizon in 2024 for US high yield. Most notably, the looming maturity wall where, according to Barclays Research, nearly $100 billion of the Bloomberg US HY Index par value is due within 2 years, representing north of 7% of the index. This, plus the coupon gap in which maturing coupons are around 6.25% on average versus a refinancing yield north of 8.5%, could become problematic for HY should the Fed under-deliver rate cuts relative to expectations in 2024. Fed fund futures currently predict four 25bps cuts this year.

In Focus: Credit Style Factor Performance

We highlight here how credit performance can be evaluated through a factor lens. Factor investing, which has long served as a strategy for equity investors to understand and exploit alpha drivers discerned over time, is now becoming a more viable option for credit investors (see: The Case For Systematic in Credit). It allows investors to gain a different perspective on the key drivers of credit returns in various market environments. The factors we evaluate are in some cases informed by the equity performance of the issuers (see Overview: Systematic Active Fixed Income Signals).

The Value Factor

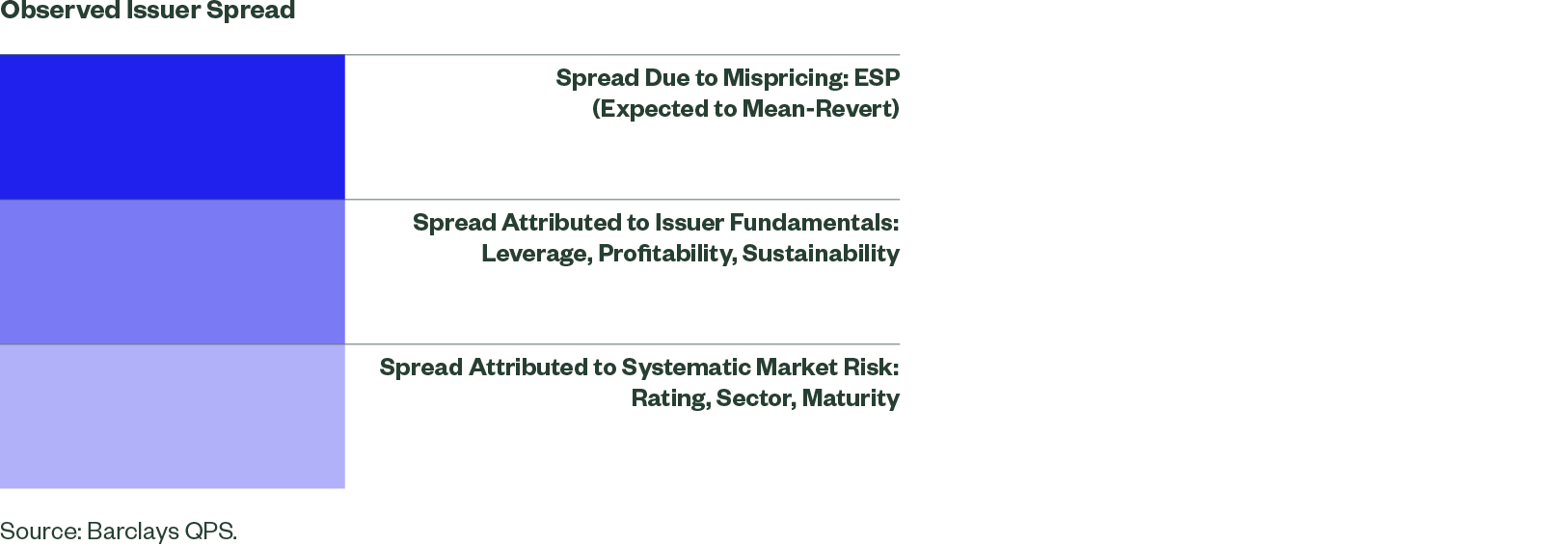

The value factor that we use is the Excess Spread to Peers, or ESP, from Barclays Quantitative Portfolio Strategy (QPS). This metric is based on a comparison of a bond’s observed spread versus an overall peer group spread, with peers determined based on industry, maturity, and credit rating. Issuer fundamentals derived from accounting data are then used to explain further the deviation between the spread of a bond and that of its peer group. The remaining portion of the observed spread after accounting for peer group and fundamentals, or the “residual,” is essentially what is unexplained, and therefore is representative of the bond’s relative value – cheapness or richness (Figure 1). This value spread has demonstrated strong mean-reversion tendencies through time. The value factor itself (via ESP) tilts towards higher-yielding, higher-spread issues in which risk is overcompensated.

