Australian Retirement Survey During a Time of Change

Since 2018, State Street Global Advisors has fielded the Global Retirement Reality Report, which includes a carve out of results for Australia.

The latest survey was conducted during the third quarter of 2023, 12 months after our 2022 survey. We present some of the key finds for Australian respondents in this report.

FINDING 1: Investment markets don’t seem to influence retirement confidence

Questions in our survey are largely subjective, asking about confidence or optimism in relation to retirement for example. Given the focus of the superannuation industry on investment returns, we were expecting to see a lift in measures of retirement confidence in 2023. After all, we conducted the survey during the third quarters each of 2022 and 2023, and Figure 1 shows the performance of key markets prior to the survey.

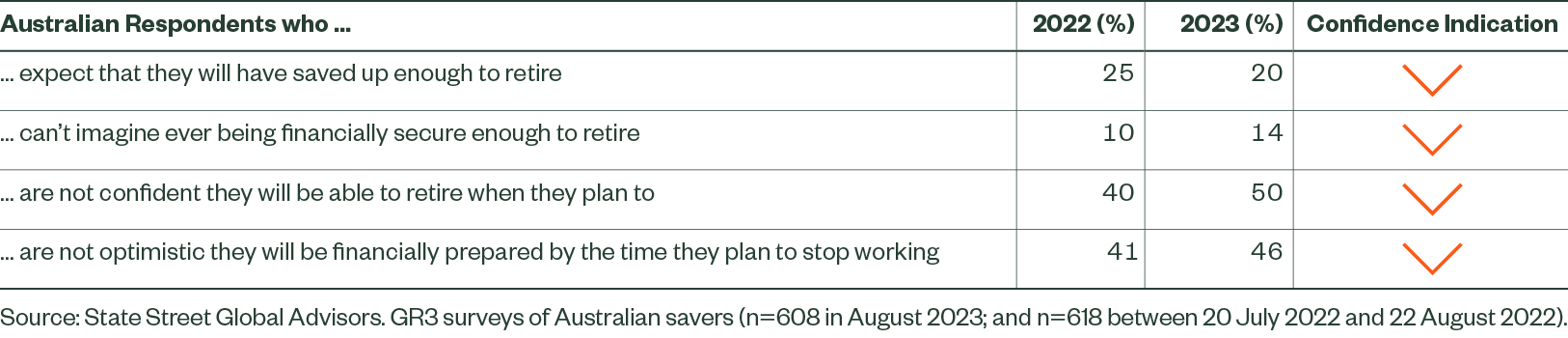

And yet, despite this dramatic reversal in markets, many of the measures of confidence appeared to have weakened rather than strengthened among our Australian respondents.

Figure 2: Retirement confidence is weakening

When we asked respondents what factors most negatively affect their confidence that they would be ready to retire when planned, the choices most often included in the top three were:

- Inflation and the cost of living crisis (73%)

- Mortgage debt/rent and housing costs (38%)

- Medical expenses (35%).

These three were selected more often than factors like having spare money for savings, the complexity of the superannuation and pension system and lack of trust in super.

Clearly confidence in retirement is a function of much more than simple investment returns.

FINDING 2: Retirement income? Australia is starting in the right place

The Retirement Income Covenant requirements have been in place since 1 July 2022. Under the covenant, superannuation trustees are required to assist their members achieve a balance between three objectives:

- maximising expected retirement income;

- managing expected risks to the sustainability and stability of retirement income; and

- having flexible access to expected funds during retirement.

In the debate over retirement incomes policy, there has been broad agreement on the principles above, but disagreement on the details. Our survey confirmed, yet again, broad support for the principles in the covenant. We asked respondents to choose between three stylised ways of accessing their savings:

The need for flexibility in early years balanced by security in later years is the model most favoured by respondents, which loosely reflects the principles of the covenant. However, plenty of respondents are attracted to alternate models, and so it is important that trustees keep member involvement at the centre of their retirement incomes strategy.

FINDING 3: Retirement income? Australia may have turned the corner on annuities

One problem that remains, at best, only partially solved in the superannuation industry is how to manage longevity risk. Developing holistic solutions to this problem has been made more difficult by the longstanding resistance to annuities in Australia. As Treasury has noted;

“The take up of lifetime income products by members remains low, and the market remains underdeveloped. This is the case despite broader regulatory changes …”1

In the 2023 survey, we saw encouraging signs that annuities may have turned the corner in Australia. Acceptance of some of the stereotypical negative statements about annuities has softened since 2022. It isn’t clear whether this softening is due to higher interest rates, or education or some other factor, but it does augur well for trustees looking to include longevity products in holistic retirement solutions.

We even saw an uptick in respondents who included annuities in their definitions of ‘Retirement Income”; 18% of respondents in 2023 selected “An annuity that provides a guaranteed income stream for the rest of my life” compared to 12% in 2022.

FINDING 4: Retirement income? Australia still has a long way to go

December 2023 saw two significant, and related, developments for retirement incomes in Australia.

