A Letter From Our CIO: Indexed Fixed Income Update

Recent markets have been a rollercoaster for fixed income investors. After a gloomy 2022, bond markets were on the road to recovery in the first half of 2023, only to see volatility surge back this past summer.

What a difference six months make. In my last letter, we were coming off a dismal 2022 where central banks roiled global markets with aggressive rate hikes in an attempt to quell stubbornly high inflation. And while 2023 has not come without its own headlines—March’s banking crisis and a close call with a US Treasury default in May come to mind—in general, bond investors were able to breathe easier this year.

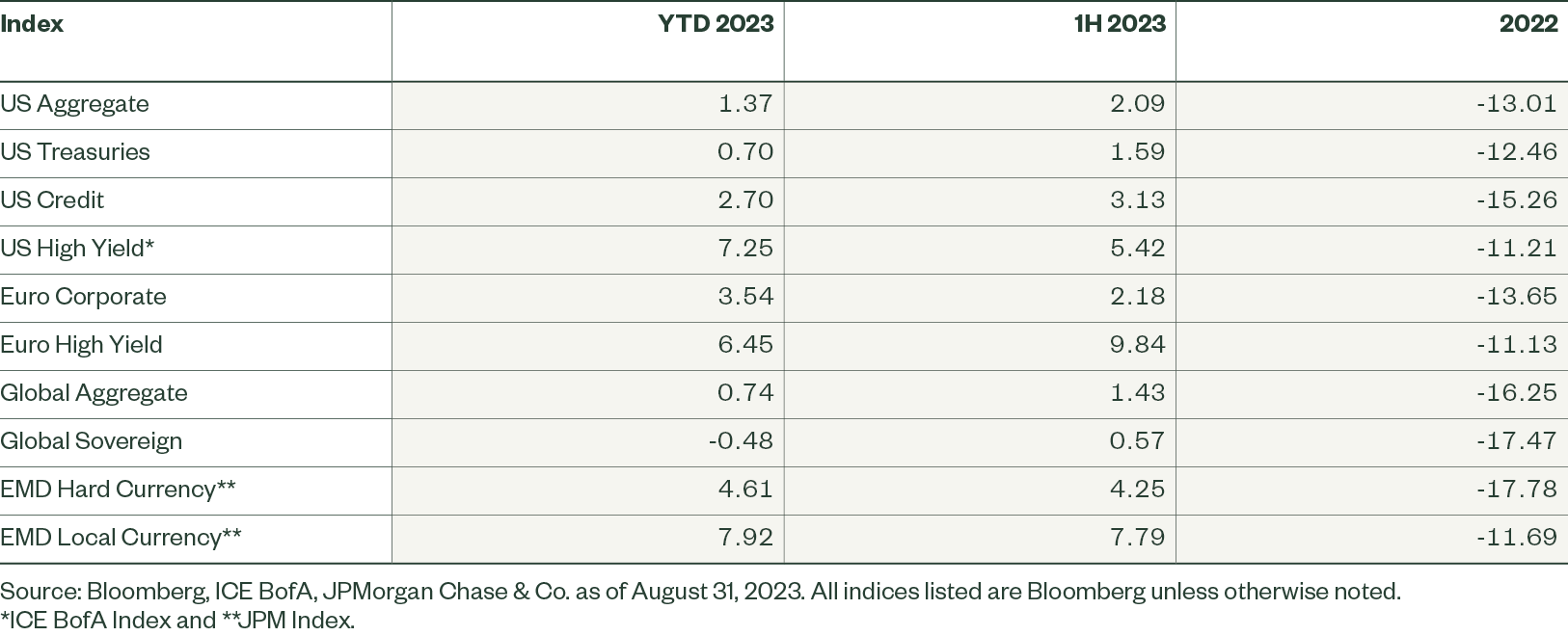

Overall, ultra aggressive bank policy has worked—we have seen a decline in global inflation, though the readings are still higher than central banks’ target ranges. In the US, we have neared (or, depending whom you ask, reached) peak policy rates while the EU and UK central banks are lagging, with more hikes expected given persistently strong jobs and wage growth data. Bond markets were on the path to recovery after 2022’s carnage, with all major indices posting positive returns for the first half of 2023. However, volatility returned in July and August amid strong economic data, a US downgrade, and a weakening Chinese economy.