Figure 1: Observed Bond Spreads Can Be Decomposed Into Explained and Unexplained Components

The Momentum Factor

The momentum factor, Barclays QPS’ Equity Momentum in Credit, or EMC, is based on the empirical fact that equity returns are a leading indicator for corporate bond returns. Why is this true? Stocks react more quickly to new information, have lower transaction costs, and benefit from broader analyst coverage compared to credit. Momentum analysis can help protect against value traps during spread widening episodes.

Figure 2 is based on Barclays QPS subdivision of the Bloomberg US Investment Grade Corporate Bond Index into quintile portfolios sorted by ESP (value) score and by EMC (momentum) score. The chart shows the cumulative excess return (over duration-matched Treasuries) of the first quintile minus the fifth quintile portfolios for each factor. We then overlay the 10-year yield and the IG corporate spread for market context. Figure 2 illustrates that both the value and momentum factors have generated consistent outperformance over Treasuries through the cycle.

Value and momentum behave differently and can be complementary in certain market environments. For example, value will tend to exhibit a carry or duration times spread (DTS) bias and therefore, will tend to perform procyclically – i.e., when credit draws down, so too will value. Momentum, however, tends to perform better in market downturns. Within a systematic credit strategy, value can be thought of as the key performance driver, while momentum and sentiment (Barclays QPS’ Equity Short Interest, or ESI) act as risk control mechanisms to enhance and stabilize performance across different market regimes. This point is illustrated in Figure 2 by the behavior of value and momentum signals at the start of the COVID crisis in 2020. The dip in cumulative return of value coincides with a rise in momentum performance making the combination of the two stable through the cycle.

To further illustrate the diversification benefit of combining these two strategies, Figure 3 shows how the value and momentum factors have moved with rates and credit spreads over the past decade.

Figure 3: Correlation Matrix, Monthly [Excess] Returns, Dec 2013 – Dec 2023

| 10Y UST Yield TR | US IG Corp Exc. Return | US HY Corp Exc. Return | US IG Value ER | US IG Momentum ER | US HY Ba-B value ER | US HY Momentum ER | |

|---|---|---|---|---|---|---|---|

| Bellweathers 10Y UST Yield TR | 1.00 | ||||||

| US IG Corp Exc. Return | -0.17 | 1.00 | |||||

| US HY Corp Exc. Return | -0.20 | 0.88 | 1.00 | ||||

| US IG Value ER | -0.22 | 0.89 | 0.81 | 1.00 | |||

| US IG Momentum ER | 0.17 | -0.73 | -0.58 | -0.71 | 1.00 | ||

| US HY Ba-B value ER | -0.14 | 0.66 | 0.60 | 0.79 | -0.51 | 1.00 | |

| US HY Momentum ER | 0.20 | -0.65 | -0.55 | -0.54 | 0.76 | -0.36 | 1.00 |

Sources: Barclays QPS, Bloomberg Finance, L.P.

When we look at factor returns vis-à-vis rate and credit spread movements, we see that value performance is negatively correlated with rates returns (-0.22), but strongly positively correlated with IG spread excess returns over Treasuries (+0.89). Likewise, in macroeconomic or fundamental crises accompanied by credit draws down as in March 2020, value will underperform. By contrast, momentum acts as a counterbalance to value, and has the opposite relationship with rates (+0.17) and spreads (-0.73) – and the two factors themselves are negatively correlated with each other (-0.71).

The Bottom Line

If the Fed cuts later this year and moves off of its restrictive policy stance, as expected, then many of the challenges on the horizon for credit – softening fundamentals and in particular the maturity wall in high yield – can be alleviated some. Despite relatively rich spread levels currently, value and momentum could still perform well moving forward if the factor signals are aligned in the sense that both are screening more/less attractive. For example, if credit spreads are tight generally speaking, then there will be less differentiation in spreads between issuers and therefore fewer value opportunities from which to benefit. In this type of environment, value will be less attractive. At the same time, if there’s a fundamental catalyst such as early signs of cracks in the labor market or more turbulence in the banking sector, that could cause a more sustained widening in credit spreads, which the momentum factor would detect, helping investors avoid falling into value traps. Indeed, this is what we saw in 2023: our attribution work showed that momentum performed strongly in Q1 2023, and value performed throughout the year, taking advantage of opportunities in the wake of the spread widening last March. In the current tight-spread environment, a more defensive posture in credit may be warranted until there’s greater dispersion in spreads between issuers driven by value creation (spread widening).