(1) The Government released its long awaited final response2 to the Quality in Advice Review from December 2022. Finding a balance between affordable, accessible, and simple financial advice and necessary consumer protections is going to be a difficult task.

(2) Treasury released a discussion and consultation paper on the retirement phase of superannuation1, which notes:

“Typical account-based pensions provide retirees with flexible access to capital, but without more guidance or active engagement from the retiree, they risk not effectively meeting the other two retirement income covenant objectives: maximising retirement income and managing risk.”

These two releases are deliberately linked. It is hard to imagine a robust ecosystem for retirement incomes that doesn’t include affordable and accessible advice. This is clearly reflected in our survey responses. When asked how they would like to sustainably withdraw savings in retirement, 40% were comfortable “figuring it out myself” while 37% wanted to work with a financial adviser. Responses that involved more active guidance from the superannuation fund itself were less popular.

To be fair, the problem of retirement income is not one that superannuation funds can solve on their own. When we asked respondents about their understanding of ‘retirement income’, most selected a simple, holistic statement that equates retirement income to a regular paycheck. This definition resonated more strongly than either an annuity or a drawdown plan, both of which are “products” that a superannuation fund might offer.

The interaction of the Age Pension, Superannuation and Healthcare makes the Australian system particularly complex. And it is for this reason that the retirement ecosystem needs both advice and innovative products from superannuation funds. In total, just under half our respondents included the Age Pension in their top three sources of income in retirement, with 29% having the Age Pension as one of their top two sources. When asked about their biggest concern in planning for retirement, 34% nominated not being able to cover an unexpected expense such as a medical or housing cost.

As a side note, only 5% identified “Not leaving a bequest” as their biggest financial planning concern, which may be a welcome finding for policy makers! It also suggests that chronic under spending by Australian retirees is not deliberate.

FINDING 5: Sustainability matters less to Australian retirees in 2023

One of the more striking findings from Australian respondents was the shift in expectations for sustainability. In 2022, 67% of Australian respondents considered it important that their superannuation fund is invested sustainably3. This proportion dropped to 56% in 2023 while the average across the rest of our surveyed countries increased from 54% to 59% over the same period. Australians have moved from having notably higher expectations than the rest of the world to having similar, or even lower, expectations of sustainability.

Similarly, only 57% of respondents in Australia expected sustainability to “happen as standard on my behalf” in 2023 compared with 65% in 2022, while support for tailored sustainability options dropped from 64% to 55% over the same period. It is unclear whether this shift in attitudes to sustainability is due to recent regulatory action, politics, changes in marketing by product issuers, or other issues rising to the forefront of consciousness.

Despite this drop in broader support for sustainability, as in 2022, four exclusion categories in 2023 again attracted close to, or more than 50% of Australian respondents: controversial weapons (56%), gambling (55%), violators of international norms like human rights (55%), and tobacco (48%).

FINDING 6: Some of differences between men and women in retirement preferences have shifted

In previous surveys we have remarked on gender differences in attitudes to superannuation and retirement. Somewhat surprisingly, some of the differences have reduced this year.

Differences are still evident in a few areas. For example, we asked respondents how they would like to sustainably withdraw savings in retirement. Women were much more likely to use an adviser (41% vs 33% for men) than to try and “figure it out myself” (33% vs 47% for men).

However, in other areas some gender differences have reduced or disappeared. For example, we asked respondents what support would enable them to remain longer in the workplace (assuming they wanted to). Women expressed a much stronger preference for flexible working arrangements than men in 2022, but this difference had disappeared in 2023 – a case of changing preferences among men rather than women.

Figure 6: What support would enable you to remain longer in the workplace (Selected in top 3)

| Offer flexible working arrangements | 2022 | 2023 |

| Male | 42% | 54% |

| Female | 59% | 50% |

| Total | 50% | 52% |

| Female vs Male | +17% | -4% |

Source: State Street Global Advisors. GR3 surveys of Australian savers (n=608 in August 2023; and n=618 between 20 July 2022 and 22 August 2022).

And secondly, when we asked respondents about barriers to retirement in 2022, “Inflation and the cost of living crisis” dominated the responses by women versus men. By 2023, men had caught up with 72% including this in their top 3 concerns compared to 73% for women.

Conclusion

Surveys like our GR3 often simply confirm our understanding of the Australian superannuation and retirement market and how it compares with peers in other countries. The survey again confirmed our belief that Australia is heading in the right direction on retirement incomes on both the policy and industry fronts. However, the survey also produced some unexpected results, in retirement confidence, in sustainability and in gender preferences. Never assume you know it all!

Survey Methodology

Our global online survey, conducted during August 2023 with international data analytics firm YouGov, engaged a total of 4,257 individuals participating in workplace-sponsored savings plans (or the market equivalent) in Canada, Australia, Ireland, the UK and the US. Surveyed countries represent a range of retirement systems. Gender, age, and regional quotas were balanced to reflect employed populations within each country.

By gaining saver sentiment, we’re seeking to further our global goal of making retirement work for people, plans and policymakers in a changing world.