Fixed Income Index Total Returns

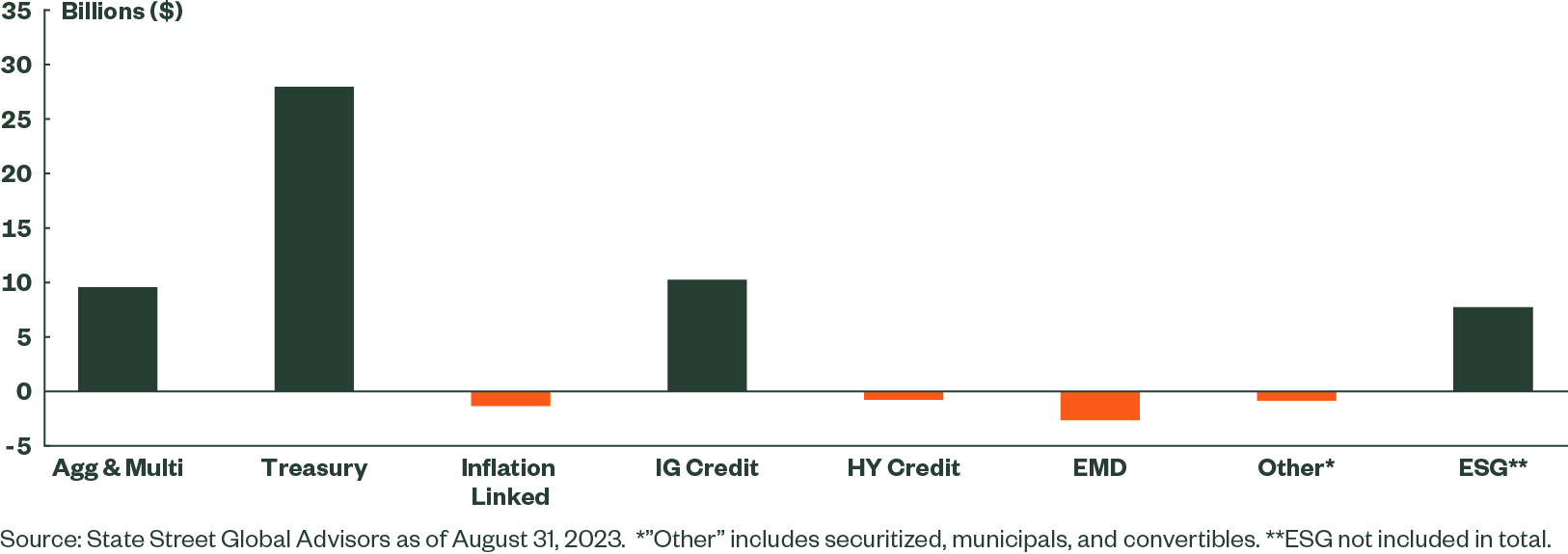

2022 Fixed Income Indexing Flows by Sub Sector

2022 Fixed Income Indexing Flows by Channel

The Future of Fixed Income

Historically, the fixed income market has been less organized and more fragmented than equity markets, hampering progress seen in other asset classes from advancements and innovations, but thankfully this is quickly changing. Post the Global Financial Crisis (GFC), we have seen improved pricing transparency for investors through the proliferation of electronic trading, which enables more efficient and reliable implementation of fixed income strategies, thereby accelerating the adoption of indexing while paving the way for new approaches such as systematic active fixed income. This alignment of transparency and technology is behind a major consideration among investors on how to best access, construct, and implement their fixed income exposures today.

One key trend gaining traction on the heels of these improved implementation efficiencies is the disaggregation of traditional core/aggregate strategies into their underlying sectors and maturity buckets as discrete building blocks. Increasingly, we are seeing investors “dis-aggregating the Agg” and reconstructing it to better deliver on their various investment objectives for fixed income. This often involves adopting two different, but complementary approaches that can solve for competing objectives such as alpha vs. beta, liquid vs. illiquid, growth vs. matching, public vs. private, etc. Clearly, no manager can be the best at all of these strategies, so we see investors employing specialist active managers as satellites, that are complemented by a reliable, transparent index manager for their core. At State Street Global Advisors we have been designing and delivering this building block approach to fixed income exposure management since launching our first aggregate strategy back in 1995. Today, we have over 100 sub-strategies/building blocks ranging from liquid Treasuries, to more complex sectors such as high yield and emerging market debt. Our success to date is built on delivering these benefits to our investors consistently over many years, and now as more investors come to appreciate and rely on this more outcome-oriented approach, we believe that we are well positioned to partner with them and help achieve their desired outcomes.

Closing Thoughts

As always, we value your business and look forward to our continued partnership in 2023 and beyond. Should you have any additional questions surrounding your investments or the markets, please do not hesitate to reach out to your client relationship manager.